Everything that you need to know to start your own business. From business ideas to researching the competition.

Practical and real-world advice on how to run your business — from managing employees to keeping the books.

Our best expert advice on how to grow your business — from attracting new customers to keeping existing customers happy and having the capital to do it.

Entrepreneurs and industry leaders share their best advice on how to take your company to the next level.

- Business Ideas

- Human Resources

- Business Financing

- Growth Studio

- Ask the Board

Looking for your local chamber?

Interested in partnering with us?

Run » finance, how to create a financial forecast for a startup business plan.

Financial forecasting allows you to measure the progress of your new business by benchmarking performance against anticipated sales and costs.

When starting a new business, a financial forecast is an important tool for recruiting investors as well as for budgeting for your first months of operating. A financial forecast is used to predict the cash flow necessary to operate the company day-to-day and cover financial liabilities.

Many lenders and investors ask for a financial forecast as part of a business plan; however, with no sales under your belt, it can be tricky to estimate how much money you will need to cover your expenses. Here’s how to begin creating a financial forecast for a new business.

[Read more: Startup 2021: Business Plan Financials ]

Start with a sales forecast

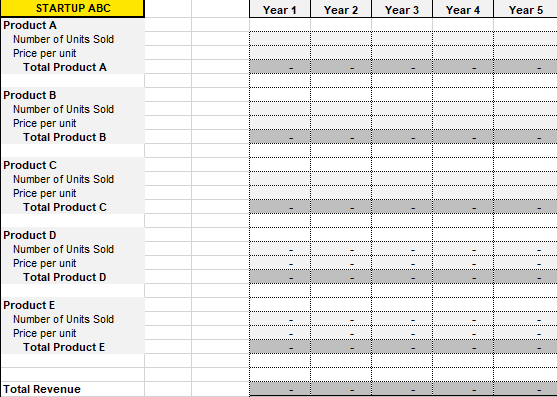

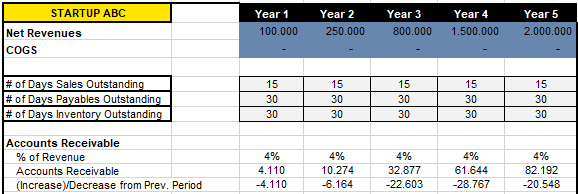

A sales forecast attempts to predict what your monthly sales will be for up to 18 months after launching your business. Creating a sales forecast without any past results is a little difficult. In this case, many entrepreneurs make their predictions using industry trends, market analysis demonstrating the population of potential customers and consumer trends. A sales forecast shows investors and lenders that you have a solid understanding of your target market and a clear vision of who will buy your product or service.

A sales forecast typically breaks down monthly sales by unit and price point. Beyond year two of being in business, the sales forecast can be shown quarterly, instead of monthly. Most financial lenders and investors like to see a three-year sales forecast as part of your startup business plan.

Lower fixed costs mean less risk, which might be theoretical in business schools but are very concrete when you have rent and payroll checks to sign.

Tim Berry, president and founder of Palo Alto Software

Create an expenses budget

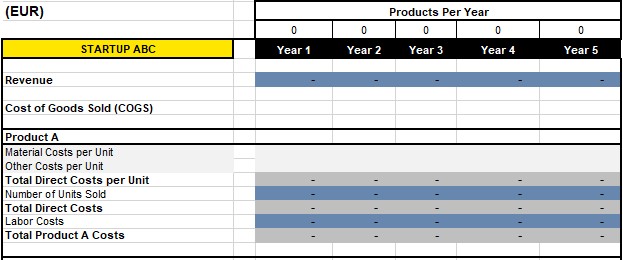

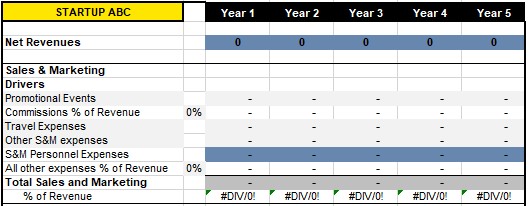

An expenses budget forecasts how much you anticipate spending during the first years of operating. This includes both your overhead costs and operating expenses — any financial spending that you anticipate during the course of running your business.

Most experts recommend breaking down your expenses forecast by fixed and variable costs. Fixed costs are things such as rent and payroll, while variable costs change depending on demand and sales — advertising and promotional expenses, for instance. Breaking down costs into these two categories can help you better budget and improve your profitability.

"Lower fixed costs mean less risk, which might be theoretical in business schools but are very concrete when you have rent and payroll checks to sign," Tim Berry, president and founder of Palo Alto Software, told Inc . "Most of your variable costs are in those direct costs that belong in your sales forecast, but there are also some variable expenses, like ads and rebates and such."

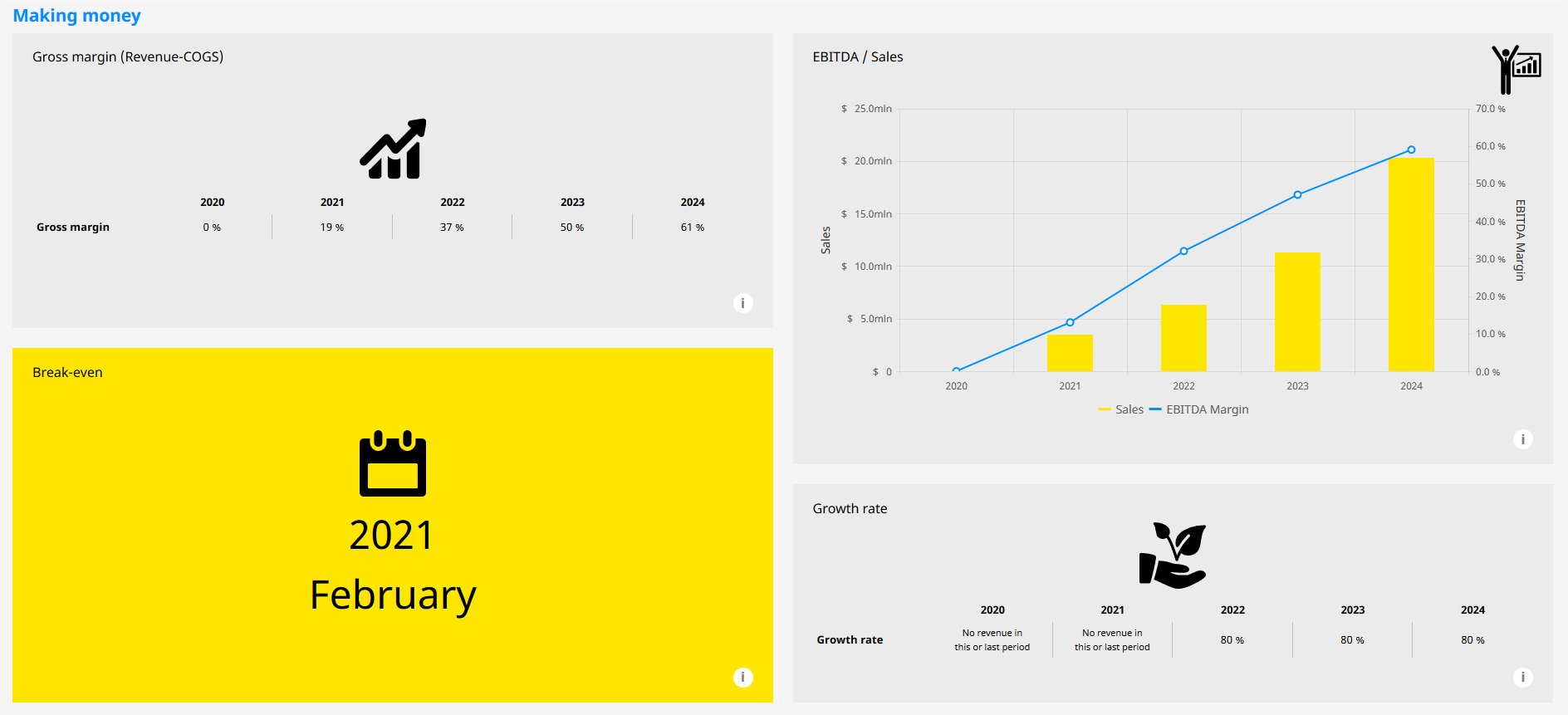

Project your break-even point

Together, your expenses budget and sales forecast paints a picture of your profitability. Your break-even projection is the date at which you believe your business will become profitable — when more money is earned than spent. Very few businesses are profitable overnight or even in their first year. Most businesses take two to three years to be profitable, but others take far longer: Tesla , for instance, took 18 years to see its first full-year profit.

Lenders and investors will be interested in your break-even point as a projection of when they can begin to recoup their investment. Likewise, your CFO or operations manager can make better decisions after measuring the company’s results against its forecasts.

[Read more: Startup 2021: Writing a Business Plan? Here’s How to Do It, Step by Step ]

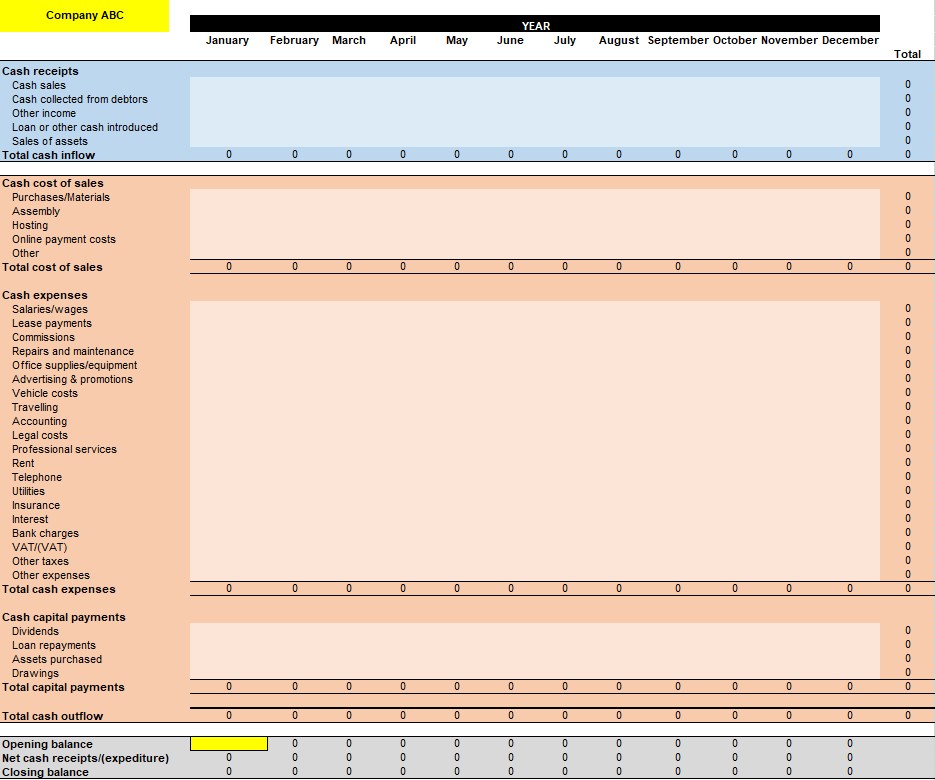

Develop a cash flow projection

A cash flow statement (or projection, for a new business) shows the flow of dollars moving in and out of the business. This is based on the sales forecast, your balance sheet and other assumptions you’ve used to create your expenses projection.

“If you are starting a new business and do not have these historical financial statements, you start by projecting a cash-flow statement broken down into 12 months,” wrote Inc . The cash flow statement will include projected cash flows from operating, investing and financing your business activities.

Keep in mind that most business plans involve developing specific financial documents: income statements, pro formas and a balance sheet, for instance. These documents may be required by investors or lenders; financial projections can help inform the development of those statements and guide your business as it grows.

CO— aims to bring you inspiration from leading respected experts. However, before making any business decision, you should consult a professional who can advise you based on your individual situation.

Follow us on Instagram for more expert tips & business owners’ stories.

CO—is committed to helping you start, run and grow your small business. Learn more about the benefits of small business membership in the U.S. Chamber of Commerce, here .

Subscribe to our newsletter, Midnight Oil

Expert business advice, news, and trends, delivered weekly

By signing up you agree to the CO— Privacy Policy. You can opt out anytime.

For more finance tips

10 free accounting tools for your small business, e-commerce credit card processing: the ultimate guide to accepting payments, what you need to know about credit card processing.

By continuing on our website, you agree to our use of cookies for statistical and personalisation purposes. Know More

Welcome to CO—

Designed for business owners, CO— is a site that connects like minds and delivers actionable insights for next-level growth.

U.S. Chamber of Commerce 1615 H Street, NW Washington, DC 20062

Social links

Looking for local chamber, stay in touch.

- Sample Plans

- WHY UPMETRICS?

Upmetrics AI Assistant: Simplifying Business Planning through AI-Powered Insights. Learn How

- 400+ Sample Business Plans

Customers Success Stories

Business Plan Course

Strategic Canvas Templates

E-books, Guides & More

Business consultants

Entrepreneurs and Small Business

Accelerators and Incubators

Educators & Business Schools

Students & Scholars

AI Business Plan Generator

Financial Forecasting

AI Assistance

Ai pitch deck generator

Stratrgic Planning

See How Upmetrics Works →

Small Business Tools

Entrepreneurs & Small Business

Accelerators & Incubators

Business Consultants & Advisors

Strategic Planning

How to Prepare a Financial Plan for Startup Business (w/ example)

Free Financial Statements Template

Ajay Jagtap

- December 7, 2023

13 Min Read

If someone were to ask you about your business financials, could you give them a detailed answer?

