Market Research: A How-To Guide and Template

Discover the different types of market research, how to conduct your own market research, and use a free template to help you along the way.

MARKET RESEARCH KIT

5 Research and Planning Templates + a Free Guide on How to Use Them in Your Market Research

Updated: 02/21/24

Published: 02/21/24

Today's consumers have a lot of power. As a business, you must have a deep understanding of who your buyers are and what influences their purchase decisions.

Enter: Market Research.

![market research where to start → Download Now: Market Research Templates [Free Kit]](https://no-cache.hubspot.com/cta/default/53/6ba52ce7-bb69-4b63-965b-4ea21ba905da.png)

Whether you're new to market research or not, I created this guide to help you conduct a thorough study of your market, target audience, competition, and more. Let’s dive in.

Table of Contents

What is market research?

Primary vs. secondary research, types of market research, how to do market research, market research report template, market research examples.

Market research is the process of gathering information about your target market and customers to verify the success of a new product, help your team iterate on an existing product, or understand brand perception to ensure your team is effectively communicating your company's value effectively.

Market research can answer various questions about the state of an industry. But if you ask me, it's hardly a crystal ball that marketers can rely on for insights on their customers.

Market researchers investigate several areas of the market, and it can take weeks or even months to paint an accurate picture of the business landscape.

However, researching just one of those areas can make you more intuitive to who your buyers are and how to deliver value that no other business is offering them right now.

How? Consider these two things:

- Your competitors also have experienced individuals in the industry and a customer base. It‘s very possible that your immediate resources are, in many ways, equal to those of your competition’s immediate resources. Seeking a larger sample size for answers can provide a better edge.

- Your customers don't represent the attitudes of an entire market. They represent the attitudes of the part of the market that is already drawn to your brand.

The market research services market is growing rapidly, which signifies a strong interest in market research as we enter 2024. The market is expected to grow from roughly $75 billion in 2021 to $90.79 billion in 2025 .

.png)

Free Market Research Kit

- SWOT Analysis Template

- Survey Template

- Focus Group Template

You're all set!

Click this link to access this resource at any time.

Why do market research?

Market research allows you to meet your buyer where they are.

As our world becomes louder and demands more of our attention, this proves invaluable.

By understanding your buyer's problems, pain points, and desired solutions, you can aptly craft your product or service to naturally appeal to them.

Market research also provides insight into the following:

- Where your target audience and current customers conduct their product or service research

- Which of your competitors your target audience looks to for information, options, or purchases

- What's trending in your industry and in the eyes of your buyer

- Who makes up your market and what their challenges are

- What influences purchases and conversions among your target audience

- Consumer attitudes about a particular topic, pain, product, or brand

- Whether there‘s demand for the business initiatives you’re investing in

- Unaddressed or underserved customer needs that can be flipped into selling opportunity

- Attitudes about pricing for a particular product or service

Ultimately, market research allows you to get information from a larger sample size of your target audience, eliminating bias and assumptions so that you can get to the heart of consumer attitudes.

As a result, you can make better business decisions.

To give you an idea of how extensive market research can get , consider that it can either be qualitative or quantitative in nature — depending on the studies you conduct and what you're trying to learn about your industry.

Qualitative research is concerned with public opinion, and explores how the market feels about the products currently available in that market.

Quantitative research is concerned with data, and looks for relevant trends in the information that's gathered from public records.

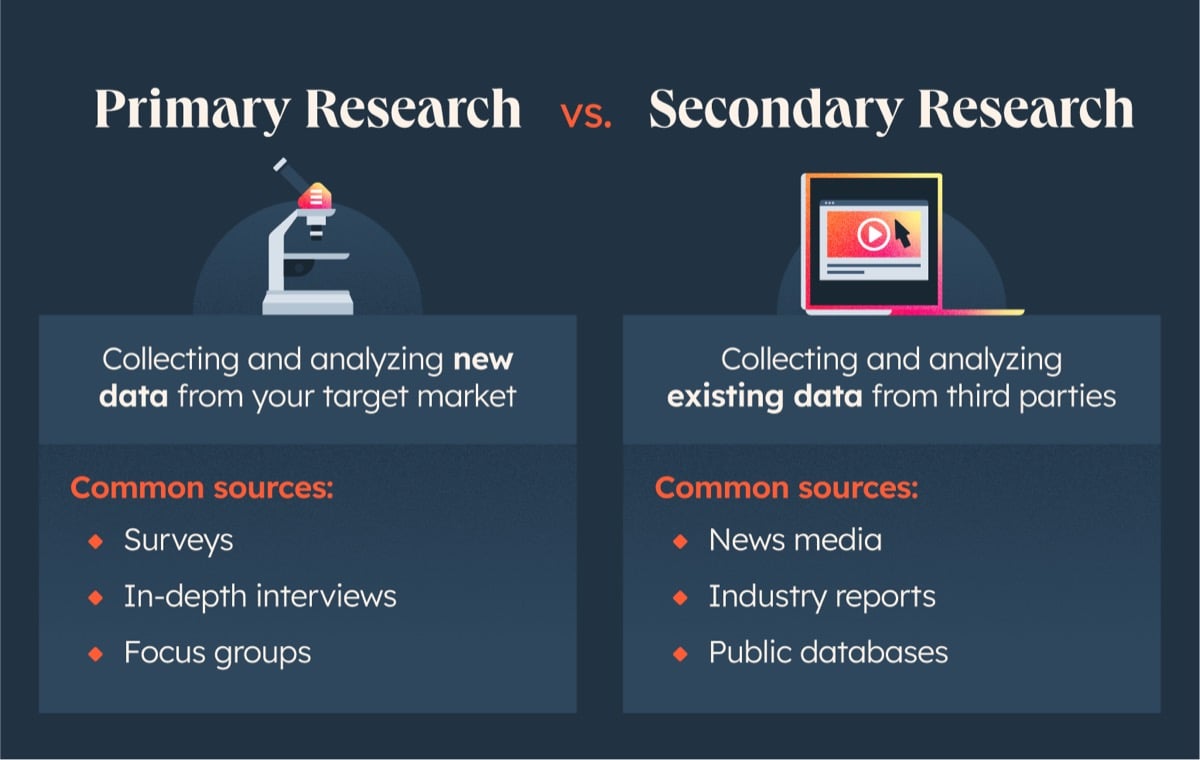

That said, there are two main types of market research that your business can conduct to collect actionable information on your products: primary research and secondary research.

Primary Research

Primary research is the pursuit of first-hand information about your market and the customers within your market.

It's useful when segmenting your market and establishing your buyer personas.

Primary market research tends to fall into one of two buckets:

- Exploratory Primary Research: This kind of primary market research normally takes place as a first step — before any specific research has been performed — and may involve open-ended interviews or surveys with small numbers of people.

- Specific Primary Research: This type of research often follows exploratory research. In specific research, you take a smaller or more precise segment of your audience and ask questions aimed at solving a suspected problem.

Secondary Research

Secondary research is all the data and public records you have at your disposal to draw conclusions from (e.g. trend reports, market statistics, industry content, and sales data you already have on your business).

Secondary research is particularly useful for analyzing your competitors . The main buckets your secondary market research will fall into include:

- Public Sources: These sources are your first and most-accessible layer of material when conducting secondary market research. They're often free to find and review — like government statistics (e.g., from the U.S. Census Bureau ).

- Commercial Sources: These sources often come in the form of pay-to-access market reports, consisting of industry insight compiled by a research agency like Pew , Gartner , or Forrester .

- Internal Sources: This is the market data your organization already has like average revenue per sale, customer retention rates, and other historical data that can help you draw conclusions on buyer needs.

- Focus Groups

- Product/ Service Use Research

- Observation-Based Research

- Buyer Persona Research

- Market Segmentation Research

- Pricing Research

- Competitive Analysis Research

- Customer Satisfaction and Loyalty Research

- Brand Awareness Research

- Campaign Research

1. Interviews

Interviews allow for face-to-face discussions so you can allow for a natural flow of conversation. Your interviewees can answer questions about themselves to help you design your buyer personas and shape your entire marketing strategy.

2. Focus Groups

Focus groups provide you with a handful of carefully-selected people that can test out your product and provide feedback. This type of market research can give you ideas for product differentiation.

3. Product/Service Use Research

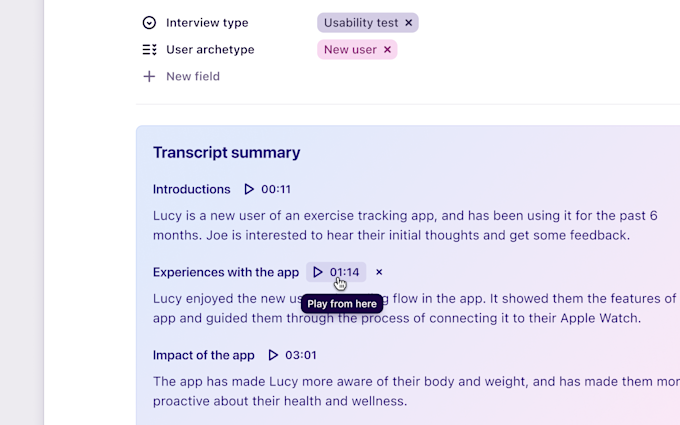

Product or service use research offers insight into how and why your audience uses your product or service. This type of market research also gives you an idea of the product or service's usability for your target audience.

4. Observation-Based Research

Observation-based research allows you to sit back and watch the ways in which your target audience members go about using your product or service, what works well in terms of UX , and which aspects of it could be improved.

5. Buyer Persona Research

Buyer persona research gives you a realistic look at who makes up your target audience, what their challenges are, why they want your product or service, and what they need from your business or brand.

