Everything that you need to know to start your own business. From business ideas to researching the competition.

Practical and real-world advice on how to run your business — from managing employees to keeping the books

Our best expert advice on how to grow your business — from attracting new customers to keeping existing customers happy and having the capital to do it.

Entrepreneurs and industry leaders share their best advice on how to take your company to the next level.

- Business Ideas

- Human Resources

- Business Financing

- Growth Studio

- Ask the Board

Looking for your local chamber?

Interested in partnering with us?

Run » finance, how to create a financial forecast for a startup business plan.

Financial forecasting allows you to measure the progress of your new business by benchmarking performance against anticipated sales and costs.

When starting a new business, a financial forecast is an important tool for recruiting investors as well as for budgeting for your first months of operating. A financial forecast is used to predict the cash flow necessary to operate the company day-to-day and cover financial liabilities.

Many lenders and investors ask for a financial forecast as part of a business plan; however, with no sales under your belt, it can be tricky to estimate how much money you will need to cover your expenses. Here’s how to begin creating a financial forecast for a new business.

[Read more: Startup 2021: Business Plan Financials ]

Start with a sales forecast

A sales forecast attempts to predict what your monthly sales will be for up to 18 months after launching your business. Creating a sales forecast without any past results is a little difficult. In this case, many entrepreneurs make their predictions using industry trends, market analysis demonstrating the population of potential customers and consumer trends. A sales forecast shows investors and lenders that you have a solid understanding of your target market and a clear vision of who will buy your product or service.

A sales forecast typically breaks down monthly sales by unit and price point. Beyond year two of being in business, the sales forecast can be shown quarterly, instead of monthly. Most financial lenders and investors like to see a three-year sales forecast as part of your startup business plan.

Lower fixed costs mean less risk, which might be theoretical in business schools but are very concrete when you have rent and payroll checks to sign.

Tim Berry, president and founder of Palo Alto Software

Create an expenses budget

An expenses budget forecasts how much you anticipate spending during the first years of operating. This includes both your overhead costs and operating expenses — any financial spending that you anticipate during the course of running your business.

Most experts recommend breaking down your expenses forecast by fixed and variable costs. Fixed costs are things such as rent and payroll, while variable costs change depending on demand and sales — advertising and promotional expenses, for instance. Breaking down costs into these two categories can help you better budget and improve your profitability.

"Lower fixed costs mean less risk, which might be theoretical in business schools but are very concrete when you have rent and payroll checks to sign," Tim Berry, president and founder of Palo Alto Software, told Inc . "Most of your variable costs are in those direct costs that belong in your sales forecast, but there are also some variable expenses, like ads and rebates and such."

Project your break-even point

Together, your expenses budget and sales forecast paints a picture of your profitability. Your break-even projection is the date at which you believe your business will become profitable — when more money is earned than spent. Very few businesses are profitable overnight or even in their first year. Most businesses take two to three years to be profitable, but others take far longer: Tesla , for instance, took 18 years to see its first full-year profit.

Lenders and investors will be interested in your break-even point as a projection of when they can begin to recoup their investment. Likewise, your CFO or operations manager can make better decisions after measuring the company’s results against its forecasts.

[Read more: Startup 2021: Writing a Business Plan? Here’s How to Do It, Step by Step ]

Develop a cash flow projection

A cash flow statement (or projection, for a new business) shows the flow of dollars moving in and out of the business. This is based on the sales forecast, your balance sheet and other assumptions you’ve used to create your expenses projection.

“If you are starting a new business and do not have these historical financial statements, you start by projecting a cash-flow statement broken down into 12 months,” wrote Inc . The cash flow statement will include projected cash flows from operating, investing and financing your business activities.

Keep in mind that most business plans involve developing specific financial documents: income statements, pro formas and a balance sheet, for instance. These documents may be required by investors or lenders; financial projections can help inform the development of those statements and guide your business as it grows.

CO— aims to bring you inspiration from leading respected experts. However, before making any business decision, you should consult a professional who can advise you based on your individual situation.

Follow us on Instagram for more expert tips & business owners’ stories.

CO—is committed to helping you start, run and grow your small business. Learn more about the benefits of small business membership in the U.S. Chamber of Commerce, here .

Subscribe to our newsletter, Midnight Oil

Expert business advice, news, and trends, delivered weekly

By signing up you agree to the CO— Privacy Policy. You can opt out anytime.

For more finance tips

Credit card processing scams and fraud small businesses should be aware of, ai shortcuts to prepare for tax season, small business owners feel optimistic heading into the final quarter of 2024.

By continuing on our website, you agree to our use of cookies for statistical and personalisation purposes. Know More

Welcome to CO—

Designed for business owners, CO— is a site that connects like minds and delivers actionable insights for next-level growth.

U.S. Chamber of Commerce 1615 H Street, NW Washington, DC 20062

Social links

Looking for local chamber, stay in touch.

How to Create a Financial Forecast: A Step-by-Step Guide for Small Business Owners

In today’s competitive market, running a small business is a balancing act. Every decision, every dollar spent or saved, blends together to form the bigger picture. But what if you could see this picture before it’s fully painted? That’s where financial forecasting comes in.

A well-crafted financial forecast is more than a set of projections—it’s a roadmap for growth, a way of seeing potential opportunities and challenges before they arrive. Here’s a step-by-step guide to building a financial forecast that can bring clarity, control, and a sense of direction to your business’s future.

Why Financial Forecasting Matters

For a small business, a financial forecast isn’t just a tool—it’s a lifeline. By illuminating both short- and long-term needs, financial forecasting enables owners to make informed decisions, manage risks, and anticipate the future. A clear, reliable forecast not only builds confidence within the company but also signals to investors and lenders that your business has the foresight to succeed. Forecasting, in many ways, is about learning to read the market trends for business planning, spotting patterns, and navigating economic uncertainties before they impact your business.

Step 1: Gather Historical Data

Building a successful forecast begins with a look backward. Accurate historical data gives context to your numbers, revealing trends and patterns that can guide future projections. Reviewing your past income statements, balance sheets, cash flow statements, and key performance indicators (KPIs) shows where you’ve been, helping you understand where you might be going.

Pro Tip : Aim to collect data from at least the past two to three years. Historical data over time reveals seasonal trends and year-over-year growth rates, giving you a clearer perspective on your business’ trajectory.

