Page One Economics ®

Is college still worth the high price weighing costs and benefits of investing in human capital.

"An investment in knowledge pays the best interest."

—Benjamin Franklin

Students have several options for life after high school, including enrolling in college, pursing a technical training program, starting a career, or enlisting for military service. While college has been a popular choice, college enrollment for recent high school graduates has dropped from its peak of 70% in 2009 to 61% in 2021. 1 In fact, some people are challenging the notion that college is the best route for the majority of students. A March 2023 survey found that only 42% of Americans believe college is worth the cost because it leads to better job opportunities and higher income , while 56% believe that earning a college degree is not worth the cost. That has changed a lot in 10 years: A 2013 study found that 53% believed college was a good decision, while 40% believed it wasn't. 2

Of course, attending college is an individual decision, as each person must weigh the costs and benefits of their options. While some costs of college are immediate (your tuition payments), the benefits are spread over an entire career. This article looks at the costs and benefits of a college education and explains the rate of return of going to college, viewing higher education as an investment. Economists often use the word investment to refer to spending on capital, but that does not mean just physical capital (tools and equipment); it can mean investment in human capital (education and training) too.

Costs and Benefits of Attending College

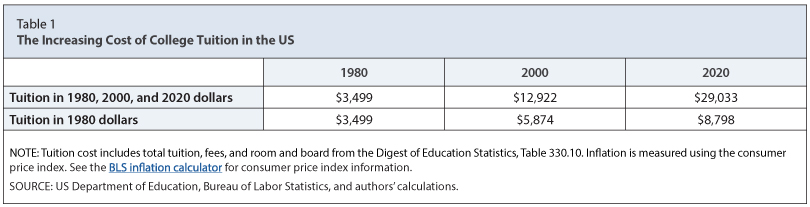

It's true that the cost of going to college has risen significantly in recent decades. The first row of Table 1 shows the average annual tuition for colleges and universities in 1980, 2000, and 2020. The last row of the table shows how much college tuition costs in terms of 1980 dollars, showing that in real (inflation adjusted) terms, attending college cost over twice as much in 2020 as it did in 1980.

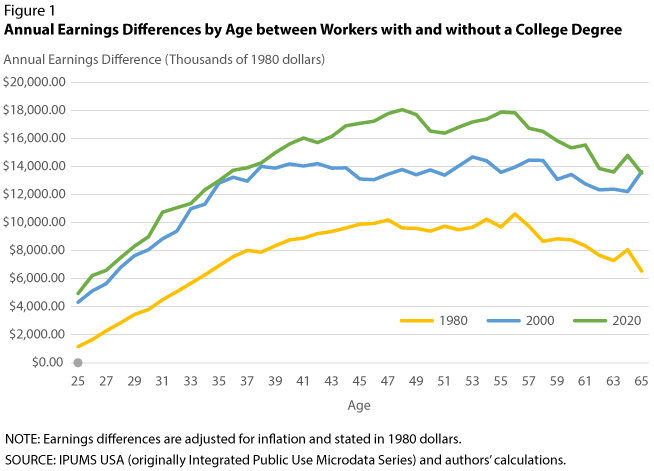

Now, let's examine the financial benefits of going to college, which include how much more money a person with a college degree earns than someone without one; this is sometimes called the college wage premium . Figure 1 shows the annual earnings differences, adjusted for inflation, between workers with a college degree and workers with no more than a high school education.

More specifically, each line in the graph represents how much more money workers with a college degree earn in a year than those with only a high school diploma, for 1980, 2000, and 2020. For each set of data, the college wage premium starts relatively small, but it increases as workers age and acquire skills and experience. For example, in 1980 (yellow line), new college graduates earned about $1,000 more than those with only a high school diploma; but, by mid-career, college-educated workers earned about $10,000 more than high school-educated workers. In 2000 and 2020, however, you can see that the differences in income between education groups were much larger. In 2020 (green line), those with a college degree earned nearly $5,000 more after graduation; but, by mid-career, college-educated workers earned $18,000 more than high school-educated workers. Note that these numbers are adjusted for inflation (stated in 1980 dollars).

What Is the Return on Investing in a College Education?