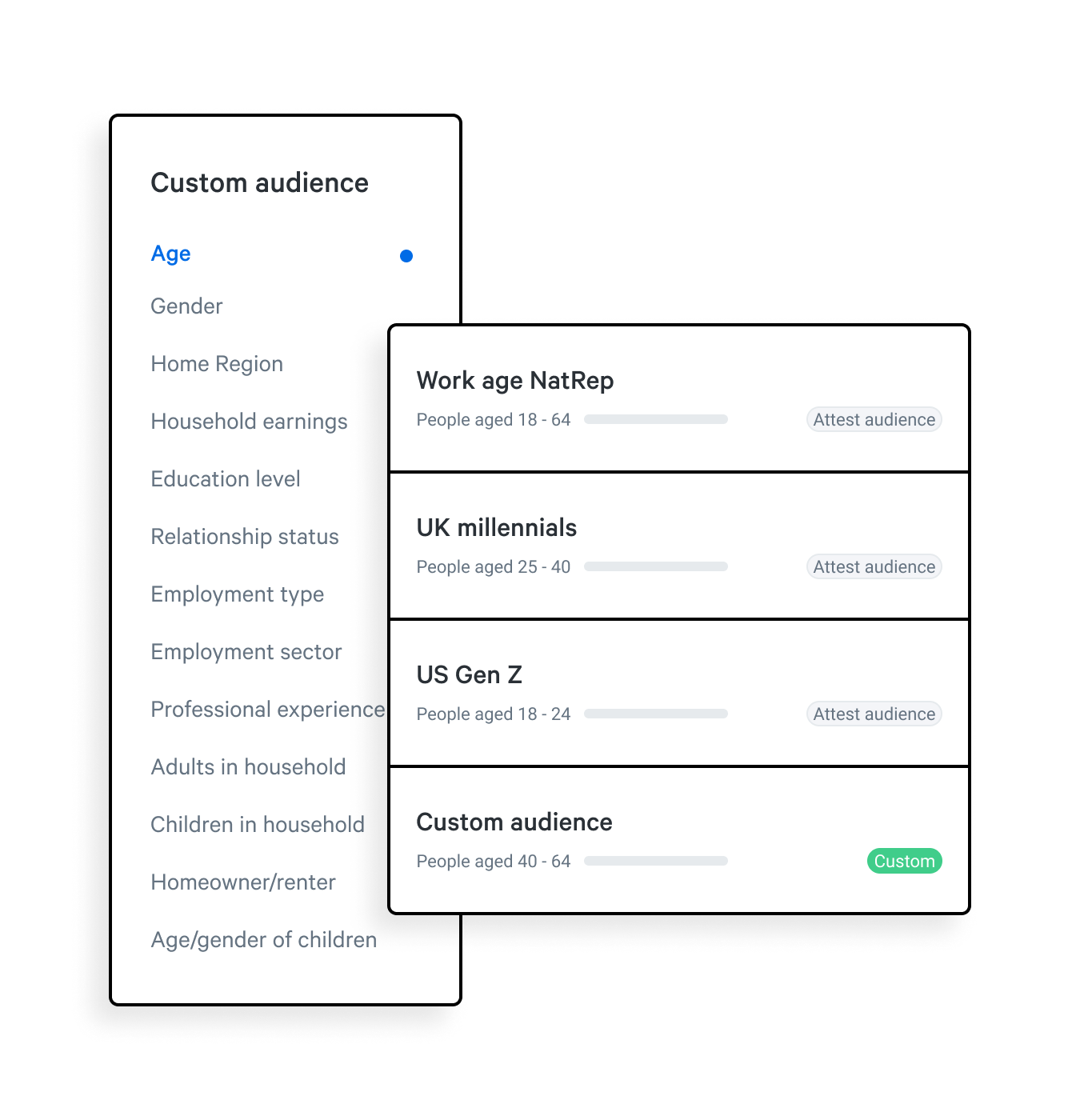

6. Market Segmentation Research

Market segmentation research allows you to categorize your target audience into different groups (or segments) based on specific and defining characteristics. This way, you can determine effective ways to meet their needs.

7. Pricing Research

Pricing research helps you define your pricing strategy . It gives you an idea of what similar products or services in your market sell for and what your target audience is willing to pay.

8. Competitive Analysis

Competitive analyses give you a deep understanding of the competition in your market and industry. You can learn about what's doing well in your industry and how you can separate yourself from the competition .

9. Customer Satisfaction and Loyalty Research

Customer satisfaction and loyalty research gives you a look into how you can get current customers to return for more business and what will motivate them to do so (e.g., loyalty programs , rewards, remarkable customer service).

10. Brand Awareness Research

Brand awareness research tells you what your target audience knows about and recognizes from your brand. It tells you about the associations people make when they think about your business.

11. Campaign Research

Campaign research entails looking into your past campaigns and analyzing their success among your target audience and current customers. The goal is to use these learnings to inform future campaigns.

- Define your buyer persona.

- Identify a persona group to engage.

- Prepare research questions for your market research participants.

- List your primary competitors.

- Summarize your findings.

1. Define your buyer persona.

You have to understand who your customers are and how customers in your industry make buying decisions.

This is where your buyer personas come in handy. Buyer personas — sometimes referred to as marketing personas — are fictional, generalized representations of your ideal customers.

Use a free tool to create a buyer persona that your entire company can use to market, sell, and serve better.

Don't forget to share this post!

Related articles.

![market research where to start SWOT Analysis: How To Do One [With Template & Examples]](https://blog.hubspot.com/hubfs/marketingplan_20.webp)

SWOT Analysis: How To Do One [With Template & Examples]

20+ Tools & Resources for Conducting Market Research

What's a Competitive Analysis & How Do You Conduct One?

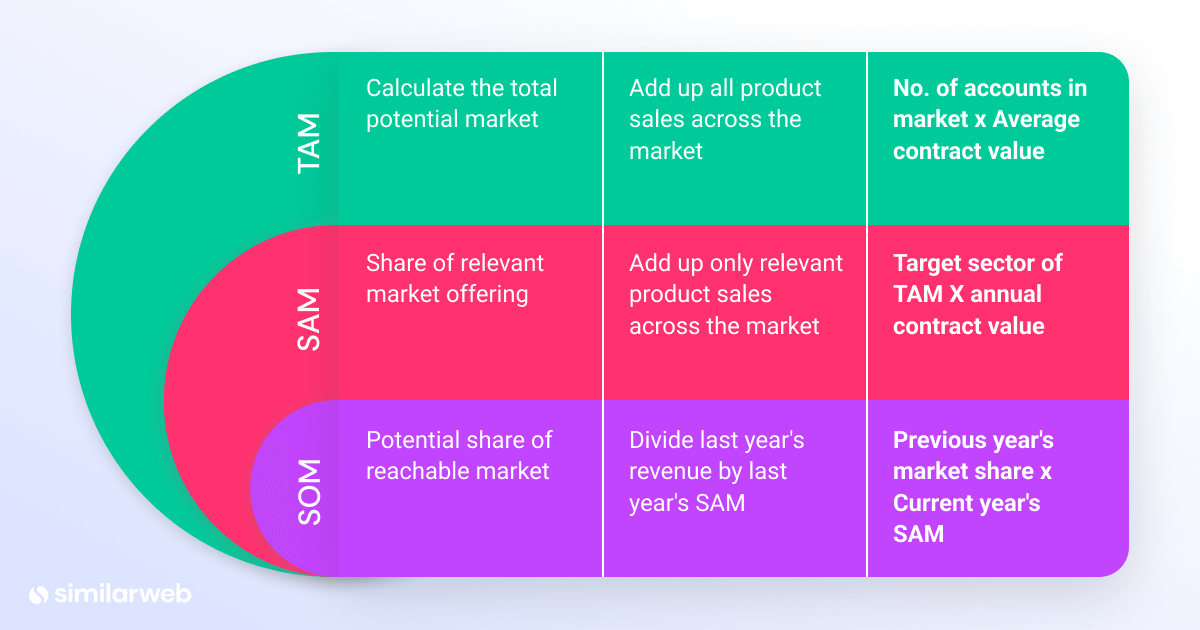

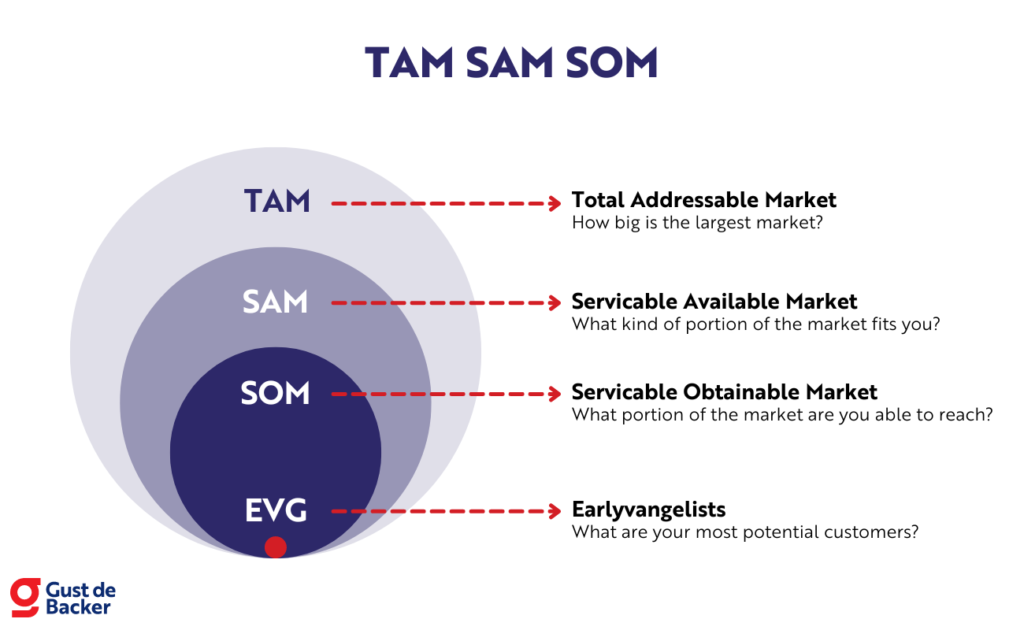

TAM SAM SOM: What Do They Mean & How Do You Calculate Them?

![market research where to start How to Run a Competitor Analysis [Free Guide]](https://blog.hubspot.com/hubfs/Google%20Drive%20Integration/how%20to%20do%20a%20competitor%20analysis_122022.jpeg)

How to Run a Competitor Analysis [Free Guide]

![market research where to start 5 Challenges Marketers Face in Understanding Audiences [New Data + Market Researcher Tips]](https://blog.hubspot.com/hubfs/challenges%20marketers%20face%20in%20understanding%20the%20customer%20.png)

5 Challenges Marketers Face in Understanding Audiences [New Data + Market Researcher Tips]

Causal Research: The Complete Guide

Total Addressable Market (TAM): What It Is & How You Can Calculate It

What Is Market Share & How Do You Calculate It?

![market research where to start 3 Ways Data Privacy Changes Benefit Marketers [New Data]](https://blog.hubspot.com/hubfs/how-data-privacy-benefits-marketers_1.webp)

3 Ways Data Privacy Changes Benefit Marketers [New Data]

Free Guide & Templates to Help Your Market Research

Marketing software that helps you drive revenue, save time and resources, and measure and optimize your investments — all on one easy-to-use platform

BRAND NEW Two-Day LIVE Summit with 20+ Ecommerce Trailblazers.

- Skip to primary navigation

- Skip to main content

A magazine for young entrepreneurs

The best advice in entrepreneurship

Subscribe for exclusive access, the complete guide to market research: what it is, why you need it, and how to do it.

Written by Mary Kate Miller | June 1, 2021

Comments -->

Get real-time frameworks, tools, and inspiration to start and build your business. Subscribe here

Market research is a cornerstone of all successful, strategic businesses. It can also be daunting for entrepreneurs looking to launch a startup or start a side hustle . What is market research, anyway? And how do you…do it?

We’ll walk you through absolutely everything you need to know about the market research process so that by the end of this guide, you’ll be an expert in market research too. And what’s more important: you’ll have actionable steps you can take to start collecting your own market research.

What Is Market Research?

Market research is the organized process of gathering information about your target customers and market. Market research can help you better understand customer behavior and competitor strengths and weaknesses, as well as provide insight for the best strategies in launching new businesses and products. There are different ways to approach market research, including primary and secondary research and qualitative and quantitative research. The strongest approaches will include a combination of all four.

“Virtually every business can benefit from conducting some market research,” says Niles Koenigsberg of Real FiG Advertising + Marketing . “Market research can help you piece together your [business’s] strengths and weaknesses, along with your prospective opportunities, so that you can understand where your unique differentiators may lie.” Well-honed market research will help your brand stand out from the competition and help you see what you need to do to lead the market. It can also do so much more.

The Purposes of Market Research

Why do market research? It can help you…

- Pinpoint your target market, create buyer personas, and develop a more holistic understanding of your customer base and market.

- Understand current market conditions to evaluate risks and anticipate how your product or service will perform.

- Validate a concept prior to launch.

- Identify gaps in the market that your competitors have created or overlooked.

- Solve problems that have been left unresolved by the existing product/brand offerings.

- Identify opportunities and solutions for new products or services.

- Develop killer marketing strategies .

What Are the Benefits of Market Research?

Strong market research can help your business in many ways. It can…

- Strengthen your market position.

- Help you identify your strengths and weaknesses.

- Help you identify your competitors’ strengths and weaknesses.

- Minimize risk.

- Center your customers’ experience from the get-go.

- Help you create a dynamic strategy based on market conditions and customer needs/demands.

What Are the Basic Methods of Market Research?