Step 2: Research Small Business Financial Forecasting Trends

Forecasting isn’t just about looking within—it’s about understanding the external forces that shape your industry. Look into small business financial forecasting trends relevant to your field. For a retail business, shifting consumer spending patterns may impact sales, while a construction company might consider the rising cost of raw materials. External trends add context to your projections, helping you make realistic forecasts.

Step 3: Project Revenue

Revenue forecasting is the cornerstone of any financial forecast. Begin by identifying potential revenue streams and estimating income from each. Historical growth rates offer a baseline, but current market trends for business planning can show you where adjustments might be needed. Is a new product launch on the horizon? Are customer preferences shifting? Are lower cost competitors entering the market? Revenue projections offer insight into where your business’ growth might come from—and what might hold it back.

Step 4: Calculate Business Expenses

Accurate cost estimation is essential to a reliable forecast. Business expenses are divided into two main types: fixed costs (like rent and salaries) and variable costs (such as raw materials and shipping). By using historical data to estimate future costs, you’re essentially predicting where cash flow might get tight. This isn’t just about budgeting; it’s about small business cost estimation that gives you clarity on spending and helps control expenses.

Insight : Plan for anticipated changes. Rising supplier costs or planned expansions need to be factored into your forecast, giving you a more realistic view of expenses.

Step 5: Create a Cash Flow Forecast for Small Business Stability

Cash flow is the engine of any small business, and a cash flow forecast ensures you have the resources to keep that engine running smoothly. By estimating your inflows (like sales or loan proceeds) and outflows (such as inventory purchases or loan payments), you create a model for managing cash on hand. A cash flow forecast for small business stability not only helps prevent cash shortages but also prepares you for potential financing needs. It may be counterintuitive to some, but your growing business generally needs more cash – not less – to fuel your asset, materials, and people spending needs.

Step 6: Set Realistic Goals

Goals are the checkpoints on your roadmap, guiding you as you move forward. Using your forecast data, establish benchmarks for revenue, expenses, and cash flow that align with your business’s objectives. Realistic goals allow you to measure progress and make adjustments. Regularly revisiting these goals keeps them in line with actual performance and the realities of the market.

Example Goal : If your revenue projections show a 10% increase, set quarterly prospecting and sales targets to track this growth. Adjusting along the way is not just part of the process, it’s essential to making your forecast work in real time.

Step 7: Reviewing and Adjusting Financial Forecasts

A financial forecast is dynamic, not static. Reviewing and adjusting financial forecasts at least quarterly is essential, especially in industries that experience seasonal or economic shifts. These regular reviews help you stay flexible, adapting to the unexpected with confidence.

Key Insight : Changes in market trends, new competition, or economic shifts can affect projections. Regular adjustments ensure that your forecast remains relevant, keeping your business resilient, no matter the landscape. The best companies develop “what-if” scenarios long before these circumstances unfold.

Benefits of Financial Forecasting for Small Businesses

Creating a financial forecast goes beyond number-crunching. It’s about preparing for growth, managing risks, and making decisions grounded in data, not guesswork. Businesses that consistently forecast gain clarity, confidence, and a better sense of control. You’ll be better positioned to seize opportunities, adapt to market shifts, and navigate both expected and unexpected challenges with a strategic approach.

Ready to Gain Financial Clarity?

For small businesses, the benefits of forecasting are clear. Building an accurate forecast can be complex. With expert support, your business can create forecasts that drive growth and provide peace of mind. At Supporting Strategies, we help small businesses achieve financial clarity, empowering them to make informed decisions and build resilient growth plans in today’s competitive market.

Jeff Kordela

Managing Director | Supporting Strategies Baltimore and Chesapeake Region, Maryland Contact Jeff

Legal and Tax Disclaimer

This website is created by Supporting Strategies to provide general bookkeeping and accounting information only. Supporting Strategies does not provide tax, legal or accounting advice, and the information contained herein is not intended to do so. As such, the information provided should not be used as a substitute for consultation with professional tax, legal, and accounting advisors, and you should consult with a tax, legal and accounting professional before engaging in any transaction.

Leave a Reply

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Supporting Strategies is not a CPA firm.

At Supporting Strategies, equality, and inclusion fuel our culture. Diversity sparks evolution and teamwork unites us, our customers, and the communities we serve.

- Small Business Operations

- Outsourced Bookkeeping Services

- Controller Services

- Small Business Bookkeeping

- Bookkeeping Services for Law Firms

- Bookkeeping Services for Healthcare Practices

- Bookkeeping Services for Nonprofits

Quick Links

- Search Openings

Work from Home

- Financial Operations Associate

- Financial Operations Manager

- Financial Operations Director

- Business Development Partner

AI ASSISTANTS

Upmetrics AI Your go-to AI-powered business assistant

AI Writing Assist Write, translate, and refine your text with AI

AI Financial Assist Automated forecasts and AI recommendations

AI Research Assist Your go-to AI-powered research assistant

TOP FEATURES

AI Business Plan Generator Create business plans faster with AI

Financial Forecasting Make accurate financial forecasts faster

INTEGRATIONS

QuickBooks Sync and compare with your QuickBooks data

Strategic Planning Develop actionable strategic plans on-the-go

AI Pitch Deck Generator Use AI to generate your investor deck

Xero Sync and compare with your Xero data

See how easy it is to plan your business with Upmetrics: Take a Tour →

AI-powered business planning software

Very useful business plan software connected to AI. Saved a lot of time, money and energy. Their team is highly skilled and always here to help.

- Julien López

BY USE CASE

Secure Funding, Loans, Grants Create plans that get you funded

Starting & Launching a Business Plan your business for launch and success

Validate Your Business Idea Discover the potential of your business idea

E2 Visa Business Plan Create a business plan to support your E2 - Visa

Business Consultant & Advisors Plan with your team members and clients

Incubators & Accelerators Empowering startups for growth

Business Schools & Educators Simplify business plan education for students

Students & Learners Your e-tutor for business planning

- Sample Plans

Plan Writing & Consulting We create a business plan for you

Business Plan Review Get constructive feedback on your plan

Financial Forecasting We create financial projections for you

SBA Lending Assistance We help secure SBA loans for your business

WHY UPMETRICS?

