Join 307,012+ Monthly Readers

Get Free and Instant Access To The Banker Blueprint : 57 Pages Of Career Boosting Advice Already Downloaded By 115,341+ Industry Peers.

- Break Into Investment Banking

- Write A Resume or Cover Letter

- Win Investment Banking Interviews

- Ace Your Investment Banking Interviews

- Win Investment Banking Internships

- Master Financial Modeling

- Get Into Private Equity

- Get A Job At A Hedge Fund

- Recent Posts

- Articles By Category

Investment Banking Pitch Books: Design, Examples & Templates

If you're new here, please click here to get my FREE 57-page investment banking recruiting guide - plus, get weekly updates so that you can break into investment banking . Thanks for visiting!

Bankers like to complain about almost everything, but near the top of the complaint list is “investment banking pitch books.”

Some Analysts claim that you’ll devote all your waking hours to creating these documents, while others say they’re time-consuming but not that terrible to create.

Some senior bankers swear by pitch book presentations, claiming that they help to win and close deals, while others think they’re over-hyped.

We’ll look at all those points and more in this article, including downloadable pitch book examples and templates for you to use.

Table Of Contents:

- What Is An Investment Banking Pitch Book?

How to Create a Pitch Book

Pitch book presentation, part 1: pitching your team as the advisor of choice, pitch book presentation, part 2: providing background and context, pitch book presentation, part 3: choose your own adventure, sell-side pitch books for sell-side mandates, buy-side pitch book examples, equity pitch book and debt pitch book examples for financing mandates, other types of pitch books, why do you spend so much time on investment banking pitch books as a junior banker, what do you need to know about pitch books as an intern or new hire, what is an investment banking pitch book.

Pitch Book Definition: In investment banking, pitch books refer to sales presentations that a bank uses to persuade a client or potential client to take action and pay for the bank’s services. Pitch books typically contain sections on the merits of the transaction; analysis of potential buyers or sellers; pricing and valuation information; as well as key risks to mitigate.

That is the classic definition, but in practice, people use the term “pitch book” to refer to almost any presentation created by a bank.

We’re going to focus on presentations to potential clients here because they tend to be the most time-consuming ones, and they generate the most horror stories as well.

There’s no way to “measure” how much pitch books matter, but it’s safe to say that they’re less important than the time spent on them implies.

Bankers win deals primarily because of relationships cultivated over a long time ; a pretty presentation right before a company goes public means little compared with the 5-10 years of meeting the CEO and CFO before that point.

Pitch books matter to you as an investment banking analyst or associate primarily because you’ll spend a good amount of time creating them – and you can’t screw up if you want a good bonus .

Almost all investment banking pitch books use a structure similar to the following:

- Situation, 0r “Current State”: Your prospective client is looking for growth.

- Complication, or “Problem”: The potential client’s growth rate has been slowing down.

- Hypothesis, or “Solution”: Acquiring a growing company can meet the potential client’s need for growth.

Then, you go into detail showing why the hypothesis might be true – including why your team is qualified to lead this transaction, similar transactions you’ve led before, and the valuation this company can expect to receive.

Investment Banking Pitch Book Sample PPT and PDF Files and Downloadable Templates

Here are a number of example pitch books in editable Powerpoint (PPT, PPTX) and PDF versions, drawn from some of the case studies within our investment banking courses :

- Jazz Pharmaceuticals – Valuation and Sell-Side M&A Pitch Book (PPT)

- Jazz Pharmaceuticals – Valuation and Sell-Side M&A Pitch Book (PDF)

- KeyBank and First Niagara – FIG M&A Pitch Book (PPT)

- KeyBank and First Niagara – FIG M&A Pitch Book (PDF)

- Netflix – Equity, Debt, and Convertible Bond Financing Pitch Book (PPT)

- Netflix – Equity, Debt, and Convertible Bond Financing Pitch Book (PDF)

Here’s what you can expect in the first few parts of any pitch book, including many examples from actual bank presentations:

The first section of investment banking pitch books introduces your firm’s platform, recent transactions, and team.

You might include stats on your firm’s position in the league tables , or explain its growth story and how it’s different from its competitors. Here are a couple of examples:

You might also write about distribution partnerships and other strategic developments here.

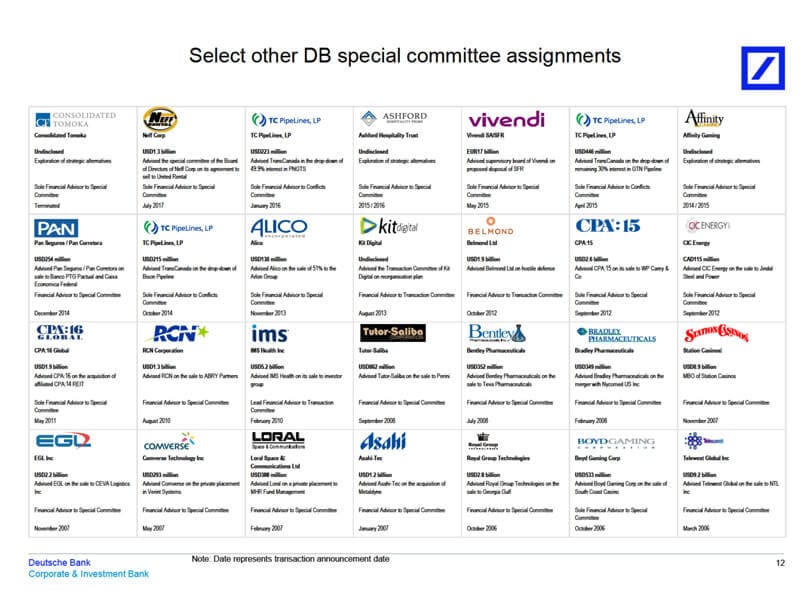

The next section consists of credentials , which include similar transactions your team has completed. Since turnover at banks is high, these lists often include transactions completed by team members when they were at other banks.

Here are a few examples:

These pages look simple, but they can be time-consuming to put together because you need to find the most relevant deals and rearrange elements from other presentations.

You may also go into more detail on a few deals and devote entire pages to them.

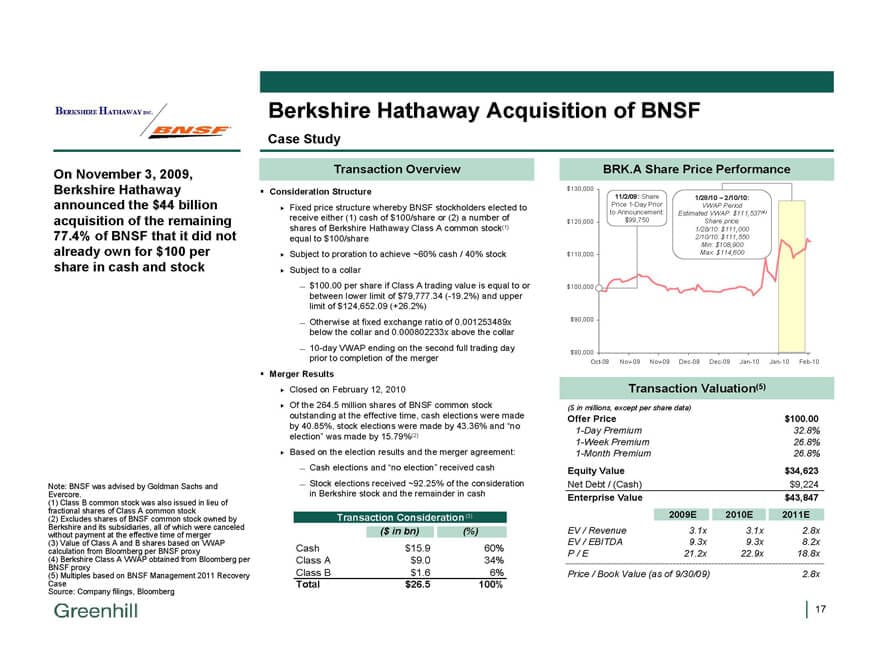

Banks often call these 1-page descriptions “ case studies ,” and you can see a few examples below:

Finally, this section will include a team biography , including previous firms, relevant deals/clients, and education for each member:

Before you move into the specific situation of the company you’re meeting, you’ll usually share some updates on the industry as a whole and recent deal activity in the sector.

Unlike the first part, which was about your team ’s experience, this one is more about general trends that affect everyone.

For example, if a tech startup is considering an initial public offering , you’ll review tech IPOs from the past 6-12 months, explain how they’ve performed, and discuss the types of companies that tend to go public.

Here are a few examples of industry updates:

And here are a few examples of deal/transaction updates:

After these first few sections, which are similar in any pitch book, the structure and content start to differ based on what the bank is pitching.

We’ll look at three broad categories here:

- Sell-side mandates (i.e., convince a company to sell itself)

- Buy-side mandates (convince a company to acquire another company)

- Financing mandates (raise debt or equity).