The basic methods of market research include surveys, personal interviews, customer observation, and the review of secondary research. In addition to these basic methods, a forward-thinking market research approach incorporates data from the digital landscape like social media analysis, SEO research, gathering feedback via forums, and more. Throughout this guide, we will cover each of the methods commonly used in market research to give you a comprehensive overview.

Primary vs. Secondary Market Research

Primary and secondary are the two main types of market research you can do. The latter relies on research conducted by others. Primary research, on the other hand, refers to the fact-finding efforts you conduct on your own.

This approach is limited, however. It’s likely that the research objectives of these secondary data points differ from your own, and it can be difficult to confirm the veracity of their findings.

Primary Market Research

Primary research is more labor intensive, but it generally yields data that is exponentially more actionable. It can be conducted through interviews, surveys, online research, and your own data collection. Every new business should engage in primary market research prior to launch. It will help you validate that your idea has traction, and it will give you the information you need to help minimize financial risk.

You can hire an agency to conduct this research on your behalf. This brings the benefit of expertise, as you’ll likely work with a market research analyst. The downside is that hiring an agency can be expensive—too expensive for many burgeoning entrepreneurs. That brings us to the second approach. You can also do the market research yourself, which substantially reduces the financial burden of starting a new business .

Secondary Market Research

Secondary research includes resources like government databases and industry-specific data and publications. It can be beneficial to start your market research with secondary sources because it’s widely available and often free-to-access. This information will help you gain a broad overview of the market conditions for your new business.

Identify Your Goals and Your Audience

Before you begin conducting interviews or sending out surveys, you need to set your market research goals. At the end of your market research process, you want to have a clear idea of who your target market is—including demographic information like age, gender, and where they live—but you also want to start with a rough idea of who your audience might be and what you’re trying to achieve with market research.

You can pinpoint your objectives by asking yourself a series of guiding questions:

- What are you hoping to discover through your research?

- Who are you hoping to serve better because of your findings?

- What do you think your market is?

- Who are your competitors?

- Are you testing the reception of a new product category or do you want to see if your product or service solves the problem left by a current gap in the market?

- Are you just…testing the waters to get a sense of how people would react to a new brand?

Once you’ve narrowed down the “what” of your market research goals, you’re ready to move onto how you can best achieve them. Think of it like algebra. Many math problems start with “solve for x.” Once you know what you’re looking for, you can get to work trying to find it. It’s a heck of a lot easier to solve a problem when you know you’re looking for “x” than if you were to say “I’m gonna throw some numbers out there and see if I find a variable.”

How to Do Market Research

This guide outlines every component of a comprehensive market research effort. Take into consideration the goals you have established for your market research, as they will influence which of these elements you’ll want to include in your market research strategy.

Secondary Data

Secondary data allows you to utilize pre-existing data to garner a sense of market conditions and opportunities. You can rely on published market studies, white papers, and public competitive information to start your market research journey.

Secondary data, while useful, is limited and cannot substitute your own primary data. It’s best used for quantitative data that can provide background to your more specific inquiries.

Find Your Customers Online

Once you’ve identified your target market, you can use online gathering spaces and forums to gain insights and give yourself a competitive advantage. Rebecca McCusker of The Creative Content Shop recommends internet recon as a vital tool for gaining a sense of customer needs and sentiment. “Read their posts and comments on forums, YouTube video comments, Facebook group [comments], and even Amazon/Goodreads book comments to get in their heads and see what people are saying.”

If you’re interested in engaging with your target demographic online, there are some general rules you should follow. First, secure the consent of any group moderators to ensure that you are acting within the group guidelines. Failure to do so could result in your eviction from the group.

Not all comments have the same research value. “Focus on the comments and posts with the most comments and highest engagement,” says McCusker. These high-engagement posts can give you a sense of what is already connecting and gaining traction within the group.

Social media can also be a great avenue for finding interview subjects. “LinkedIn is very useful if your [target customer] has a very specific job or works in a very specific industry or sector. It’s amazing the amount of people that will be willing to help,” explains Miguel González, a marketing executive at Dealers League . “My advice here is BE BRAVE, go to LinkedIn, or even to people you know and ask them, do quick interviews and ask real people that belong to that market and segment and get your buyer persona information first hand.”

Market research interviews can provide direct feedback on your brand, product, or service and give you a better understanding of consumer pain points and interests.

When organizing your market research interviews, you want to pay special attention to the sample group you’re selecting, as it will directly impact the information you receive. According to Tanya Zhang, the co-founder of Nimble Made , you want to first determine whether you want to choose a representative sample—for example, interviewing people who match each of the buyer persona/customer profiles you’ve developed—or a random sample.

“A sampling of your usual persona styles, for example, can validate details that you’ve already established about your product, while a random sampling may [help you] discover a new way people may use your product,” Zhang says.

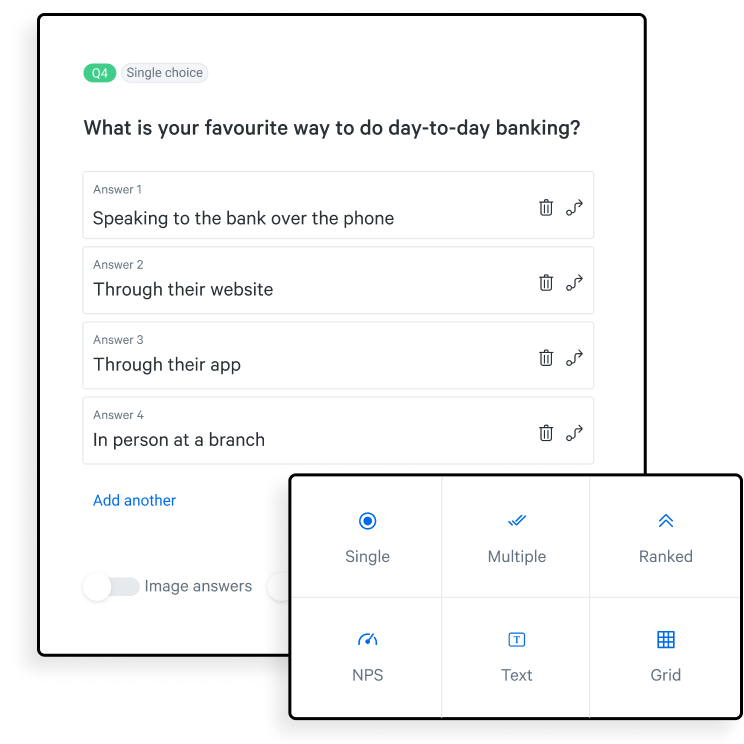

Market Surveys

Market surveys solicit customer inclinations regarding your potential product or service through a series of open-ended questions. This direct outreach to your target audience can provide information on your customers’ preferences, attitudes, buying potential, and more.

Every expert we asked voiced unanimous support for market surveys as a powerful tool for market research. With the advent of various survey tools with accessible pricing—or free use—it’s never been easier to assemble, disseminate, and gather market surveys. While it should also be noted that surveys shouldn’t replace customer interviews , they can be used to supplement customer interviews to give you feedback from a broader audience.

Who to Include in Market Surveys

- Current customers

- Past customers

- Your existing audience (such as social media/newsletter audiences)

Example Questions to Include in Market Surveys

While the exact questions will vary for each business, here are some common, helpful questions that you may want to consider for your market survey. Demographic Questions: the questions that help you understand, demographically, who your target customers are:

- “What is your age?”

- “Where do you live?”

- “What is your gender identity?”

- “What is your household income?”

- “What is your household size?”

- “What do you do for a living?”

- “What is your highest level of education?”

Product-Based Questions: Whether you’re seeking feedback for an existing brand or an entirely new one, these questions will help you get a sense of how people feel about your business, product, or service:

- “How well does/would our product/service meet your needs?”

- “How does our product/service compare to similar products/services that you use?”

- “How long have you been a customer?” or “What is the likelihood that you would be a customer of our brand?

Personal/Informative Questions: the deeper questions that help you understand how your audience thinks and what they care about.

- “What are your biggest challenges?”

- “What’s most important to you?”

- “What do you do for fun (hobbies, interests, activities)?”

- “Where do you seek new information when researching a new product?”

- “How do you like to make purchases?”

- “What is your preferred method for interacting with a brand?”

Survey Tools

Online survey tools make it easy to distribute surveys and collect responses. The best part is that there are many free tools available. If you’re making your own online survey, you may want to consider SurveyMonkey, Typeform, Google Forms, or Zoho Survey.

Competitive Analysis

A competitive analysis is a breakdown of how your business stacks up against the competition. There are many different ways to conduct this analysis. One of the most popular methods is a SWOT analysis, which stands for “strengths, weaknesses, opportunities, and threats.” This type of analysis is helpful because it gives you a more robust understanding of why a customer might choose a competitor over your business. Seeing how you stack up against the competition can give you the direction you need to carve out your place as a market leader.

Social Media Analysis

Social media has fundamentally changed the market research landscape, making it easier than ever to engage with a wide swath of consumers. Follow your current or potential competitors on social media to see what they’re posting and how their audience is engaging with it. Social media can also give you a lower cost opportunity for testing different messaging and brand positioning.

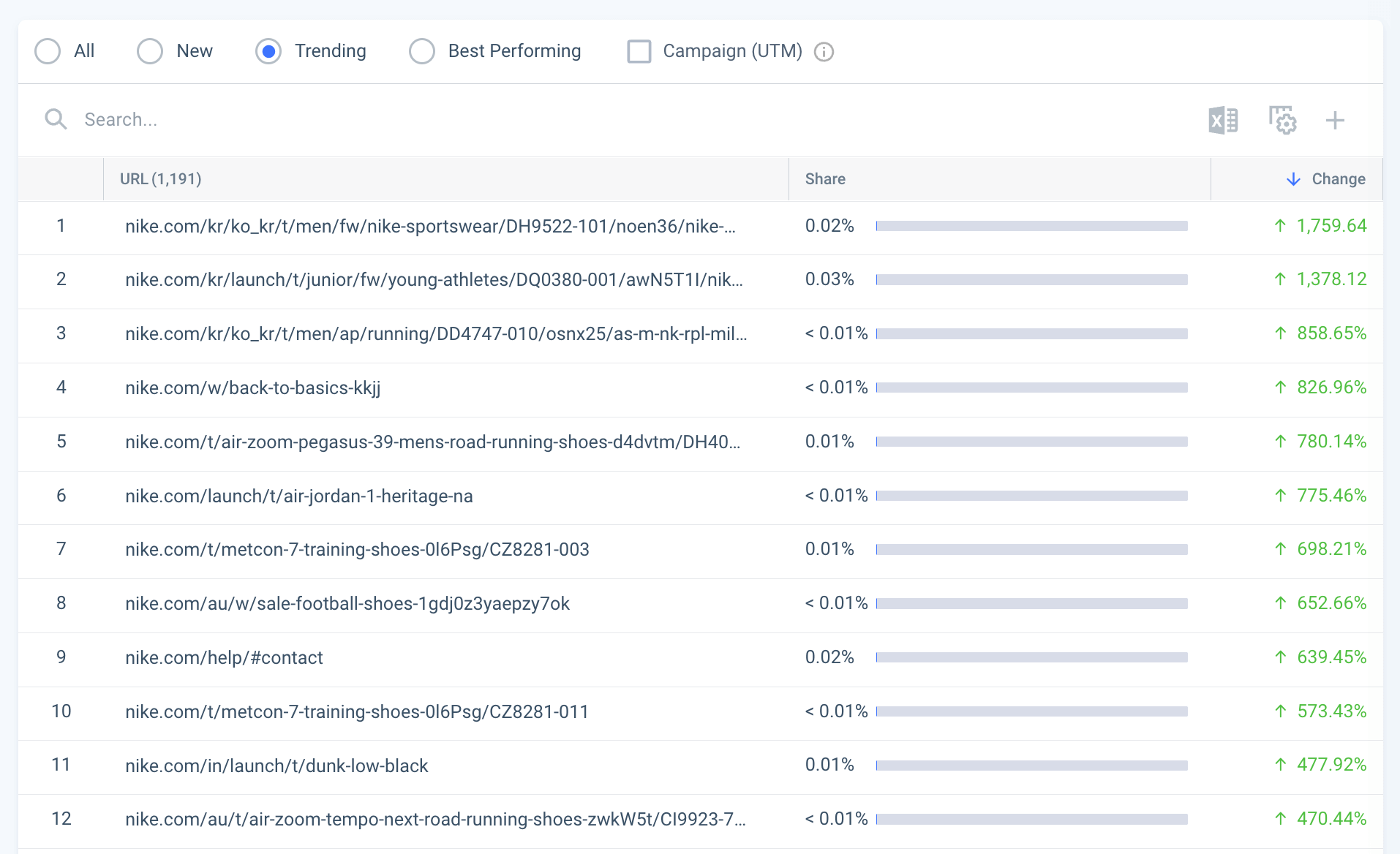

SEO Analysis and Opportunities

SEO analysis can help you identify the digital competition for getting the word out about your brand, product, or service. You won’t want to overlook this valuable information. Search listening tools offer a novel approach to understanding the market and generating the content strategy that will drive business. Tools like Google Trends and Awario can streamline this process.