Reviews See why customers love Upmetrics

Blogs Latest business planning tips and strategies

Strategic Planning Templates Ready-to-use strategic plan templates

Business Plan Course A step-by-step business planning course

Customer Success Stories Read our customer success stories

Help Center Help & guides to plan your business

Ebooks & Guides A free resource hub on business planning

Business Tools Free business tools to help you grow

How to Prepare a Financial Plan for Startup Business (w/ example)

Financial Statements Template

Ajay Jagtap

- December 7, 2023

- 13 Min Read

If someone were to ask you about your business financials, could you give them a detailed answer?

Let’s say they ask—how do you allocate your operating expenses? What is your cash flow situation like? What is your exit strategy? And a series of similar other questions.

Instead of mumbling what to answer or shooting in the dark, as a founder, you must prepare yourself to answer this line of questioning—and creating a financial plan for your startup is the best way to do it.

A business plan’s financial plan section is no easy task—we get that.

But, you know what—this in-depth guide and financial plan example can make forecasting as simple as counting on your fingertips.

Ready to get started? Let’s begin by discussing startup financial planning.

What is Startup Financial Planning?

Startup financial planning, in simple terms, is a process of planning the financial aspects of a new business. It’s an integral part of a business plan and comprises its three major components: balance sheet, income statement, and cash-flow statement.

Apart from these statements, your financial section may also include revenue and sales forecasts, assets & liabilities, break-even analysis, and more. Your first financial plan may not be very detailed, but you can tweak and update it as your company grows.

Key Takeaways

- Realistic assumptions, thorough research, and a clear understanding of the market are the key to reliable financial projections.

- Cash flow projection, balance sheet, and income statement are three major components of a financial plan.

- Preparing a financial plan is easier and faster when you use a financial planning tool.

- Exploring “what-if” scenarios is an ideal method to understand the potential risks and opportunities involved in the business operations.

Why is Financial Planning Important to Your Startup?

Poor financial planning is one of the biggest reasons why most startups fail. In fact, a recent CNBC study reported that running out of cash was the reason behind 44% of startup failures in 2022.

A well-prepared financial plan provides a clear financial direction for your business, helps you set realistic financial objectives, create accurate forecasts, and shows your business is committed to its financial objectives.

It’s a key element of your business plan for winning potential investors. In fact, YC considered recent financial statements and projections to be critical elements of their Series A due diligence checklist .

Your financial plan demonstrates how your business manages expenses and generates revenue and helps them understand where your business stands today and in 5 years.

Makes sense why financial planning is important to your startup or small business, doesn’t it? Let’s cut to the chase and discuss the key components of a startup’s financial plan.

Say goodbye to old-school excel sheets & templates

Make accurate financial plan faster with AI

Plans starting from $7/month

Key Components of a Startup Financial Plan

Whether creating a financial plan from scratch for a business venture or just modifying it for an existing one, here are the key components to consider including in your startup’s financial planning process.

Income Statement

An Income statement , also known as a profit-and-loss statement(P&L), shows your company’s income and expenditures. It also demonstrates how your business experienced any profit or loss over a given time.

Consider it as a snapshot of your business that shows the feasibility of your business idea. An income statement can be generated considering three scenarios: worst, expected, and best.

Your income or P&L statement must list the following:

- Cost of goods or cost of sale

- Gross margin

- Operating expenses

- Revenue streams

- EBITDA (Earnings before interest, tax, depreciation , & amortization )

Established businesses can prepare annual income statements, whereas new businesses and startups should consider preparing monthly statements.

Cash flow Statement

A cash flow statement is one of the most critical financial statements for startups that summarize your business’s cash in-and-out flows over a given time.

This section provides details on the cash position of your business and its ability to meet monetary commitments on a timely basis.

Your cash flow projection consists of the following three components:

✅ Cash revenue projection: Here, you must enter each month’s estimated or expected sales figures.

✅ Cash disbursements: List expenditures that you expect to pay in cash for each month over one year.

✅ Cash flow reconciliation: Cash flow reconciliation is a process used to ensure the accuracy of cash flow projections. The adjusted amount is the cash flow balance carried over to the next month.

Furthermore, a company’s cash flow projections can be crucial while assessing liquidity, its ability to generate positive cash flows and pay off debts, and invest in growth initiatives.

Balance Sheet

Your balance sheet is a financial statement that reports your company’s assets, liabilities, and shareholder equity at a given time.

Consider it as a snapshot of what your business owns and owes, as well as the amount invested by the shareholders.

This statement consists of three parts: assets , liabilities, and the balance calculated by the difference between the first two. The final numbers on this sheet reflect the business owner’s equity or value.

Balance sheets follow the following accounting equation with assets on one side and liabilities plus Owner’s equity on the other:

Here is what’s the core purpose of having a balance-sheet:

- Indicates the capital need of the business

- It helps to identify the allocation of resources

- It calculates the requirement of seed money you put up, and

- How much finance is required?

Since it helps investors understand the condition of your business on a given date, it’s a financial statement you can’t miss out on.

Break-even Analysis

Break-even analysis is a startup or small business accounting practice used to determine when a company, product, or service will become profitable.

For instance, a break-even analysis could help you understand how many candles you need to sell to cover your warehousing and manufacturing costs and start making profits.

Remember, anything you sell beyond the break-even point will result in profit.

You must be aware of your fixed and variable costs to accurately determine your startup’s break-even point.

- Fixed costs: fixed expenses that stay the same no matter what.

- Variable costs: expenses that fluctuate over time depending on production or sales.

A break-even point helps you smartly price your goods or services, cover fixed costs, catch missing expenses, and set sales targets while helping investors gain confidence in your business. No brainer—why it’s a key component of your startup’s financial plan.

Having covered all the key elements of a financial plan, let’s discuss how you can create a financial plan for your startup or small business.

How to Create a Financial Section of a Startup Business Plan?

1. determine your financial needs.

You can’t start financial planning without understanding your financial requirements, can you? Get your notepad or simply open a notion doc; it’s time for some critical thinking.

Start by assessing your current situation by—calculating your income, expenses , assets, and liabilities, what the startup costs are, how much you have against them, and how much financing you need.