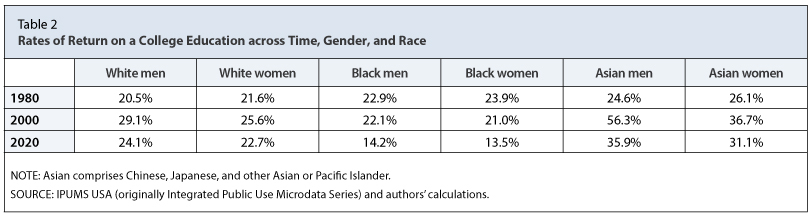

Let's again consider the costs of a college degree. In 1980, the price paid for a college education, on average, was $13,996 (4 x $3,499). If you add up the extra income these workers received each year after graduation, the rate of return on the college tuition they initially paid is very large. For example, a White woman who invested in a college education in 1980 could expect to make back in annual income the cost of her college education plus 21.6%—all of this in addition to the income she would have made without a college degree. By 2020, this rate had risen to 22.7%. Table 2 shows the rates of return on a college education for several demographic groups in 1980, 2000, and 2020.

Of course, there are other ways to invest money besides a college education. For example, instead of paying for four or more years of college, a person could invest money in a financial asset and go straight into the workforce. In this case, the person might have a lower wage, but invested funds and capital gains would add to their income. Although the rates of return on a college education vary greatly across time, gender, and race, they are still considered higher than the returns on financial assets, such as stocks and bonds. For example, investing in the stock market has returned about 10% per year since 1957 3 ; in 2020, returns on a college education varied from 13.5% to 35.9%. By this measure, a college degree is an excellent investment.

What Is This Calculation Missing?

Calculating the rate of return on a college education is imperfect because it is not a tangible asset . A numerical calculation excludes certain intangible aspects that may affect the estimated rates of return on a college education. These include a person's inherent skills, employment status, and career satisfaction.

The Skill Sets Behind Higher Earnings

The rates of return shown in Table 2 were calculated from data collected on the earnings of college-educated workers. However, it is possible that college-educated workers have skills—ones they had even before attending college—that make them simultaneously better at earning high incomes and more likely to pursue a degree. The question here is are people more highly skilled because they went to college or are highly skilled people simply more likely to go to college? 4 It's difficult to tell the difference, so this may cause the rate of return on a college degree to be overestimated.

Unemployment

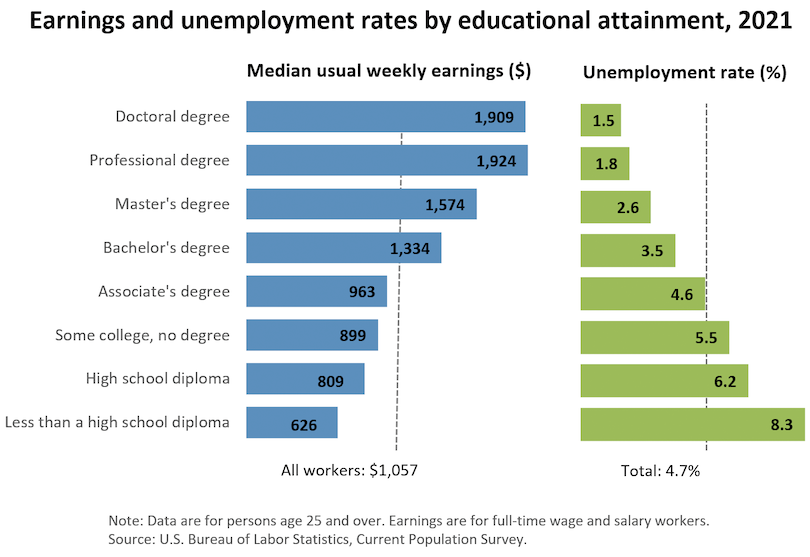

You can only collect income data from someone who has a job, meaning everyone accounted for in this calculation is employed. This information does not account for the fact that high school-educated workers tend to experience higher rates of unemployment. That is, if you have only a high school diploma, you are more likely to be unemployed than someone with a college education. This concept is depicted in Figure 2, which shows the unemployment rates for varying levels of education. You can see that the more educated a person is, the more likely they are to have a job. This issue could cause the rates of return on a college degree to be underestimated.

Career Satisfaction and Non-Financial Benefits

As previously stated, people attend college (or don't) for many different reasons. This article did not include any factors aside from financial ones. For example, high school-educated and college-educated workers may work different hours, work in different conditions, or face different stressors. This calculation does not account for career satisfaction, or lack thereof, that one might get from a specific type of job.

