Talk to our experts

1800-120-456-456

- National Income

National Income – Defining a Country’s Richness

To simply understand what National Income is, it can be represented as - National Income defines a country's wealth. This income depicts the value of goods and services which are produced by an economy. This gives effect to the net result of all the economic activities performed in the country.

Imagine how you would define a country’s wealth without any economic term? In that case, there would be no accountability and responsibility linked with the production in the country. The resources would go uncalculated and there would be a vague economic atmosphere. Thus, let us indulge in this study which talks about National Income.

Understanding National Income

(Image will be uploaded soon)

National income is the sum total of the value of all the goods and services manufactured by the residents of the country, in a year., within its domestic boundaries or outside. It is the net amount of income of the citizens by production in a year.

To be more precise, national income is the accumulated money value of all final goods and services produced in a country during one financial year. Computation of National Income is very vital as it indicates the overall health of our economy for that particular year.

The aggregate economic performance of a nation is calculated with the help of National income data. The basic purpose of national income is to throw light on aggregate output and income and provide a basis for the government to formulate its policy, programs, to maximize the national welfare of the people. Central Statistical Organization calculates the national income in India.

Definition of National Income

The definition of National Income if of two types-

Traditional Definition of National Income

Modern Definition

Traditional Definition of National Income-

According to Marshall: “The labor and capital of a country acting on its natural resources produce annually a certain net aggregate of commodities, material and immaterial including services of all kinds. This is the true net annual income or revenue of the country or national dividend.”

Modern Definition

This definition has two subparts

Gross Domestic Product

Gross Domestic Product, abbreviated as GDP, is the aggregate value of goods and services produced in a country. GDP is calculated over regular time intervals, such as a quarter or a year. GDP as an economic indicator is used worldwide to measure the growth of countries economy.

Goods are valued at their market prices, so:

All goods measured in the same units (e.g., dollars in the U.S.)

Things without exact market value are excluded.

Constituents of GDP

Wages and salaries

Undistributed profits

Mixed-income

Direct taxes

Depreciation

The Formula for Calculation of GDP

GDP = consumption + investment + government spending + exports - imports.

Gross National Product

Gross National Product (GNP) is an estimated value of all goods and services produced by a country’s residents and businesses. GNP does not include the services used to produce manufactured goods because its value is included in the price of the finished product. It also includes net income arising in a country from abroad.

Components of GNP

Consumer goods and services

Gross private domestic income

Goods produced or services rendered

Income arising from abroad.

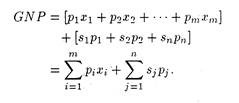

Formula to Calculate GNP

GNP = GDP + NR (Net income from assets abroad or Net Income Receipts) - NP (Net payment outflow to foreign assets).

Importance of National Income

Setting economic policy.

National Income indicates the status of the economy and can give a clear picture of the country’s economic growth . National Income statistics can help economists in formulating economic policies for economic development.

Inflation and Deflationary Gaps

For timely anti-inflationary and deflationary policies, we need aggregate data of national income. If expenditure increases from the total output, it shows inflammatory gaps and vice versa.

Budget Preparation

The budget of the country is highly dependent on the net national income and its concepts. The Government formulates the yearly budget with the help of national income statistics in order to avoid any cynical policies.

Standard of Living

National income data assists the government in comparing the standard of living amongst countries and people living in the same country at different times.

Defense and Development

National income estimates help us to bifurcate the national product between defense and development purposes of the country. From such figures, we can easily know, how much can be set aside for the defense budget.

Sets of methods for measuring National Income

There are four methods of measuring national income. The type of method to be used depends on the availability of data in a country and the purpose which is attempted for.

Income Method

In this method, we add net income payments received by all citizens of a country in a particular year. Net incomes that result in all the factors of production like net rents, wages, interest, and profits are all added together, but income received in the form of transfer payments are omitted.

Product Method

According to this method, the aggregate value of final goods and services produced in a country during a financial year is computed at market prices. To find out GNP, the data of all the productive activities-agricultural products, Minerals, Industrial products, the contributions to production made by transport, insurance, communication, lawyers, doctors, teachers. Etc are accumulated and assessed.