Assessing your current financial situation and health will help determine how much capital you need for your small business and help plan fundraising activities and outreach.

Furthermore, determining financial needs helps prioritize operational activities and expenses, effectively allocate resources, and increase the viability and sustainability of a business in the long run.

Having learned to determine financial needs, let’s head straight to setting financial goals.

2. Define Your Financial Goals

Setting realistic financial goals is fundamental in preparing an effective financial plan for your business plan. So, it would help to outline your long-term strategies and goals at the beginning of your financial planning process.

Let’s understand it this way—if you are a SaaS startup pursuing VC financing rounds, you may ask investors about what matters to them the most and prepare your financial plan accordingly.

However, a coffee shop owner seeking a business loan may need to create a plan that appeals to banks, not investors. At the same time, an internal financial plan designed to offer financial direction and resource allocation may not be the same as previous examples, seeing its different use case.

Feeling overwhelmed? Just define your financial goals—you’ll be fine.

You can start by identifying your business KPIs (key performance indicators); it would be an ideal starting point.

3. Choose the Right Financial Planning Tool

Let’s face it—preparing a financial plan using Excel is no joke. One would only use this method if they had all the time in the world.

Having the right financial planning software will simplify and speed up the process and guide you through creating accurate financial forecasts.

Many financial planning software and tools claim to be the ideal solution, but it’s you who will identify and choose a tool that is best for your financial planning needs.

Create a Financial Plan with Upmetrics in no time

Enter your Financial Assumptions, and we’ll calculate your monthly/quarterly and yearly financial projections.

Start Forecasting

4. Make Assumptions Before Projecting Financials

Once you have a financial planning tool, you can move forward to the next step— making financial assumptions for your plan based on your company’s current performance and past financial records.

You’re just making predictions about your company’s financial future, so there’s no need to overthink or complicate the process.

You can gather your business’ historical financial data, market trends, and other relevant documents to help create a base for accurate financial projections.

After you have developed rough assumptions and a good understanding of your business finances, you can move forward to the next step—projecting financials.

5. Prepare Realistic Financial Projections

It’s a no-brainer—financial forecasting is the most critical yet challenging aspect of financial planning. However, it’s effortless if you’re using a financial planning software.

Upmetrics’ forecasting feature can help you project financials for up to 7 years. However, new startups usually consider planning for the next five years. Although it can be contradictory considering your financial goals and investor specifications.

Following are the two key aspects of your financial projections:

Revenue Projections

In simple terms, revenue projections help investors determine how much revenue your business plans to generate in years to come.

It generally involves conducting market research, determining pricing strategy , and cash flow analysis—which we’ve already discussed in the previous steps.

The following are the key components of an accurate revenue projection report:

- Market analysis

- Sales forecast

- Pricing strategy

- Growth assumptions

- Seasonal variations

This is a critical section for pre-revenue startups, so ensure your projections accurately align with your startup’s financial model and revenue goals.

Expense Projections

Both revenue and expense projections are correlated to each other. As revenue forecasts projected revenue assumptions, expense projections will estimate expenses associated with operating your business.

Accurately estimating your expenses will help in effective cash flow analysis and proper resource allocation.

These are the most common costs to consider while projecting expenses:

- Fixed costs

- Variable costs

- Employee costs or payroll expenses

- Operational expenses

- Marketing and advertising expenses

- Emergency fund

Remember, realistic assumptions, thorough research, and a clear understanding of your market are the key to reliable financial projections.

6. Consider “What if” Scenarios

After you project your financials, it’s time to test your assumptions with what-if analysis, also known as sensitivity analysis.

Using what-if analysis with different scenarios while projecting your financials will increase transparency and help investors better understand your startup’s future with its best, expected, and worst-case scenarios.

Exploring “what-if” scenarios is the best way to better understand the potential risks and opportunities involved in business operations. This proactive exercise will help you make strategic decisions and necessary adjustments to your financial plan.

7. Build a Visual Report

If you’ve closely followed the steps leading to this, you know how to research for financial projections, create a financial plan, and test assumptions using “what-if” scenarios.

Now, we’ll prepare visual reports to present your numbers in a visually appealing and easily digestible format.

Don’t worry—it’s no extra effort. You’ve already made a visual report while creating your financial plan and forecasting financials.