You’ll start by including a few slides on how your bank would position the company and make it attractive to potential buyers.

For example, if the firm is a traditional services provider with a growing online presence, you might attempt to spin it as a “SaaS” (Software-as-a-Service) company – within reason.

If you’re pitching a large company on a divestiture, you might explain how you’ll make the division sound like more of a standalone entity – meaning that buyers won’t have to spend as much time and money integrating it.

Next, you’ll lay out the company’s valuation and the price it might expect to receive in a sale.

This valuation section might be only 1-2 slides in a short pitch book or 20+ slides in a longer one.

Common elements include the valuation football field , output of a DCF model , comparable public companies , and precedent transactions .

The “football field,” or summary valuation, pages range from simple to more interesting to so complicated they could be eye charts .

Here are a few examples of other valuation-related slides:

It is unusual to include a Contribution Analysis or any M&A analysis in this section unless the deal is highly targeted or has advanced quite far.

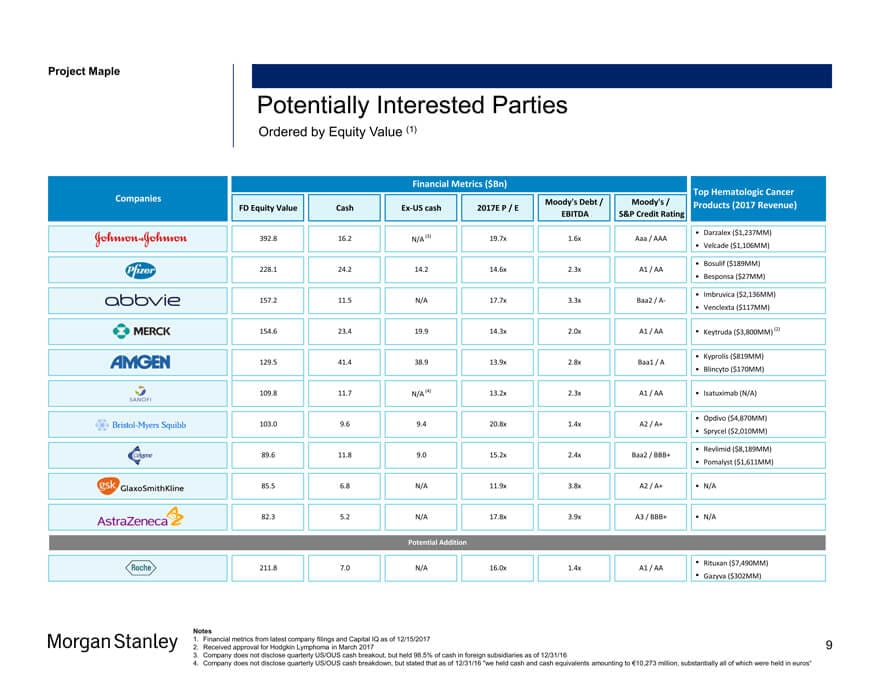

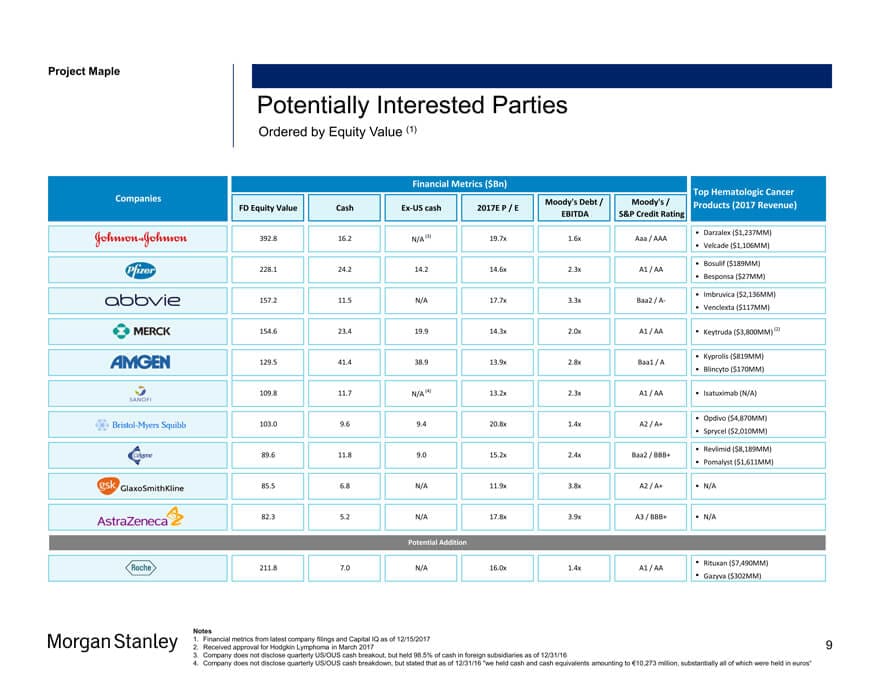

After the valuation section, you’ll discuss “potential buyers,” a list that is sometimes the longest and most time-consuming section of the entire pitch book.

Short summaries aren’t too bad, but if a senior banker wants a full page on each acquirer, you can look forward to a lot of monotonous work gathering the information.

Here are a few shorter examples:

You’ll conclude the pitch book with a summary of your recommendations and the company’s next steps.

For example, you might suggest that the company pursue a targeted sale process with the 5-10 best buyers and aim to complete a deal within 12 months.

These slides tend to be generic ones, used across multiple presentations:

Finally, in longer investment banking pitch books, there is often an Appendix with more detailed models and data, and sometimes even longer lists of potential acquirers.

No one reads this section, but bankers enjoy spending time on unnecessary work (read: evidence of effort).

Investment banking pitch books for buy-side M&A deals follow a similar structure, with a few key differences:

- The “Positioning” part in the beginning might be more about the types of acquisitions the company should pursue and how your bank will help close these deals.

- There may be valuation information, but the purpose will be different: in buy-side deals, you value the buyer to estimate how much a stock issuance to fund the deal might be worth. You might also include quick valuations of potential targets.

- Instead of profiling potential acquirers, you’ll profile potential targets . This list is often longer than the list of potential buyers because a large company could, in theory, choose from hundreds or thousands of potential targets to acquire.

Buy-side M&A pitch books are often shorter than sell-side ones, but they can be more tedious to create due to the longer profile lists.

As a junior banker, you won’t have much input into the acquisition targets that are profiled in these presentations, but senior bankers try to present ideas that:

- Maintain or exceed the firm’s cost of capital.

- Maintain the firm’s competitive advantage.

- Enhance the firm’s ability to serve clients.

- Help the firm expand into high-growth geographies or industries.

Large companies often meet with dozens of bankers per month, so originality can be important as well; many investment banks pitch the same set of acquisition targets repeatedly.

If you present an idea the company has seen 100 times before, they’re unlikely to be excited – but if you find a company they haven’t considered, or you have some exclusive insight, you’ll capture their attention.

It’s tough to find real investment banking pitch books for these transactions because most buy-side M&A deals never close, so the banks do not disclose any of the documents.

But here are a few company profile and associated commentary slides similar to the ones found in buy-side pitch books:

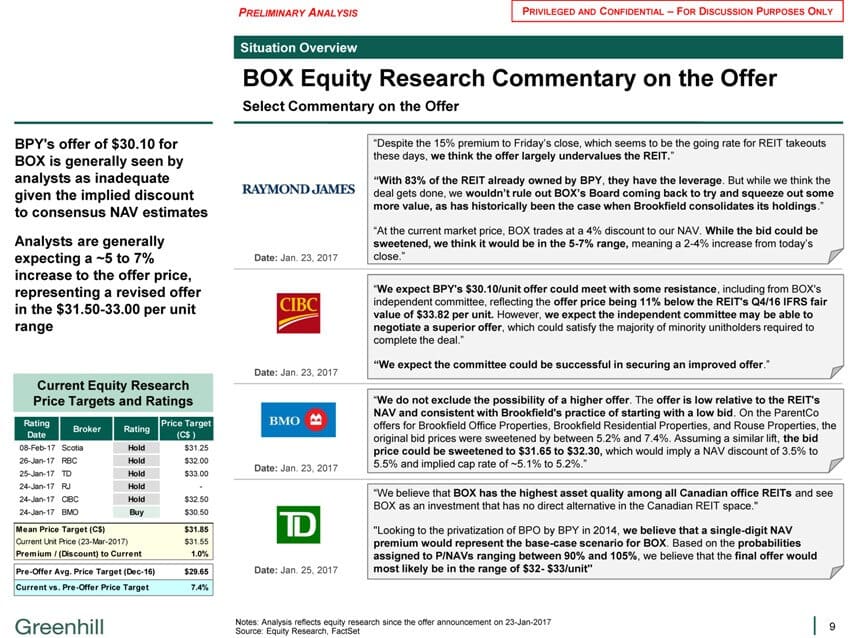

- Brookfield Canada Office Properties by Greenhill

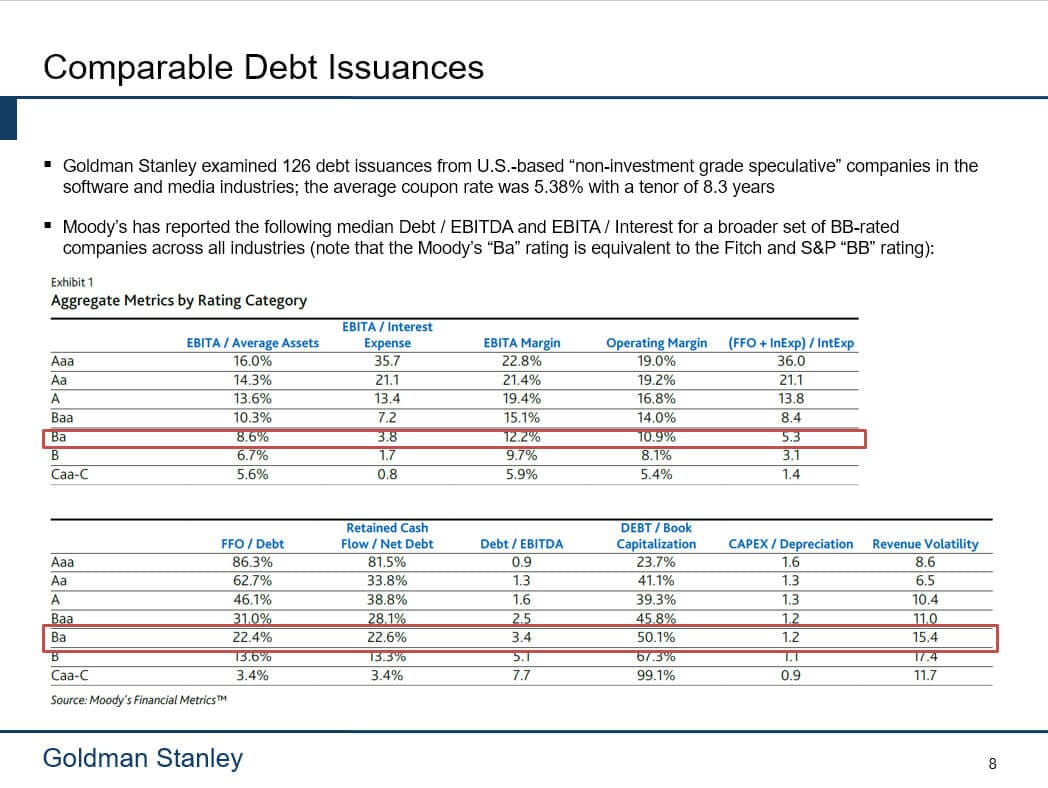

- Banco Santander S.A. by Goldman Sachs

- Side-by-Side Comparison of Buyer and Seller by JP Morgan

- Equity Research Commentary on Buyer’s Offer for Seller by Greenhill

In financing mandates – for equity, debt, and even restructuring deals – there are a few major differences compared with the investment banking pitch books described above:

- No Profiles – You are simply pitching the company on raising capital or restructuring its capital, so there is no need to discuss potential buyers or sellers.

- Financing Models Instead of / or In Addition to Valuation – Valuation still matters for equity and restructuring deals, but you will also have to present additional analyses that are relevant to the deal.

For example, if you’re pitching an IPO, you might show the range of multiples at which the company could go public, the range of proceeds it might receive, and how its value might change after the deal.

In a debt deal, you’ll show the credit stats and ratios for the company under different scenarios, such as Term Loans vs. Subordinated Notes, and explain which one is best based on that.

For more examples, please see the articles on ECM , DCM , and Restructuring .

Also, see our coverage of IPO valuation models and debt vs. equity analysis :

Many other presentations get labeled “pitch books” even if banks pitching their own services do not create them.

For example, management presentations for pitching clients to potential buyers are often labeled “pitch books.”

However, they’re just extended versions of the Confidential Information Memorandum (CIM) .

And in the EMEA region, they’re the same thing because CIMs tend to be more like presentations than written documents.

Banks also create presentations to deliver Fairness Opinions , update clients on recent buyer or seller activity, and update clients on the status of M&A deal negotiations.

None of these is a pitch book according to the classic definition, but the slides often look similar, and there may be some common elements, such as the valuation section.

Not all pitch books take days or weeks to complete – shorter ones might require only a few hours of work.

But they can easily spiral into never-ending projects that require all-nighters and extraordinary effort to finish, resulting in those legendary investment banking hours .

That’s because of:

- Attention to Detail – You’ll spend a lot of time making sure your punctuation is consistent, that all the footnotes are in the right spots, and that the dates are correct.

- Dozens of Revisions – Senior bankers love to make changes well past the point of diminishing returns. It’s not uncommon to see “v44” at the end of file names.

- Conflicting Changes – The Associate wants one thing, the VP wants another, and the MD wants something else. And if you implement the MD’s version based on seniority, the others may fight back.

- Random Graphic Design Work – This one is more of an issue at boutique firms that lack presentations departments, but sometimes you’ll have to spend time creating fancy visual elements on slides – which end up being useless once your MD changes his mind and rips out those slides.

If you’re new to the industry, you should familiarize yourself with the layout and design elements of pitch books, but you do not need to be an expert on the creation process.

Different banks use different tools and methods, so it might be counterproductive to learn too much in advance.

You should also learn the key PowerPoint shortcuts very well, including how to customize PowerPoint to make it more efficient (see our tutorial on PowerPoint Shortcuts in Investment Banking below):

Everyone knows that Excel is important in finance, but people tend to underestimate PowerPoint – even though most junior bankers spend more time in PowerPoint than Excel.

To learn those efficiently, check out our PowerPoint Pro course , which covers the fundamentals of presentation creation, including how to set up PowerPoint properly in the first place, alignment and formatting tricks, slide organization, pasting in Excel data, and applying the “finishing touches.”

There are also practice exercises for creating deal and company profiles and fixing slides with formatting problems.

If you learn all that and understand the structure and layout of investment banking pitch books, you won’t have much to complain about – even as the other interns and analysts around you are whining.

You might be interested in a detailed tutorial on investment banking PowerPoint shortcuts or this article titled Stock Pitch Guide: How to Pitch a Stock in Interviews and Win Offers .

About the Author

Brian DeChesare is the Founder of Mergers & Inquisitions and Breaking Into Wall Street . In his spare time, he enjoys lifting weights, running, traveling, obsessively watching TV shows, and defeating Sauron.

Free Exclusive Report: 57-page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews

Read below or Add a comment

10 thoughts on “ Investment Banking Pitch Books: Design, Examples & Templates ”

Hi Brian. Thank you for valuable information!

I’m currently interning. After sitting in a client presentation. What questions should I ask my supervisor regarding the presentation. As we’re going to have a follow up call

I’m not sure I understand your question. The questions you ask are completely dependent on the presentation, so I can’t really answer this without knowing the contents of the presentation.

Its a great article. Appreciate if you also have a link or article for new PE firm Pitch Deck (presenting to investment banks or FIGs), please. Thanks

Sorry, don’t have anything there.

Great article! The information is very helpful and informative. Where and how can I find other examples of sell-side pitchbooks similar to the ones mentioned in this article?

Thanks, Ryan

Thanks. Unfortunately, sell-side pitch books are hard to find because they’re not disclosed publicly. You can find presentations for recently announced deals by Googling the deal’s name and limiting the search to the sec.gov site and going through those results.

Is an information memorandum informally called a teaser or is this something else?

A teaser is a much shorter document, such as a 1-2-page summary of the company’s key benefits, financials, growth opportunities, etc.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Perfect Your PowerPoint Skills

The BIWS PowerPoint Pro course gives you everything you need to complete pitch books and presentations in half the time and move straight to the front of the "top tier bonus" line.

Investment banking pitchbook: Types, examples, and tips

A pitchbook is an essential sales tool in the investment banking process . It helps bankers pitch their services to current and potential clients.

The guide below aims to explain how a pitchbook works and how to create it.

What is a pitchbook?

An investment banking pitchbook is a marketing document created and presented by investment banks to existing and potential clients to sell their advisory services.

An investment banking pitchbook is also referred to as a merger and acquisition pitchbook, sell-side pitchbook, or Confidential Information Memorandum. For startups, a pitchbook is typically called a pitch deck.

What is a pitchbook used for?

A pitch, a presentation made using a pitchbook, aims to persuade a potential client company to choose your investment firm to handle a financial transaction like M&A, IPO, restructuring, or raising capital.

Thus, each investment banker wants to make a pitchbook concise, informative, convincing, and attractive enough to attract and win prospective clients.

Note: To learn everything about starting a hedge fund , read our dedicated article.

Types of investment banking pitchbooks

General pitchbook.