Ready to Kick Your Business Into High Gear?

Now that you’ve completed the guide to market research you know you’re ready to put on your researcher hat to give your business the best start. Still not sure how actually… launch the thing? Our free mini-course can run you through the essentials for starting your side hustle .

About Mary Kate Miller

Mary Kate Miller writes about small business, real estate, and finance. In addition to writing for Foundr, her work has been published by The Washington Post, Teen Vogue, Bustle, and more. She lives in Chicago.

Related Posts

Create Viral Infographics That Boost Your Organic Traffic

How to Create a Video Sales Letter (Tips and Tricks from a 7-Figure Copywriter)

How to Write a Sales Email That Converts in 2024

What Is a Media Kit: How to Make One in 2024 (With Examples)

Namestorming: How to Choose a Brand Name in 20 Minutes or Less

10 Ways to Increase Brand Awareness without Increasing Your Budget

What Is a Content Creator? A Deep Dive Into This Evolving Industry

Content Creator vs Influencer: What’s the Difference?

How Much Do YouTube Ads Cost? A Beginner’s Pricing Breakdown

How to Get Podcast Sponsors Before Airing an Episode

How Founders Can Overcome Their Sales Fears with AJ Cassata

How to Grow Your YouTube Channel & Gain Subscribers Quickly

How to Write Good Instagram Captions That Hook Your Audience

Discovering the Best CRM for Consultants

10 Instagram Growth Hacks For More Engaged Followers (Without Running Ads)

FREE TRAINING FROM LEGIT FOUNDERS

Actionable Strategies for Starting & Growing Any Business.

Send us an email

How to do market research: The complete guide for your brand

Written by by Jacqueline Zote

Published on April 13, 2023

Reading time 10 minutes

Blindly putting out content or products and hoping for the best is a thing of the past. Not only is it a waste of time and energy, but you’re wasting valuable marketing dollars in the process. Now you have a wealth of tools and data at your disposal, allowing you to develop data-driven marketing strategies . That’s where market research comes in, allowing you to uncover valuable insights to inform your business decisions.

Conducting market research not only helps you better understand how to sell to customers but also stand out from your competition. In this guide, we break down everything you need to know about market research and how doing your homework can help you grow your business.

Table of contents:

What is market research?

Why is market research important, types of market research, where to conduct market research.

- Steps for conducting market research

- Tools to use for market research

Market research is the process of gathering information surrounding your business opportunities. It identifies key information to better understand your audience. This includes insights related to customer personas and even trends shaping your industry.

Taking time out of your schedule to conduct research is crucial for your brand health. Here are some of the key benefits of market research:

Understand your customers’ motivations and pain points

Most marketers are out of touch with what their customers want. Moreover, these marketers are missing key information on what products their audience wants to buy.

Simply put, you can’t run a business if you don’t know what motivates your customers.

And spoiler alert: Your customers’ wants and needs change. Your customers’ behaviors today might be night and day from what they were a few years ago.

Market research holds the key to understanding your customers better. It helps you uncover their key pain points and motivations and understand how they shape their interests and behavior.

Figure out how to position your brand

Positioning is becoming increasingly important as more and more brands enter the marketplace. Market research enables you to spot opportunities to define yourself against your competitors.

Maybe you’re able to emphasize a lower price point. Perhaps your product has a feature that’s one of a kind. Finding those opportunities goes hand in hand with researching your market.

Maintain a strong pulse on your industry at large

Today’s marketing world evolves at a rate that’s difficult to keep up with.

Fresh products. Up-and-coming brands. New marketing tools. Consumers get bombarded with sales messages from all angles. This can be confusing and overwhelming.

By monitoring market trends, you can figure out the best tactics for reaching your target audience.

Not everyone conducts market research for the same reason. While some may want to understand their audience better, others may want to see how their competitors are doing. As such, there are different types of market research you can conduct depending on your goal.

Interview-based market research allows for one-on-one interactions. This helps the conversation to flow naturally, making it easier to add context. Whether this takes place in person or virtually, it enables you to gather more in-depth qualitative data.

Buyer persona research

Buyer persona research lets you take a closer look at the people who make up your target audience. You can discover the needs, challenges and pain points of each buyer persona to understand what they need from your business. This will then allow you to craft products or campaigns to resonate better with each persona.

Pricing research

In this type of research, brands compare similar products or services with a particular focus on pricing. They look at how much those products or services typically sell for so they can get more competitive with their pricing strategy.

Competitive analysis research

Competitor analysis gives you a realistic understanding of where you stand in the market and how your competitors are doing. You can use this analysis to find out what’s working in your industry and which competitors to watch out for. It even gives you an idea of how well those competitors are meeting consumer needs.