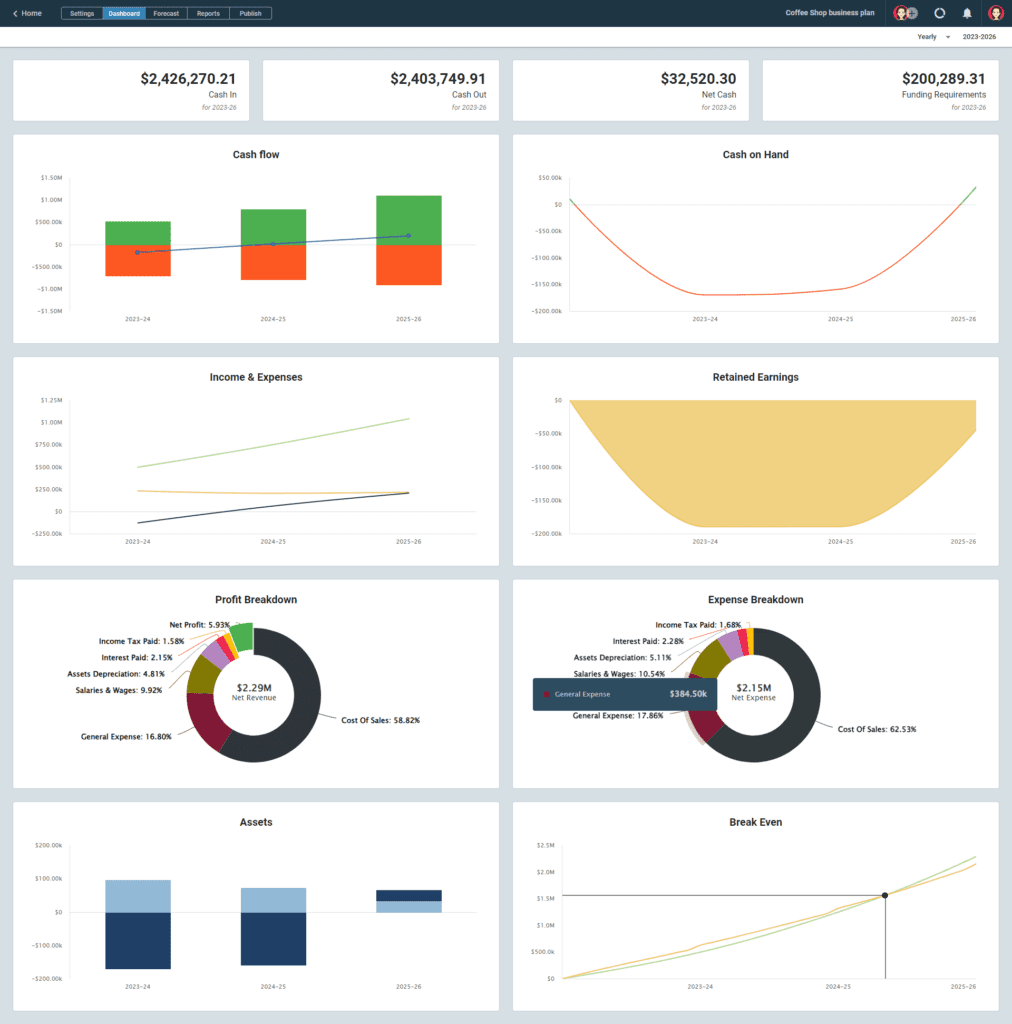

Check the dashboard to see the visual presentation of your projections and reports, and use the necessary financial data, diagrams, and graphs in the final draft of your financial plan.

Here’s what Upmetrics’ dashboard looks like:

8. Monitor and Adjust Your Financial Plan

Even though it’s not a primary step in creating a good financial plan for your small business, it’s quite essential to regularly monitor and adjust your financial plan to ensure the assumptions you made are still relevant, and you are heading in the right direction.

There are multiple ways to monitor your financial plan.

For instance, you can compare your assumptions with actual results to ensure accurate projections based on metrics like new customers acquired and acquisition costs, net profit, and gross margin.

Consider making necessary adjustments if your assumptions are not resonating with actual numbers.

Also, keep an eye on whether the changes you’ve identified are having the desired effect by monitoring their implementation.

And that was the last step in our financial planning guide. However, it’s not the end. Have a look at this financial plan example.