General pitchbooks provide an overview of the investment bank. They contain

- General information like the company’s vision, mission, global presence, and key management personnel

- Information on recent deals, including client lists and services provided to them

- Firm’s ranking in comparison with its competitors

- Statistics related to recent deals and successful investments

A general pitchbook should be regularly updated with current information.

Sell-side M&A pitchbooks

When a firm wants to sell its business or a part of it, it turns to investment banks that can help them find potential buyers. Investment bankers, for their part, create sell-side M&A pitchbooks to convince the client to choose them to handle the M&A transaction.

A sell-side M&A pitchbook contains

- A list of potential buyers most suitable to the client’s needs and requirements; if there is no known potential buyer, they may include examples or a generic profile of a potential buyer

- Bank overview highlighting the bank’s main advantages over its competitors

- Valuation overview specifying the value of the company

- Recommendations helpful to the client to complete the transaction successfully

- Appendix including additional details of the deal, potentially interesting to the client

Deal pitchbook

A deal pitch book is created specifically for a particular deal with the purpose to prove that an investment firm can specifically cater to its client’s financial and investing needs. Here’s what it contains:

- Lists of the firm’s major accomplishments and clients

- Graphs that demonstrate the market growth rate, the firm’s positioning overview, and the valuation summary that shows the firm’s potential to serve its client

- Relevant financial models and statistics wherever necessary

- Examples of how the firm might execute the deal . Details depend on the nature of the deal; for instance: for an M&A, a list of potential partners, buyers, or sellers; for an IPO, the profile of investors; for private equity funding, profiles of financial sponsors; etc.

A deal pitch book should be concise and contain the most relevant information to demonstrate how the firm can contribute and help achieve the client’s goals.

Management presentations

After clients settle for a deal with an investment bank, they create a management presentation, aiming to pitch to potential investors. The presentation includes:

- A firm’s main attributes and specific details such as products, services, customers, market overview, key company executives, organizational chart, financial performance, and growth forecasts

- Company’s valuation analysis showing the estimated value or worth of an asset

- Financial strength highlighting the firms’ advantages and arguments to invest

- Investment needs and details about the project that needs to be financed

- Client’s goals and how the investment firm can help achieve them

- Weaknesses and recommendations for improving them

To prepare a management presentation, investment bankers should actively interact with their clients and have regular feedback sessions. Only in such a way a pitch book will be comprehensive and contain sufficient information about the company to attract investors.

Investment banking pitchbook examples

Investment banking pitch publications are difficult to find as they contain confidential information. Consequently, good examples to follow when preparing your presentation are very rare.

A few pitchbook examples have been filed with The Securities and Exchange Commission (SEC) and are now available to the public. Find them below.

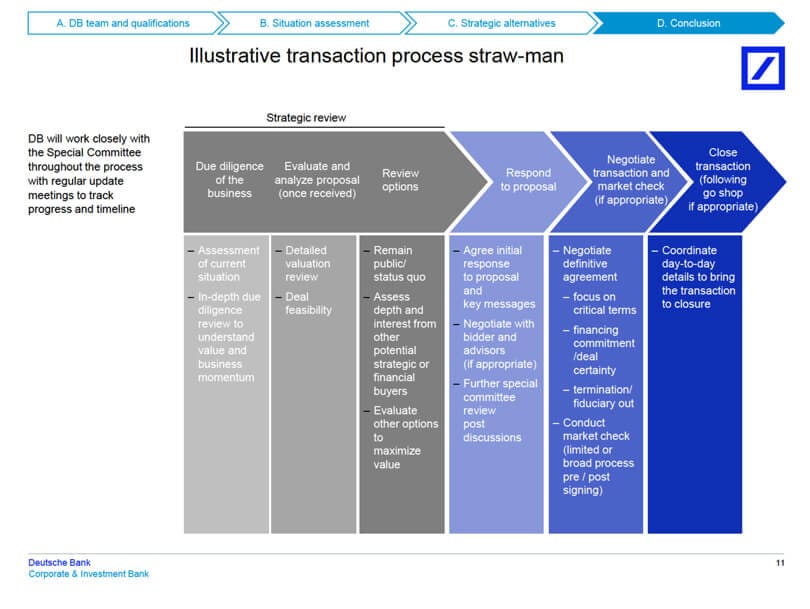

- Deutsche Bank pitchbook

Deutsche Bank Securities Inc. is a company offering investment advisory services, such as financial planning, portfolio management, asset allocation, etc. With the presentation, they pitch to AmTrust, a property and casualty insurer, to become their sell-side advisor.

- Perella pitchbook

Perella Weinberg Partners is a financial services firm focused on investment banking advisory services. With the presentation, it pitches to retailer Rue21, evaluating a buyout by private equity firm Apax Partners.

- Goldman Sachs Pitchbook

Goldman, a leading global investment bank, is pitching to Airvana, a mobile broadband company, to become their sell-side advisor. This is a typical sell-side pitchbook that focuses on why the client should choose Goldman for the transaction.

- Dell special committee investment presentation

This is a pitchbook template to be used by investment bankers, designed by Dell, a well-known technology company. It includes a description of the transaction process, perspectives for the client, an overview of financial forecasts, and an evaluation of strategic alternatives.

How to create an investment banking pitchbook

Find out how to create pitchbook presentations.

Who prepares a pitchbook?

The pitchbook preparation involves several contributors—anyone from analysts and associates to senior bankers like a managing director and a vice president.

The VP and the managing director define the structure of the pitch. The outline should be focused on the financial solution required by the client. After that, the outline is given to the associates and analysts. They research, analyze, and propose numbers relevant to the client’s industry.

Before the pitchbook is completely ready for presentation to the clients, it undergoes many changes and drafts. Such a diligent approach ensures there are no mistakes that might compromise the firm’s reputation.

Usually, the whole process takes from a couple of days to a few weeks, depending on how much time the deal team has to devote to creating the pitchbook.

When investment bankers prepare a pitchbook, they need to double-check every detail and ensure they’re using the most up-to-date information and statistics. It demonstrates professionalism and shows clients they can rely on the firm to achieve their financial goals.

What to include in an investment banking pitchbook

Here are the main components of an investment banking pitchbook that aims to win a new client:

Start with the title, logos, and date. Then give a table of contents indicating what the pitchbook consists of.

- Current state overview

State the purpose of the pitchbook—the client is looking for growth and your firm can help with it.

- Bank introduction

Tell about your bank, its achievements in the client’s industry, and why you’re better than competitors. Also, mention people that are going to be involved in the transaction, highlighting their experience and explaining why they are the best for this job.

- Market overview

Describe the market trends in the client’s industry. Use visual aids like charts and graphs to make the pitch book presentation clearer.

- Valuation methods

Show what valuation methods the bank used to determine the worth of the asset. The most common methods are DCF analysis, comparable company analysis, and precedent transactions.

- Transaction strategy

Emphasize key points of the strategy that the bank will use during the transaction—timing, fees, the capital the bank can raise, etc.

Provide the additional information that wasn’t included in the main pitchbook but that the client may need to look at. For example, calculations or financial reports.

How to deliver the pitch

The pitch is usually delivered in person at the bank or client’s office by senior members of the investment banking team. As a rule, it’s the managing director who leads the meeting.

Junior members like analysts or associates may be present but don’t actively participate in the presentation. They can just take notes or look for additional information when required.

Here are a few helpful tips for delivering the pitch:

- Make the presentation engaging and clear

Ensure that everyone can hear and see you well. Also, don’t overdo it with jargon—speak so that everyone can understand you.

- Clarify the opportunities and risks

Describe the opportunities the client will have working with you, but also be honest and straightforward about the challenges the client will face during the transaction. It’s also essential to propose possible solutions to the difficulties.

- Show the change your service will create

Be descriptive and let the client feel the positive change they’re going to experience if working with you.

- Answer the questions

Be ready to deal with different questions, including uncomfortable ones. Make sure to return to the client with the answer, in case you don’t have it at that moment.

- Explain why you and not someone else

Give the client something that makes you unique and attractive to them as they have probably heard other pitches very similar to yours.

Key takeaways

Here are the main points to remember about an investment banking pitchbook:

- An investment banking pitchbook is a document or presentation created by an investment bank and then used by its sales department to sell products and services to attract new clients.

- The main investment banking pitchbooks are general, sell-side M&A, deal pitchbooks, and management presentations.

- A pitchbook is prepared by a managing director, a vice president, analysts, and associates.

- The main components of an investment banking pitchbook are the intro, current state overview, bank introduction, market overview, valuation methods, transaction strategy, and appendix.

Other insights

What are SPAC warrants: Key points and considerations

Investment Banking Pitch Book

By Ivy Wang |

Reviewed By Rebecca Baldridge |

February 14, 2023

What is an Investment Banking Pitch Book

In investment banking, a pitch book is a marketing presentation intended to convince an existing or potential client to retain their firm for a deal. Pitch books typically contain sections on the merits of the transaction, an analysis of potential buyers or sellers, pricing and valuation information, and key risks to mitigate.