Let’s say they ask—how do you allocate your operating expenses? What is your cash flow situation like? What is your exit strategy? And a series of similar other questions.

Instead of mumbling what to answer or shooting in the dark, as a founder, you must prepare yourself to answer this line of questioning—and creating a financial plan for your startup is the best way to do it.

A business plan’s financial plan section is no easy task—we get that.

But, you know what—this in-depth guide and financial plan example can make forecasting as simple as counting on your fingertips.

Ready to get started? Let’s begin by discussing startup financial planning.

What is Startup Financial Planning?

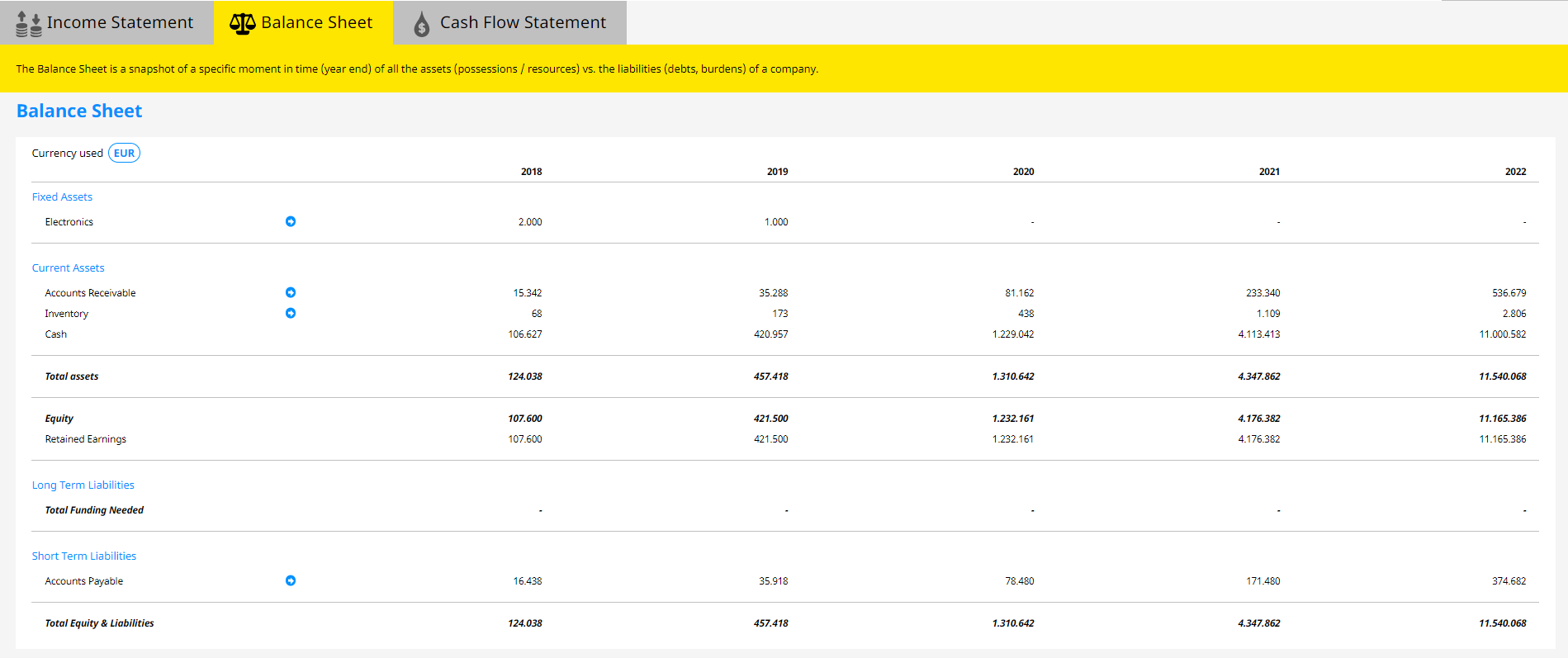

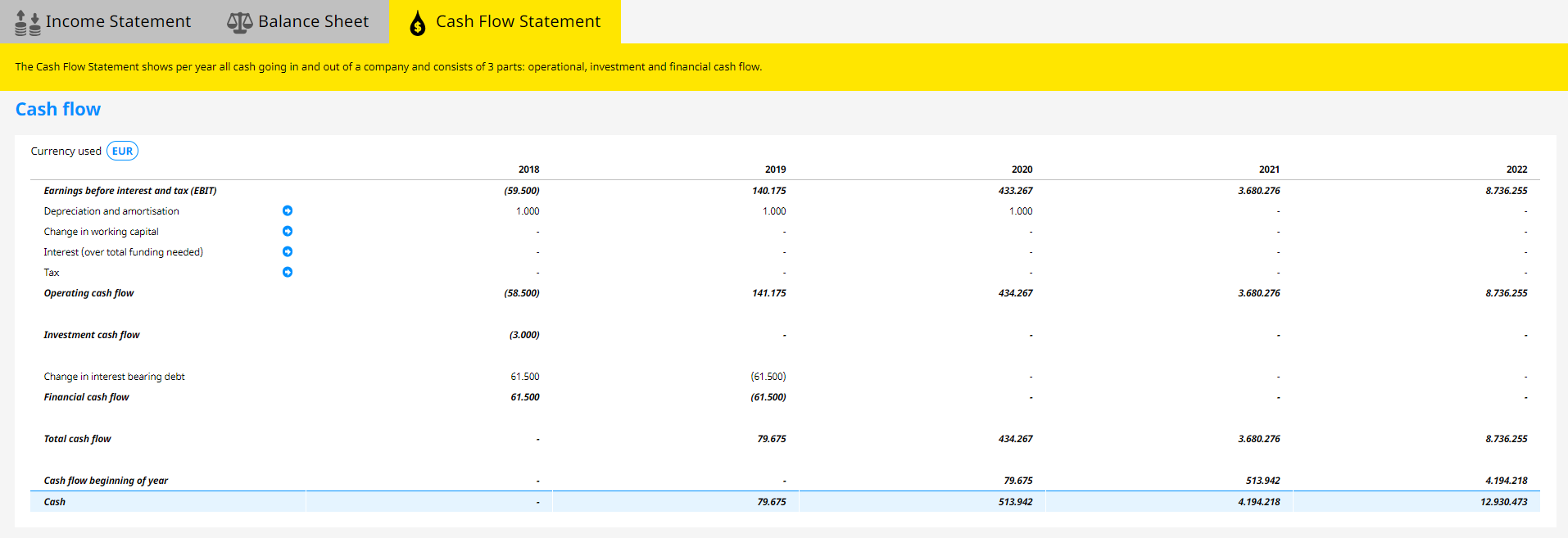

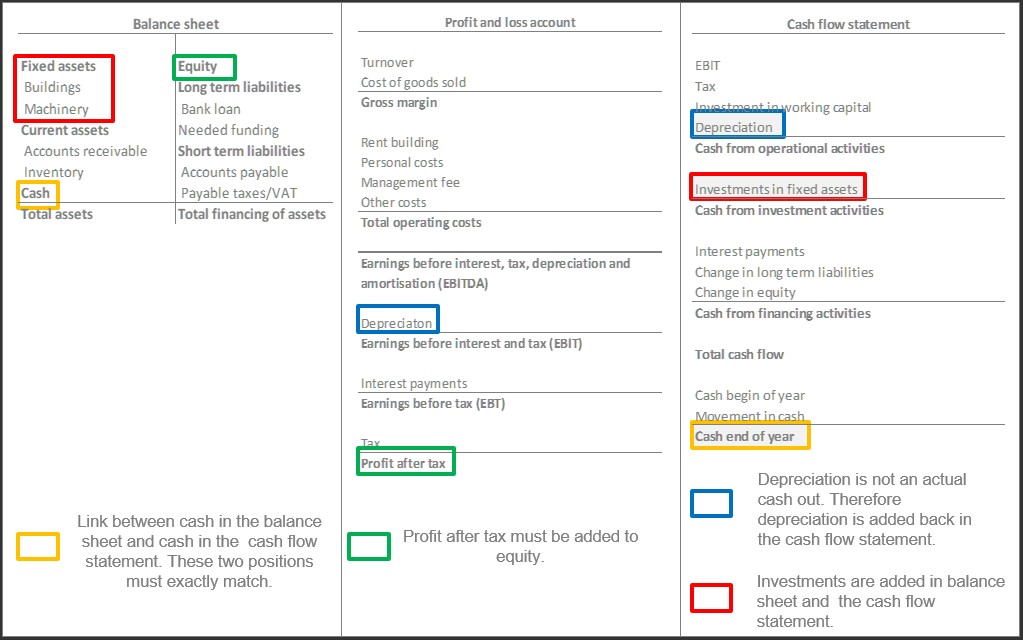

Startup financial planning, in simple terms, is a process of planning the financial aspects of a new business. It’s an integral part of a business plan and comprises its three major components: balance sheet, income statement, and cash-flow statement.

Apart from these statements, your financial section may also include revenue and sales forecasts, assets & liabilities, break-even analysis , and more. Your first financial plan may not be very detailed, but you can tweak and update it as your company grows.

Key Takeaways

- Realistic assumptions, thorough research, and a clear understanding of the market are the key to reliable financial projections.

- Cash flow projection, balance sheet, and income statement are three major components of a financial plan.

- Preparing a financial plan is easier and faster when you use a financial planning tool.

- Exploring “what-if” scenarios is an ideal method to understand the potential risks and opportunities involved in the business operations.

Why is Financial Planning Important to Your Startup?

Poor financial planning is one of the biggest reasons why most startups fail. In fact, a recent CNBC study reported that running out of cash was the reason behind 44% of startup failures in 2022.

A well-prepared financial plan provides a clear financial direction for your business, helps you set realistic financial objectives, create accurate forecasts, and shows your business is committed to its financial objectives.

It’s a key element of your business plan for winning potential investors. In fact, YC considered recent financial statements and projections to be critical elements of their Series A due diligence checklist .

Your financial plan demonstrates how your business manages expenses and generates revenue and helps them understand where your business stands today and in 5 years.

Makes sense why financial planning is important to your startup, doesn’t it? Let’s cut to the chase and discuss the key components of a startup’s financial plan.

Say goodbye to old-school excel sheets & templates

Make accurate financial plan faster with AI

Plans starting from $7/month

Key Components of a Startup Financial Plan

Whether creating a financial plan from scratch for a business venture or just modifying it for an existing one, here are the key components to consider including in your startup’s financial planning process.

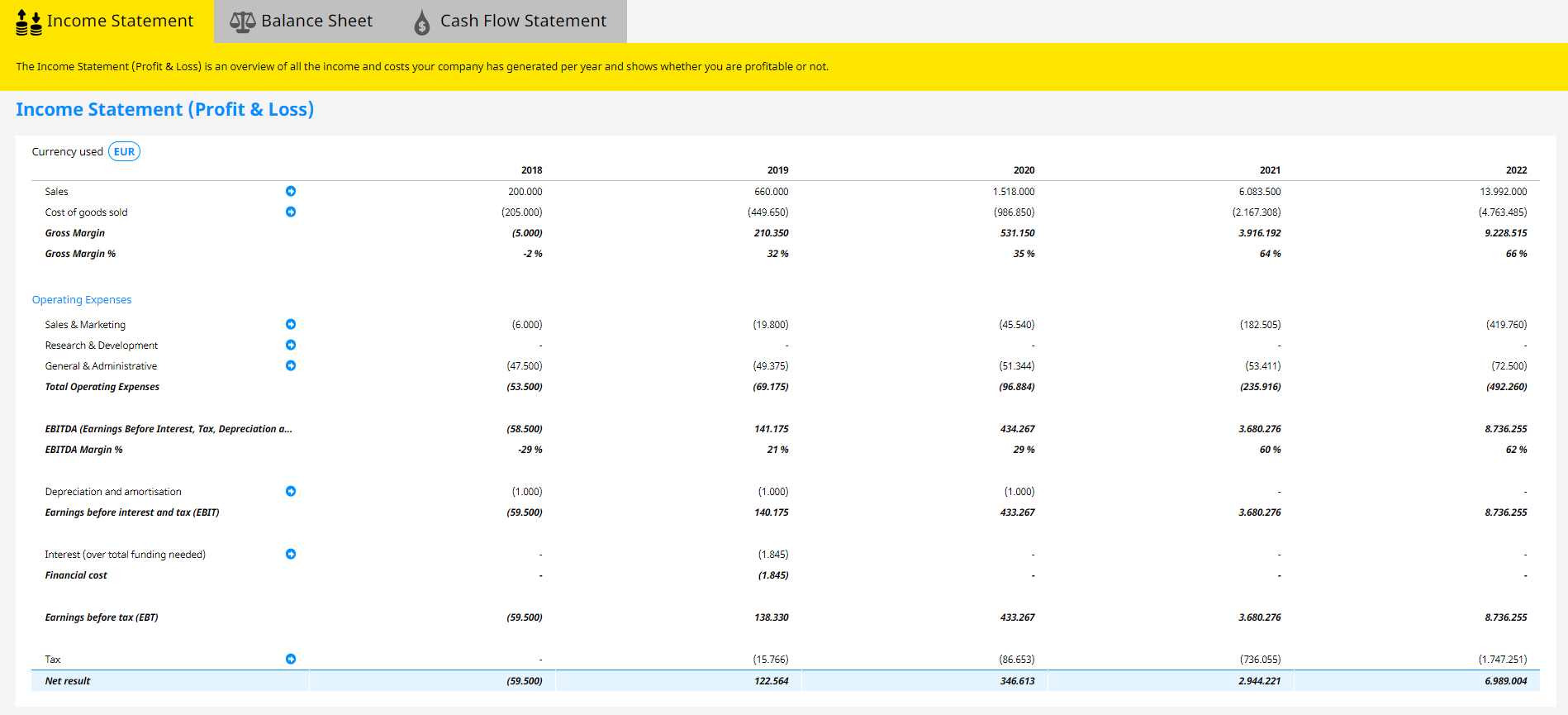

Income Statement

An Income statement , also known as a profit-and-loss statement(P&L), shows your company’s income and expenditures. It also demonstrates how your business experienced any profit or loss over a given time.