Startup Financial Plan Example

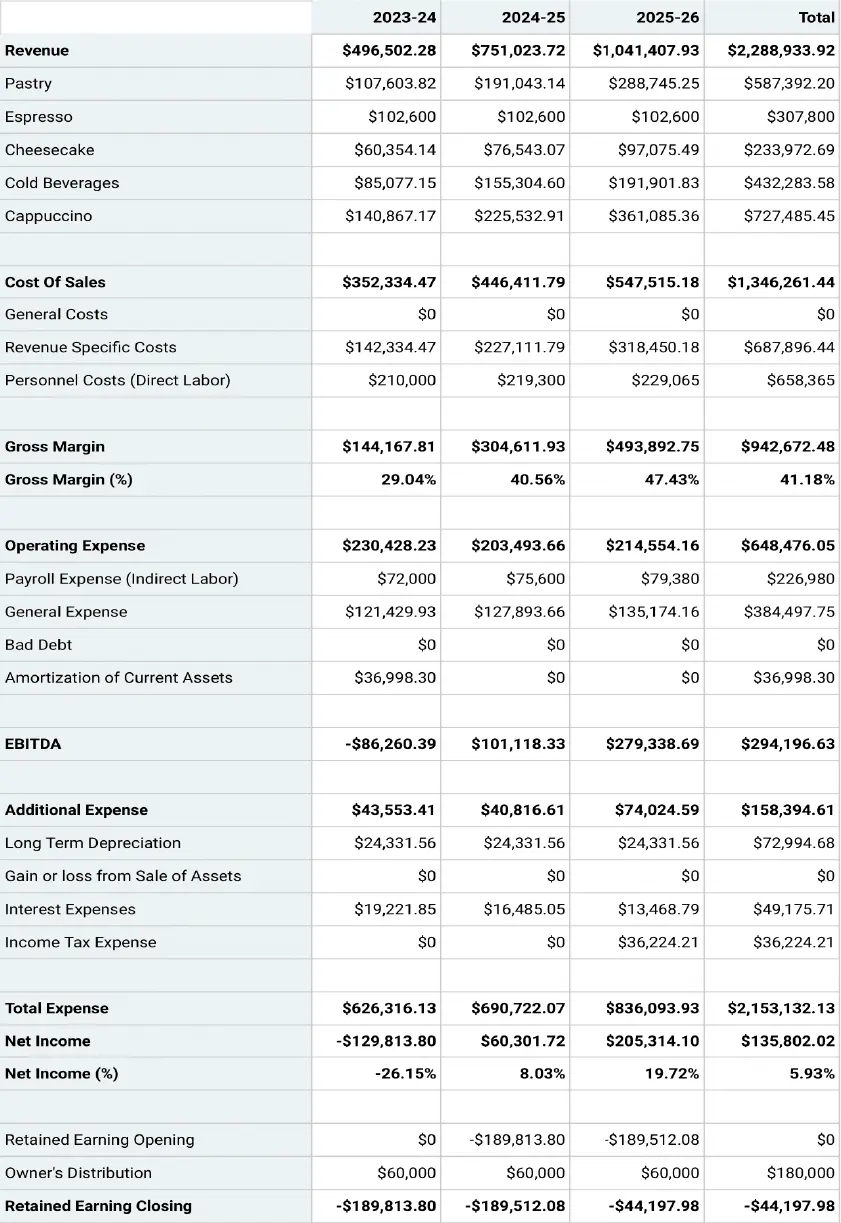

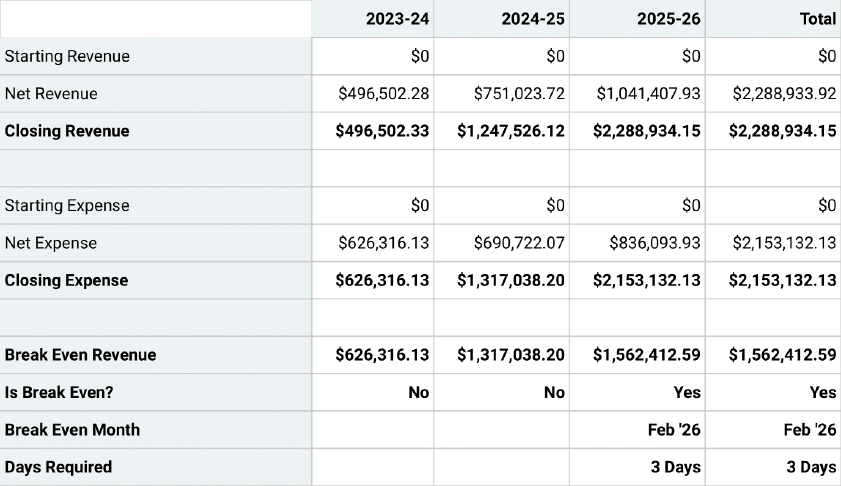

Having learned about financial planning, let’s quickly discuss a coffee shop startup financial plan example prepared using Upmetrics.

Important Assumptions

- The sales forecast is conservative and assumes a 5% increase in Year 2 and a 10% in Year 3.

- The analysis accounts for economic seasonality – wherein some months revenues peak (such as holidays ) and wanes in slower months.

- The analysis assumes the owner will not withdraw any salary till the 3rd year; at any time it is assumed that the owner’s withdrawal is available at his discretion.

- Sales are cash basis – nonaccrual accounting

- Moderate ramp- up in staff over the 5 years forecast

- Barista salary in the forecast is $36,000 in 2023.

- In general, most cafes have an 85% gross profit margin

- In general, most cafes have a 3% net profit margin

Projected Balance Sheet

Projected Cash-Flow Statement

Projected Profit & Loss Statement

Break Even Analysis

Start Preparing Your Financial Plan

We covered everything about financial planning in this guide, didn’t we? Although it doesn’t fulfill our objective to the fullest—we want you to finish your financial plan.

Sounds like a tough job? We have an easy way out for you—Upmetrics’ financial forecasting feature. Simply enter your financial assumptions, and let it do the rest.

So what are you waiting for? Try Upmetrics and create your financial plan in a snap.

Build your Business Plan Faster

with step-by-step Guidance & AI Assistance.

Frequently Asked Questions

How often should i update my financial projections.

Well, there is no particular rule about it. However, reviewing and updating your financial plan once a year is considered an ideal practice as it ensures that the financial aspirations you started and the projections you made are still relevant.

How do I estimate startup costs accurately?

You can estimate your startup costs by identifying and factoring various one-time, recurring, and hidden expenses. However, using a financial forecasting tool like Upmetrics will ensure accurate costs while speeding up the process.

What financial ratios should startups pay attention to?

Here’s a list of financial ratios every startup owner should keep an eye on:

- Net profit margin

- Current ratio

- Quick ratio

- Working capital

- Return on equity

- Debt-to-equity ratio

- Return on assets

- Debt-to-asset ratio

What are the 3 different scenarios in scenario analysis?

As discussed earlier, Scenario analysis is the process of ascertaining and analyzing possible events that can occur in the future. Startups or small businesses often consider analyzing these three scenarios:

- base-case (expected) scenario

- Worst-case scenario

- best case scenario.

About the Author

Ajay is the Head of Content at Upmetrics. Before joining our team, he was a personal finance blogger and SaaS writer, covering topics such as startups, budgeting, and credit cards. If not writing, he’s probably having a power nap. Read more

Get started with Upmetrics Al

- 400+ sample business plans

- Al-powered financial planning

- Collaborative workspace

Reach Your Goals with Accurate Planning

Financial Projections for Startups [Template + Course Included]

January 11, 2022

Adam Hoeksema

Financial projections are an important part of any business plan or startup pitch deck. They allow a company to estimate future revenues, expenses, and profits, and to identify potential risks and opportunities. We have been helping founders create financial projections through our templates, tools, and custom financial modeling services since 2012. I thought it was finally time to write a comprehensive article that should answer the key questions that we get from founders again and again. So here is what I plan to cover:

What are financial projections?

Why should a startup create financial projections, how to create a financial forecast , creating sales projections based on data, forecasting operating expenses, salary projections.

- Startup cost forecasting

Pro forma financial statements

Existing business vs. startup vs acquisition forecasting, how to know whether my projections are realistic, what will investors and lenders be looking for in my projections, tools used for financial forecasting.

But first, who am I, and do I know anything about financial projections?

My name is Adam Hoeksema and I am the Co-Founder of ProjectionHub. Since 2012 we have helped over 50,000 entrepreneurs create financial projections between our software tool and our business projection spreadsheet templates .

I didn’t spend a decade on Wall Street or make a killing in private equity, and I haven’t even raised VC funding myself.

But I did spend over a decade launching a growing an SBA (Small Business Administration) lender in the Indianapolis, IN area. During that time we made over 1,800 small business loans and we often asked our clients for financial projections along with their loan applications. That is why I started ProjectionHub.

So 10 years ago my experience was with helping small, main street businesses create projections and secure loan funding to start their dream. Along the way, I learned a ton about startup projections for tech-based businesses as well. Today about 50% of our work is with small businesses looking for an SBA loan and 50% is with tech-based businesses looking to raise capital from investors.

With that background in mind, I want to share with you what I have learned along the way to try to make your financial forecasting process just a little bit easier. Let’s dive in!

Financial projections are estimates of the future financial performance of a company. These projections are typically based on a set of assumptions and are used to help businesses plan for the future and make informed decisions about investments, financing, and other strategic matters. Most ProjectionHub customers use pro forma financials to help external stakeholders, such as investors and lenders understand a company's financial position and future prospects. Financial projections typically include projections of income, expenses, cash flow, and balance sheet items.

There are many opinions on whether a startup needs to create a forecasted balance sheet and how many years a set of projections should be. At ProjectionHub, all of our financial projection templates have an integrated pro forma income statement, cash flow and balance sheet in annual and monthly format for 5 years. This seems to meet the needs of 99% of our customers, so I think it is pretty safe to say that your investor or lender might not require all of that level of information, but they probably won’t require more than a 5-year forecast of your 3 statement financials.