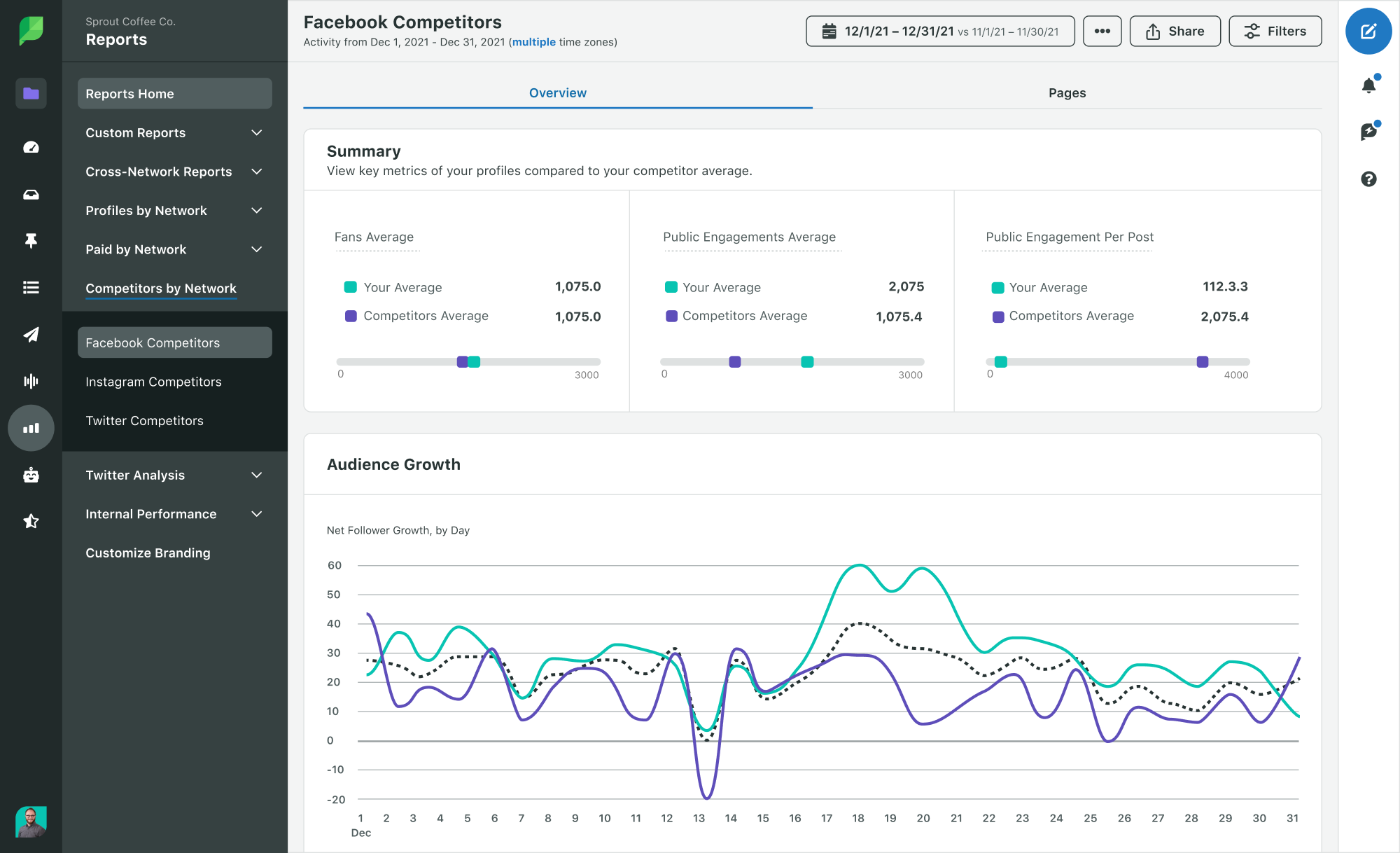

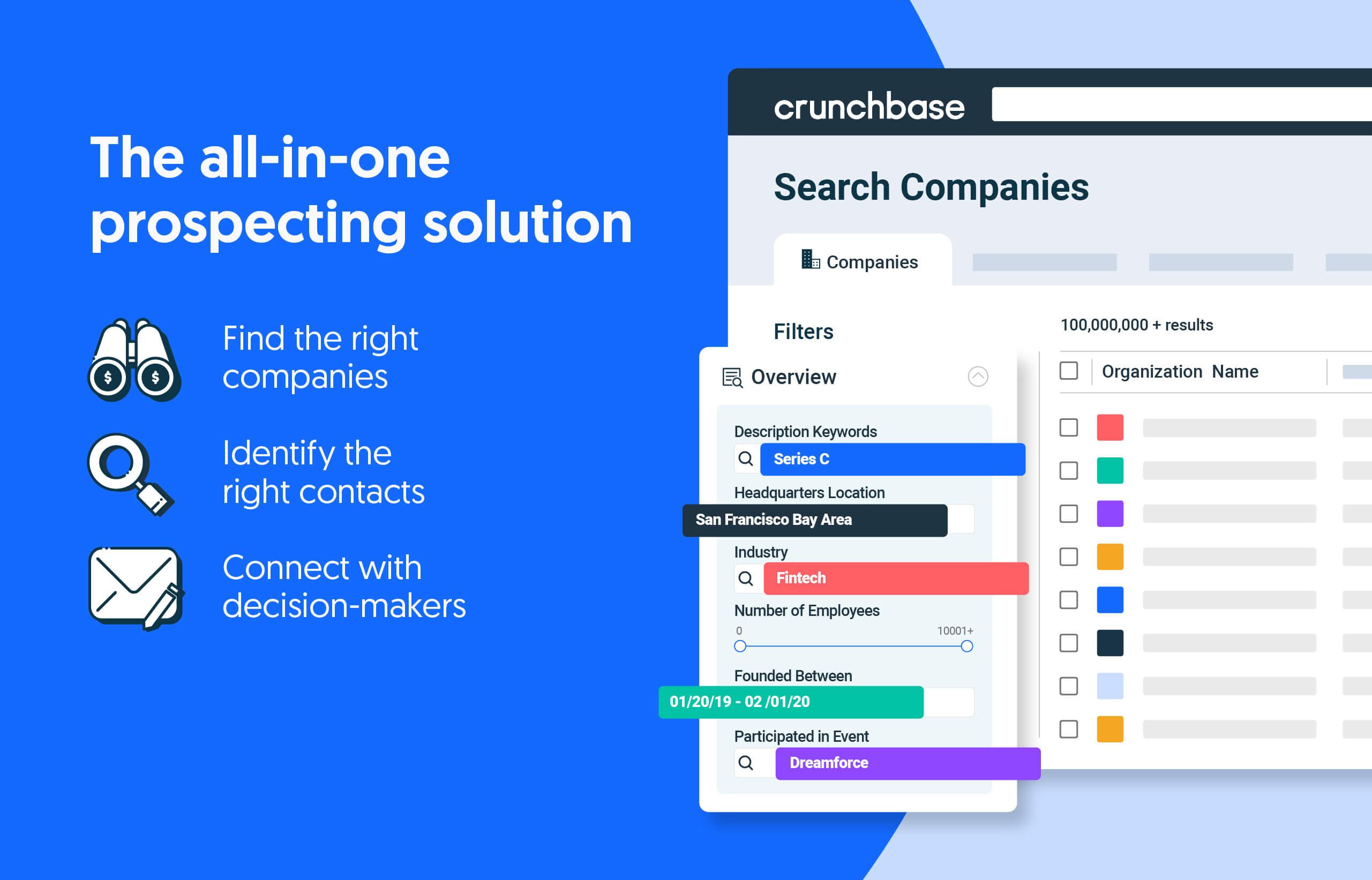

Depending on the competitor analysis tool you use, you can get as granular as you need with your research. For instance, Sprout Social lets you analyze your competitors’ social strategies. You can see what types of content they’re posting and even benchmark your growth against theirs.

Brand awareness research

Conducting brand awareness research allows you to assess your brand’s standing in the market. It tells you how well-known your brand is among your target audience and what they associate with it. This can help you gauge people’s sentiments toward your brand and whether you need to rebrand or reposition.

If you don’t know where to start with your research, you’re in the right place.

There’s no shortage of market research methods out there. In this section, we’ve highlighted research channels for small and big businesses alike.

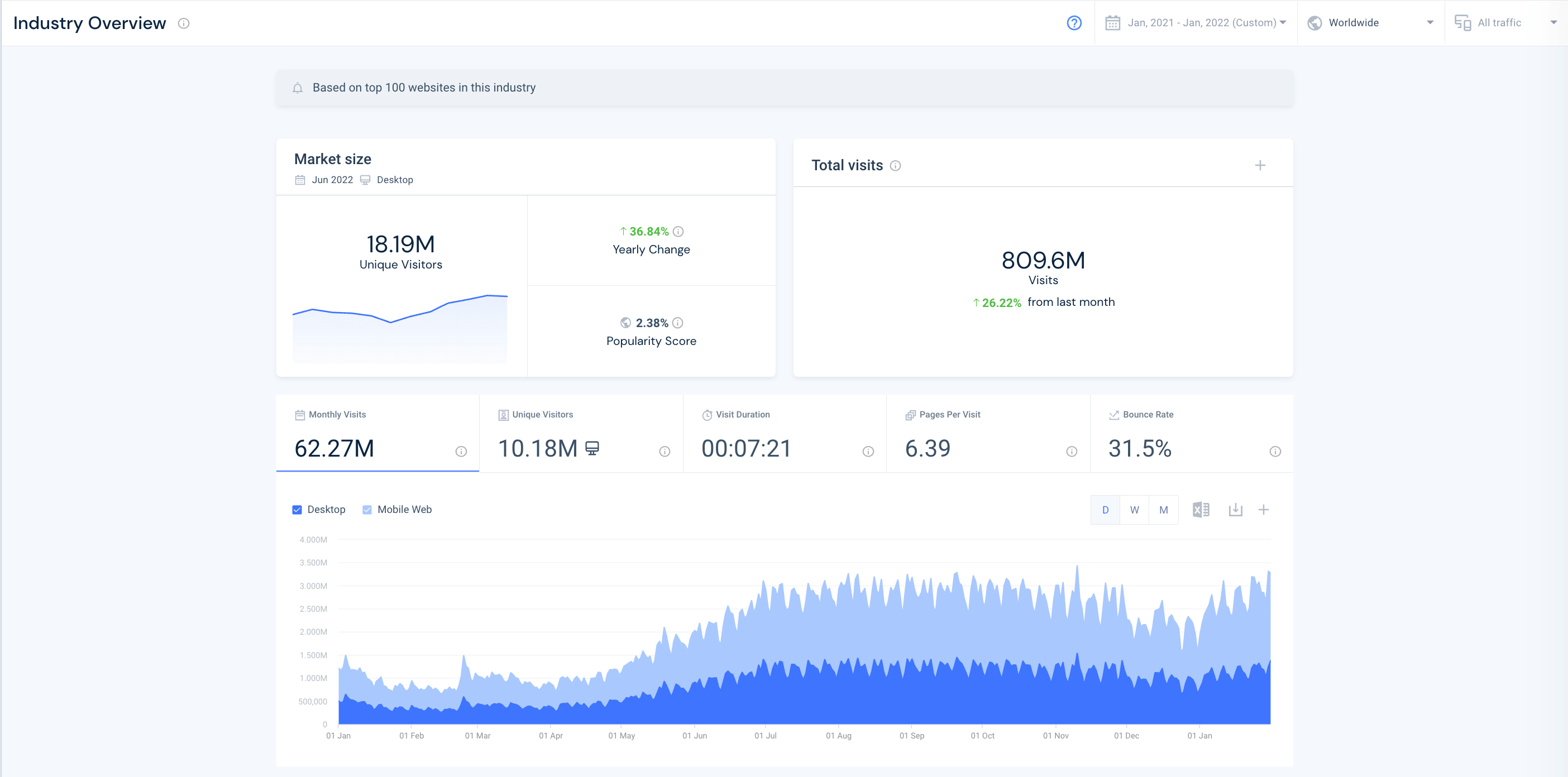

Considering that Google sees a staggering 8.5 billion searches each day, there’s perhaps no better place to start.

A quick Google search is a potential goldmine for all sorts of questions to kick off your market research. Who’s ranking for keywords related to your industry? Which products and pieces of content are the hottest right now? Who’s running ads related to your business?

For example, Google Product Listing Ads can help highlight all of the above for B2C brands.

The same applies to B2B brands looking to keep tabs on who’s running industry-related ads and ranking for keyword terms too.

There’s no denying that email represents both an aggressive and effective marketing channel for marketers today. Case in point, 44% of online shoppers consider email as the most influential channel in their buying decisions.

Looking through industry and competitor emails is a brilliant way to learn more about your market. For example, what types of offers and deals are your competitors running? How often are they sending emails?

Email is also invaluable for gathering information directly from your customers. This survey message from Asana is a great example of how to pick your customers’ brains to figure out how you can improve your quality of service.

Industry journals, reports and blogs

Don’t neglect the importance of big-picture market research when it comes to tactics and marketing channels to explore. Look to marketing resources such as reports and blogs as well as industry journals

Keeping your ear to the ground on new trends and technologies is a smart move for any business. Sites such as Statista, Marketing Charts, AdWeek and Emarketer are treasure troves of up-to-date data and news for marketers.

And of course, there’s the Sprout Insights blog . And invaluable resources like The Sprout Social Index™ can keep you updated on the latest social trends.

Social media

If you want to learn more about your target market, look no further than social media. Social offers a place to discover what your customers want to see in future products or which brands are killin’ it. In fact, social media is become more important for businesses than ever with the level of data available.

It represents a massive repository of real-time data and insights that are instantly accessible. Brand monitoring and social listening are effective ways to conduct social media research . You can even be more direct with your approach. Ask questions directly or even poll your audience to understand their needs and preferences.

The 5 steps for how to do market research

Now that we’ve covered the why and where, it’s time to get into the practical aspects of market research. Here are five essential steps on how to do market research effectively.

Step 1: Identify your research topic

First off, what are you researching about? What do you want to find out? Narrow down on a specific research topic so you can start with a clear idea of what to look for.

For example, you may want to learn more about how well your product features are satisfying the needs of existing users. This might potentially lead to feature updates and improvements. Or it might even result in new feature introductions.

Similarly, your research topic may be related to your product or service launch or customer experience. Or you may want to conduct research for an upcoming marketing campaign.

Step 2: Choose a buyer persona to engage

If you’re planning to focus your research on a specific type of audience, decide which buyer persona you want to engage. This persona group will serve as a representative sample of your target audience.

Engaging a specific group of audience lets you streamline your research efforts. As such, it can be a much more effective and organized approach than researching thousands (if not millions) of individuals.

You may be directing your research toward existing users of your product. To get even more granular, you may want to focus on users who have been familiar with the product for at least a year, for example.

Step 3: Start collecting data

The next step is one of the most critical as it involves collecting the data you need for your research. Before you begin, make sure you’ve chosen the right research methods that will uncover the type of data you need. This largely depends on your research topic and goals.

Remember that you don’t necessarily have to stick to one research method. You may use a combination of qualitative and quantitative approaches. So for example, you could use interviews to supplement the data from your surveys. Or you may stick to insights from your social listening efforts.

To keep things consistent, let’s look at this in the context of the example from earlier. Perhaps you can send out a survey to your existing users asking them a bunch of questions. This might include questions like which features they use the most and how often they use them. You can get them to choose an answer from one to five and collect quantitative data.

Plus, for qualitative insights, you could even include a few open-ended questions with the option to write their answers. For instance, you might ask them if there’s any improvement they wish to see in your product.

Step 4: Analyze results

Once you have all the data you need, it’s time to analyze it keeping your research topic in mind. This involves trying to interpret the data to look for a wider meaning, particularly in relation to your research goal.

So let’s say a large percentage of responses were four or five in the satisfaction rating. This means your existing users are mostly satisfied with your current product features. On the other hand, if the responses were mostly ones and twos, you may look for opportunities to improve. The responses to your open-ended questions can give you further context as to why people are disappointed.

Step 5: Make decisions for your business

Now it’s time to take your findings and turn them into actionable insights for your business. In this final step, you need to decide how you want to move forward with your new market insight.

What did you find in your research that would require action? How can you put those findings to good use?

The market research tools you should be using

To wrap things up, let’s talk about the various tools available to conduct speedy, in-depth market research. These tools are essential for conducting market research faster and more efficiently.

Social listening and analytics

Social analytics tools like Sprout can help you keep track of engagement across social media. This goes beyond your own engagement data but also includes that of your competitors. Considering how quickly social media moves, using a third-party analytics tool is ideal. It allows you to make sense of your social data at a glance and ensure that you’re never missing out on important trends.

Email marketing research tools

Keeping track of brand emails is a good idea for any brand looking to stand out in its audience’s inbox.

Tools such as MailCharts , Really Good Emails and Milled can show you how different brands run their email campaigns.

Meanwhile, tools like Owletter allow you to monitor metrics such as frequency and send-timing. These metrics can help you understand email marketing strategies among competing brands.

Content marketing research

If you’re looking to conduct research on content marketing, tools such as BuzzSumo can be of great help. This tool shows you the top-performing industry content based on keywords. Here you can see relevant industry sites and influencers as well as which brands in your industry are scoring the most buzz. It shows you exactly which pieces of content are ranking well in terms of engagements and shares and on which social networks.