Consider it as a snapshot of your business that shows the feasibility of your business idea. An income statement can be generated considering three scenarios: worst, expected, and best.

Your income or P&L statement must list the following:

- Cost of goods or cost of sale

- Gross margin

- Operating expenses

- Revenue streams

- EBITDA (Earnings before interest, tax, depreciation , & amortization )

Established businesses can prepare annual income statements, whereas new businesses and startups should consider preparing monthly statements.

Cash flow Statement

A cash flow statement is one of the most critical financial statements for startups that summarize your business’s cash in-and-out flows over a given time.

This section provides details on the cash position of your business and its ability to meet monetary commitments on a timely basis.

Your cash flow projection consists of the following three components:

✅ Cash revenue projection: Here, you must enter each month’s estimated or expected sales figures.

✅ Cash disbursements: List expenditures that you expect to pay in cash for each month over one year.

✅ Cash flow reconciliation: Cash flow reconciliation is a process used to ensure the accuracy of cash flow projections. The adjusted amount is the cash flow balance carried over to the next month.

Furthermore, a company’s cash flow projections can be crucial while assessing liquidity, its ability to generate positive cash flows and pay off debts, and invest in growth initiatives.

Balance Sheet

Your balance sheet is a financial statement that reports your company’s assets, liabilities, and shareholder equity at a given time.

Consider it as a snapshot of what your business owns and owes, as well as the amount invested by the shareholders.

This statement consists of three parts: assets , liabilities, and the balance calculated by the difference between the first two. The final numbers on this sheet reflect the business owner’s equity or value.

Balance sheets follow the following accounting equation with assets on one side and liabilities plus Owner’s equity on the other:

Here is what’s the core purpose of having a balance-sheet:

- Indicates the capital need of the business

- It helps to identify the allocation of resources

- It calculates the requirement of seed money you put up, and

- How much finance is required?

Since it helps investors understand the condition of your business on a given date, it’s a financial statement you can’t miss out on.

Break-even Analysis

Break-even analysis is a startup or small business accounting practice used to determine when a company, product, or service will become profitable.

For instance, a break-even analysis could help you understand how many candles you need to sell to cover your warehousing and manufacturing costs and start making profits.

Remember, anything you sell beyond the break-even point will result in profit.

You must be aware of your fixed and variable costs to accurately determine your startup’s break-even point.

- Fixed costs: fixed expenses that stay the same no matter what.

- Variable costs: expenses that fluctuate over time depending on production or sales.

A break-even point helps you smartly price your goods or services, cover fixed costs, catch missing expenses, and set sales targets while helping investors gain confidence in your business. No brainer—why it’s a key component of your startup’s financial plan.

Having covered all the key elements of a financial plan, let’s discuss how you can create a financial plan for your startup.

How to Create a Financial Section of a Startup Business Plan?

1. determine your financial needs.

You can’t start financial planning without understanding your financial requirements, can you? Get your notepad or simply open a notion doc; it’s time for some critical thinking.

Start by assessing your current situation by—calculating your income, expenses , assets, and liabilities, what the startup costs are, how much you have against them, and how much financing you need.

Assessing your current financial situation and health will help determine how much capital you need for your startup and help plan fundraising activities and outreach.

Furthermore, determining financial needs helps prioritize operational activities and expenses, effectively allocate resources, and increase the viability and sustainability of a business in the long run.

Having learned to determine financial needs, let’s head straight to setting financial goals.

2. Define Your Financial Goals

Setting realistic financial goals is fundamental in preparing an effective financial plan. So, it would help to outline your long-term strategies and goals at the beginning of your financial planning process.

Let’s understand it this way—if you are a SaaS startup pursuing VC financing rounds, you may ask investors about what matters to them the most and prepare your financial plan accordingly.

However, a coffee shop owner seeking a business loan may need to create a plan that appeals to banks, not investors. At the same time, an internal financial plan designed to offer financial direction and resource allocation may not be the same as previous examples, seeing its different use case.

Feeling overwhelmed? Just define your financial goals—you’ll be fine.

You can start by identifying your business KPIs (key performance indicators); it would be an ideal starting point.

3. Choose the Right Financial Planning Tool

Let’s face it—preparing a financial plan using Excel is no joke. One would only use this method if they had all the time in the world.

Having the right financial planning software will simplify and speed up the process and guide you through creating accurate financial forecasts.

Many financial planning software and tools claim to be the ideal solution, but it’s you who will identify and choose a tool that is best for your financial planning needs.

Create a Financial Plan with Upmetrics in no time

Enter your Financial Assumptions, and we’ll calculate your monthly/quarterly and yearly financial projections.

Start Forecasting

4. Make Assumptions Before Projecting Financials

Once you have a financial planning tool, you can move forward to the next step— making financial assumptions for your plan based on your company’s current performance and past financial records.

You’re just making predictions about your company’s financial future, so there’s no need to overthink or complicate the process.

You can gather your business’ historical financial data, market trends, and other relevant documents to help create a base for accurate financial projections.

After you have developed rough assumptions and a good understanding of your business finances, you can move forward to the next step—projecting financials.

5. Prepare Realistic Financial Projections

It’s a no-brainer—financial forecasting is the most critical yet challenging aspect of financial planning. However, it’s effortless if you’re using a financial planning software.

Upmetrics’ forecasting feature can help you project financials for up to 7 years. However, new startups usually consider planning for the next five years. Although it can be contradictory considering your financial goals and investor specifications.

Following are the two key aspects of your financial projections:

Revenue Projections

In simple terms, revenue projections help investors determine how much revenue your business plans to generate in years to come.

It generally involves conducting market research, determining pricing strategy , and cash flow analysis—which we’ve already discussed in the previous steps.

The following are the key components of an accurate revenue projection report:

- Market analysis

- Sales forecast

- Pricing strategy

- Growth assumptions

- Seasonal variations

This is a critical section for pre-revenue startups, so ensure your projections accurately align with your startup’s financial model and revenue goals.

Expense Projections

Both revenue and expense projections are correlated to each other. As revenue forecasts projected revenue assumptions, expense projections will estimate expenses associated with operating your business.

Accurately estimating your expenses will help in effective cash flow analysis and proper resource allocation.

These are the most common costs to consider while projecting expenses:

- Fixed costs

- Variable costs

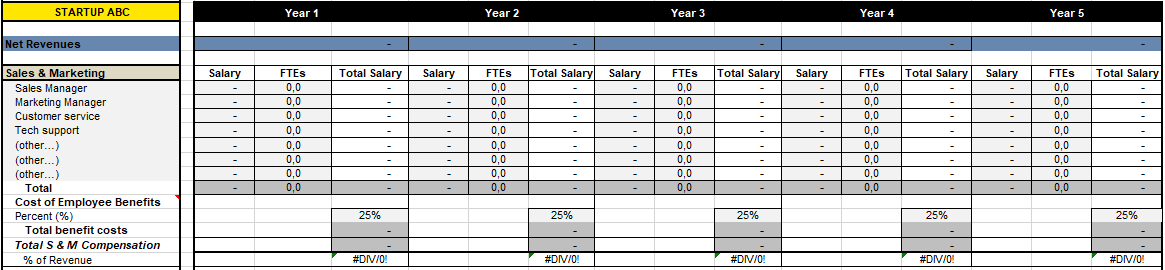

- Employee costs or payroll expenses

- Operational expenses

- Marketing and advertising expenses

- Emergency fund

Remember, realistic assumptions, thorough research, and a clear understanding of your market are the key to reliable financial projections.

6. Consider “What if” Scenarios

After you project your financials, it’s time to test your assumptions with what-if analysis, also known as sensitivity analysis.

Using what-if analysis with different scenarios while projecting your financials will increase transparency and help investors better understand your startup’s future with its best, expected, and worst-case scenarios.

Exploring “what-if” scenarios is the best way to better understand the potential risks and opportunities involved in business operations. This proactive exercise will help you make strategic decisions and necessary adjustments to your financial plan.

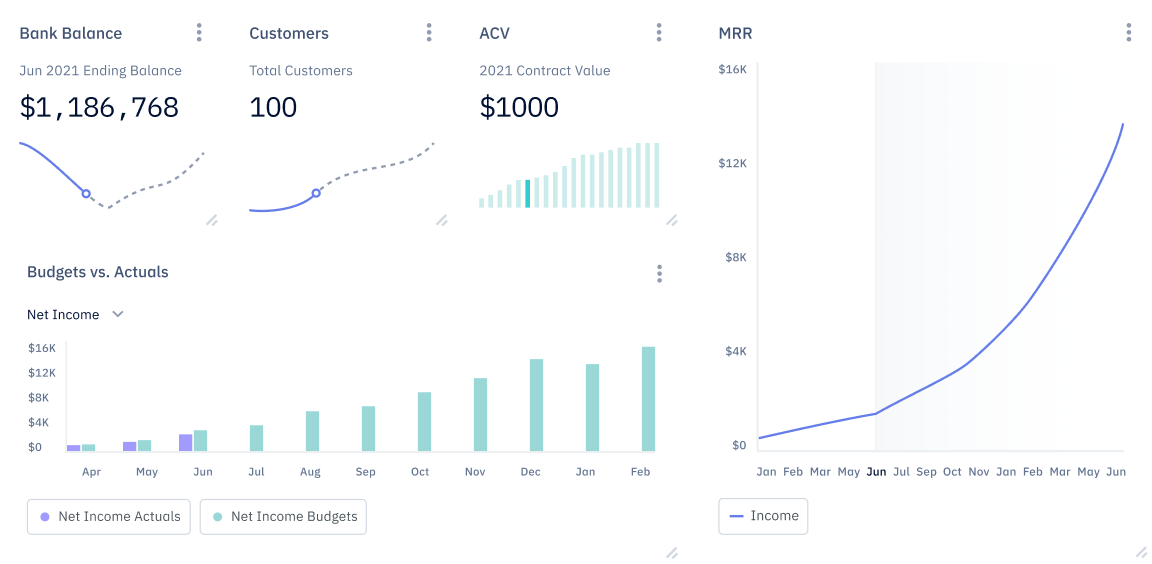

7. Build a Visual Report

If you’ve closely followed the steps leading to this, you know how to research for financial projections, create a financial plan, and test assumptions using “what-if” scenarios.

Now, we’ll prepare visual reports to present your numbers in a visually appealing and easily digestible format.

Don’t worry—it’s no extra effort. You’ve already made a visual report while creating your financial plan and forecasting financials.