So it sounds like a lot of work to create a financial forecast, so why do we create projections? No one can know the future. Isn’t it just a pointless exercise?

Well, I think it is smart for an entrepreneur to create a set of projections before they start a business to understand what they are getting themselves into and what it will take to break even and generate a profit.

I could beat that drum all day, and you know what it doesn’t really matter. Even if we know it is a good idea to create projections before throwing our life savings into a new venture, most entrepreneurs will not create projections before starting their business. I have just come to accept this!

So the real reason to create projections is because the people with the money, the investors and lenders ask for them.

- Investors will ask for a financial model because they want to see how you plan to use their money, how long you think it will last, and what the potential return could be.

- Lenders will ask to see financial projections for startups or new projects or divisions in a business because they want to be able to see whether you think you can pay them back or not. How does your debt service coverage ratio look? How many cups of coffee are you going to have to sell to make your monthly loan payment?

Now that we know why we are creating projections and who the audience is, let’s get into the “how.”

So the plan now is to walk through how to create a set of financial projections, how to do good research to take a data-driven approach when modeling, what tools you can use to help you with research, and then how to know whether your forecast is realistic once you are done. We are going to look at:

- Creating revenue projections

- Operating Expenses

- Salaries Forecasting

- How to get investor and lender-ready projections

Revenue Projections

This is where we will camp out for a while. I want to show you a few examples of different types of revenue models to show you how I approach creating revenue projections.

If you have a stable, existing business, then it is possible that the best approach to creating sales projections is simply to take last year’s numbers and apply a growth rate based on your expectations of growth. Since that approach is quite straightforward I am not going to spend any time on that today. Our Existing Business Forecast Template will be perfect for you in this scenario.

We are going to focus on more of a first principles approach. I am going to outline two different approaches that I often take when building a financial model. First a capacity approach and then a customer funnel approach.

Capacity-Based Revenue Projections

I use a capacity-based approach to revenue projections when a company is pretty certain to have demand for their products or services and their revenue is more of a function of your price x capacity.

Here are some examples of businesses where I would take a capacity-based approach.

Farming Projections

For a farm, your revenue forecast is going to be based on how many acres you are farming x the yield per acre x the price per unit for your crop. You don’t really need to worry about whether you have a customer or not. Since most crops are commodities you won’t need to find a customer, you simply sell into the ready made market at the market price.

Trucking Projections

Trucking is similar in the sense that as long as you have a valid license and a working truck, you will be able to find loads to deliver. The question is more about how many trucks do you have, how many miles per day can each truck drive and what price will you be able to earn per mile. Again this is about capacity and price, not whether or not you can find a customer. This is the approach we take to show how a trucking business with one truck can generate $400k in annual revenue .

Daycare Facility

A daycare facility will also be able to calculate a capacity based on the size of the facility and the teacher-to-student ratio requirements. Once you have your capacity it is mostly a function of pricing to determine your revenue forecast. You can see a screenshot from our daycare financial forecast tool to see how we think about modeling this type of business.

I would say most tech businesses do not fall into a capacity-based projection approach.

For tech companies, I typically use a customer funnel-based approach to forecasting revenue.

Customer Funnel-Based Revenue Projection Approach

These are companies where your customer might not even know your product or service exists and might not know that they want it or need it so you are going to have to really go out and market and sell. You will likely have a customer funnel that will have leads that convert into customers over time.

Here are some examples of business models where I would use a customer funnel approach to financial modeling.

B2B SaaS Projections

For a B2B SaaS product you will probably have an advertising budget and a sales team that will drive leads that your team will work to qualify. Then some percentage of those sales qualified leads will turn into customers. You will need assumptions for things like:

- A monthly ad budget

- Cost per click to attract a website visitor

- Percentage of website visitors that become sales qualified leads

- Percentage of sales qualified leads that the sales team converts into customers

- Average monthly spend per customer

DTC Product Forecasting

For direct to consumer product companies you will have a similar customer funnel. Once you get to a customer, then you might have assumptions like:

- Average order value

- % of customers that become repeat customers

- How often do repeat customers repurchase

Consumer Apps

For a consumer mobile app you will need assumptions for things like:

- Monthly ad budget

- Cost per download

- Organic / word of mouth downloads

- % of customers that download the app that convert into active users

- % of active users that churn each year

- Average monthly spend per active user per month

So this should give you an idea of the structure of assumptions that you will need in order to approach creating projections, but I just left you with a bunch of assumptions that you have no idea how to fill in with realistic data.

Next I want to show you what I would do in order to research and find good data for your sales projections.

So how do you know how many people are searching on Google for terms that are relevant to your product or service? How do you know how much it would cost to advertise and get a click for that term? How do you know what a reasonable conversion rate is from a website visitor to a customer? How do you know what the average order value is for an ecommerce business like yours, etc?

I recorded an entire course on this , but I have listed some tools and some slides below to show you my typical research process.

As you will notice in the slides, I start out be simply doing Google research to try to find reasonable assumptions for as many of the key assumptions as I can.

From there, I like to use the following tools:

- Ahrefs - I use this tool for competitor research to determine how much organic traffic my competitors are getting and thereby how much organic traffic my website might get over time.

- Google Trends - I use Google Trends to see seasonality trends in a business.

- Google Adwords Keyword Tool - I use this tool to forecast how much it will cost per click to attract a website visitor, and to see search volume for certain keywords.

- Bizminer - You can use Bizminer industry reports to get an idea of key industry ratios to get an idea of whether your projections are realistic for your industry.

When forecasting expenses I like a couple of different resources to help me forecast my expenses and ensure that my expense projections are within industry standards.

Expenses for Small Businesses

Bizminer - You can use Bizminer industry reports to get an idea of key industry ratios. For example, you can determine if the average company in your industry spends 10% on rent or 12% on rent.