Expenditure Method

The total expenditure by the society in a financial year is summed up together and includes personal consumption expenditure, net domestic investment, government expenditure on goods and services, and net foreign investment. This concept is backed by the assumption that national income is equal to national expenditure.

Value Added Method

The distinction between the value of material outputs and material inputs at every stage of production is Value added.

The Gross Domestic Product and the Gross National Product are the two most widely used measures in a country’s calculation of aggregate economic unit.

GDP is the measure of the value of goods and services that are being produced within a country's borders, by the citizens and the non-citizens. While GNP determines the value of goods and services that are being produced by the country's citizens in the domestic and abroad spectrum. GDP is popularly used by the global economies at large. While, the United States eliminated the use of GNP in the year 1991, thereby adopting GDP as the measure to compare their economy with other economies.

India’s Richness: National Income of India 2020-2021

In the year 2020-2021, India had a total NI of 135.13 lakh crore, well this is a provisional estimate only. However, in the round of the fourth quarter (in the month of January-March), the country had an economic growth of 1.6%, while the GDP was calculated at Rs. 38.96 lakh crore in the fourth quarter in the year 2020-21, this is count is slightly different to Rs 38.33 lakh crore in the fourth quarter of 2019-20.

FAQs on National Income

1. Name the four top countries with the highest GDP?

The top four countries with the highest GDP are:

The United States with $19.485 trillion

China with $12.238 trillion

Japan with $4.872 trillion

Germany with $3.693 trillion

2. Who manages all the monetary policies of India?

The RBI, Reserve Bank of India manages the monetary policy of India. For further information check out the Vedantu app or website.

3. How are GDP and GNP different from each other?

GDP is the value of goods and services produced within a country's borders, by citizens and non-citizens in a financial year. GNP measures the value of goods and services produced by only a country's citizens but both within and outside the country’s borders.

- Our Selections

- About NEXT IAS

- Director’s Desk

- Advisory Panel

- Faculty Panel

- General Studies Courses

- Optional Courses

- Current Affairs Program (CA-VA)

- Mentorship Program (AIM)

- Interview Guidance Program

- Postal Courses

- Prelims Test Series

- Mains Test Series (GS & Optional)

- ANUBHAV (All India Open Mock Test)

- Daily Current Affairs

- Current Affairs MCQ

- Monthly Current Affairs Magazine

- Previous Year Papers

- Down to Earth

- Kurukshetra

- Union Budget

- Economic Survey

- Download NCERTs

- NIOS Study Material

- Beyond Classroom

- Toppers’ Copies

- Student Portal

TABLE OF CONTENTS

National income: meaning, measures, accounting methods & more.

National Income (NI) is a fundamental concept in economics, acting as a key metric for gauging a country’s economic performance. As an important economic metric of a nation, it influences policy decisions, investment considerations, and socio-economic planning. This article of NEXT IAS aims to study in detail the concept of National Income (NI), its measures including Gross Domestic Product (GDP) and Gross National Product (GNP), methods employed to compute it, and other related concepts.

What is National Income (NI)?

It refers to the aggregate value of all the final goods and services produced in a country in a particular period of time (usually one financial year).

What is National Income Accounting?

It is a bookkeeping system that a national government uses to measure the level of the country’s economic activity in a given time period.

Basic Concepts Related to National Income Accounting

Understanding the concepts of National Income (NI) and National Income Accounting requires understanding some related concepts. These concepts are dealt with in the sections that follow.

Circular Flow of Income

The circular flow of income is a model of the economy in which major exchanges are represented as flows of money, goods, services, etc. among the economic agents. As per this model, money and goods & services flow in the opposite direction but move in a closed circuit.

Production, consumption, and investment are important economic activities of an economy. In carrying out these economic activities, people make transactions between different sectors of the economy. Because of these transactions, income and expenditure move in a circular form. This is called the circular flow of income.