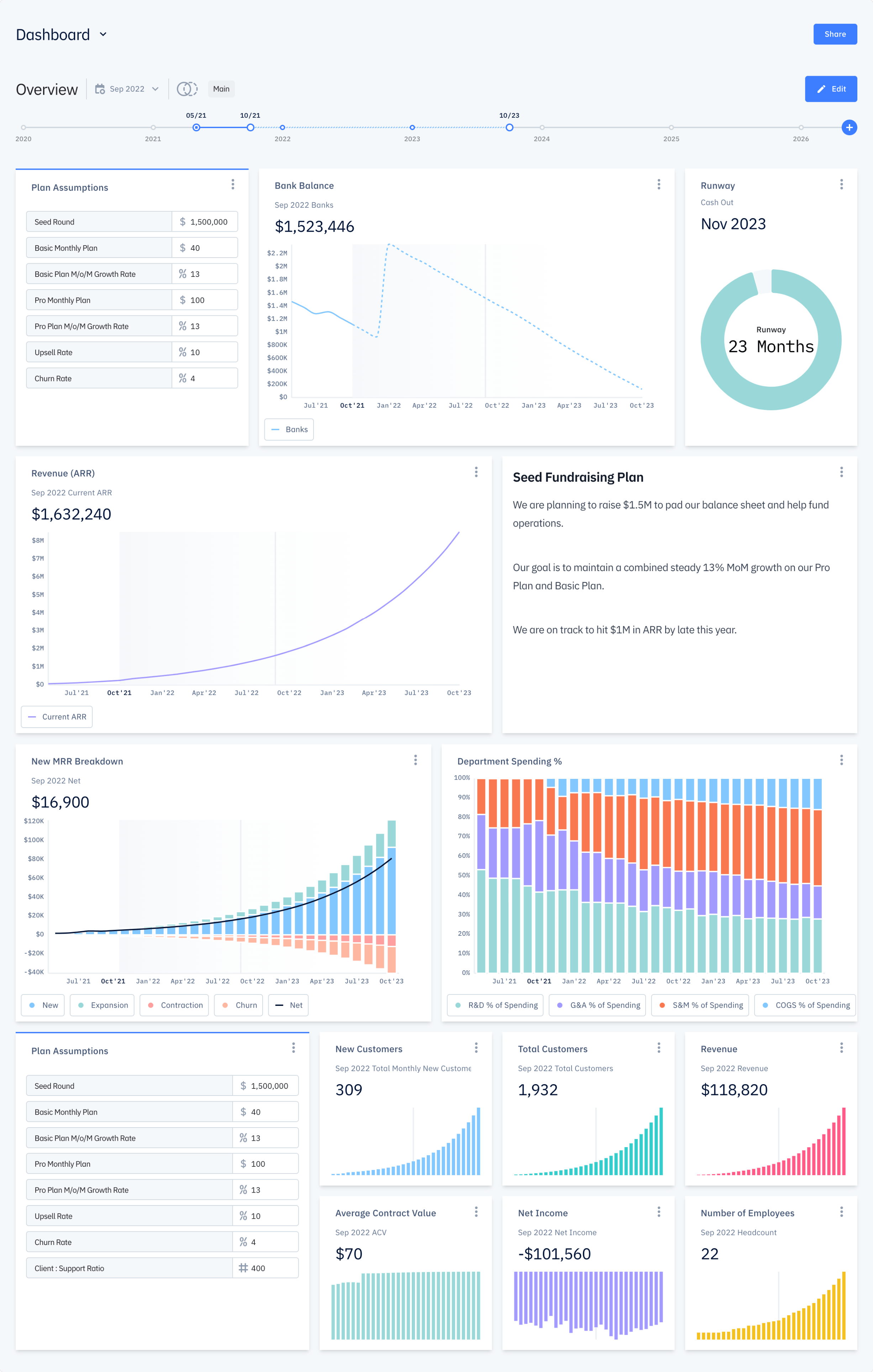

Check the dashboard to see the visual presentation of your projections and reports, and use the necessary financial data, diagrams, and graphs in the final draft of your financial plan.