SEO and keyword tracking

Monitoring industry keywords is a great way to uncover competitors. It can also help you discover opportunities to advertise your products via organic search. Tools such as Ahrefs provide a comprehensive keyword report to help you see how your search efforts stack up against the competition.

Competitor comparison template

For the sake of organizing your market research, consider creating a competitive matrix. The idea is to highlight how you stack up side-by-side against others in your market. Use a social media competitive analysis template to track your competitors’ social presence. That way, you can easily compare tactics, messaging and performance. Once you understand your strengths and weaknesses next to your competitors, you’ll find opportunities as well.

Customer persona creator

Finally, customer personas represent a place where all of your market research comes together. You’d need to create a profile of your ideal customer that you can easily refer to. Tools like Xtensio can help in outlining your customer motivations and demographics as you zero in on your target market.

Build a solid market research strategy

Having a deeper understanding of the market gives you leverage in a sea of competitors. Use the steps and market research tools we shared above to build an effective market research strategy.

But keep in mind that the accuracy of your research findings depends on the quality of data collected. Turn to Sprout’s social media analytics tools to uncover heaps of high-quality data across social networks.

- Leveling Up

- Marketing Disciplines

The 43 best marketing resources we recommend in 2024

Executing a successful demand generation strategy [with examples]

How customer relationship marketing on social media drives revenue

- Other Platforms

SMS marketing 101: What is SMS Marketing (+ examples)

- Now on slide

Build and grow stronger relationships on social

Sprout Social helps you understand and reach your audience, engage your community and measure performance with the only all-in-one social media management platform built for connection.

- Business Essentials

- Leadership & Management

- Credential of Leadership, Impact, and Management in Business (CLIMB)

- Entrepreneurship & Innovation

- *New* Digital Transformation

- Finance & Accounting

- Business in Society

- For Organizations

- Support Portal

- Media Coverage

- Founding Donors

- Leadership Team

- Harvard Business School →

- HBS Online →

- Business Insights →

Business Insights

Harvard Business School Online's Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills.

- Career Development

- Communication

- Decision-Making

- Earning Your MBA

- Negotiation

- News & Events

- Productivity

- Staff Spotlight

- Student Profiles

- Work-Life Balance

- Alternative Investments

- Business Analytics

- Business Strategy

- Business and Climate Change

- Design Thinking and Innovation

- Digital Marketing Strategy

- Disruptive Strategy

- Economics for Managers

- Entrepreneurship Essentials

- Financial Accounting

- Global Business

- Launching Tech Ventures

- Leadership Principles

- Leadership, Ethics, and Corporate Accountability

- Leading with Finance

- Management Essentials

- Negotiation Mastery

- Organizational Leadership

- Power and Influence for Positive Impact

- Strategy Execution

- Sustainable Business Strategy

- Sustainable Investing

- Winning with Digital Platforms

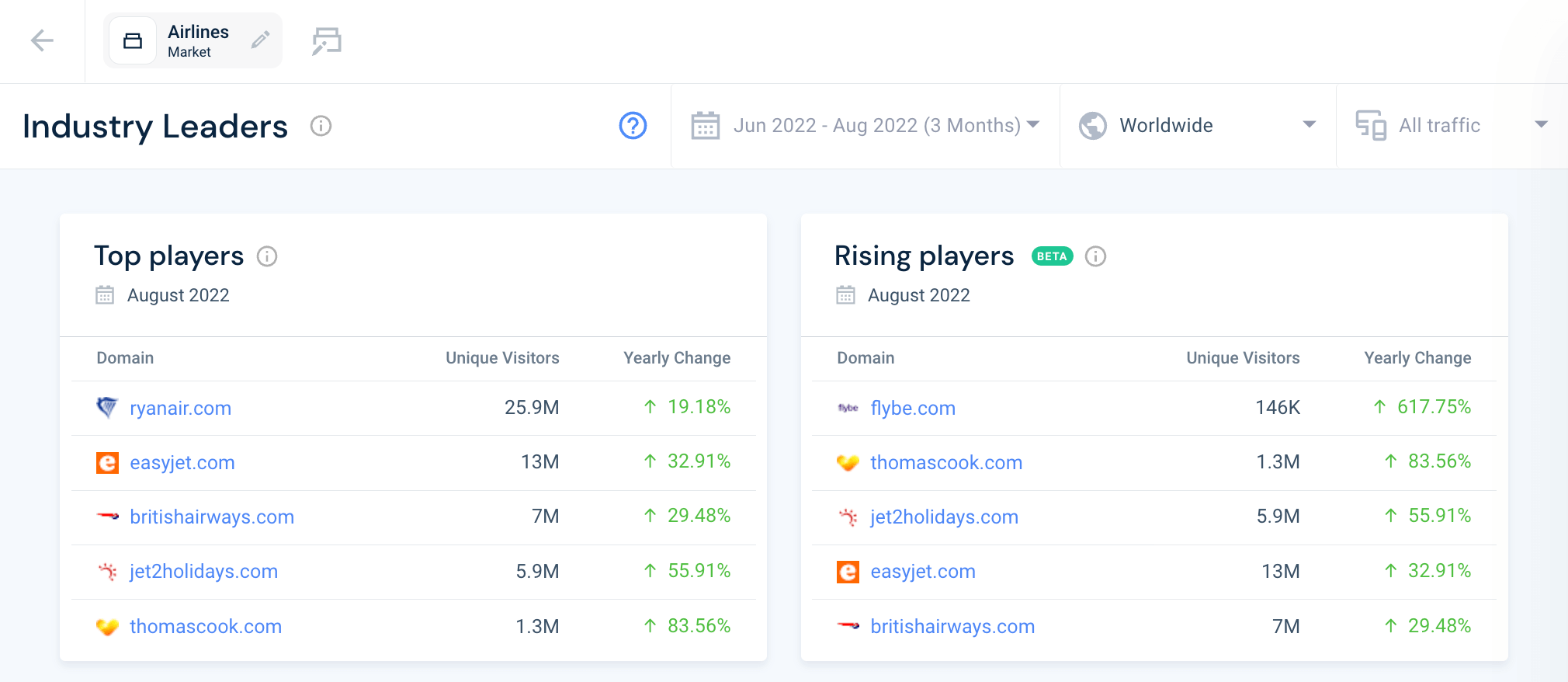

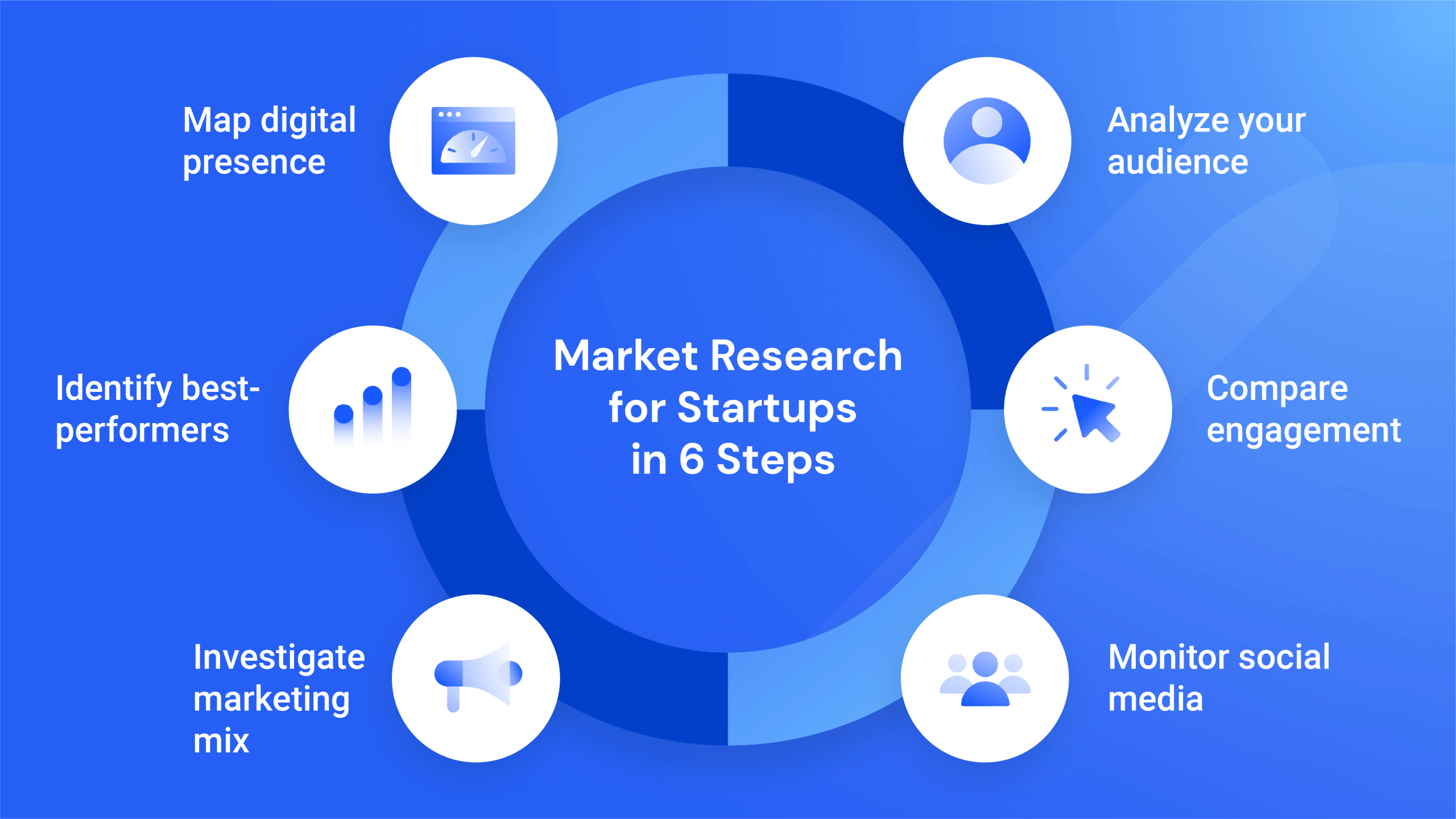

How to Conduct Market Research for a Startup

- 17 Mar 2022

With every innovative product idea comes the pressing question: “Will people want to buy it?”

As an entrepreneur with a big idea, what’s the best way to determine how potential customers will react to your product? Conducting market research can provide the data needed to decide whether your product fits your target market.

Before launching a new venture, you should understand market research. Here’s how to conduct market research for a startup and why it’s important.

Access your free e-book today.

What Is Market Research?

Market research is the process of gathering information about customers and the market as a whole to determine a product or service’s viability. Market research includes interviews, surveys, focus groups, and industry data analyses.

The goal of market research is to better understand potential customers, how well your product or service fits their needs, and how it compares to competitors’ offerings.

There are two types of research you can conduct: primary and secondary.

- Primary research requires collecting data to learn about your specific customers or target market segment. It’s useful for creating buyer personas, segmenting your market, and improving your product to cater to customers’ needs .

- Secondary research is conducted using data you didn’t collect yourself. Industry reports, public databases, and other companies’ proprietary data can be used to gain insights into your target market segment and industry.

Why Is Market Research Important for Entrepreneurs?

Before launching your venture, it’s wise to conduct market research to ensure your product or service will be well received. Feedback from people who fall into your target demographics can be invaluable as you iterate on and improve your product.

Performing market research can also help you determine a pricing strategy by gauging customers’ willingness to pay for your product. Additionally, it can improve the user experience by revealing what features matter most to potential customers.

When assessing which startups to fund, investors place heavy importance on thorough market research that indicates promising potential. Providing tangible proof that your product fulfills a market need and demonstrating you’ve taken the time to iterate on and improve it signal that your startup could be a worthwhile investment.

Related: How to Talk to Potential Investors: 5 Tips

How to Do Market Research for a Startup

1. form hypotheses.