Domestic/ Economic Territory

It refers to the geographical territory administered by the Government of India within which the person, goods, and capital can circulate freely.

Note: Foreign embassies located in India are NOT a part of domestic/economic territory. However, Indian embassies located abroad are a part of domestic/economic territory.

Market Price (MP)

- Market Price (MP) refers to the price that a consumer pays for the product while purchasing it from the seller.

- In other words, it is the price at which a product is sold in the market.

- Market Price (MP) includes indirect taxes (as they are added to the selling price) and excludes subsidies received (as they are deducted from the selling price).

Factor Cost (FC)

- Factor Cost (FC) refers to the cost of factors of production that are incurred by a firm when producing goods and services.

- In other words, it is the cost of producing a good or service.

- Factor Cost (FC) excludes indirect taxes (since they are not related to the production process) but includes subsidies received (as these are direct inputs into the production).

Factor Cost (FC) = Market Price – Indirect Taxes + Subsidy

Nominal Price or Current Price

The market price of any good or service in the current year is called the Nominal Price or Current Price. Since inflation is included in the current market price, the Nominal Price or Current Price changes as per the current level of inflation.

Base Price or Constant Price

In order to compare the National Income of various years, it is calculated with reference to a particular year. This reference year is called the Base Year, and the market price of any good or service in the base year is called the Base Price or Constant Price.

Depreciation

Depreciation, also known as the Consumption of Fixed Capital, refers to the loss in value of fixed assets due to wear and tear, accidental damages, and obsolescence.

Net Factor Income from Abroad (NFIA)

Net Factor Income from Abroad (NFIA) is equal to the difference between factor income (rent, wages, interest, and profit) earned by normal residents of India temporarily residing abroad and factor income earned by non-residents temporarily residing in India.

NFIA = Factor Income from Abroad to India – Factor Income from India to Abroad

Transfer Payments

- Transfer Payments refer to those unilateral payments corresponding to which there is no exchange of goods or services.

- Examples: scholarships, gifts, donations, etc.

- Transfer payments are not included in National Income (NI).

Capital Output Ratio (COR)

Capital Output Ratio (COR) refers to the amount of capital (investment) needed to produce one unit of output.

Capital Output Ratio (COR) = Capital/Output

Capital Output Ratio (COR) reflects the level of efficiency in an economy. The higher the COR, the more capital is required to produce, and hence less efficiency is there in the economy, and vice versa.

Incremental Capital Output Ratio (ICOR)

Incremental Capital Output Ratio (ICOR) refers to the additional unit of capital (investment) needed to produce an additional unit of output.

Incremental Capital Output Ratio (ICOR) = Incremental Capital/Incremental Output.

Measures of National Income (NI)

There are various metrics for measuring the NI, such as:

Gross Domestic Product (GDP)

- Gross National Product (GNP), etc

These measures are discussed in detail in the sections that follow.

Gross Domestic Product (GDP) measures the aggregate production of final goods and services taking place within the domestic economy during a year.

Two key phrases here are:

- Final Goods and Services: It means that only the final, and not the intermediate, goods and services are taken into account for the calculation of GDP.

- Within the Domestic Economy: It means that the produce of resident citizens as well as foreign nationals who reside within that geographical boundary is considered.

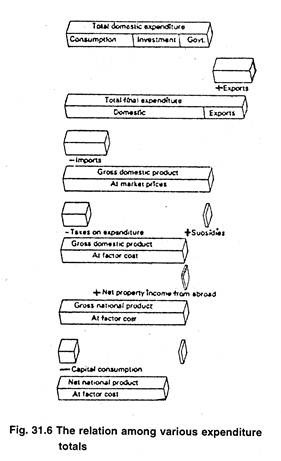

GDP at Market Price (GDPMP)

GDP at Market Price (GDPMP) is the market value of all final goods and services produced within a domestic territory of a country during one financial year.

GDP at Market Price (GDPMP) includes indirect taxes but excludes subsidies.