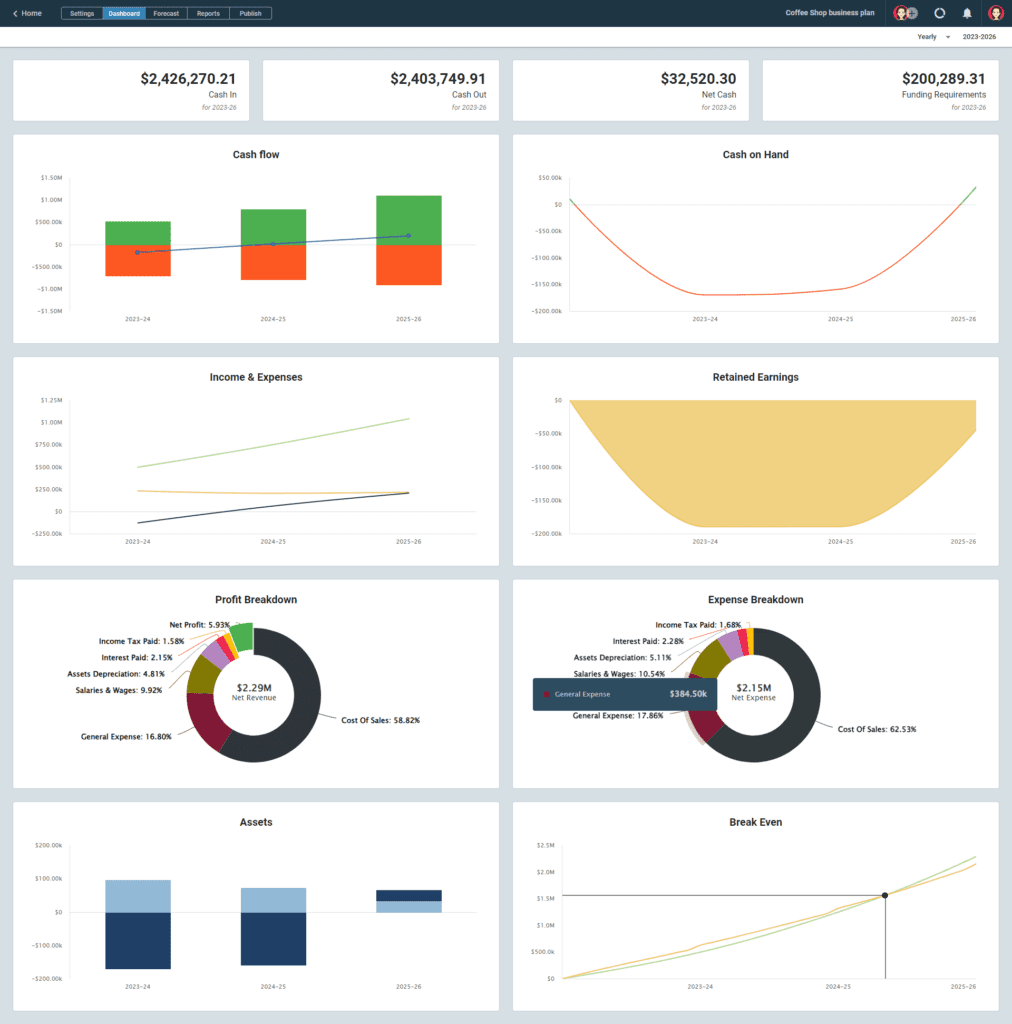

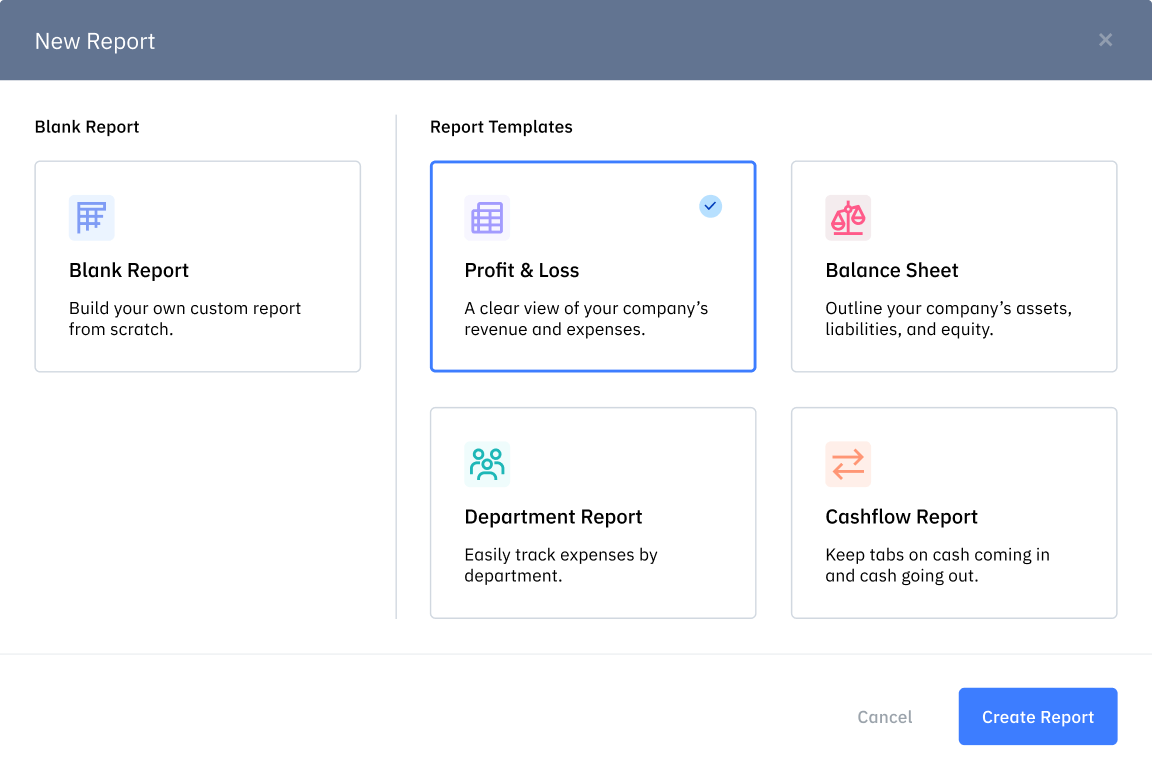

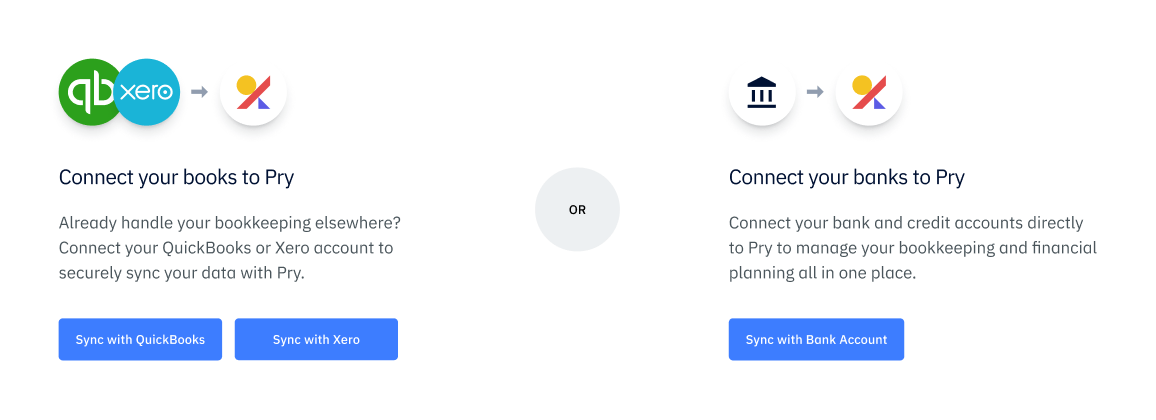

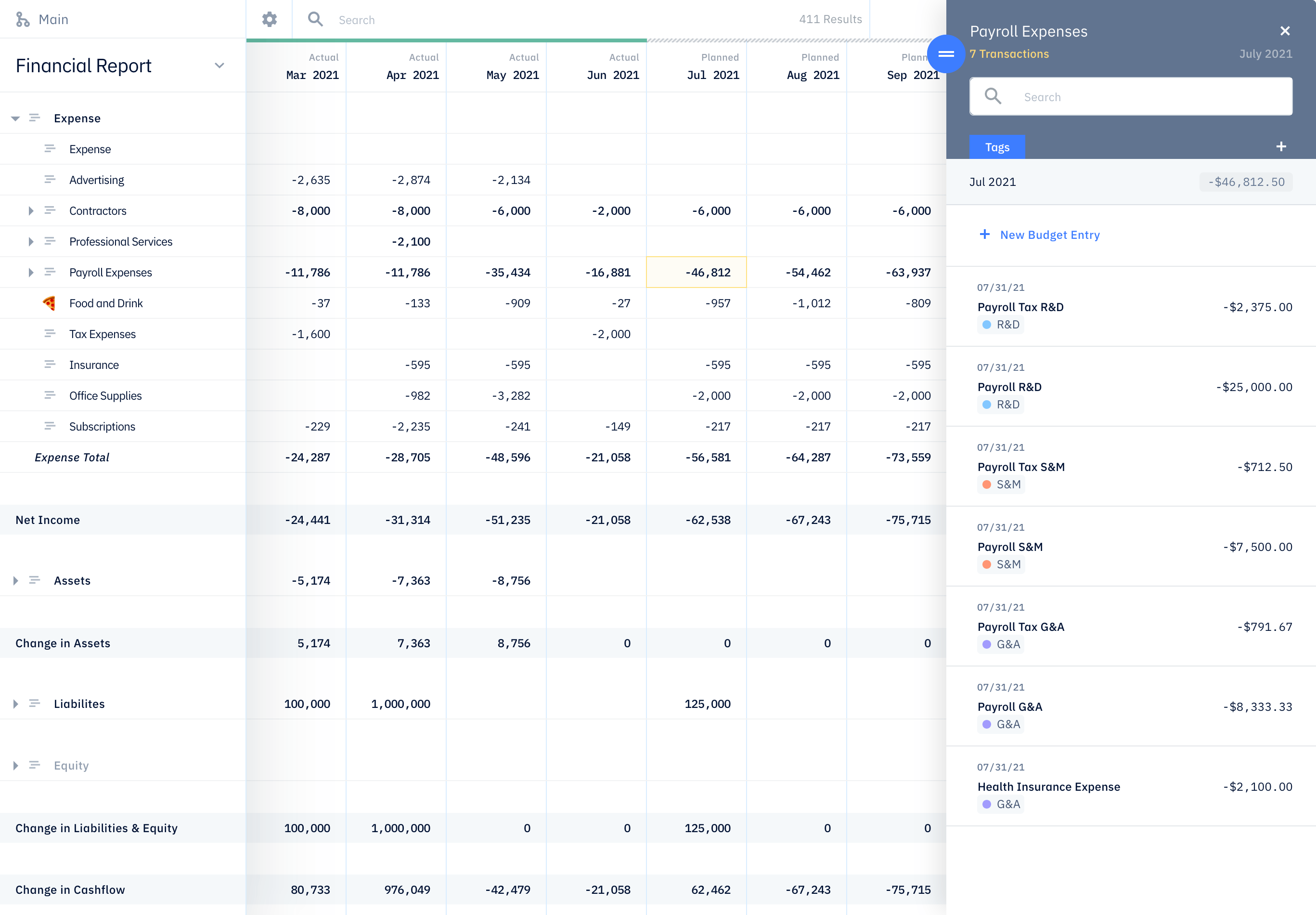

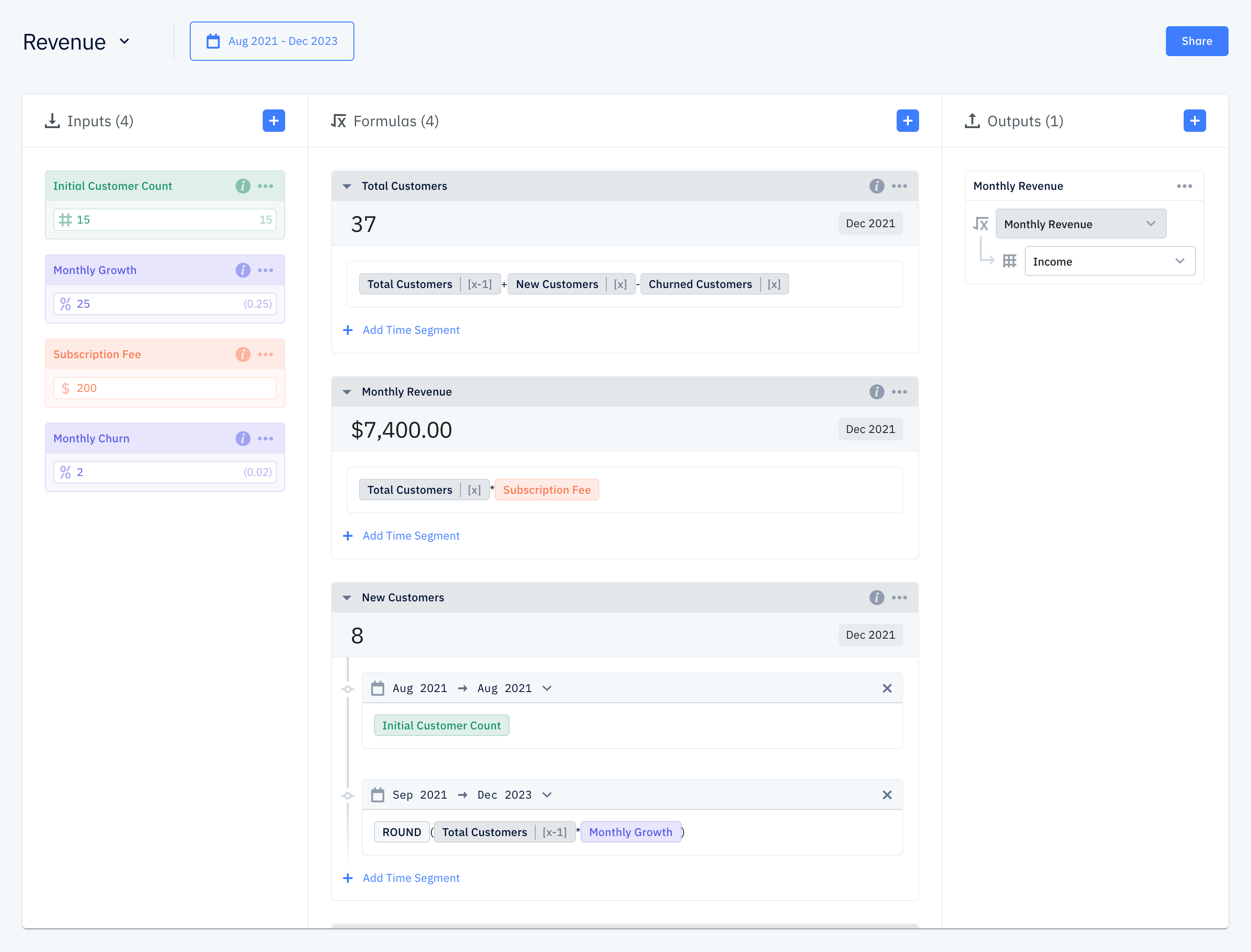

Here’s what Upmetrics’ dashboard looks like:

8. Monitor and Adjust Your Financial Plan

Even though it’s not a primary step in creating a good financial plan, it’s quite essential to regularly monitor and adjust your financial plan to ensure the assumptions you made are still relevant, and you are heading in the right direction.

There are multiple ways to monitor your financial plan.

For instance, you can compare your assumptions with actual results to ensure accurate projections based on metrics like new customers acquired and acquisition costs, net profit, and gross margin.

Consider making necessary adjustments if your assumptions are not resonating with actual numbers.

Also, keep an eye on whether the changes you’ve identified are having the desired effect by monitoring their implementation.

And that was the last step in our financial planning guide. However, it’s not the end. Have a look at this financial plan example.

Startup Financial Plan Example

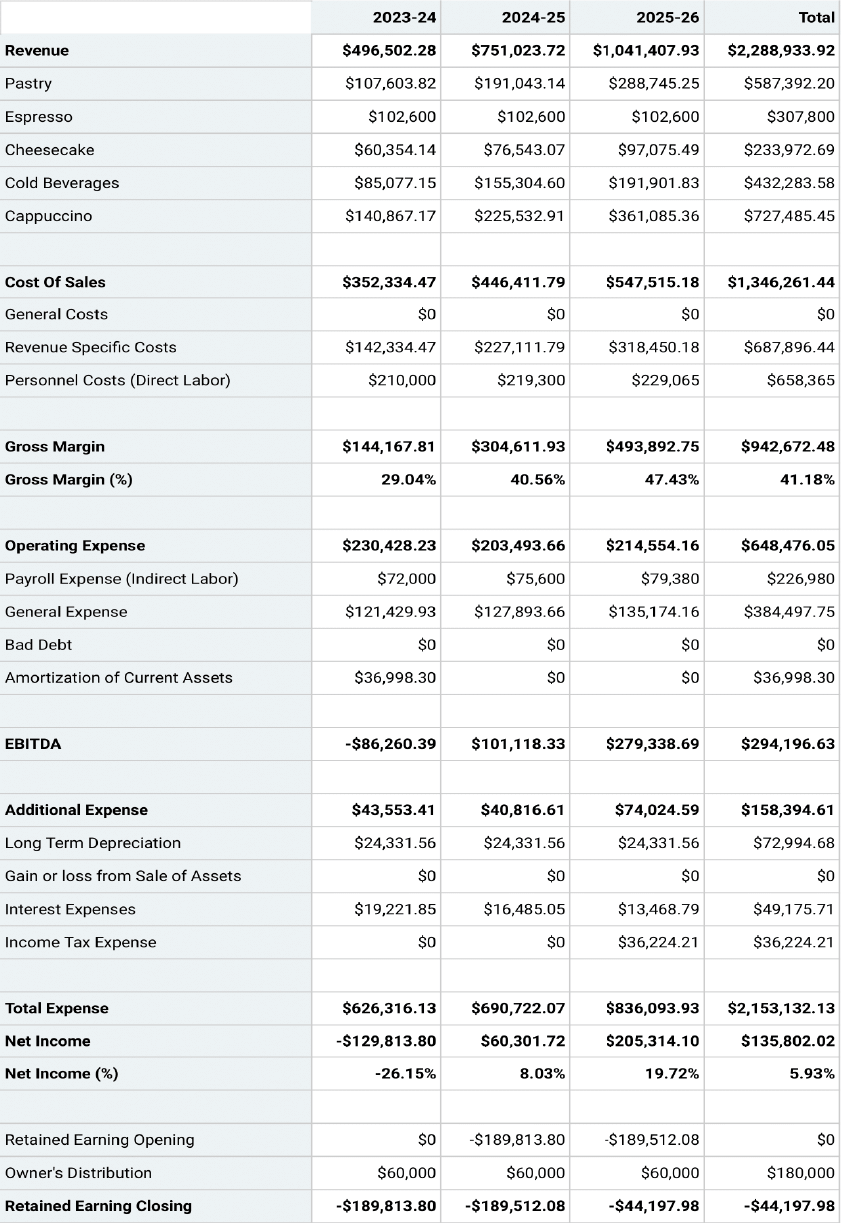

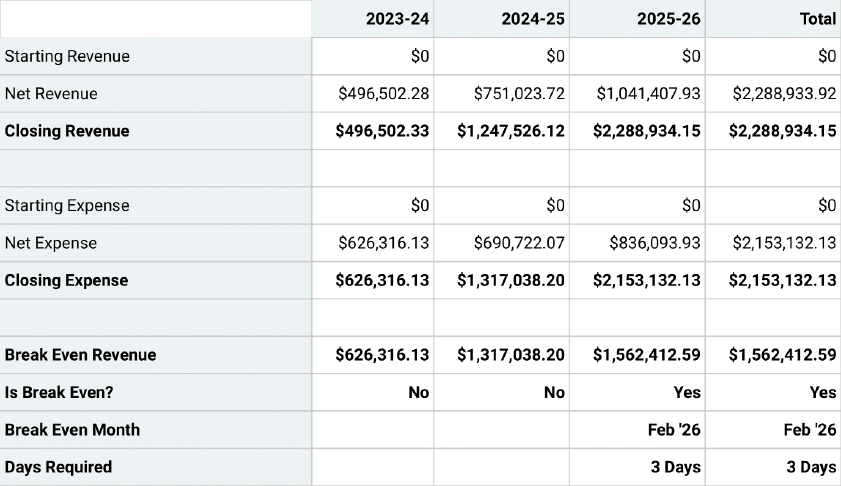

Having learned about financial planning, let’s quickly discuss a coffee shop startup financial plan example prepared using Upmetrics.

Important Assumptions

- The sales forecast is conservative and assumes a 5% increase in Year 2 and a 10% in Year 3.

- The analysis accounts for economic seasonality – wherein some months revenues peak (such as holidays ) and wanes in slower months.

- The analysis assumes the owner will not withdraw any salary till the 3rd year; at any time it is assumed that the owner’s withdrawal is available at his discretion.

- Sales are cash basis – nonaccrual accounting

- Moderate ramp- up in staff over the 5 years forecast

- Barista salary in the forecast is $36,000 in 2023.

- In general, most cafes have an 85% gross profit margin

- In general, most cafes have a 3% net profit margin

Projected Balance Sheet

Projected Cash-Flow Statement

Projected Profit & Loss Statement

Break Even Analysis

Start Preparing Your Financial Plan

We covered everything about financial planning in this guide, didn’t we? Although it doesn’t fulfill our objective to the fullest—we want you to finish your financial plan.

Sounds like a tough job? We have an easy way out for you—Upmetrics’ financial forecasting feature. Simply enter your financial assumptions, and let it do the rest.

So what are you waiting for? Try Upmetrics and create your financial plan in a snap.

Build your Business Plan Faster

with step-by-step Guidance & AI Assistance.

Frequently Asked Questions

How often should i update my financial projections.

Well, there is no particular rule about it. However, reviewing and updating your financial plan once a year is considered an ideal practice as it ensures that the financial aspirations you started and the projections you made are still relevant.

How do I estimate startup costs accurately?

You can estimate your startup costs by identifying and factoring various one-time, recurring, and hidden expenses. However, using a financial forecasting tool like Upmetrics will ensure accurate costs while speeding up the process.

What financial ratios should startups pay attention to?

Here’s a list of financial ratios every startup owner should keep an eye on:

- Net profit margin

- Current ratio

- Quick ratio

- Working capital

- Return on equity

- Debt-to-equity ratio

- Return on assets

- Debt-to-asset ratio

What are the 3 different scenarios in scenario analysis?

As discussed earlier, Scenario analysis is the process of ascertaining and analyzing possible events that can occur in the future. Startups or businesses often consider analyzing these three scenarios:

- base-case (expected) scenario

- Worst-case scenario

- best case scenario.

About the Author

Ajay is a SaaS writer and personal finance blogger who has been active in the space for over three years, writing about startups, business planning, budgeting, credit cards, and other topics related to personal finance. If not writing, he’s probably having a power nap. Read more

Related Articles

How to Write a Business Plan Complete Guide

How to Calculate Business Startup Costs

How to Prepare a Financial Plan for Small Business?

Reach your goals with accurate planning.

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Popular Templates

Financial Projections for Startups [Template + Course Included]

January 11, 2022

Adam Hoeksema

Financial projections are an important part of any business plan or startup pitch deck. They allow a company to estimate future revenues, expenses, and profits, and to identify potential risks and opportunities. We have been helping founders create financial projections through our templates, tools, and custom financial modeling services since 2012. I thought it was finally time to write a comprehensive article that should answer the key questions that we get from founders again and again. So here is what I plan to cover:

What are financial projections?

Why should a startup create financial projections, how to create a financial forecast , creating sales projections based on data, forecasting operating expenses, salary projections.

- Startup cost forecasting

Pro forma financial statements

Existing business vs. startup vs acquisition forecasting, how to know whether my projections are realistic, what will investors and lenders be looking for in my projections, tools used for financial forecasting.

But first, who am I, and do I know anything about financial projections?

My name is Adam Hoeksema and I am the Co-Founder of ProjectionHub. Since 2012 we have helped over 50,000 entrepreneurs create financial projections between our software tool and our business projection spreadsheet templates .