Conclusion

Students have many options for life after high school. One of the most popular options is college. Even though college enrollment has dropped and people have a more dismal outlook on the returns on investing in a college education, the data suggest it is still one of the best investments a person can make. In fact, the advice former Federal Reserve Chair Ben Bernanke gave in 2007 still seems to ring true: "When I travel around the country, meeting with students, businesspeople, and others interested in the economy, I am occasionally asked for investment advice…. I know the answer to the question, and I will share it with you today: Education is the best investment." 5

1 The Economics Daily, US Bureau of Labor Statistics, May 23, 2022; https://www.bls.gov/opub/ted/2022/61-8-percent-of-recent-high-school-graduates-enrolled-in-college-in-october-2021.htm .

2 "Americans Are Losing Faith in College Education, WSJ-NORC Poll Finds." Wall Street Journal , March 31, 2023; https://www.wsj.com/articles/americans-are-losing-faith-in-college-education-wsj-norc-poll-finds-3a836ce1 .

3 See https://www.officialdata.org/us/stocks/s-p-500/1957?amount=100&endYear=2022/ .

4 Wolla, Scott A. "College: Learning the Skills To Pay the Bills?" Federal Reserve Bank of St. Louis Page One Economics ®, December 2015; https://research.stlouisfed.org/publications/page1-econ/2015/12/01/college-learning-the-skills-to-pay-the-bills/ .

5 Bernanke, Ben S. "Education and Economic Competitiveness." Speech presented at the US Chamber Education and Workforce Summit, Washington, DC, September 24, 2007; https://www.federalreserve.gov/newsevents/speech/bernanke20070924a.htm .

© 2023, Federal Reserve Bank of St. Louis. The views expressed are those of the author(s) and do not necessarily reflect official positions of the Federal Reserve Bank of St. Louis or the Federal Reserve System.

Asset: A resource with economic value that an individual, corporation, or country owns with the expectation that it will provide future benefits.

Benefits: Things favorable to a decisionmaker; rewards gained from an action/activity.

Costs: Things unfavorable to a decisionmaker.

Financial asset: A contract that states the conditions under which one party (a person or institution) promises to pay another party cash at some point in the future.

Income: The payment people receive for providing resources in the marketplace. When people work, they provide human resources (labor) and in exchange they receive income in the form of wages or salaries. People also earn income in the forms of rent, profit, and interest.

Investment: An asset purchased with the hope that it will gain value and provide a financial return.

Investment in human capital: The efforts people put forth to acquire human capital. These efforts include education, experience, and training.

Rate of return: A useful measure to compare how different assets may increase your wealth.

Real: Monetary values, wages, or prices, adjusted for inflation and measured in constant prices—that is, in prices of a given or base period. Real monetary values are obtained by adjusting nominal wages or prices with a price measure such as the CPI.

Cite this article

Subscribe to Our Newsletter

Stay current with brief essays, scholarly articles, data news, and other information about the economy from the Research Division of the St. Louis Fed.

SUBSCRIBE TO THE RESEARCH DIVISION NEWSLETTER

Research division.

- Legal and Privacy

One Federal Reserve Bank Plaza St. Louis, MO 63102

Information for Visitors

Experts discuss whether college is still worth it

Subscribe to the center for economic security and opportunity newsletter, gabriela goodman gabriela goodman research assistant - economic studies , center for economic security and opportunity.

December 13, 2023

This is a summary of an event held on December 7, 2023. You can watch the full video of the event here .

Higher education has historically been seen as the most reliable path to economic mobility. However, with uncertainty around student loan programs, high sticker prices, and growing distrust in institutions, Americans are increasingly questioning whether college is still worth it.

On December 7, 2023, the Center for Economic Security and Opportunity (CESO) hosted a virtual panel moderated by Sarah Reber, a CESO senior fellow, to discuss the value of higher education and returns to obtaining a college degree. Below are some key takeaways.

Attitudes toward higher education have shifted.

Paul Tough, a contributing writer at the New York Times Magazine where he has written about these trends, started the discussion off by summarizing changing attitudes toward higher education: Ten years ago, 74% of young adults agreed that higher education is very important, down to only 41% today. This shifting perspective is manifesting in declining college enrollment, explained Tough. The number of U.S. undergraduates has declined to 15.5 million from 18 million in 2010.