What questions do you aim to answer through market research? Using those questions, you can make predictions called hypotheses . Defining your hypotheses upfront can help guide your approach to selecting subjects, researching questions, and testing designs.

An example question you may ask is: “How much are people in my target demographic willing to pay for the current version of my product?” Your hypothesis could be: “If my product contains all its current features, customers will be willing to pay $500 for it.”

Another example question you may ask is: “What’s the user’s biggest pain point, and is my product meeting their needs?” Your hypothesis could be: “I believe the user’s biggest pain point is needing an easy, unintimidating way to learn basic car maintenance, and I predict that my product meets that need.”

You can and should test multiple hypotheses, but try to select no more than a few per test, so the research stays focused.

Related: A Beginner’s Guide to Hypothesis Testing in Business

2. Select the Type of Research Needed to Test Hypotheses

Once you’ve formed your hypotheses, determine which type of research to conduct.

If your hypotheses focus on determining your startup’s place in the broader market, start with secondary research. This can include using existing data to determine market size, how much of that market your startup could reasonably own, who your biggest competitors are, and how your brand and product compare to theirs.

If your hypotheses require primary research, decide which data collection method best fits your needs. These can include one-on-one interviews, surveys, focus groups, and polls. Primary research allows you to gather insights into customer satisfaction and loyalty, brand awareness and perception, and real-time product usability.

3. Identify Target Demographics and Recruit Subjects

To gather meaningful insights, you need to understand your target demographic. Do you aim to cater to working parents, young athletes, or pet owners? Determine the type of person who can benefit from your product.

If you conduct primary research, you need to recruit subjects. This can be done in several ways, including:

- Word of mouth: The simplest but least reliable way to recruit participants is by word of mouth. Ask people you know to refer others to be research subjects, then screen them to confirm they fit your target demographic.

- Promoting the study on social media: Many social media platforms enable you to show an ad to people who fall into specific demographic categories or have certain interests. This allows you to get the word out to a large number of people who qualify.

- Hiring a third-party market research company: Some companies provide full market research services and recruit participants and conduct research on your behalf.

However you recruit subjects, ensure they take a screener survey beforehand, which allows you to determine whether they fit the specific demographic you want to study or have a trait that eliminates them from the research pool. It also provides demographic data—such as age and race—that enables you to select a diverse subset of your target demographic.

In addition, you can offer compensation to boost participation, such as money, meal vouchers, gift cards, or early access to your product. Make it clear that compensation is in appreciation for subjects’ time and honest feedback.

4. Conduct the Research

Once you’ve determined the type of research and target demographic necessary to test your hypotheses, conduct your research. To reduce bias, enlist someone unfamiliar with your hypotheses to perform interviews or lead focus groups.

Ask questions based on your audience and hypotheses. For instance, if you’re aiming to test existing customers’ purchase motivations, you may ask: “What challenge were you trying to solve when you first bought the product?”

If examining brand perception, your audience should consist of potential customers who don’t yet know your brand. Present them with a list of competitor logos—with yours in the mix—and ask them to rank the brands by perceived reliability.

While the questions you ask are vehicles to prove or disprove hypotheses, ensure they don’t lead subjects in one direction. To craft unbiased research questions , use neutral language and vary the order of options in multiple-choice questions. This can keep subjects from selecting the same option each time if they sense the third option is always mapped to a certain outcome. It also helps account for primacy bias (the tendency to select the first option in a list) and recency bias (the tendency to select the final option in a list).

Once you’ve collected data, ensure it’s organized efficiently and securely so you can protect subjects’ identities .

Related: 3 Examples of Bad Survey Questions and How to Fix Them

5. Gather Insights and Determine Action Items

After you’ve organized your data, analyze it to extract actionable insights. While some of the data will be qualitative rather than quantitative, you can detect patterns in responses to make it quantifiable. For instance, noting that 15 of 20 subjects mentioned feeling overwhelmed when attempting to assemble your product.

Once you’ve analyzed the data and communicated emerging trends using data visualizations , outline action items.

If the majority of users in your target demographic reported feeling overwhelmed while assembling your product, action items might include:

- Creating different versions of assembly instructions to test with other groups, varying diagrams and instructional language

- Researching instruction manual best practices

Each round of market research can offer more information about how your product is perceived and experienced by potential users.

Market Research as an Ongoing Endeavor

While it’s useful to conduct market research before launching your product, you should revisit your hypotheses and form new ones over the course of building your venture.

By conducting market research with each version of your product, you can gradually improve it and ensure it continues to fit target customers’ needs.

Are you interested in bolstering your entrepreneurship skills? Explore our four-week online course Entrepreneurship Essentials and our other entrepreneurship and innovation courses to learn to speak the language of the startup world.

About the Author

How to Conduct Market Research for Startups

With 50% of new businesses failing within the first five years of operation, startups need to develop a deep understanding of their customer base quickly in order to thrive. Successful new business ventures strategically begin by gathering accurate and thorough information about their industry to identify the best path ahead. Conducting market research for startups is a key step toward meeting customer needs and strengthening marketing messaging.

Market research brings together important details about a business's customers, competition, and industry. The results serve as a tool in a startup’s business planning process as it evolves. Analyzing the findings can help determine the viability of a business concept and identify areas for adjustment to improve performance, profitability, and attract investors.

“Without market research, a startup is just making guesses. Listening to your prospective customers will help you align your product/service and marketing messaging to address their needs.” Dr. Elaine Young, Champlain College Online

As noted by Dr. Elaine Young , professor and program director of marketing communication at Champlain College Online, “Startups need market research so that they can gain insight into the behaviors and values of their target customers. Just because you think your startup idea is amazing, doesn't mean that consumers will. Without market research, a startup is just making guesses. Listening to your prospective customers will help you align your product/service and marketing messaging to address their needs.”

Table of Contents

What is market research?

Why is it valuable for startups, types of market research, methods of market research, how to do market research for startups, sample questions to ask customers.

Market research is defined as the process of collecting, analyzing, and interpreting a broad set of information about a specific market or industry. The research might focus on:

- A potential product or service for that market

- Existing and/or potential customers for the product or service

- The needs, purchase habits, characteristics, and location of your target market

- Competitors in your industry

- Trends within your market or industry as a whole

As a business strategy, market research enables companies to make actionable decisions according to data-based findings. These measurable statistics can be gathered through a variety of methods, which we will explore below.

Startups benefit from market research in multiple ways. With so much time, energy, and funds invested in a startup, taking steps to strengthen the concept and connection to your target audience is critical to survival and the bottom line.

The market research process delivers value to startups by:

- Allowing you to test the ideas and concepts behind your product or service

- Enticing investors with data showing the projected profitability of your venture

- Providing statistical evidence to potentially support your business concept or encourage you to adapt it to better meet the needs of your target market

- Helping to clarify exactly who your customers are

- Serving as evidence to investors of an entrepreneur’s commitment to improving a business based on current market conditions

- Increasing the odds of success of your startup

“Market research can help founders focus their energy, enthusiasm, and resources toward a specific segment and the real target audience.”

Adrienne Wallace, Grand Valley State University

The American Marketing Association confirms that market research can directly increase your bottom line. And trusted market research findings can also speed up the process of getting investors on board with your startup venture.

“Startups can't begin with just a hope and a prayer,” notes Adrienne Wallace , associate professor at Grand Valley State University. “Market research can help founders focus their energy, enthusiasm, and resources toward a specific segment and the real target audience instead of making the age-old error of ‘everyone is the target’ because it simply can't be that for efforts to be fruitful.”

There are two types of market research used most in the business world today: primary and secondary. They can be used individually but are often combined to create a broader understanding of your target market.

Primary research

Primary research involves collecting data directly from your target market. This is often achieved through the use of surveys, interviews, and focus groups. The findings can provide a comprehensive understanding of your customer base’s needs and preferences.

Secondary research

Secondary research requires examining existing data collected by third parties. Examples of potential data sources include news media, industry reports, proprietary data from other companies, academic journals, or public databases. Although targeted data is not always available for your particular industry, secondary research enables you to gain insight and understanding about an industry overall.

Choosing a specific method of market research — either quantitative or qualitative — will determine the type of data collected in your research.

Quantitative research

Quantitative market research gathers large numerical datasets that can be used in statistical analysis. These results offer more accurate snapshots of industry trends and market challenges. Common methods of collecting quantitative research data are through surveys, questionnaires, and polls.

Qualitative research

Qualitative market research strives to identify the reasons behind customers’ buying habits, as well as their needs, wants, and overall customer satisfaction . These results can help clarify the “why” behind your target market’s behaviors and feelings. Focus groups, in-depth interviews, and online bulletin boards are typical methods for conducting qualitative market research.

Generally, quantitative market research is more commonly utilized than qualitative market research because it is more scientific, unbiased, and more easily plicated in future studies. In 2019, 61% of the money spent on market research in the United States went toward quantitative research, with only 12% spent on qualitative research.

Conducting market research is not a quick process, so it requires thoughtful planning. You may handle this research on your own or hire a third-party market research company to manage the process on your behalf. The steps below will guide you through developing a market research strategy that benefits your startup.

Step 1. Define your research purpose

The first step in market research for startups is to determine what questions you hope to answer through this research. From those questions, you can develop projected results that will help reveal the overall purpose of your research. Understanding the purpose from the beginning will be an asset in identifying the best approach to selecting subjects, composing questions, and testing product designs.

Examples of market research purpose include:

- Confirming consumers’ biggest pain point and whether your product meets their needs

- Tracking and predicting relevant industry trends

- Determining consumer spending capacity for a product/service

- Gauging the market infiltration of your competitors

Step 2. Study your target market and competitors closely

It’s important to take time to study existing information about your target market, your competitors, and your target demographic. Growing your knowledge base about all of these factors in advance will strengthen the relevancy of your research.

When working on demographics, a buyer persona template can be a useful tool to help segment the consumer audience into smaller groups for better targeting. Understanding each group’s behaviors and motivation can lead to research findings that resonate deeply with your customer base.

Step 3. Choose the right type and method for your needs

The best type of market research for your business will depend on the purpose you aim to achieve. If your goal is a broad-scope industry view, secondary research examining existing data may provide you with all the information you need. But if your strategy is to clarify specific details about your customer base, you will need to collect new data through primary research.

The ideal method for data collection also depends on the end goal. Quantitative research methods such as surveys create data useful in making market predictions. Qualitative research methods like focus groups and in-depth interviews offer more personal and subjective responses from participants. Such responses are valuable when seeking direct consumer insight on your product or service and on brand awareness.

Step 4. Recruit appropriate research subjects

If you are pursuing primary research, the subjects involved in your study should be capable of providing insights that are directly relevant and valuable to your market research goals. Recruitment methods can vary from social media posts to hiring third-party market research firms and incentivizing participation.

Seek out existing customers, former customers, and potential customers to create a full spectrum view of your market and product. Other potential sources for research participants include:

- Recent customers

- Customers who did not complete their purchase

- Word of mouth among both personal and professional networks

Step 5. Conduct your research

Execute your market research plan based on the method you identified in Step 3. Appoint someone not deeply connected with the project planning as the point person for interviews or focus groups in an effort to reduce potential bias. When creating surveys, strive to incorporate neutral (non-leading) language as a way to craft unbiased research questions.

Christina Inge , an instructor and curriculum designer at Northeastern University, suggests an effective research technique called customer discovery. “It requires asking customers what their needs are,” she says, “rather than showing them your product or service and asking for their reactions. This can help you get to the heart of what your customers need, leading to better product market fit, faster.”

Step 6. Analyze your results

Once you’ve collected and organized all of your data, analyze it for relevant trends and patterns. Any qualitative data, such as feedback from focus groups or interviews, can be interpreted quantitatively by noting response ratios amongst the participants. Examine your findings for insights that offer actionable next steps.