I didn’t spend a decade on Wall Street or make a killing in private equity, and I haven’t even raised VC funding myself.

But I did spend over a decade launching a growing an SBA (Small Business Administration) lender in the Indianapolis, IN area. During that time we made over 1,800 small business loans and we often asked our clients for financial projections along with their loan applications. That is why I started ProjectionHub.

So 10 years ago my experience was with helping small, main street businesses create projections and secure loan funding to start their dream. Along the way, I learned a ton about startup projections for tech-based businesses as well. Today about 50% of our work is with small businesses looking for an SBA loan and 50% is with tech-based businesses looking to raise capital from investors.

With that background in mind, I want to share with you what I have learned along the way to try to make your financial forecasting process just a little bit easier. Let’s dive in!

Financial projections are estimates of the future financial performance of a company. These projections are typically based on a set of assumptions and are used to help businesses plan for the future and make informed decisions about investments, financing, and other strategic matters. Most ProjectionHub customers use pro forma financials to help external stakeholders, such as investors and lenders understand a company's financial position and future prospects. Financial projections typically include projections of income, expenses, cash flow, and balance sheet items.

There are many opinions on whether a startup needs to create a forecasted balance sheet and how many years a set of projections should be. At ProjectionHub, all of our financial projection templates have an integrated pro forma income statement, cash flow and balance sheet in annual and monthly format for 5 years. This seems to meet the needs of 99% of our customers, so I think it is pretty safe to say that your investor or lender might not require all of that level of information, but they probably won’t require more than a 5-year forecast of your 3 statement financials.

So it sounds like a lot of work to create a financial forecast, so why do we create projections? No one can know the future. Isn’t it just a pointless exercise?

Well, I think it is smart for an entrepreneur to create a set of projections before they start a business to understand what they are getting themselves into and what it will take to break even and generate a profit.

I could beat that drum all day, and you know what it doesn’t really matter. Even if we know it is a good idea to create projections before throwing our life savings into a new venture, most entrepreneurs will not create projections before starting their business. I have just come to accept this!

So the real reason to create projections is because the people with the money, the investors and lenders ask for them.

- Investors will ask for a financial model because they want to see how you plan to use their money, how long you think it will last, and what the potential return could be.

- Lenders will ask to see financial projections for startups or new projects or divisions in a business because they want to be able to see whether you think you can pay them back or not. How does your debt service coverage ratio look? How many cups of coffee are you going to have to sell to make your monthly loan payment?

Now that we know why we are creating projections and who the audience is, let’s get into the “how.”

So the plan now is to walk through how to create a set of financial projections, how to do good research to take a data-driven approach when modeling, what tools you can use to help you with research, and then how to know whether your forecast is realistic once you are done. We are going to look at:

- Creating revenue projections

- Operating Expenses

- Salaries Forecasting

- How to get investor and lender-ready projections

Revenue Projections

This is where we will camp out for a while. I want to show you a few examples of different types of revenue models to show you how I approach creating revenue projections.

If you have a stable, existing business, then it is possible that the best approach to creating sales projections is simply to take last year’s numbers and apply a growth rate based on your expectations of growth. Since that approach is quite straightforward I am not going to spend any time on that today. Our Existing Business Forecast Template will be perfect for you in this scenario.

We are going to focus on more of a first principles approach. I am going to outline two different approaches that I often take when building a financial model. First a capacity approach and then a customer funnel approach.

Capacity-Based Revenue Projections

I use a capacity-based approach to revenue projections when a company is pretty certain to have demand for their products or services and their revenue is more of a function of your price x capacity.

Here are some examples of businesses where I would take a capacity-based approach.

Farming Projections

For a farm, your revenue forecast is going to be based on how many acres you are farming x the yield per acre x the price per unit for your crop. You don’t really need to worry about whether you have a customer or not. Since most crops are commodities you won’t need to find a customer, you simply sell into the ready made market at the market price.

Trucking Projections

Trucking is similar in the sense that as long as you have a valid license and a working truck, you will be able to find loads to deliver. The question is more about how many trucks do you have, how many miles per day can each truck drive and what price will you be able to earn per mile. Again this is about capacity and price, not whether or not you can find a customer. This is the approach we take to show how a trucking business with one truck can generate $400k in annual revenue .

Daycare Facility

A daycare facility will also be able to calculate a capacity based on the size of the facility and the teacher-to-student ratio requirements. Once you have your capacity it is mostly a function of pricing to determine your revenue forecast. You can see a screenshot from our daycare financial forecast tool to see how we think about modeling this type of business.

I would say most tech businesses do not fall into a capacity-based projection approach.

For tech companies, I typically use a customer funnel-based approach to forecasting revenue.

Customer Funnel-Based Revenue Projection Approach

These are companies where your customer might not even know your product or service exists and might not know that they want it or need it so you are going to have to really go out and market and sell. You will likely have a customer funnel that will have leads that convert into customers over time.

Here are some examples of business models where I would use a customer funnel approach to financial modeling.

B2B SaaS Projections

For a B2B SaaS product you will probably have an advertising budget and a sales team that will drive leads that your team will work to qualify. Then some percentage of those sales qualified leads will turn into customers. You will need assumptions for things like:

- A monthly ad budget

- Cost per click to attract a website visitor

- Percentage of website visitors that become sales qualified leads

- Percentage of sales qualified leads that the sales team converts into customers

- Average monthly spend per customer

DTC Product Forecasting

For direct to consumer product companies you will have a similar customer funnel. Once you get to a customer, then you might have assumptions like:

- Average order value

- % of customers that become repeat customers

- How often do repeat customers repurchase

Consumer Apps

For a consumer mobile app you will need assumptions for things like:

- Monthly ad budget

- Cost per download

- Organic / word of mouth downloads

- % of customers that download the app that convert into active users

- % of active users that churn each year

- Average monthly spend per active user per month

So this should give you an idea of the structure of assumptions that you will need in order to approach creating projections, but I just left you with a bunch of assumptions that you have no idea how to fill in with realistic data.

Next I want to show you what I would do in order to research and find good data for your sales projections.

So how do you know how many people are searching on Google for terms that are relevant to your product or service? How do you know how much it would cost to advertise and get a click for that term? How do you know what a reasonable conversion rate is from a website visitor to a customer? How do you know what the average order value is for an ecommerce business like yours, etc?

I recorded an entire course on this , but I have listed some tools and some slides below to show you my typical research process.

As you will notice in the slides, I start out be simply doing Google research to try to find reasonable assumptions for as many of the key assumptions as I can.

From there, I like to use the following tools:

- Ahrefs - I use this tool for competitor research to determine how much organic traffic my competitors are getting and thereby how much organic traffic my website might get over time.

- Google Trends - I use Google Trends to see seasonality trends in a business.

- Google Adwords Keyword Tool - I use this tool to forecast how much it will cost per click to attract a website visitor, and to see search volume for certain keywords.

- Bizminer - You can use Bizminer industry reports to get an idea of key industry ratios to get an idea of whether your projections are realistic for your industry.

When forecasting expenses I like a couple of different resources to help me forecast my expenses and ensure that my expense projections are within industry standards.

Expenses for Small Businesses

Bizminer - You can use Bizminer industry reports to get an idea of key industry ratios. For example, you can determine if the average company in your industry spends 10% on rent or 12% on rent.

Expenses for Tech Startups

SaaS Capital - You can use this report from SaaS Capital to get an idea of the spending categories as a % of revenue for tech companies. This is specifically focused on SaaS, so if you are in ecommerce or a hardware startup you will need to find a similar source for your industry. You can see an example of the expense ratios from SaaS Capital below:

When forecasting salaries I actually take two different approaches. I typically start out by projecting specific salaries and positions for the first 24 months of the projection. Then after that, I simply include salaries in larger buckets of operating expenses like General & Admin, R&D, and Sales & Marketing. When you are raising investment the investors will likely want to know your specific use of funds for the first 18 to 24 months, but after that they will understand that it is impossible to predict exact positions, timing and salaries, so transitioning to an expense as a % of revenue makes sense. You can see how this looks in one of our financial models for a B2B SaaS company :

Detailed Salary Projections for the First 24 Months:

Salaries included in operating expense categories as a percentage of sales for year 3 and beyond:

Startup Cost Forecasting

When forecasting your startup costs, your specific location, concept, size and scale of business will make a dramatic difference in what it costs to launch your business. I don’t recommend that you just take the first “average startup cost” number that you find in a Google search because your specific situation matters. You will need to do your own research for each startup cost, but I have actually found it helpful to use ChatGPT to ask for a list of common startup expenses for business XYZ so that I don’t forget any common expenses.

I have already mentioned this before, but I commonly take a different approach to creating projections for an existing business compared to a startup compared to modeling a business acquisition.

Existing Business Projections

When modeling a projection for an existing business I like to use our existing business budgeting template that allows me to enter in historical revenue and expenses and use that as a baseline to build a forecast by increasing or decreasing expenses and revenue based on my plans.

Startup Projections

For a startup, I would use one of our 70+ industry specific financial projection templates and start from the ground up. You would use the research process outlined in this article to create your projections.

Forecasting a Business Acquisition

For creating projections for a business that you are looking to acquire I would use our acquisition financial model which will allow you to enter in historical financials from the target business, but it will also allow you to make adjustments to the balance sheet and revenue and expenses for a post acquisition pro forma. You can’t simply use the existing balance sheet and income statement because both will likely change quite a bit after the sale of the business.

Finally, I wanted to show you some example pro forma statements so that you can see what the end product should look like.

Pro forma P&L Example

Here is an example of our 5 year pro forma income statement.

Pro forma Balance Sheet Example

Here is an example of our 5 year pro forma balance sheet.

Once you have a complete set of projections (if you are using a ProjectionHub template) I would suggest taking a look at the profit and loss at a glance table as seen below:

In this example, I am looking at projections for a technology company that is looking to raise investment. So a couple of things that I would look at for a tech company pro forma.

- The first year should probably be a loss because that is why you are looking to raise investment right? I would just make sure you are assuming that you will raise enough investment to cover that first year loss.

- Next I would look at how fast revenue is growing. For an investable company there is a rule of thumb “triple, triple, double, double” which means after investment an investor will be hoping that you triple sales the first 2 years and then double sales the following two years. This is really hard to do, so if you are forecasting that you will do 10x every year you are probably off base!

- For tech startups you can look at this study with our partner Story Pitch Decks where we looked at what is a reasonable projection for a tech startup . This study will show you what other similar companies are projecting, so that you can ensure that whatever you project will fall within the norms that investors see.

Investors and lenders will likely be looking at the following numbers and ratios to make sure your projections seem to be reasonable:

- Gross Profit Margin

- Profit Margin

- Debt Service Coverage Ratio

- Comparing to industry averages

- Do revenue projections, units sold make sense?

- Does your balance sheet balance?

- When do you reach breakeven?

- Do you have room for error?

I suggest that you simply Google these things and make sure your numbers seem “normal.” For example, if you are opening a coffee shop you could Google “average profit margin for a coffee shop” and you would probably find our article on coffee shop profit margins . Confirm that your forecasted profit margins are in line and reasonable. Do this same exercise with each of these key ratios and numbers.

As a thank you for reading this behemoth of an article, you can download our free financial projection template . Other tools that I utilized or mentioned in the article include:

- Ahrefs - For competitor research

- Google Trends - For seasonality trends

- Google Adwords Keyword Tool - For search volume and cost per click

- Bizminer - For industry expense ratios

- ProjectionHub Pro Forma Templates - You can use our library of templates built specifically for over 70 unique industries and business models.

If you would like to learn more about my process for creating financial projections, you can watch this course that I put on for tech startups looking to create investor-ready financial projections.

Insert Webinar video below

Well I hope this has been helpful to you. If you have specific questions please feel free to reach out directly to us at [email protected]

About the Author

Adam is the Co-founder of ProjectionHub which helps entrepreneurs create financial projections for potential investors, lenders and internal business planning. Since 2012, over 50,000 entrepreneurs from around the world have used ProjectionHub to help create financial projections.

Other Stories to Check out

How to finance a small business acquisition.

In this article we are going to walk through how to finance a small business acquisition and answer some key questions related to financing options.

How to Acquire a Business in 11 Steps

Many people don't realize that acquiring a business can be a great way to become a business owner if they prefer not to start one from scratch. But the acquisition process can be a little intimidating so here is a guide helping you through it!

How to Buy a Business with No Money Down

Learn the rare scenarios enabling the purchase of a business with no money down and delve into the complexities of selling via seller notes, highlighting the balance of expanded opportunities and inherent risks in these unique financial transactions.

Have some questions? Let us know and we'll be in touch.

Transformed 500+ small businesses • Founded by ex-Rocket Internet APAC CFO • Pre-approved five-star satisfaction • Specialized in small business growth

- Corporate Incorporation Services in Singapore

- Bookkeeping Services in Singapore

- Payroll Services

- Corporate Secretarial Services in Singapore

- Pitch your start up

- Due Diligence

- Investor Growth Services

- Part-Time/Fractional CFO

- Success Stories

Speak To An Expert

Guide to Mastering Startup Financial Planning and Management

The world of startups is exciting, dynamic, and often fraught with challenges. One of these challenges is the management and planning of finances.

Startup Financial Planning is a crucial aspect of running a successful business and should not be overlooked. This guide will delve into vital aspects of startup financial management , including budgeting, cash flow management, financial forecasting, expense management, vendor management, and financial security and risk management.