A well-tailored pitch book is a secret to bagging multi-million-dollar deals. Investment banking analysts and associates spend a significant amount of time working on pitch books, and any career in investment banking requires the ability to create pitch books and use them to pitch to prospective investors.

Key Learning Points

- Investment banks create pitch books to market their business to clients. The goal is to be chosen by the client to handle a transaction such as buying or selling a company or raising capital.

- A pitch book for an M&A transaction includes the target’s vision, mission, company overview, and business model.

- Most investment banking pitch books are created in PowerPoint and fall into three categories: bank introductions, deal pitches, and management presentations.

- Creating an investment banking pitch book requires significant preparation and meticulous attention to detail.

Types of Investment Banking Pitch books

There are several types of investment banking pitch books, differentiated depending on purpose and content. We can categorize them as one of three types:

- Market Overviews/Bank Introduction: These are the pitch books used to introduce a bank to prospective clients. They can also be used to give clients updates. These decks include Information that will help create a favorable impression for potential clients, such as background and history, vision and mission, organizational structure, company size, recent achievements and successful deals, and a market overview/update.

- Deal Pitch Book: These include two main types, which are buy-side and sell-side M&A pitchbooks. Debt insurance and IPOs also fall under this category. These decks include details that will present the deal and help potential clients understand how a bank proposes to undertake the work. This might include the following: market growth rate, relevant financial models , list of potential buyers, acquisition candidates, and financial sponsors with detailed descriptions (if applicable).

- Management Presentations: These presentations are used to pitch clients to investors after the business is won. Important information about the client company is included, such as background, market overview, products and services, customers, organizational chart, financial performance, and expansion and growth opportunities.

Uses of Pitch Books

A pitch book is one of the most important tools that investment bankers use to help sell their services:

- It acts as a marketing device and is used by all the investment banks worldwide.

- It exemplifies valuable and comprehensive marketing material.

- It acts as the starting point of the initial pitch or sales introduction for the investment bank when it is trying to seek new business.

- It provides a deep analysis of a current or potential client and deal.

- It offers the bank a chance to demonstrate why a client should choose them from a broad field of competitors.

An Inside Look at Investment Banking Pitch Books

In general, a pitch book is divided into 5 sections:

- Market Update – Provides charts illustrating current capital markets conditions. This is the part of the pitch book that is intended to convince clients that now is the right time to carry out a transaction.

- Credentials – Numerous biographies and league tables that show why the bank is the right choice.

- Deal Outline – Gives a sense of what the deal would involve. It also provides other options to consider.

- Considerations – Includes charts and tables exhibiting effects on EPS and any other potential problems. It’s important to read the footnotes in this section as potential problems are normally referred to as “execution” or “management”.

- Appendix –This is a very important section as it includes models with a variety of scenarios.

How to Create a Pitch Book in Investment Banking

Creating an investment banking pitch book can be daunting. It requires careful preparation and attention to detail. Usually, the majority of the pages (especially in the Credentials and Market Update sections) can be lifted from an already-existing book with the names and financials changed.

Almost all investment banking pitch books use a structure similar to the following:

- Situation, or “Current State”: Your prospective client is looking for growth.

- Complication, or “Problem”: The potential client’s growth rate has been slowing.

- Hypothesis, or “Solution”: Acquiring a growing company can meet the potential client’s need for growth.

Then, the deck goes into detail, showing why the hypothesis might be true – including why the bank’s team is qualified to lead the transaction, similar transactions the bank has led before, and the valuation this company can expect to receive.

Pitch books must be designed to impress prospective clients. Apart from the design, they must have a compelling message. It is therefore vital to have a clear message underpinning the pitch. There should also be a clear message on each slide.

Pitchbook Examples

You can learn a lot by looking at examples of pitch books that have been used successfully in the past. They will illustrate what kind of content and design elements work well with investors and potential clients.

Example 1: Goldman Sachs Pitchbook Airvana Go Private Deck

Goldman Sachs has a track record of creating successful pitchbooks. One of their pitch books was used to win Airvana’s business. In the investment presentation, they gave the company the codename Atlas. Goldman made the presentation to Atlas’ Special Committee, and they included many detailed company projections. This shows how fully they understood Airvana’s business and financial position. Goldman included a detailed analysis of several strategic alternatives in their pitchbook.

Example 2: Medley Management’s 3-way Merger with Medley Capital and Sierra Income

This is another excellent example. The pitchbook was prepared by Barclays when they were pitching to become the M&A advisor to Medley Management during its merger with Medley Capital and Sierra Income. It’s a 38 pager that features beautifully designed graphs, pie charts, and tables. These techniques and presentation styles made it easier for Barclays to communicate with its potential clients effectively.

Example 3: Sale of Rouse Properties to Brookfield Asset Management

This is a sell-side pitchbook prepared by Bank of America and presented to Rouse Properties. Brookfield later acquired the business. The presentation includes 58 slides and has an impressive, concise, and detailed executive summary.

Pitchbook Template

The purpose of the pitch book is to give a comprehensive overview of the investment bank. It contains details such as the number of analysts, previous IPO successes, and the average number of deals completed per year. It can also include information about the financial strengths of the bank and the range of services it offers to its clients.

Creating a pitch book is often time-consuming and challenging, but the process can be simplified by using a template. A pitch book template is a blueprint that contains layouts, colors, fonts, effects, background styles, and general content.

Get our free download of an outline of an investment banking pitch book

An investment banking pitch book is a structured PowerPoint presentation created to attract new businesses. The pitch describes why the bank is the best choice for a transaction. The deck would focus on products if used by an investment firm. For example, it could use graphs and comparisons to a suitable benchmark to demonstrate the merits of a portfolio. There isn’t one formulaic way to make an investment banking pitch book. Much of the work depends on various factors, such as company culture or who a bank is pitching to.

If you want to get the same training as new hires to the top 4 investment banks, and master accounting, financial modeling, valuation, plus M&A and LBO analysis, enroll on the Investment Banker online course .

Additional Resources

Investment Banking Course

Everything You Need to Know about Investment Banking Spring Weeks

Investment Banking Recruitment: The Ultimate Guide

Investment Banking Interview Skills

Share this article

Investment banking pitchbook template and workflow.

Sign up to access your free download and get new article notifications, exclusive offers and more.

Recommended Course

- Recently Active

- Top Discussions

- Best Content

By Industry

- Investment Banking

- Private Equity

- Hedge Funds

- Real Estate

- Venture Capital

- Asset Management

- Equity Research

- Investing, Markets Forum

- Business School

- Fashion Advice

- Technical Skills

- Valuation Resources

Investment Banking Pitch Book

A structured PowerPoint presentation created to attract new businesses

Prior to becoming a Founder for Curiocity, Hassan worked for Houlihan Lokey as an Investment Banking Analyst focusing on sellside and buyside M&A , restructurings, financings and strategic advisory engagements across industry groups.

Hassan holds a BS from the University of Pennsylvania in Economics.

Josh has extensive experience private equity, business development, and investment banking. Josh started his career working as an investment banking analyst for Barclays before transitioning to a private equity role Neuberger Berman. Currently, Josh is an Associate in the Strategic Finance Group of Accordion Partners, a management consulting firm which advises on, executes, and implements value creation initiatives and 100 day plans for Private Equity-backed companies and their financial sponsors.

Josh graduated Magna Cum Laude from the University of Maryland, College Park with a Bachelor of Science in Finance and is currently an MBA candidate at Duke University Fuqua School of Business with a concentration in Corporate Strategy.

What Is An Investment Banking Pitch Book?

- What’s Included In An Investment Banking Pitch Book?

Pitch Book Presentations Structure

How is the pitch book actually made, sell-side pitch books, buy-side pitch books.

An investment banking pitch book is a marketing document created by investment bankers to present to potential clients. The primary objective of this document is to showcase the bank's credentials, services, and value proposition in the hopes of winning business mandates from clients.

Essentially, it's a sales tool, and its effectiveness can be a key determinant in securing deals. The pitch highlights the bank's expertise in transaction procedures, demonstrating why the client should choose the bank for their financial needs.

The initial steps of the pitching process can vary greatly depending on the relationship with the customer and the type of traction.

Banks and investment firms prepare pitch books to facilitate the sale of products and services by listing the company's key characteristics. In addition, pitch books are helpful guides for sellers to remember key benefits and provide visual aids when presenting to customers.

Presentation books are helpful guides for sellers to remember key benefits and provide visual aids when presenting to customers.

In investment banking, pitch books refer to the selling point used by a bank to persuade a prospective client to take action and pay for the bank's services.

Pitch books frequently feature sections on:

- The transaction's virtues

- Analysis of prospective buyers or sellers

- Price and rating information

- Important risks to consider

The effectiveness of pitch books can vary, and their importance depends on the specific situation and the quality of the content.

Most of the time, bankers close deals through enduring relationships. The strong relationships between the chief executive and chief financial officers, built on trust and prior experiences, are more important than a strong presentation before a company goes public.