Tough attributed this trend to two primary causes. First, trust in institutions is falling, and higher education is no exception. This is particularly the case among conservative voters who perceive colleges as pushing a liberal political agenda. Second, people are worried about the financial risk associated with high college costs and low completion rates.

Research suggests that average returns to college are still high.

David Deming, Harvard University Professor of Political Economy, explained that after increasing for decades, the college wage premium—the difference in average earnings between college graduates and non-college graduates—has plateaued, but remains around 65%. That is, the average four-year college graduate earns about 65% more than the average high school graduate.

Related Content

Online only

10:30 am - 11:30 am EST

Phillip Levine, Sarah Reber

December 11, 2023

The panelists also discussed the cost of going to college, noting that financial aid is available for qualifying low-income students, though it is not always enough to make college affordable. Stephanie Cellini, George Washington University Professor of Public Policy and Economics, pointed out that while the average posted “sticker price” of college has been rising, the “net price”—what students pay after subtracting out financial assistance that doesn’t have to be repaid—is lower than the sticker price that receives so much attention. She notes that the average sticker price has actually been decreasing in recent years. (See a recent discussion of that trend here .) Still, Cellini emphasized that many students have to take out loans to afford college and then struggle to repay these loans.

Denisa Gándara, Assistant Professor of Educational Leadership and Policy at UT Austin, added that higher wages are not the only benefit of college attendance. For example, there is a growing body of evidence suggesting that college graduates have better physical and mental health. Society also benefits when people go to college; college graduates tend to be more civically engaged, reported Gándara.

Returns vary by institution.

Cellini said that some colleges, particularly for-profit institutions, are riskier than others. For-profit colleges are generally more expensive than non-profit or public alternatives and don’t increase earnings as much. As a result, students who attend for-profit institutions tend to have higher debt and are more likely to default on their student loans. Gándara expanded on this point, saying that for-profit institutions enroll a disproportionate number of low-income, veteran, and older students. This disparity means that it is often students from more disadvantaged backgrounds that attend schools with lower returns.

Starting but not completing college can make students financially worse off.

Tough pointed out that about 40% of students who start college don’t complete their degree. These students often end up in a worse financial position than their peers who chose not to attend college in the first place.

Our college institutions are in desperate need of reform. David Deming, Harvard University Professor of Political Economy

Deming agreed that completion is too low and suggested that lack of resources at many colleges is a major part of the problem. Student support services are particularly important. As Gándara mentioned, public and other less well-funded schools enroll more low-income students—exactly the types of students who could benefit more from stronger support systems.

Community colleges have limitations but can be an affordable alternative to four-year institutions.

Panelists pointed out the value of community colleges, an oftentimes more affordable option than traditional four-year colleges. Students can start at community college and transfer to a four-year college. However, as Deming noted, transferring from community college to a four-year college is not necessarily a smooth process. Additionally, he added that short-term programs often lead to shorter-term benefits and fewer transferable skills. Both Deming and Cellini touched on potential benefits of “stacking” credentials, meaning using multiple educational programs such as vocational training and traditional degrees to build a more comprehensive skillset and knowledge base.

Where do we go from here?

The panelists described a number of approaches to increasing the returns to college and improving college completion rates. Cellini mentioned initiatives to hold schools accountable for their students’ outcomes. Both Cellini and Tough proposed efforts to make information about financial aid and college choices more easily accessible and digestible, though Tough argued that some policy discussions have over-emphasized helping individual students navigate a too-complex system at the expense of more systematic change that would make higher education fairer. Deming suggested expanding government subsidies to make college more affordable. The panelists agreed that community colleges require more funding.

So, is college still worth it?

The consensus among the panelists: College is worth it for most people, with some caveats. Institution type and area of study both impact the returns to college, as do academic preparation and risks associated with not completing a degree. “The system is not fair,” Tough added.

There are actions society can take to make college pay off for more people. “Our college institutions are in desperate need of reform,” concluded Deming. As reiterated throughout the panel, the U.S. college system disadvantages low-income students, often leaving them with substantial debt while providing insufficient support systems to help them succeed.

The Brookings Institution is financed through the support of a diverse array of foundations, corporations, governments, individuals, as well as an endowment. A list of donors can be found in our annual reports published online here . The findings, interpretations, and conclusions in this report are solely those of its author(s) and are not influenced by any donation.