One famous example of a startup that pivoted toward success as a result of closely analyzing the market research on their target market is Tune In Hook Up. As an online video dating site that wasn’t seeing much traffic, their research revealed that users struggled to share videos easily with one another. Based on their findings, they decided to shift away from romance and focus on the videos, renaming themselves YouTube.

Step 7. Create an actionable report from your findings

Gather your findings into a report that outlines the recommended actions necessary to address the market research results. Whether the data provides positive or negative insights, you should always come away with actionable steps and suggestions for the next stage of your startup.

Find additional tips and a free report template in HubSpot’s’ How To Do Market Research: A Guide and Template .

Drafting market research questions for startups is not an exact science because cookie-cutter surveys and interview questions will not work. Every product, service, and industry has unique features that require tailored language in each research question.

Below is a sampling of the type of questions you may want to consider:

- What do you like most about our new product or service?

- What do you wish our product or service did that it does not currently do?

- What do you lose sleep over at night?

- What price would you consider so low that you’d question this product’s overall quality?

- Which of these companies have you purchased this product from in the past six months? (list of competitors)

Market research is a booming industry around the globe, but nowhere more so than in the United States. The U.S. is the leading country for market research services , with the industry bringing in $18.75 billion in 2020, more than six times the industry-related revenue of any other country in the world. It’s no surprise, considering how quality market research can directly impact a company’s bottom line and growth. Free kits for growth marketing can help you get moving on the road to success through market research for startups.

Your go-to destination for education, inspiration, and resources for startup founders.

Startup Resources

6 Steps to Managing Remote Teams: A Guide for Startups

28 Startup Trends to Watch in 2023 - HubSpot for Startups

What Is an Incubator? A Complete Guide - HubSpot for Startups

What Is a Business Accelerator? Everything You Need To Know - HubSpot for Startups

Learn / Blog / Article

Back to blog

How to do market research in 4 steps: a lean approach to marketing research

From pinpointing your target audience and assessing your competitive advantage, to ongoing product development and customer satisfaction efforts, market research is a practice your business can only benefit from.

Learn how to conduct quick and effective market research using a lean approach in this article full of strategies and practical examples.

Last updated

Reading time.

A comprehensive (and successful) business strategy is not complete without some form of market research—you can’t make informed and profitable business decisions without truly understanding your customer base and the current market trends that drive your business.

In this article, you’ll learn how to conduct quick, effective market research using an approach called 'lean market research'. It’s easier than you might think, and it can be done at any stage in a product’s lifecycle.

How to conduct lean market research in 4 steps

What is market research, why is market research so valuable, advantages of lean market research, 4 common market research methods, 5 common market research questions, market research faqs.

We’ll jump right into our 4-step approach to lean market research. To show you how it’s done in the real world, each step includes a practical example from Smallpdf , a Swiss company that used lean market research to reduce their tool’s error rate by 75% and boost their Net Promoter Score® (NPS) by 1%.

Research your market the lean way...

From on-page surveys to user interviews, Hotjar has the tools to help you scope out your market and get to know your customers—without breaking the bank.

The following four steps and practical examples will give you a solid market research plan for understanding who your users are and what they want from a company like yours.

1. Create simple user personas

A user persona is a semi-fictional character based on psychographic and demographic data from people who use websites and products similar to your own. Start by defining broad user categories, then elaborate on them later to further segment your customer base and determine your ideal customer profile .

How to get the data: use on-page or emailed surveys and interviews to understand your users and what drives them to your business.

How to do it right: whatever survey or interview questions you ask, they should answer the following questions about the customer:

Who are they?

What is their main goal?

What is their main barrier to achieving this goal?

Pitfalls to avoid:

Don’t ask too many questions! Keep it to five or less, otherwise you’ll inundate them and they’ll stop answering thoughtfully.

Don’t worry too much about typical demographic questions like age or background. Instead, focus on the role these people play (as it relates to your product) and their goals.

How Smallpdf did it: Smallpdf ran an on-page survey for a couple of weeks and received 1,000 replies. They learned that many of their users were administrative assistants, students, and teachers.

Next, they used the survey results to create simple user personas like this one for admins:

Who are they? Administrative Assistants.

What is their main goal? Creating Word documents from a scanned, hard-copy document or a PDF where the source file was lost.

What is their main barrier to achieving it? Converting a scanned PDF doc to a Word file.

💡Pro tip: Smallpdf used Hotjar Surveys to run their user persona survey. Our survey tool helped them avoid the pitfalls of guesswork and find out who their users really are, in their own words.

You can design a survey and start running it in minutes with our easy-to-use drag and drop builder. Customize your survey to fit your needs, from a sleek one-question pop-up survey to a fully branded questionnaire sent via email.

We've also created 40+ free survey templates that you can start collecting data with, including a user persona survey like the one Smallpdf used.

2. Conduct observational research

Observational research involves taking notes while watching someone use your product (or a similar product).

Overt vs. covert observation

Overt observation involves asking customers if they’ll let you watch them use your product. This method is often used for user testing and it provides a great opportunity for collecting live product or customer feedback .

Covert observation means studying users ‘in the wild’ without them knowing. This method works well if you sell a type of product that people use regularly, and it offers the purest observational data because people often behave differently when they know they’re being watched.

Tips to do it right:

Record an entry in your field notes, along with a timestamp, each time an action or event occurs.

Make note of the users' workflow, capturing the ‘what,’ ‘why,’ and ‘for whom’ of each action.

Don’t record identifiable video or audio data without consent. If recording people using your product is helpful for achieving your research goal, make sure all participants are informed and agree to the terms.

Don’t forget to explain why you’d like to observe them (for overt observation). People are more likely to cooperate if you tell them you want to improve the product.

💡Pro tip: while conducting field research out in the wild can wield rewarding results, you can also conduct observational research remotely. Hotjar Recordings is a tool that lets you capture anonymized user sessions of real people interacting with your website.

Observe how customers navigate your pages and products to gain an inside look into their user behavior . This method is great for conducting exploratory research with the purpose of identifying more specific issues to investigate further, like pain points along the customer journey and opportunities for optimizing conversion .

With Hotjar Recordings you can observe real people using your site without capturing their sensitive information

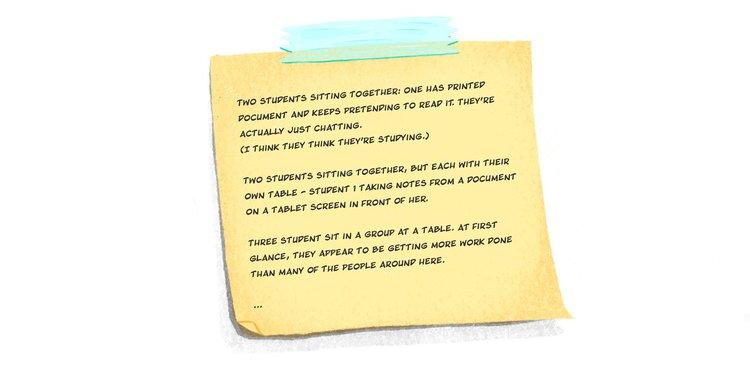

How Smallpdf did it: here’s how Smallpdf observed two different user personas both covertly and overtly.

Observing students (covert): Kristina Wagner, Principle Product Manager at Smallpdf, went to cafes and libraries at two local universities and waited until she saw students doing PDF-related activities. Then she watched and took notes from a distance. One thing that struck her was the difference between how students self-reported their activities vs. how they behaved (i.e, the self-reporting bias). Students, she found, spent hours talking, listening to music, or simply staring at a blank screen rather than working. When she did find students who were working, she recorded the task they were performing and the software they were using (if she recognized it).

Observing administrative assistants (overt): Kristina sent emails to admins explaining that she’d like to observe them at work, and she asked those who agreed to try to batch their PDF work for her observation day. While watching admins work, she learned that they frequently needed to scan documents into PDF-format and then convert those PDFs into Word docs. By observing the challenges admins faced, Smallpdf knew which products to target for improvement.

“Data is really good for discovery and validation, but there is a bit in the middle where you have to go and find the human.”

3. Conduct individual interviews

Interviews are one-on-one conversations with members of your target market. They allow you to dig deep and explore their concerns, which can lead to all sorts of revelations.

Listen more, talk less. Be curious.

Act like a journalist, not a salesperson. Rather than trying to talk your company up, ask people about their lives, their needs, their frustrations, and how a product like yours could help.

Ask "why?" so you can dig deeper. Get into the specifics and learn about their past behavior.

Record the conversation. Focus on the conversation and avoid relying solely on notes by recording the interview. There are plenty of services that will transcribe recorded conversations for a good price (including Hotjar!).

Avoid asking leading questions , which reveal bias on your part and pushes respondents to answer in a certain direction (e.g. “Have you taken advantage of the amazing new features we just released?).

Don't ask loaded questions , which sneak in an assumption which, if untrue, would make it impossible to answer honestly. For example, we can’t ask you, “What did you find most useful about this article?” without asking whether you found the article useful in the first place.

Be cautious when asking opinions about the future (or predictions of future behavior). Studies suggest that people aren’t very good at predicting their future behavior. This is due to several cognitive biases, from the misguided exceptionalism bias (we’re good at guessing what others will do, but we somehow think we’re different), to the optimism bias (which makes us see things with rose-colored glasses), to the ‘illusion of control’ (which makes us forget the role of randomness in future events).

How Smallpdf did it: Kristina explored her teacher user persona by speaking with university professors at a local graduate school. She learned that the school was mostly paperless and rarely used PDFs, so for the sake of time, she moved on to the admins.

A bit of a letdown? Sure. But this story highlights an important lesson: sometimes you follow a lead and come up short, so you have to make adjustments on the fly. Lean market research is about getting solid, actionable insights quickly so you can tweak things and see what works.

💡Pro tip: to save even more time, conduct remote interviews using an online user research service like Hotjar Engage , which automates the entire interview process, from recruitment and scheduling to hosting and recording.

You can interview your own customers or connect with people from our diverse pool of 200,000+ participants from 130+ countries and 25 industries. And no need to fret about taking meticulous notes—Engage will automatically transcribe the interview for you.

4. Analyze the data (without drowning in it)

The following techniques will help you wrap your head around the market data you collect without losing yourself in it. Remember, the point of lean market research is to find quick, actionable insights.

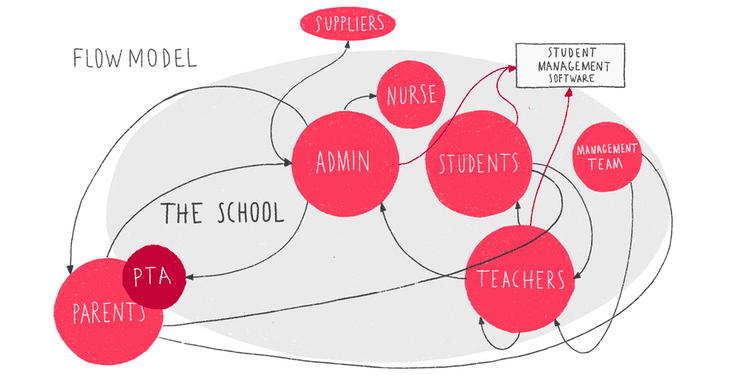

A flow model is a diagram that tracks the flow of information within a system. By creating a simple visual representation of how users interact with your product and each other, you can better assess their needs.

You’ll notice that admins are at the center of Smallpdf’s flow model, which represents the flow of PDF-related documents throughout a school. This flow model shows the challenges that admins face as they work to satisfy their own internal and external customers.

Affinity diagram

An affinity diagram is a way of sorting large amounts of data into groups to better understand the big picture. For example, if you ask your users about their profession, you’ll notice some general themes start to form, even though the individual responses differ. Depending on your needs, you could group them by profession, or more generally by industry.