Key Takeaways

- Investment banking pitch books are structured PowerPoint presentations designed to attract new business. They articulate why the bank is the best choice for transaction processes and why clients should opt for its services.

- Investment Banking Pitch books outline key characteristics of a business and serve as guidelines for the sales force, providing essential information about the company.

- Creating an investment banking pitch book is a joint effort involving junior and senior bankers, with analysts and investment banking personnel doing most of the work.

- The process of creating pitch books can be complex, involving challenges such as conflicting changes in content and design preferences.

- Despite the effort put into pitch books, building enduring relationships often plays a more critical role in closing deals than the presentation alone.

What's Included In An Investment Banking Pitch Book?

In general, the process of creating a pitch book is fairly standard and follows the structure below:

- Format: Title, Date, and Title logos

- Index: All sections of the pitchbook

- Executive Summary/Situation Summary: Explains why you keep the presentation and CTA/Recommendation on one page

- Introduce the key team members and briefly overview the bank's expertise , highlighting relevant experience and achievements. Clearly define the purpose of discussing the bank's history with the customers.

- Market Overview: Tables, charts, and analysis outlining the state of the market and consumer trends.

- Valuation: Valuation methods include comparative analysis of companies, historical transactions, and DCF analysis

- Transaction strategy: details of the bank's strategy

- Summary: Summarize why the team and bank are best suited to conduct the transaction and how the environment can do so, e.g., that the market is relevant, the valuation it deems feasible, and the bank's strategy. There may be problems with trading, but it does not belong in the ledger queues

- Annexure: May contain a variety of information within the offer but mainly supporting information that the bank deems questionable but which is not pertinent to the main stock ledger, e.g., assumptions/model details

Everything You Need To Master PowerPoint for Finance

To Help You Thrive in the Most Prestigious Jobs on Wall Street.

As briefly mentioned, an investment bank, corporate finance firm , or other M&A intermediary that advises on the sale or disposal of shares or assets of a business uses a pitch book (or pitch deck ) as a marketing presentation.

Presentations like this serve as information layouts and usually consist of the following elements:

- The first section of the Investment Banking Pitch Books introduces your firm's platform, recent transactions, and the team.

- You can add statistics about your company's position in the rankings or explain your growth story and how you differ from your competitors.

- You can also discuss distribution alliances and other strategic developments in this section.

- The credentials in the next section include information on transactions your rivals have carried out that are comparable to yours. These lists frequently contain transactions done by staff at other banks due to the high rate of bank turnover.

- These pages look simple, but putting them together can be time-consuming as you have to find the most relevant offers and rearrange elements from other presentations.

- You can also go into some agreements in more detail and devote entire pages to them.

- This part concludes with a biography of the team, detailing former employers, pertinent transactions, and clients.

- Before moving on to the specific situation of the company you are meeting with, you typically share some news about the industry and recent business activity.

- Sell-side mandates involve persuading a company to sell itself, employing various strategies to maximize value for the client and facilitate the sales process.

- Acquisition mandates involve convincing a company to acquire another entity, necessitating thorough market analysis, negotiation skills, and strategic planning .

- Financing mandates encompass raising debt or capital through various financial instruments tailored to meet the client's specific financial needs and optimize their capital structure .

Pitch book creation involves collaboration between junior and senior bankers, analysts, and investment banking personnel. Analysts and investment banking personnel are primarily responsible for the detailed work involved.

Typically, a director (who has a relationship with the client) sits down with the vice president to conduct a general review of the bid book.

The vice president or director then puts together the presentation structure and has the associate work with the analyst to pull together all the numbers and create the analysis used to complete the presentation.

For an investment firm, the presentation book would be more product-oriented. For example, it could show the history of an investment portfolio through charts and comparisons with an appropriate benchmark .

If the investment strategy is more advanced, it will show the stock selection method and other information to help the prospective client understand the strategy.

In 2011, Autonomy was acquired by several larger competitors. Hewlett-Packard and Oracle were interested, but HP ultimately prevailed and acquired the software infrastructure company.

Oracle has decided to publish an IPO launch book developed by Qatalyst Partners on its website.

In the introductory book, Qatalyst provides examples of how Oracle would benefit from the acquisition of Autonomy and shows that it would increase its competitive advantage in areas where Oracle could not gain a foothold.

It also showed the company's key financials and how it had positive revenue and margin growth. The book also introduced the partners and customers Oracle would acquire immediately after purchasing the company. It went into detail about the Autonomy of the management team and the directors.

Let's take a look at the pitch for the Sell-Side Pitch Books:

- First, provide a few slides outlining how your bank will market the business and make it appealing to potential purchasers.

- Common elements include the "soccer field" valuation chart, DCF model output, comparable public companies , and historical transactions. These all make the presentation more visually appealing and comprehensible.

- "Soccer field" or rating summary pages vary in complexity, from basic representations to intricate charts designed to provide detailed insights. Including a Contribution Analysis or M&A Analysis in this section is common if the business is very specific or advanced.

- Last but not least, longer investment banking presentation books frequently tend to include an appendix with more thorough models, statistics, and relatively longer lists of potential buyers.

Investment banking submission books for M&A purchase transactions follow a similar structure, with a few key differences. The primary distinction is that in buy-side deals, the bank actively facilitates the transaction closure process.

In sales contracts, key goals include:

- Valuing the buyer

- Assessing potential stock issues

- Securing funding

- Swiftly evaluating potential acquisition targets to facilitate the transaction process

Unlike sell-side deals focusing on potential buyers, buy-side submissions focus on profiling potential targets. Considering large firms might consider hundreds or thousands of targets, this list is generally broader than potential buyer lists.

Buy-side transactions share similarities with generic pitch books in structure. However, they emphasize the type of acquisition and employ a unique valuation structure. This structure determines stock distribution based on the estimated value of the buyer.

Moreover, their profiling algorithm tends to be significantly more inclusive, emphasizing potential targets rather than just acquirers.

Hence, the importance of this stage cannot be stressed enough, as it lays the foundation for the business flow operation and is thus typically conducted by senior analysts.

To avoid repetitiveness in acquisition targets, large companies sometimes engage external bankers to ensure the authenticity and diversity of potential targets.

Proposing a unique and original business concept captures the firm's interest, as opposed to suggesting ideas that have been previously heard, which may not generate enthusiasm.

Everything You Need To Break into Investment Banking

Sign Up to The Insider's Guide on How to Land the Most Prestigious Jobs on Wall Street.

Researched and authored by Ayoub Mresa | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

- Comparable Company Analysis

- Discounted Cash Flow (DCF)

- M&A Considerations and Implications

- Market Approach Valuation

- Valuation Methods

Get instant access to lessons taught by experienced private equity pros and bulge bracket investment bankers including financial statement modeling, DCF, M&A, LBO, Comps and Excel Modeling.

or Want to Sign up with your social account?

- Search Search Please fill out this field.

What Is Investment Banking?

Understanding investment banking, regulation and investment banking, initial public offering (ipo) underwriting, example of investment banking, the bottom line.

- Investing Basics

Investment Banking: What It Is, What Investment Bankers Do

Julia Kagan is a financial/consumer journalist and former senior editor, personal finance, of Investopedia.

:max_bytes(150000):strip_icc():format(webp)/Julia_Kagan_BW_web_ready-4-4e918378cc90496d84ee23642957234b.jpg)

Pete Rathburn is a copy editor and fact-checker with expertise in economics and personal finance and over twenty years of experience in the classroom.

:max_bytes(150000):strip_icc():format(webp)/E7F37E3D-4C78-4BDA-9393-6F3C581602EB-2c2c94499d514e079e915307db536454.jpeg)

Investment banking is a type of banking that organizes large, complex financial transactions such as mergers or initial public offering (IPO) underwriting. These banks may raise money for companies in a variety of ways, including underwriting the issuance of new securities for a corporation, municipality, or other institution. They may manage a corporation's IPO. Investment banks also provide advice in mergers, acquisitions, and reorganizations.

In essence, investment bankers are experts who have their fingers on the pulse of the current investment climate. They help their clients navigate the complex world of high finance.

Key Takeaways

- Investment banking deals primarily with raising money for companies, governments, and other entities.

- Investment banking activities include underwriting new debt and equity securities for all types of corporations.

- Investment banks will also facilitate mergers and acquisitions, reorganizations, and broker trades for institutions and private investors.

- Investment bankers work with corporations, governments, and other groups. They plan and manage the financial aspects of large projects.

- Investment banks were legally separated from other types of commercial banks in the United States from 1933 to 1999, when the Glass-Steagall Act that segregated them was repealed.

Ellen Lindner / Investopedia

Investment banks underwrite new debt and equity securities for all types of corporations, aid in the sale of securities, and help facilitate mergers and acquisitions , reorganizations, and broker trades for institutions and private investors. Investment banks also provide guidance to issuers regarding the offering and placement of stock.