GDP at Factor Cost (GDPFC)

GDP at Factor Cost (GDPFC) refers to the aggregate value of income earned from the factors of production i.e. Land, Labor, Capital, and Entrepreneurship. GDP at Factor Cost (GDPFC) excludes indirect taxes but includes subsidies.

GDP at Factor Cost (GDPFC) = GDP at Market Price (GDPMP) – Indirect Taxes + Subsidies

Gross National Product (GNP)

Gross national product (GNP) is an estimate of the total value of all the final products and services produced in a given period by the production owned by a country’s citizens.

- Final Goods and Services : It means that only the final, and not the intermediate, goods and services are taken into account for the calculation of GNP.

- Owned by a Country’s Citizens : It means that the produce of resident as well as non-resident citizens of the country is considered, whereas that of the foreign nationals who reside within that geographical boundary of the country is NOT considered.

Thus, GNP = GDP + Factor Income from Abroad to India – Factor Income from India to Abroad.

= GDP + Net Factor Income from Abroad (NFIA)

Difference between GDP and GNP

The major difference between GDP and GNP lies in how the two concepts define the economy. While GDP defines the economy in terms of territory, GNP defines it in terms of citizens. Thus, GDP measures the aggregate production of final goods and services taking place within the domestic economy. On the other hand, GNP measures the total value of all the final products and services produced by the citizens of a country.

Real GDP Vs Nominal GDP

Real GDP refers to the total value of all goods and services produced by an economy in a given year, expressed in constant prices or base year’s prices.

Thus, Real GDP = GDP at Constant Price.

Nominal GDP

Nominal GDP refers to the total value of all goods and services produced by an economy in a given year, expressed in current market prices.

Thus, Nominal GDP = GDP at Current Price.

It is to be noted that Nominal GDP includes inflation, while Real GDP does not.

GDP Deflator

The GDP Deflator refers to the ratio of Nominal GDP to Real GDP.

Thus, GDP Deflator = Nominal GDP/Real GDP

As a ratio of the NI calculated at the Current Price and that at a reference price, the GDP Deflator is an economic measure of inflation.

Gross Value Added (GVA)

Gross value added (GVA) is defined as the value of output less the value of intermediate consumption. It represents the contribution of labor and capital to the production process. Thus, the value of GVA can be derived from the GDP as follows:

GVA = GDP – Indirect Taxes + Subsidies

Difference between GVA and GDP

Net national income (nni).

Net National Income (NNI) refers to Gross National Income minus the Depreciation of fixed capital assets. Thus, it takes into account the losses due to depreciation.

Prominent metrics for measuring the Net National Income (NNI) are:

- Net Domestic Product (NDP), and

Net National Product (NNP)

Net domestic product (ndp).

Net Domestic Product (NDP) is arrived at by deducting the depreciation from GDP. Thus,

Net Domestic Product = GDP – Depreciation.

Net National Product (NNP) is calculated by subtracting the depreciation from GNP. Thus,

Net National Product = GNP – Depreciation.

Methods of Computing National Income (NI)

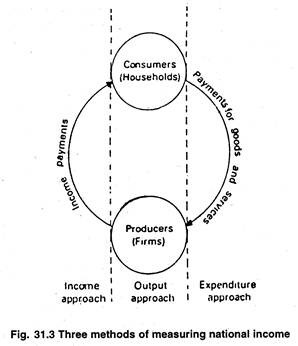

National Income (GDP or GNP) can be calculated by 3 methods: Income Method, Expenditure Method, and Production Method.

Income Method

Under this method, NI is obtained by summing up the incomes of all individuals in an economy. Individuals earn incomes by contributing their own services and the services of their property such as land and capital to the national production. Thus,

National Income (NI) = Employee compensation + Corporate profits + Proprietors’ Income + Rental income + Net Interest

Product or Value Added Method

This is also called “Output Method”.

Under this method, NI is computed by adding the values of output produced or services rendered by the different sectors of the economy during the year. It is to be noted that while computing the values of output figures, only the value added by each firm in the production process is taken into account. Thus, this method makes use of the concept of Value-added.