Education Access & Equity Higher Education

Economic Studies

Center for Economic Security and Opportunity

9:00 am - 10:00 am EDT

Kelli Bird, Ben Castleman

April 23, 2024

Phillip Levine

April 12, 2024

- {{children.title}} {{currentYear}} {{children.title}}

{{parent.cta_data.text}}

- Manage Account

- GET STARTED

Is College Worth the Cost? Pros & Cons of Paying for College

By Jeff White, CEPF

November 29, 2022

College is expensive, but it can be worth it for many people, giving you a high return on your investment by helping you secure high salaries and build your dream career. However, college isn’t for everyone. If you’re not pursuing a specific career path that requires school then the significant costs of going to college may simply not be worth it.

Therefore, when asking yourself if is college worth it for you, you should weigh the pros and cons of going to college against the costs. It’s also important to consider the alternatives to going to college, as well as explore the different ways you can pay for college without accumulating crippling student debt.

One way to lower the overall costs of going to college is by opening a 529 plan and making regular investments into your future before you ever have to pay for school.

How Much College Costs

College has long been expensive, but this is a more pressing concern than ever before. The cost of going to college increased by more than 150% over the last 40 years and is predicted to continue to increase at accelerated rates into the future.

College tuition and fees form a big part of the cost of going to college, but they’re not the full picture. When weighing up whether college is worth it, it’s important to consider the total cost of attendance (COA), which includes:

- Room and board

- Books, supplies and equipment

- Transportation

- Personal expenses

If enrolling in college in 2023, you can expect your four-year undergraduate degree to cost you between $110,000 and around $240,000, depending on the type of school you attend. Graduate and advanced degrees typically cost less, though they can add to the total cost of your college education.

That’s before you add on interest from student loans. Loan repayments can increase your overall costs, even double the total amount you’ll pay for college.

On the other hand, investment dividends and tax benefits from savings plans can be highly advantageous, effectively reducing the amount you pay for college

Total Cost of US College Degrees in 2023

What’s more, these costs are set to increase in the future, though you can offset them through scholarships, grants, and savings. You can calculate how much you’ll need to pay for college using our college savings calculator .

Reasons College Is Worth the Cost

Despite the high costs associated with going to college, it can be worth it for many people. You may very well find that your investment pays off in the long run, by allowing you to build a well-paid, successful career. Not to mention the invaluable life experience and connections you gain at school.

1. College Graduates Usually Make More Money

Overall, college graduates with a minimum of an undergraduate degree earn significantly more than employees with a high school diploma only. According to the Bureau of Labor Statistics , graduates with a bachelor’s degree or higher had median usual weekly earnings of $1,556 when working full-time, compared to just $866 for high school graduates with no college studies. In this way, a college degree can almost double your earning potential.

As you progress up the career ladder, you’ll be able to use your growing work experience to secure even better-paid positions, all built on the basis of your college education. In this way, paying for college is an investment in your future, and you can expect to see a significant return on that investment that could add up to hundreds of thousands of dollars over the course of your career.

2. Many Careers Require a College Degree

Not only can a college degree help you get a better job, but it’s also a minimum requirement for many career paths. If you want to secure virtually any professional position, whether, in business, social services, finance, or IT, you’ll need some kind of tertiary qualification. For some roles, you’ll only be considered if you have a relevant graduate or professional degree.

With more and more employers looking for candidates with a college education, it will be harder than ever to be competitive in the job market in the future if you don’t have at least an undergraduate degree. In this way, for many people, a college education is worth the cost.

3. You Get Access to a Network of Possibilities

Going to college gives you much more than a piece of paper. Notably, you’ll meet a wide range of specialists and future professionals in your field, from your fellow students to your tutors and professors. In many industries, who you know is as important as what you know, and building your network through college can be extremely helpful in launching your career.

The connections you make at college can put you in touch with career opportunities, give you essential career advice, or provide valuable professional references. They could turn out to be future mentors, clients, suppliers, or business partners. Furthermore, at college, you’ll likely get access to career centers, job fairs, professional clubs, volunteer opportunities, and guidance counselors, all of which can help you to launch your career.

Reasons College Isn’t Worth the Cost

Although college can be advantageous in a range of ways, it also comes with certain drawbacks that can mean it’s simply not worth the cost for some people.

1. You May Not Need a Degree for Your Chosen Career

While many modern jobs require a degree, this is not the case for all career paths. For example, you can pursue a career in most trades with a qualification from a technical college and/or an apprenticeship. You can pursue other professions with a qualification from a community college, including many health care positions, from dental hygienist to registered nurse.