Many large investment banking systems are affiliated with or subsidiaries of larger banking institutions, and many have become household names, the largest being Goldman Sachs, Morgan Stanley, JPMorgan Chase, Bank of America Merrill Lynch, and Deutsche Bank.

Broadly speaking, investment banks assist in large, complicated financial transactions. They may provide advice on how much a company is worth and how best to structure a deal if the investment banker's client is considering an acquisition, merger, or sale. Investment banks' activities also may include issuing securities as a means of raising money for the client groups and creating the documentation for the U.S. Securities and Exchange Commission (SEC) necessary for a company to go public.

Investment banks employ investment bankers who help corporations, governments, and other groups plan and manage large projects , saving their clients time and money by identifying risks associated with the project before the client moves forward.

In theory, investment bankers are experts who have their finger on the pulse of the current investing climate, so businesses and institutions turn to investment banks for advice on how best to plan their development, as investment bankers can tailor their recommendations to the present state of economic affairs.

The Glass-Steagall Act was passed in 1933 after the 1929 stock market crash led to massive bank failures. The purpose of the law was to separate commercial and investment banking activities. The mixing of commercial and investment banking activities was considered very risky and may have worsened the 1929 crash. This is because, when the stock market crashed, investors rushed to draw their money from banks to meet margin calls and for other purposes, but some banks were unable to honor these requests because they too had invested their clients' money in the stock market.

Before Glass-Steagall was passed, banks could divert retail depositors' funds into speculative operations such as investing in the equity markets. As such operations became more lucrative, banks took larger and larger speculative positions, eventually putting depositors' funds at risk.

However, the stipulations of the act were considered harsh by some in the financial sector, and Congress eventually repealed the Glass-Steagall Act in 1999. The Gramm-Leach-Bliley Act of 1999 thus eliminated the separation between investment and commercial banks. Since the repeal, most major banks have resumed combined investment and commercial banking operations.

Essentially, investment banks serve as middlemen between a company and investors when the company wants to issue stock or bonds . The investment bank assists with pricing financial instruments to maximize revenue and with navigating regulatory requirements.

Often, when a company holds its IPO, an investment bank will buy all or much of that company's shares directly from the company. Subsequently, as a proxy for the company launching the IPO, the investment bank will sell the shares on the market. This makes things much easier for the company itself, as it effectively contracts out the IPO to the investment bank.

Moreover, the investment bank stands to make a profit, as it will generally price its shares at a markup from what it initially paid for them. In doing so, it also takes on a substantial amount of risk . Although experienced analysts use their expertise to accurately price the stock as best they can, the investment bank can lose money on the deal if it turns out that it has overvalued the stock, as in this case, it will often have to sell the stock for less than it initially paid for it.

Suppose that Pete's Paints Co., a chain supplying paints and other hardware, wants to go public. Pete, the owner, gets in touch with José, an investment banker working for a larger investment banking firm. Pete and José strike a deal wherein José (on behalf of his firm) agrees to buy 100,000 shares of Pete's Paints for the company's IPO at the price of $24 per share, a price at which the investment bank's analysts arrived after careful consideration.

The investment bank pays $2.4 million for the 100,000 shares and, after filing the appropriate paperwork, begins selling the stock for $26 per share. However, the investment bank is unable to sell more than 20% of the shares at this price and is forced to reduce the price to $23 per share to sell the remaining shares.

For the IPO deal with Pete's Paints, then, the investment bank has made $2.36 million [(20,000 × $26) + (80,000 × $23) = $520,000 + $1,840,000 = $2,360,000]. In other words, José's firm has lost $40,000 on the deal because it overvalued Pete's Paints.

Investment banks often will compete with one another to secure IPO projects, which can force them to increase the price they are willing to pay to secure the deal with the company that is going public. If competition is particularly fierce, this can lead to a substantial blow to the investment bank's bottom line .

Most often, however, there will be more than one investment bank underwriting securities in this way, rather than just one. While this means that each investment bank has less to gain, it also means that each one will have reduced risk.

What Do Investment Banks Do?

Broadly speaking, investment banks assist in large, complicated financial transactions . They may provide advice on how much a company is worth and how best to structure a deal if the investment banker's client is considering an acquisition, merger, or sale. Essentially, their services include underwriting new debt and equity securities for all types of corporations, providing aid in the sale of securities, and helping to facilitate mergers and acquisitions, reorganizations, and broker trades for both institutions and private investors. They also may issue securities as a means of raising money for the client groups and create the necessary U.S. Securities and Exchange Commission (SEC) documentation for a company to go public.

What Is the Role of Investment Bankers?

Investment banks employ people who help corporations, governments, and other groups plan and manage large projects, saving their clients time and money by identifying risks associated with the project before the client moves forward. In theory, investment bankers should be experts who have their finger on the pulse of the current investing climate. Businesses and institutions turn to investment banks for advice on how best to plan their development. Investment bankers, using their expertise, tailor their recommendations to the present state of economic affairs.

What Is an Initial Public Offering (IPO)?

An initial public offering (IPO) refers to the process of offering shares of a private corporation to the public in a new stock issuance. Public share issuance allows a company to raise capital from public investors. Companies must meet requirements set by exchanges and the SEC to hold an IPO. Companies hire investment banks to underwrite their IPOs. The underwriters are involved in every aspect of the IPO due diligence, document preparation, filing, marketing, and issuance.

The names of investment banks like Goldman Sachs and Morgan Stanley come up frequently in discussions about the financial market, highlighting the importance of these institutions in the financial world. In general, investment banks assist clients with large and complex financial transactions. This includes underwriting new debt and equity securities, aiding in the sale of securities, and helping to facilitate mergers and acquisitions, reorganizations, and broker trades. Investment banks may help other organizations raise capital by underwriting initial public offerings (IPOs) and creating the documentation required for a company to go public.

J.P. Morgan. " Investment Banking ."

:max_bytes(150000):strip_icc():format(webp)/investmentbanker.asp-final-3b802f4529cf4af3b5f76c097e2aea4f.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- Collections

Investment Banking Slide Examples of Company Overview

Tl;dr: Part of a collection of real examples of M&A investment banking slides. This blog covers Company Overview examples. See the PowerPoint presentations investment bankers are paid millions for. No matter your job, or your aspirations, you can learn from these slides.

This is part of a collection of 67 free M&A presentations from the top 20 banks (based on ranking, and also the quality of presentation for you to learn from).

Collection of M&A slide examples

The main page for all the M&A resources is here .

I have broken out 827 examples of slides across 32 sections. You can click through to the section you want to learn about next here:

Is this blog for you?

Why the heck should you care? Investment banks (historically) attracted the best and the brightest.

- Slide structure/design : Learn how complicated concepts are structured and designed in PowerPoint

- Analysis approach : See exactly how complex financial methods are presented

- Strategy and communication : M&A deals are not (normally, other than many Duff and Phelps decks) cookie cutter. There’s a host of topics that need to be dealt with

- Morbid interest : I used to do this for a living, but it’s still interesting to see how PPT are made… but then maybe it’s just me and so FML 😉

Who this will help:

- You want to work in banking : There’s a lot of applicants. Knowing the job helps you answer questions

- You work in banking : Even if you’re an MD, you need to know how the best are structuring their thoughts/analysis

- You write presentations : You can’t buy learnings like this. You can learn from the slides

- You have a curious mind : Good for you

About Company Overview slides

We are in no bed and go easy on the butter territory for Analysts now.

Very simply, company overview slides are like Tinder profiles. They say just enough to know whether you are interested, or not (in most cases).

When you are doing coverage, you’ll absolutely spend a tonne of time writing company overviews which are typically 2 pages, some times 4 (the constraint is what is publicly available), and are only more extensive if:

- You’re doing an interloper analysis (Competitive deal- who the heck is also in the round?!)

- You’re doing a deep dive for an acquisition which can be a managed process or unsolicited

Why these slides are made

Why do you get told to make these slides then?:

- Show that you know about everyone in the industry

- Educate clients, but really you’re trying to see if you can sell them on a deal

- Show you are doing lots of work for the client so they 1/ hire you, 2/ feel they are getting their money’s worth

- Train analysts about an industry (it’s not a goal, it’s a side effect)

Comments on making these slides

It’s base monkey work

In terms of hard stuff, this is like coloring in time at a Kindergarten. If you can’t write company profiles, your career is not looking bright.

They can get complicated

If you’re on the sell-side in a process with an IM, you have a lot of information. The issue is the volume. When you first get an IM the first presentation you will do is on your initial thoughts. This is like company profile++.

Mainly dealing with public info

Especially when you are doing coverage monkey decks, you’re only going to spend a limited amount of time making slides. The real issue is that you’re working with public information. Think of it as me telling you “get me some intel on google, facebook, snap, bla, bla, bla”. You don’t know Mark, Evan etc, so you have what is publicly available. That’s great for public companies with 10Ks, but good luck when you’re talking private companies. And frequently you’re talking private companies, so there is very little around.