Expenditure Method

It is also called ‘Total Outlay Method’. This method assumes that the income earned by an individual is either spent on consumer goods/services or saved and invested. Thus,

National Income (NI) = Personal Consumption Expenditure (C) + Investments (I) + Government Expenditure (G) + Exports (X) – Imports (I)

New GDP Series

The Ministry of Statistics and Programme Implementation (MoSPI) launched a new series of GDP in 2019.

Major changes that have been made to the methodology of GDP calculation are as follows:

- Change in Base Year : The base year has been changed from 2004-05 to 2011-12.

- Factor Costs Replaced with Market Prices: The old series of GDP used Factor Costs for calculating GDP. The new series used market prices for calculating GDP.

- While the earlier data gave only a factory-level picture, the new data looks at the enterprise level.

These changes have led to a significant change in the GDP figures. For example, India’s GDP growth rate for the financial year 2013-14 was 4.7% as per the old methodology, and 6.9% as per the new methodology.

Difficulties in Estimating NI

Major problems faced while estimating NI can be studied under two heads – Conceptual Difficulties and Statistical or Practical Difficulties.

Conceptual Difficulties

The conceptual problem relates to how and what is to be included and what is not in the measurement of National Income (NI). Though the concept of NI implies that everything that is produced should be reckoned, by definition, we consider only those things that are exchanged for money or carry some price.

In order to mitigate these difficulties, certain guidelines have been laid down about the process of National Income estimation, and about what components have to be included.

Statistical or Practical Difficulties

- The lack of adequate statistical data due to flaws in extrapolation, and ineffective training of illiterate statistical staff, makes the task of National Income estimation more acute and difficult.

- Multiple counting is also an important problem while calculating NI.

- India is a country with large regional diversities. Thus, different languages, customs, etc., also create a problem in computing the estimates.

Shortcomings of GDP

GDP, as an indicator of economic growth, faces some shortcomings as explained below:

- It fails to measure the inequality status of a nation. Thus, it does not describe whether or not the people are truly benefitting from economic growth.

- It does not take into account non-market transactions, such as volunteer work.

- Black markets and illegal activities create distortions in values and hence the figures of GDP.

- A large part of many undeveloped economies relies on barter trade (trade through swapping goods) rather than the employment of debt instruments and banknotes. GDP figures underestimate economic activities in such cases.

- GDP does not take into account the loss to the environment and hence undermines the concept of sustainable economic growth.

- When an earthquake hits and requires rebuilding, GDP increases. Similarly, when someone gets sick and money is spent on their care, it’s counted as part of GDP. But, we’re not better off because of a destructive earthquake or people getting sick.

- For example, GDP makes no adjustment for leisure time.

Alternatives to GDP

Due to shortcomings of GDP to measure the welfare and well-being of the people, several other indicators have been proposed and are being used. Some of these indices are discussed below.

Genuine Progress Indicator (GPI)

- Genuine Progress Indicator (GPI) is a metric that has been suggested to replace, or supplement GDP as a measure of economic growth.

- It measures whether the environmental impact and social costs of economic production and consumption in a country are negative or positive factors in overall health and well-being.

Gross National Happiness (GNH)

- Gross National Happiness (GNH) attempts to measure the sum total not only of economic output but also of net environmental impacts, the spiritual and cultural growth of citizens, mental and physical health, and the strength of the corporate and political systems.

- The term was first coined by Jigme Singye Wangchuck, the King of Bhutan in the early 1970s.

Gross Sustainable Development Product (GSDP)

- Gross Sustainable Development Product (GSDP) measures the economic impacts of environmental and health degradation or improvement; resource depletion, depreciation; the impact of people’s activity on the environment; quality of environment, etc.

- It has been developed by the Global Community Assessment Centre and the Society for World Sustainable Development.

Human Development Index (HDI)

- Health : Measured through – Life expectancy at birth

- Education : Measured through – Mean years of schooling, and Expected years of schooling

- Standard of Living: Measured through – Gross National Income per capita on a PPP basis.