Other roles don’t need any kind of qualification and allow you to build experience on the job. If your chosen career doesn’t need a college education, you would be better off saving on the cost and jumping straight into work.

2. You May Not Graduate if Your Heart Isn’t Into it

It’s pretty common for high school graduates to sign up for college degrees they’re not interested in because of pressure from their parents, guidance counselors, or peers. If you aren’t really motivated, you’ll likely find college a hard grind, underperform, and may drop out before you finish your degree.

However, by the time you drop out, you may have already racked up significant costs in tuition, room and board, as well as other expenses. Although you’ll still gain experience, knowledge, and connections from your time at college, without qualification to show for it, it probably won’t be worth the investment of money, not to mention time.

3. College Is Expensive

College is very expensive , especially when you consider not just tuition and fees, but the total cost of attendance. If you don’t have a savings plan, financial aid, or other resources to draw on, you could be paying back the cost of your college education for a long time.

If you take out student loans, you’ll likely carry this debt for 10 to 30 years, even if you get a good job after graduation. One survey found that the average graduate took more than 20 years to pay off their student debt.

You should also keep in mind that it may take you longer than four years to complete your undergraduate degree, so costs may be even higher than you anticipate.

Therefore, it’s important to weigh up the cost of college against the benefits you’re likely to receive and compare this to possible alternatives.

Alternatives to Going to College

While the advantages of college can make it worthwhile for many people, it’s not for everyone. Depending on your interests, personality, and future ambitions, these alternatives may be a better option for you:

- Trade school: Trade schools are vocational colleges that will give you hands-on training in a range of technical areas, such as plumbing, electrical, carpentry, or car mechanics. They’re significantly more affordable than college, typically shorter, and could be a much better fit if you like to work with their hands. Most trade school courses last between six months and two years and cost between $3,674 and $15,923 to complete.

- Community College: A community college can allow you to gain a degree at a much lower cost than a four-year university. If you choose a community college in your district, you can expect to pay around $10,000 to $20,000 a year and gain a certificate or associate’s degree that will open doors to a range of careers, such as a registered nurse, radiation therapist, dental hygienist, or computer programmer.

- Take online courses: Another way to build your skills and knowledge is through short-term courses offered by universities or MOOC (massive open online course) platforms. Although not as valuable in the job market as a formal degree, they can be a great way to supplement your work experience and demonstrate your commitment to professional development.

- Start to work: You may not need any kind of qualification at all to pursue your chosen career. If studying is not for you, you could choose a field that doesn’t need a degree, such as entry-level roles in administration and marketing, or professions such as scuba diving or real estate.

- Become an entrepreneur: Another alternative to study is to launch your own business, especially if you’re prepared to take on this responsibility, put in the hard work, and have a winning idea. Of course, a college education is highly valuable for anyone who runs their own business, but you may be able to go to school, later on, funded by the proceeds of your business.

Ways to Pay for College to Make it Worth it

If you’ve weighed up the pros and cons of going to college and have decided it’s worth it for you, there are a few ways you can make it more affordable and avoid crippling student debt. It is possible to reduce the amount you’ll need to pay for college , and even go to college for free . Here are some ways you can cut costs and pay for college.

Saving for College With a 529 Plan

529 savings plans and tax-advantaged savings accounts allow you to contribute funds that will be invested on your behalf and later withdraw it to pay for your college tuition and expenses. Therefore, your initial investment can grow over time, meaning that you effectively pay less for college in the end. Additionally, 529 plans have a number of tax advantages and can save you on your federal and state taxes.

It’s best to start contributing to 529 plans as early as possible to get the maximum benefits. Some parents start these accounts when their children are babies, or even before they are born . However, it’s never too late to start saving for college, and you can start a 529 savings plan at any time and keep withdrawing funds until you graduate.

Get Scholarships and Grants

Don’t overlook the value of scholarships and grants, both of which can be extremely helpful in allowing you to pay for college. By submitting a Free Application for Federal Student Aid (FAFSA), you’ll be considered for a range of needs-based aid from the federal and state governments, as well as many colleges. The FAFSA deadline is 30 June each year, but opens in October, so it’s a good idea to put your application in as soon as possible.