Expenses for Tech Startups

SaaS Capital - You can use this report from SaaS Capital to get an idea of the spending categories as a % of revenue for tech companies. This is specifically focused on SaaS, so if you are in ecommerce or a hardware startup you will need to find a similar source for your industry. You can see an example of the expense ratios from SaaS Capital below:

When forecasting salaries I actually take two different approaches. I typically start out by projecting specific salaries and positions for the first 24 months of the projection. Then after that, I simply include salaries in larger buckets of operating expenses like General & Admin, R&D, and Sales & Marketing. When you are raising investment the investors will likely want to know your specific use of funds for the first 18 to 24 months, but after that they will understand that it is impossible to predict exact positions, timing and salaries, so transitioning to an expense as a % of revenue makes sense. You can see how this looks in one of our financial models for a B2B SaaS company :

Detailed Salary Projections for the First 24 Months:

Salaries included in operating expense categories as a percentage of sales for year 3 and beyond:

Startup Cost Forecasting

When forecasting your startup costs, your specific location, concept, size and scale of business will make a dramatic difference in what it costs to launch your business. I don’t recommend that you just take the first “average startup cost” number that you find in a Google search because your specific situation matters. You will need to do your own research for each startup cost, but I have actually found it helpful to use ChatGPT to ask for a list of common startup expenses for business XYZ so that I don’t forget any common expenses.

I have already mentioned this before, but I commonly take a different approach to creating projections for an existing business compared to a startup compared to modeling a business acquisition.

Existing Business Projections

When modeling a projection for an existing business I like to use our existing business budgeting template that allows me to enter in historical revenue and expenses and use that as a baseline to build a forecast by increasing or decreasing expenses and revenue based on my plans.

Startup Projections

For a startup, I would use one of our 70+ industry specific financial projection templates and start from the ground up. You would use the research process outlined in this article to create your projections.

Forecasting a Business Acquisition

For creating projections for a business that you are looking to acquire I would use our acquisition financial model which will allow you to enter in historical financials from the target business, but it will also allow you to make adjustments to the balance sheet and revenue and expenses for a post acquisition pro forma. You can’t simply use the existing balance sheet and income statement because both will likely change quite a bit after the sale of the business.

Finally, I wanted to show you some example pro forma statements so that you can see what the end product should look like.

Pro forma P&L Example

Here is an example of our 5 year pro forma income statement.

Pro forma Balance Sheet Example

Here is an example of our 5 year pro forma balance sheet.

Once you have a complete set of projections (if you are using a ProjectionHub template) I would suggest taking a look at the profit and loss at a glance table as seen below:

In this example, I am looking at projections for a technology company that is looking to raise investment. So a couple of things that I would look at for a tech company pro forma.

- The first year should probably be a loss because that is why you are looking to raise investment right? I would just make sure you are assuming that you will raise enough investment to cover that first year loss.

- Next I would look at how fast revenue is growing. For an investable company there is a rule of thumb “triple, triple, double, double” which means after investment an investor will be hoping that you triple sales the first 2 years and then double sales the following two years. This is really hard to do, so if you are forecasting that you will do 10x every year you are probably off base!

- For tech startups you can look at this study with our partner Story Pitch Decks where we looked at what is a reasonable projection for a tech startup . This study will show you what other similar companies are projecting, so that you can ensure that whatever you project will fall within the norms that investors see.

Investors and lenders will likely be looking at the following numbers and ratios to make sure your projections seem to be reasonable:

- Gross Profit Margin

- Profit Margin

- Debt Service Coverage Ratio

- Comparing to industry averages

- Do revenue projections, units sold make sense?

- Does your balance sheet balance?

- When do you reach breakeven?

- Do you have room for error?

I suggest that you simply Google these things and make sure your numbers seem “normal.” For example, if you are opening a coffee shop you could Google “average profit margin for a coffee shop” and you would probably find our article on coffee shop profit margins . Confirm that your forecasted profit margins are in line and reasonable. Do this same exercise with each of these key ratios and numbers.

As a thank you for reading this behemoth of an article, you can download our free financial projection template . Other tools that I utilized or mentioned in the article include:

- Ahrefs - For competitor research

- Google Trends - For seasonality trends

- Google Adwords Keyword Tool - For search volume and cost per click

- Bizminer - For industry expense ratios

- ProjectionHub Pro Forma Templates - You can use our library of templates built specifically for over 70 unique industries and business models.

If you would like to learn more about my process for creating financial projections, you can watch this course that I put on for tech startups looking to create investor-ready financial projections.

Insert Webinar video below

Well I hope this has been helpful to you. If you have specific questions please feel free to reach out directly to us at [email protected]

About the Author

Adam is the Co-founder of ProjectionHub which helps entrepreneurs create financial projections for potential investors, lenders and internal business planning. Since 2012, over 50,000 entrepreneurs from around the world have used ProjectionHub to help create financial projections.

Other Stories to Check out

Coffee shop profit margin averages and forecast template.

This report takes a look at the coffee shop industry, including coffee shop profit margin averages and forecasts, to help you make an educated decision on whether or not to open your own cafe.

Direct to Consumer (D2C) Product Startup Revenue Stats: A Study of 99 D2C Product Startups [2022]

StarterStory has an incredible database of over 2,600 startup case studies which include many in the D2C Product space, so we pulled together and analyzed a group of 99 D2C startups to learn more about what these companies actually generate in terms of revenue.

Differences Between A Budget & Forecasting For Growth Planning

Identifying the right time to budget and forecast is important for your business growth. Find out how to create a budget and forecast for your company's future plans.

Have some questions? Let us know and we'll be in touch.

IMAGES

VIDEO

COMMENTS

In this guide, you'll learn how to create a financial forecast that allows you to measure the progress of your new business by benchmarking performance against anticipated sales and costs.

The role of financial forecasting in small business success cannot be overstated, as it lays the groundwork for informed decision-making. In this blog, we'll walk you through a step-by-step guide on how financial forecasting can set your startup on the path to success.

Here’s a step-by-step guide to building a financial forecast that can bring clarity, control, and a sense of direction to your business’s future. Why Financial Forecasting Matters. For a small business, a financial forecast isn’t just a tool—it’s a lifeline. By illuminating both short- and long-term needs, financial forecasting ...

A well-prepared financial plan provides a clear financial direction for your business, helps you set realistic financial objectives, create accurate forecasts, and shows your business is committed to its financial objectives. It’s a key element of your business plan for winning potential investors.

Discover how to craft a startup financial forecast with our guide. Uncover the importance of projections, sales forecasting and budgeting for your success.

Creating financial projections for your startup business plan or pitch deck can seem like an intimidating step in the planning process. This article outlines the process for creating startup projections and includes access to a template and course.