The Essence of Budgeting and Financial Planning in Startups

Financial planning and budgeting form the backbone of any startup. These crucial processes help startups allocate resources efficiently, prevent overspending, and ensure optimal fund distribution. A comprehensive budget identifies both fixed and variable costs, aligning with the startup’s financial landscape.

The Startup Budget

A startup budget serves as a roadmap that guides your financial decisions and shapes your business operations. It details your startup’s current revenue, deducts the fixed and variable costs, and sets aside funds for emergencies. A well-planned budget ensures the efficient use of resources, prevents overspending, and contributes to the startup’s financial stability.

Financial Planning

Financial planning in startups involves setting realistic financial goals based on a comprehensive understanding of the business’s financial landscape. It includes forecasting revenue and expenses, conducting a market analysis to project sales and revenue streams, and estimating both operating and non-operating expenses.

Cash Flow Management: The Lifeline of Your Startup

Cash flow management is a critical aspect of startup financial management. It involves monitoring the inflows and outflows of cash within a defined timeframe, ensuring the availability of funds for day-to-day operations, and planning for contingencies.

Establishing a Cash Flow Statement

A cash flow statement serves as a financial report that provides aggregated data about all the cash inflows a company receives from its ongoing operations and external investment sources. It also includes all cash outflows that pay for business activities and investments during a given period.

Analysing and Forecasting Cash Flow

Conducting a thorough analysis of your cash flow statement helps identify trends and potential problems. It involves focusing on operating, investing, and financing activities and using the insights to prepare monthly forecasts . Regular forecasting helps maintain a healthy cash flow and ensures your business remains solvent.

Optimising Cash Flow

To optimise cash inflow, consider strategies such as offering discounts for early payments, tightening credit requirements, and issuing invoices promptly. For cash outflow, negotiate extended payment terms with suppliers, prioritize payments to vendors, and control discretionary spending.

Financial Forecasting: Navigating the Future

Financial forecasting is a vital part of startup financial planning. It involves predicting future revenue, costs, and financial outcomes based on historical data, market research, and financial trends.

Revenue Forecasting

Revenue forecasting is an essential component of financial forecasting. It includes projecting future sales and income based on present data and market trends. The forecast’s accuracy directly impacts the budget, financial planning, and overall business strategy.

Expense Forecasting

Predicting future expenses allows startups to plan for resource allocation effectively. Expense forecasting considers factors like inflation, cost of labor, and market conditions. It helps startups prepare for upcoming costs, and aids in decision-making regarding investments and growth opportunities.

Understanding Financial Modeling

Financial modeling is a process that allows businesses to forecast a financial picture for the company. It involves creating a model that represents financial asset performance, investment return outlook, future operating performance, or other financial projections. A well-crafted financial model serves as a decision-making tool, helping startups evaluate potential investments or financial decisions.

Expense Management: Optimising Costs

Expense management involves organizing and controlling the costs incurred in running a business. This process is crucial for maintaining financial stability, maximising profitability, and ensuring the efficient use of resources.

Prioritising Expenses

Startups should prioritise expenses to avoid cash flow issues. Differentiating between essential and optional business expenses is crucial for effective financial management. Regularly comparing actual spend against your budget helps identify areas of overspending and necessitates adjustments.

Reducing Unnecessary Spend

Identifying and eliminating unnecessary expenses can significantly improve a startup’s financial health. Scrutinizing your cash flow statement helps locate areas of excessive spending, enabling cost reductions and improved cash reserves.

Maximising Tax Returns

Startups should take advantage of tax breaks and deductions. These can include deductions for setup costs, marketing expenses, equipment purchases, and contributions to retirement accounts. Utilizing these benefits can significantly reduce a startup’s tax liability, improving its bottom line.

Vendor Management: Fostering Strong Partnerships

Effective vendor management is essential for smooth business operations, cost-effectiveness, and fostering strong partnerships. It involves selecting the right vendors, establishing clear communication and expectations, regularly reviewing performance, and diversifying vendor relationships.

Vendor Selection

Choosing the right vendors is a critical first step in vendor management. Consider factors such as reputation, reliability, and pricing. A thorough evaluation ensures that you partner with vendors who can consistently meet your business needs.

Vendor Performance Reviews

Regularly reviewing vendor performance helps identify any issues early and allows for timely resolution. Using agreed-upon metrics or key performance indicators (KPIs), you can objectively evaluate how well a vendor is meeting your expectations.

Diversifying Vendor Relationships

Relying on a single vendor can pose significant risks. Diversifying vendor relationships provides flexibility and reduces potential disruptions to your supply chain.

Financial Security and Risk Management: Safeguarding Your Future

Financial security and risk management are vital for a startup’s sustainability and long-term success. It involves maintaining healthy cash flow, budgeting effectively, diversifying revenue streams, and planning for contingencies.

Ensuring Financial Security

Financial security for startups involves having enough resources to cover both current and future expenses. It requires effective cash flow management, building emergency reserves, diversifying revenue streams, and accurate budgeting and forecasting.

Risk Assessment and Management

Risk management involves identifying potential risks and implementing strategies to mitigate their impact. This includes internal risks, such as operational issues, and external risks, like market fluctuations or regulatory changes.

Contingency Planning

Contingency plans outline how the startup will navigate unexpected financial challenges or disruptive events. It includes backup plans for suppliers, alternative production methods, and crisis communication strategies.

Successful Startup Financial Planning involves a multifaceted approach covering various aspects, from budgeting to vendor management. By understanding and implementing these strategies effectively, startups can enhance their financial stability, optimize their resources, and set a solid foundation for success.

At Growwth Partners, we understand the importance of financial management for start-ups. Our services include automated financial management systems, bookkeeping, payroll automation, and more. We help start-ups streamline their financial operations, improve efficiency, and make informed decisions. Contact us today to learn more about how we can support your start-up’s financial management needs.

The material / information contained above or other parts of this website is for general information purposes only and should not be relied upon for tax, legal or accounting advice. You should consult an expert in the relevant field before engaging in any transaction since applicability of the above may be different on the facts and circumstances of your situation. While we have made every attempt to ensure that the information contained on this website has been obtained from reliable sources, we are not responsible for any errors, omission or the results obtained by using the above information. We are not responsible for updating the above for changes in law, practices, or interpretation.

Why Choose Accounting Services for a Startup In Singapore? An In-Depth Analysis

How to Prepare Your Start-Up for Due Diligence & Optimise Financial Reporting

Navigating Taxation and Bookkeeping Essentials for Singapore Startups

How to Secure Startup Funding in Singapore: A Comprehensive Guide

Singapore Startup Incorporation – A Comprehensive Guide

Company Registration in Singapore from India: A Comprehensive Guide

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Growwth Partners

Get started swiftly & easily with us to manage and grow your business efficiently through our CFO, Finance & Accounting and Growth Solutions

+65-98615600

Growwth Partners, 65 Chulia Street, #46-00 OCBC Centre, Singapore 049513

Quick Links

Copyright © 2024 Growwth Partners. All Rights Reserved

Privacy Policy

Hey there! 😀 This is Jatin, founder and CEO of Growwth Partners. Is there anything I can help you with? Chat with me now on whatsapp!

How to Set Up a Financial Forecasting Model For Your Startup

The ultimate guide to financial modeling for startups.

Setting up a robust financial forecasting model is the cornerstone for any successful startup. Navigating the intricacies of finances can be daunting, but a well-structured financial forecast not only serves as a roadmap but also empowers entrepreneurs to make informed decisions critical to their business’s growth and sustainability. In this blog post, we’ll explain why financial forecasting is important, give you a step-by-step guide for creating a strong plan, and call out what is significant to consider to achieve an accurate and reliable model. We aim to equip you with the knowledge and tools necessary to develop a solid financial roadmap that propels your startup toward success.

Why is Financial Forecasting Important?

Financial forecasting serves as a guide to businesses during times of uncertainty. They offer a strategic plan, help with decision-making, and ultimately help achieve long-term success.

For startups specifically, financial forecasting is a must. During the early stages of these businesses, a financial plan helps predict the potential challenges that may arise. The plan gives insight into how resources should be allocated and what funds should be saved.

Startups, typically operating in an environment of high risk and rapid change, rely on accurate financial projections to attract investors, chart sustainable growth trajectories, and steer away from potential pitfalls that could derail their ambitious endeavors. The ability to forecast financial outcomes empowers startups to make informed decisions, adapt swiftly to market fluctuations, and maintain a healthy financial standing in the face of uncertainty, positioning them for resilience and success in the competitive business landscape.

A Step by Step Guide

- Define your Goals and Objectives

Clearly outline the short-term and long-term goals of your business. Understand what you aim to achieve through financial forecasting – whether it’s securing funding, managing cash flow, or planning for growth.

- Do the Research

Collect and analyze historical financial data from your startup. This includes income statements, balance sheets, cash flow statements, and any other relevant financial records. Understanding past performance is crucial for making accurate projections. It’s also important to understand the different models that are available and how they can fit your needs.

- Gather the Data

Collect relevant financial information from external sources such as banks, credit agencies, and other public records and understand how they will impact your business.

- Input the Data into a Model

Use the data collected and import it into a spreadsheet or other software program

for analysis.

- Analyze the Results

Analyze the results to determine the best types of investments and strategies for reaching your goals.

- Visualize the Data

Utilize visuals such as charts and graphs to help understand the information

- Test and Evaluate the Outcomes

Test different scenarios within your model to make sure it is working accurately and evaluate the results accordingly.

- Update Your Forecasts Regularly

Regularly update your forecasting model with new data as it becomes available in order to ensure accuracy over time.

By following these steps and continuously refining your financial forecasting plan, you’ll equip your startup with a powerful tool to make informed decisions, manage risks, and drive sustainable growth.

Things to Consider

When conducting financial forecasting as a startup business, several crucial considerations can significantly impact the accuracy and relevance of your projections:

By considering these factors while financial forecasting, startups can develop more accurate, reliable, and adaptable financial models, empowering them to make informed decisions and navigate the challenges inherent in the early stages of business development.

In Conclusion

In essence, financial forecasting serves as a guiding light for startups, lighting the path toward sustainable growth and success. By meticulously analyzing past performance, making informed assumptions about the future, and projecting key financial metrics, startups gain a profound understanding of their business landscape. This foresight arms entrepreneurs with the insights needed to steer their ventures through uncertain terrain, make strategic decisions, secure funding, and remain agile in a rapidly evolving market.

Ultimately, financial forecasting isn’t just about numbers on a spreadsheet; it’s a dynamic tool empowering startups to navigate challenges, capitalize on opportunities, and pave the way toward a future where their innovative ideas thrive and flourish. Embracing the power of financial forecasting equips startups with the resilience and foresight necessary to transform visions into tangible, long-lasting success stories.

*This blog does not constitute solicitation or provision of legal advice and does not establish an attorney-client relationship. This blog should not be used as a substitute for obtaining legal advice from an attorney licensed or authorized to practice in your jurisdiction.*

- Last Modified

- December 21, 2023

FOR ANY QUESTIONS

- MAILING ADDRESS

Finvisor HQ 48 2nd St, 4th Floor San Francisco, CA 94105

- PHONE NUMBER

(415) 416-6682

- EMAIL ADDRESS

" * " indicates required fields

A Guide to Financial Projections for Startups

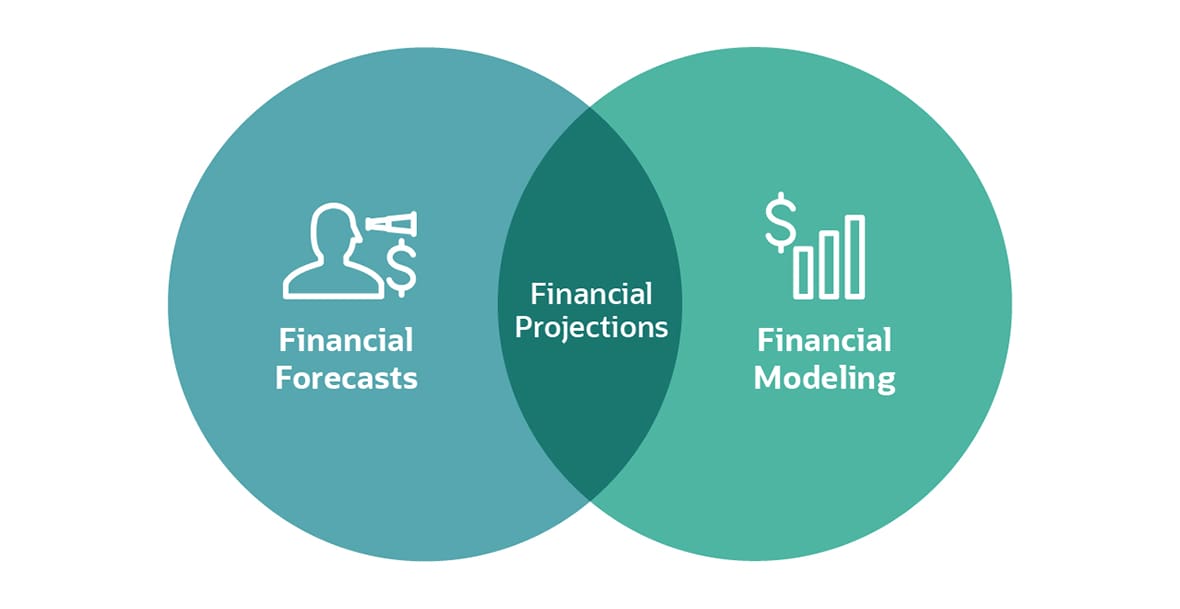

Financial projections and financial forecasting provide a view into the future financial health of your startup. The terms are sometimes used interchangeably, but there are key distinctions that make one a better tool for guiding internal decision-making and the other the best way to show investors and lenders that your business deserves their confidence.