A number of schools and organizations also offer merit-based scholarships, based on academic performance, talent in sports, music, or other fields, as well as certain demographics. It’s also important to fill out the FAFSA in order to be eligible for scholarships, as many colleges use this as a basis for awards. You should also do your research and identify private scholarships, and put in applications for those you qualify for.

Work While in School

Traditionally, working was seen as a way to pay for college, and this may be how your parents got their degrees. However, it can be risky to try to work your way through school . Rising college costs have long outpaced minimum wage, and trying to hold down a full-time job could detract from your studies and harm your performance. After all, you don’t want the degree you’ve worked so hard for to become less valuable because of your poor grades!

Therefore, it’s arguably better to use work as a supplemental way to pay for your college education, along with other approaches such as savings plans and financial aid. The ⅓ rule can be a good balance: aim to cover one-third of your college expenses through savings, one-third through current income, and one-third through loans or grants.

Who Should Go to College?

College is the right choice for anyone who wants to pursue a career path where a formal degree is either a mandatory requirement or highly advantageous. This applies to the majority of professional occupations, from medicine to law and engineering to teaching, where you’ll need an undergraduate degree and in some cases a master’s or doctorate to even be considered by recruiters.

Additionally, you should consider going to college if you want to become an entrepreneur, as the skills and knowledge you’ll gain, and most importantly the connections you’ll make could be invaluable in helping you to launch your business.

Before you decide to go to college, it’s also important to consider whether you are motivated and committed enough to see the course through to the end. Finally, it’s important to have a strong financial plan in place, preferably covering a range of funding sources, such as savings plans, financial aid, and work/study programs.

The Bottom Line

So, is college worth it? If you want to pursue a career in a field that doesn’t require a degree or are not really motivated to study, then the significant costs of going to college may not be worth it for you.

However, if you’re passionate about a professional career path that requires a college education and you can reduce student loan borrowing costs through scholarships, grants, work, or savings plans, then a college education could be a valuable investment that more than pays for itself in the long run.

Frequently Asked Questions (FAQs)

Do the benefits of college still outweigh the costs.

The answer to this question will depend on your own interests, motivations, and career goals, as well as how reliant you are on student loans. However, if you can leverage savings and/or grants or scholarships to cover some of your college costs, and are interested in a career that requires a college degree, this investment will be well worth your while.

Are college graduates happier?

Official figures show that college graduates earn more on average than people with high school education, and research suggests that they may be happier as well. One survey found that 94% of respondents with a bachelor’s degree or higher reported being happy or very happy with their lives, compared to only 89% of high school graduates.

How do you decide if you should go to college?

The decision of whether to go to college will largely come down to your career and life goals.

Your financial position may also play a role here, as if you need to take out significant student loans that will burden you with debt for decades to come, it may not be worth it.

How can I apply for financial aid for college?

The first step for applying for college is to submit the FAFSA form , which will qualify you for federal student aid including grants, subsidized student loans, and work-study options. Many schools and states use the information you provide on the FAFSA to offer additional aid.

Is online college cheaper than studying on campus?

In most cases, the tuition for online courses is comparable to studying on campus. However, by studying remotely, you could save on other costs, such as room and board, transportation, and living expenses.

Related Articles

How to Get Started With Banking for Kids

The 15 lowest-cost 529 savings plans

Can You Use Student Loans to Pay for Rent?

Can I Buy a House and Pay My Mortgage with 529 Plan Money?

SPONSOR CENTER

A good place to start:

See the best 529 plans, personalized for you

Unlock Printing

Already have an account? Log in

Home / Essay Samples / Education / College Tuition / Is College Worth the Cost

Is College Worth the Cost

- Category: Education , Life

- Topic: College Tuition , Cost of Education

Pages: 2 (859 words)

- Downloads: -->

--> ⚠️ Remember: This essay was written and uploaded by an--> click here.

Found a great essay sample but want a unique one?

are ready to help you with your essay

You won’t be charged yet!

Adversity Essays

Inspiration Essays

Empathy Essays

Fear Essays

Hope Essays

Related Essays

We are glad that you like it, but you cannot copy from our website. Just insert your email and this sample will be sent to you.

By clicking “Send”, you agree to our Terms of service and Privacy statement . We will occasionally send you account related emails.

Your essay sample has been sent.

In fact, there is a way to get an original essay! Turn to our writers and order a plagiarism-free paper.

samplius.com uses cookies to offer you the best service possible.By continuing we’ll assume you board with our cookie policy .--> -->