Examples of Company Overview

These are a very random bunch of Company Overview slides. I didn’t overthink these, nor did I try and show consistency. You always have varying levels of information to work with, so you do the best you can with it. All you’re trying to do is:

- Find the most salient points

- Ensure your boss doesn’t look dumb

Want to learn more about investment banking presentations?

Want easy access to knowledge?

- Basic : Want to get a convenient file of all the 67 presentations? Get it here

- Premium : If you would love to learn more, you can buy an Excel with 374 presentations. Get it here

- Pro : For uber-nerds, you can buy a complete index of 3,490 rows of filings back to 2001. Get it here

Want to learn more ?

Advent International GPE IX Pitch Deck

ACM Permanent Crop Fund 2 Pitch Deck

Is it a bad sign when a CEO of a company sells his stock?

Generally, yes. In public markets, it is always not a positive sign. If it is a small amount, fine. CEOs of public companies are typically...

Why do companies use cash to finance acquisitions?

The cynical answer is that they don’t want to return the cash to investors as a dividend or share buyback and they don’t know how...

McKinsey Request for Proposal examples

Here are some examples of Request for Proposal/Quotation (RFP/RFQ) for contracts that McKinsey won. Most are for government contracts so they are shared under transparency...

BCG: Dell and Pivotal combination

A real BCG presentation on a proposed Dell and Pivotal deal. There isn’t a proper title because it’s an internal document I found in SEC...

McKinsey: Forecasting HCA Healthcare EBITDA performance

A real Mckinsey presentation on HCA Healthcare and forecasting their EBITDA performance. [Caveat- I found this in an SEC filing and they Use HENRY as...

McKinsey: Forecasting HCA Healthcare EBITDA Growth

A real Mckinsey presentation on HCA Healthcare and their EBITDA growth. [Caveat- I found this in an SEC filing and they Use HENRY as the...

LEK: Opportunities Uncovered & Myths Debunked

A real LEK presentation on media consumption, platforms and behavioural responses. Want to see more? Head to the collection here: Management Consulting Collection

Get in the game

Free tools and resources like this shipped to you as they happen.

Comments (0)

There are no comments yet :(

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Information

- Consulting Options

- Financial model consulting

- Fundraising support structure

- Fundraising support structure application

- Startup support structure

- Startup support structure application

Start and Raise

Financial models.

- Pitch decks

- Deal structures

- Mergers and Acquisitions

- Marketplace

- App Social Financial Model

- Ecommerce Financial Model

- Enterprise SaaS Financial Model

- Marketplace Financial Model

- Basic Marketplace Financial Model

- SaaS Financial Model

- Subscription Ecommerce Financial Model

- Professional Cap Table Model

- Pro OKR PPP KPI Tracker Tool

- Investment Banking Presentations

- Complex Charts

- Excel Productivity Addin

- Simple pitch deck template

- About Alexander Jarvis

- About 50folds

- Report a bug

- Can I call you

Consulting Icon

Education icon, models icon, resources icon, join our newsletter.

Got any suggestions?

We want to hear from you! Send us a message and help improve Slidesgo

Top searches

Trending searches

8 templates

solar eclipse

25 templates

ai technology

148 templates

55 templates

22 templates

Investment Banking Meeting

Investment banking meeting presentation, free google slides theme and powerpoint template.

Your next meeting is approaching and you want to present your information about investment banking in a very visual way. An attractive design will capture your bosses, colleagues or clients’ eye, so let’s aim for something big like that. What about this template? It’s modern with dark vibrant colors to make your presentation very contrasted and bold. Write your professional information and let the geometrical and striking design do the rest!

Features of this template

- 100% editable and easy to modify

- 28 different slides to impress your audience

- Contains easy-to-edit graphics such as graphs, maps, tables, timelines and mockups

- Includes 500+ icons and Flaticon’s extension for customizing your slides

- Designed to be used in Google Slides and Microsoft PowerPoint

- 16:9 widescreen format suitable for all types of screens

- Includes information about fonts, colors, and credits of the resources used

How can I use the template?

Am I free to use the templates?

How to attribute?

Attribution required If you are a free user, you must attribute Slidesgo by keeping the slide where the credits appear. How to attribute?

Related posts on our blog.

How to Add, Duplicate, Move, Delete or Hide Slides in Google Slides

How to Change Layouts in PowerPoint

How to Change the Slide Size in Google Slides

Related presentations.

Premium template

Unlock this template and gain unlimited access

IMAGES

VIDEO

COMMENTS

What Is An Investment Banking Pitch Book? Pitch Book Definition: In investment banking, pitch books refer to sales presentations that a bank uses to persuade a client or potential client to take action and pay for the bank's services. Pitch books typically contain sections on the merits of the transaction; analysis of potential buyers or sellers; pricing and valuation information; as well as ...

An investment banking pitch book is a PowerPoint presentation designed to win new business. The "pitch" is typically an explanation of why the bank in question is best suited to lead the transaction and why they should be engaged by the client. There are various types of pitches, and depending on the relationship with the client and the ...

In investment banking, a pitchbook serves as a marketing presentation to convince an existing client or potential client to hire their firm for advising on the matter at hand. For example, the pitch book could be used in a "bake-off" among various competing firms for the same client to provide M&A advisory services to a client interested in ...

An investment banking pitch book or pitch deck is a sales presentation used by investment banks to attract and engage current and potential clients. This specialized report, which is typically created using PowerPoint, aims to demonstrate why a particular investment bank is best suited to provide advisory services for a potential client.

A common framework for investment banking client presentations is the three-act structure, which begins with introducing yourself, your firm, and your client along with the main problem or ...

An investment banking pitchbook is a document or presentation created by an investment bank and then used by its sales department to sell products and services to attract new clients. The main investment banking pitchbooks are general, sell-side M&A, deal pitchbooks, and management presentations. A pitchbook is prepared by a managing director ...

An investment banking pitch book is a structured PowerPoint presentation created to attract new businesses. The pitch describes why the bank is the best choice for a transaction. The deck would focus on products if used by an investment firm.

Investment Banking Pitchbook Template. The CFI Investment Banking Pitchbook template is free and available for anyone to download. If you're looking for an example or a guide on how to make your pitchbook, this will be a great starting point. The presentation is based on a hypothetical pitch to a board of directors on several potential ...

Investment Banking Pitch books outline key characteristics of a business and serve as guidelines for the sales force, providing essential information about the company. Creating an investment banking pitch book is a joint effort involving junior and senior bankers, with analysts and investment banking personnel doing most of the work.

This is a classic skillset for Analysts who need to make world-class presentations. This advanced PowerPoint tutorial will help you become a world-class financial analyst for careers in investment banking, private equity, corporate development, equity research, and FP&A. By watching the instructor build the pitchbook right on your screen, you ...

Free. Largest free collection of investment bank presentations and slide examples to learn about how to make M&A decks. 65 decks from 20 top-tier banks, with 827 examples of slides sorted into 32 sections. For the committed, you can access thousands more decks. 65 investment banking presentations.

1 Audience Engagement. One of the most obvious signs of a successful presentation is the level of engagement from your audience. You want to capture their attention, interest, and curiosity ...

Investment banking is a specific division of banking related to the creation of capital for other companies, governments and other entities. Investment banks underwrite new debt and equity ...

Here is a quick 3-minute video on what is in the Basic investment banking presentation collection so you are sure of what you are getting. You will see: What the Excel file looks like. The fields in it as well as the sheets. Examples of the banking presentations you'll see. How you see the presentation (As I keep being asked!)

The formatting commands I recommend adding in PowerPoint are: 1. Font Color; 2. Shape fill; 3. Shape outline weight. Note: To add the shape fill and shape outline weight commands, you'll first need to insert a shape and select it to open up up the Shape Format tab, as pictured below:

1. Build a Compelling Story to Hook Investors. It's important to create a cohesive story that grabs the attention of the investors right off the bat. It's an opportunity to show how you came up with that idea and why you're so passionate about it. The best pitch decks start with a real problem.

Investment Banking Analyst → The analyst is the entry-level position in the industry and, therefore, must handle the most mundane tasks, such as performing company research, analyzing financial statements (i.e., deal room), creating financial models, and preparing presentation material. Investment Banking Associate → The responsibilities of ...

The main page for all the M&A resources is here. I have broken out 827 examples of slides across 32 sections. You can click through to the section you want to learn about next here: Company Overview. Corporate Structure. Management Projections. Research Analyst. Comparison Financial Projections. Analysis At Various Prices.

Investment banking is the division of a bank or financial institution that serves governments, corporations, and institutions by providing underwriting ( capital raising) and mergers and acquisitions ( M&A) advisory services. Investment banks act as intermediaries between investors (who have money to invest) and corporations (who require ...

Investment Banking Meeting Presentation . Business . Free Google Slides theme and PowerPoint template . Your next meeting is approaching and you want to present your information about investment banking in a very visual way. An attractive design will capture your bosses, colleagues or clients' eye, so let's aim for something big like that.