Both disciplines use current and historical transactional data, coupled with information on market conditions and industry trends, to predict what a startup’s journey may look like and whether it’s on track to meet its intended targets.

But while financial forecasting predicts events that are likely to happen, financial projections are used to present and examine hypothetical scenarios. According to the American Institute of Certified Public Accountants Standards Section 301, forecasts present the assumptions that reflect conditions the business expects to exist and the course of action it expects to take. Financial projections, on the other hand, allow financial professionals to model hypothetical “what if” scenarios.

Market analysts and financers often want to see “what if” scenarios so they can ground their decisions in data when evaluating whether to invest in or lend to the startup.

To complete financial projections, startups can use current and historical financial statements and external market information such as reports from government agencies such as the Department of Labor or market and industry projections from consulting firms. Revenue projections give investors and lenders a sense of how much you will sell by modeling out how it impacts operating expenses, for instance, on the income statement. Cash flow projections show where you will get that money—from receivables, loans, a line of credit, etc. Profit and loss projections help investors assess the growth potential of your business , while a balance sheet projection can suggest the rate of return on an investment in your company.

Taken together, financial forecasts and financial projections provide a toolset for a startup to not only react to imminent potential scenarios but also anticipate more far-fetched ones. With clear, data-based definitions around targets, a startup will know when, for instance, its selling expenses are outpacing revenue growth, and make adjustments.

Why Do I Need a Financial Model?

To get financial projections for a startup, you must use a financial model—often an Excel-based tool that brings in data from current financial statements and market trends to project how those statements may look in the future. Financial modeling produces financial projections by taking financial forecasts and playing them out.

In order to make financial projections, you will first need to gather your financial statements, decide on the scenarios you’d like to play out and, most importantly, build a financial model to do the work. You can build these basic financial models in Excel with the help of a finance expert.

The spreadsheet-based formulas allow you to play out different assumptions and see how different variables will impact line items and ultimately business plans. Financial projections can be completed across all three financial statements: your income statement/P&L, your balance sheet and cash flow statement. With projected financial statements, you can complete scenario planning.

Financial projections provide specific targets to drive performance and help a company achieve its goals. They also give lenders and investors a sense of the company’s long-term financial prospects, increasing their confidence in the business. Above all, these projections give the startup a much better idea of the impact of external factors on its financials and the investments it needs to make to achieve its business plan.

When Do I Use Projections?

Financial projections are used internally to show the effects of internal business decisions and external market conditions. For instance, what would happen if you added a new line of hand sanitizers in the fall? How would it affect the production of other products? How would that affect revenue and profit? And what external conditions need to be considered?

Executives within the company use financial projections to make decisions about raising capital, pursuing an acquisition or divestiture, opening new stores or entering new markets. They also use them to prioritize projects, establish budgets and plan for the future. Financial projections help a startup see the big picture and zero in on moves that best align with the company’s business plan, helping define its strategy moving forward.

Outside the company’s proverbial four walls, financial statements demonstrate business performance to shareholders, investors and lenders while financial models and projections help estimate and justify performance targets. For this reason, financial projections are crucial for startups. When investors and lenders can see how certain business plans play out in terms of your startup’s future financial health, they have more information with which to make financing and investing decisions.

#1 Cloud ERP Software

What Is Included in a Financial Projection?

Financial projections can be short-term, which cover one year and each month thereafter, or mid-term, which cover three years and are broken down year by year. A financial projection generally takes into account your startup’s business model, goals and objectives, along with income tax planning, business insurance and investment vehicles.

To project financial statements—projected financial statements are also called “pro forma” financial statements—you’ll need past and current statements. These include the income statement/profit and loss statement (P&L), the balance sheet and the cash flow statement. These financial statements provide a sort of common language among companies, banks, investors, regulators and anyone who needs to understand the company’s financial performance, according to Ernst and Young.

- The P&L shows: Performance metrics such as gross revenue and net profit. A P&L statement also provides important details that can be used to calculate key metrics like EBITDA (earnings before interest, taxes, depreciation and amortization), which gives investors insight into operational performance of a company so they can compare its efficiency with that of other companies. The P&L can be used to compare time periods, budget vs. actual performance and performance against other companies. It can indicate overall weak or strong performance.

- The balance sheet shows: Tangible assets a company owns (the computers, the building, etc.) and everything it owes (its debt or liabilities) over a specific time period, as well as receivables, which aren’t technically “owned” until they have been converted into cash. The difference between the value of the assets and liabilities on the books represents shareholder equity, which can consist of stocks, retained earnings or other forms of income.

- The cash flow statement shows: All cash going in and out of a company over a specific time period. The cash flow statement includes the three types of cash flow: operating activities, investing activities and financing activities. Operating cash flow measures the amount of cash generated by normal business operations. Investing cash flow measures cash coming in or out of the business from its long-term or capital investments. Financing cash flow measures cash coming in from financing transactions such as debt, equity and dividends.

Negative or positive cash flow gives investors a better sense of your overall cash position. They are looking for indicators that point toward the sustainability, solvency and growth potential of the business. Projected profit and loss statements give them an indication of whether you’ll bring in enough money to cover anticipated expenses. The projected balance sheet estimates your future financial position, which helps them determine the worth of your startup.

Investors use actual financials to assess the current value of shares and projections to estimate the future value of those shares. This helps in determining a potential return should they decide to invest in the company.

How Do I Build a Financial Projection?

To build a financial projection, you need to have accurate, easily accessible information on your past and current finances. Start with the income statement. You’ll need a strong and reliable picture of your revenue, your cost of goods sold, how much you’re spending on R&D, the cost of operations or SG&A (selling, general and administrative expenses), operating income or operating loss and the value of current assets, such as cash, receivables, inventory, investment income, etc.

Building a financial projection is challenging. Oftentimes, the hardest part for startups is getting the numbers themselves.

According to Ernst and Young, there are two ways to get those numbers: based on the market share you want to capture (top-down) or based on the resources at hand and the current data (bottom-up). EY recommends using bottom-up forecasts in the shorter term of one to two years and top-down in the longer term of three to five years. Used together, the two offer a healthy balance between ambition and realistic chances to capture market share.

To build a financial model, you will need at least three years of historical data, and The Journal of Accountancy provides a comprehensive list of financial data and metrics to include.

Complete this process for every financial statement. Model “what if” scenarios to keep independent variables constant, while looking at the metrics that would be affected if, say, you added a new product line and needed more people to sell it, more equipment to manufacture it and more supplies with which to make it.

8 Tips for Valid Startup Financial Projections

Startups should complete financial forecasting and financial projections with a few tips in mind.

- Know your audience. Remember the difference between a financial forecast and a financial projection, with the latter being particularly useful for investors and lenders who will be looking at your company from the outside.

- Get your house in order. Getting easy access to accurate historical and current financial data with which to model is often the most challenging part. Bad data won’t produce an accurate forecast and weakens the confidence of investors and lenders. Start with a reliable source of transactional data.

- Start with spend. In general, it’s much easier to predict your expenses than your revenues . Start building your forecast model by outlining your burn rate and fixed operating expenses: things like rent, utilities and insurance.

- Don’t be too conservative (nor too aggressive). Investors like to see both aggressive and conservative scenarios. Model both optimistic and cautious scenarios in financial projections, especially if the business environment is uncertain.

- Don’t let financial projections become static. Constantly reassess your financial projections and add new assumptions for modeling your growth rate. Projections without constant care become static and irrelevant.

- Be honest. Be absolutely clear about cash flow, and make sure it’s consistent across your financial statements.

- Look outside. Researching industry trends is essential to producing credible financial projections. Constantly compare your projections with those of other businesses in your industry.

- Get help. Producing regular financial statements can be difficult for startups, which means projecting financial statements can be very challenging. A CPA or a financial leader like a CFO is critical, as is software that automates the process.

Keeping accurate and easily accessible information on the current financial health of your startup is the first step to making good business decisions. But seeing the possible impact of business plans—and allowing key stakeholders to do so too—empowers you to execute sustainable and profitable plans.

Financial Management

Financial Forecast vs. Financial Projection: Key Differences

Financial terms are easily confused and often used interchangeably. But phrases like "financial forecast" and "financial projection" that sound similar are quite…

Trending Articles

Editorial Picks

- How to Manage Payroll for a Small Business

- 12 Top Employee Experience Metrics & KPIs to Measure

- Accounting Defined

- Guide to Inbound and Outbound Logistics: Processes, Differences and How to Optimize

Educational Resources

Business Solutions Glossary of Terms

Before you go...

Discover the products that 37,000+ customers depend on to fuel their growth.

Before you go. Talk with our team or check out these resources.

Want to set up a chat later? Let us do the lifting.

NetSuite ERP

Explore what NetSuite ERP can do for you.

Business Guide

Complete Guide to Cloud ERP Implementation

This site uses cookies to store information on your computer. Some are essential to make our site work; others help us improve the user experience. By using the site, you consent to the placement of these cookies. Read our privacy policy to learn more.

- MANAGEMENT ACCOUNTING

Effective financial projections for a startup

Get a business started with meaningful financial projections..

- Management Accounting

- Business Planning

Today's business world is bursting with startups, particularly in the technology industry. One of the biggest contributors to a startup's success is a sound business plan that includes meaningful financial projections.

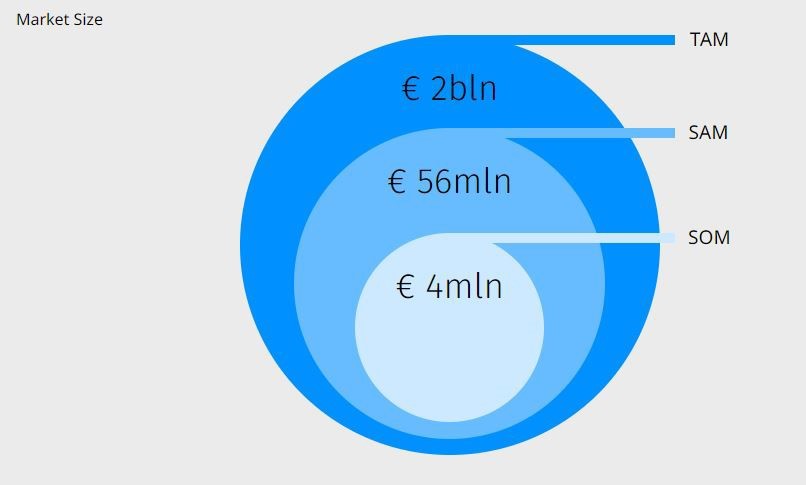

Accountants have the skills to help entrepreneurs build logical financial assumptions to increase the probability of attracting investments. Refining these projections can also help startups develop a growth strategy by keeping information simple and hitting on the key metrics, such as market size.

This list of practical considerations for startups and the accountants who support them is by no means exhaustive, and for many readers the concepts may be familiar. It's meant to serve as a handy guide to key conversations that can keep a startup on the right track.

An Excel workbook providing a more detailed look at the three-year projections in this example is available here .

Revenue will influence the rest of the profit and loss (P&L) assumptions. So if revenue estimates are materially misstated, the company risks overstaffing or understaffing and/or purchasing assets incorrectly. Revenue is also a key metric for potential investors. Estimates do not need to be precise, but they do need to be realistic and supported by a viable story.

Step 1: Collect critical inputs

Four crucial inputs are used to calculate revenue for a new business: revenue levers, revenue drivers, activity assumptions, and pricing.

Revenue levers: Revenue levers are the various opportunities to earn revenue. Levers can include products and/or services, software maintenance agreements, channel partner sales, etc. Start with a list of all the revenue levers that will produce income over the period of the financial projections.

Revenue drivers: Revenue drivers are the activities that influence how revenue levers produce income. Each revenue lever could potentially have a different driver. Think about what activity will increase or decrease revenue for each lever.

Revenue driver activity assumptions: Activity assumptions are the inputs that will indicate how the revenue driver will act. To determine assumptions, work with marketing, sales, or the CEO, depending on the company organization.

Pricing: Pricing is a necessary input to calculate total revenue. This article does not go into detail on pricing methodology. If prices have not yet been determined, read pricing guides and/or articles to ensure effective pricing methods are being implemented.

Step 2: Convert inputs into the revenue estimate

Now that the revenue inputs have been determined, it's as straightforward as inputting the data into a model that calculates total revenue. In its simplest form, the calculation is revenue driver assumption multiplied by price for each revenue lever . If the driver is marketing spend, there will be an additional step to convert dollars spent to revenue earned.

Create revenue calculations for three to five years by year, quarter, or month. A monthly calculation is helpful if your revenue driver is new clients, as clients will be attained throughout the year and will not provide a full year's revenue in year 1. The monthly or quarterly detail should be summarized by year to report the total annual impact.

Be sure to include an estimate for churn. Revenue can be easily overstated or understated without a reasonable estimate on the business that will be lost over the period of the pro forma.

Step 3: Review the final revenue outcome