- It was developed by Indian Economist Amartya Sen and Pakistani economist Mahbub ul Haq.

- It is published annually by the United Nations Development Programme ( UNDP ) as part of its Human Development Report.

Social Progress Index (SPI)

- The Social Progress Index (SPI) measures the extent to which countries provide for the social and environmental needs of their citizens.

- It focuses exclusively on indicators of social outcomes, rather than measuring inputs.

- It has been developed by the Social Progress Imperative.

Human Capital Index (HCI)

- The Human Capital Index seeks to measure the amount of human capital that a child can expect to attain by the age of 18.

- Survival : Measured by under-5 mortality rates.

- Quality : Measured by harmonizing test scores from major international student achievement testing programs

- Quantity : Measured by the number of years of school that a child can expect to obtain by age 18 given the prevailing pattern of enrollment rates across grades in respective countries.

- Health : Measured using two indicators – adult survival rates, and rate of stunting for children under age 5 years.

Green GDP is a term used generally for expressing GDP after adjusting for environmental damages such as biodiversity loss, climate change impacts, etc. Thus, it is an indicator of economic growth with environmental factors taken into consideration.

In conclusion, much more than just a numerical figure, National Income (NI) is a comprehensive reflection of a country’s economic vitality. Though the current measures of NI have some shortcomings, they play a crucial role in guiding governments, businesses, and individuals in making informed economic decisions. As we strive for a more holistic understanding of progress, research & development should be carried out to develop more comprehensive measures of National Income (NI) that encompass social well-being and environmental sustainability.

FAQs on National Income

How to calculate national income.

It is calculated by summing up the values of all the final goods and services produced in an economy during a financial year.

Who calculates India’s National Income?

The National Statistical Office (NSO), under the Ministry of Statistics and Program Implementation (MoSPI), calculates the NI in India.

Latest Article

Nuclear Power Plants in India

Socio-Religious Reform Movements in India

Judicial System in British India

मृदा संरक्षण: अर्थ, तकनीक, अभ्यास और अधिक

Nuclear Doctrine of India

भारत में वन: समस्याएँ और संरक्षण

Explore Categories

- Art and Culture

- Disaster Management

- Environment and Ecology

- Important Days

- Indian Economy

- Indian Polity

- Indian Society

- Internal Security

- International Relations

- Science and Technology

Subscribe to our Newsletter!

National Income: Components, Importance, Methods, Limitation

- Post author: Anuj Kumar

- Post published: 26 September 2021

- Post category: Commerce / Economics

- Post comments: 0 Comments

Table of Contents

- 1 What is National Income?

- 2.1 Gross Domestic Product GDP

- 2.2 Gross National Product GNP

- 2.3 Net National Product NNP

- 2.4 Net National Product at Factor Cost NNPfc

- 2.5 Net Domestic Product At Market Prices NDPMP

- 2.6 Income From Domestic Product Accruing To Private Sector

- 2.7 Private Income

- 2.8 Personal Income

- 2.9 Personal Disposable Income

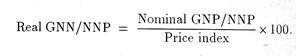

- 3.1 Comparison of Real and Nominal Income

- 3.2 Indication of Prosperity

- 3.3 Regional Comparison

- 3.4 Reflect Sectoral Contribution

- 3.5 Guide to Economic Planning and Policy Formulation

- 3.6 Inflationary and Deflationary Gaps

- 3.7 Basis of Economic Welfare

- 3.8 Basis of Economic Policy

- 3.9 Basis of Economic Structure

- 3.10 Basis of Distribution of National Income

- 3.11 Basis of Budgetary Policies

- 3.12 National Expenditur

- 3.13 International Sphere

- 3.14 Distribution of Grants and Aids

- 3.15 Facilitates Business Forecasting

- 3.16 Indicator of Economic Progress

- 4.1 Census of Product Method

- 4.2 Census of Income Method

- 4.3 Census of Expenditure Method

- 4.4 Value Added Method

- 5.1 Does Not Include the Rate of Growth of Population

- 5.2 Does Not Reflect the Distribution of GDP

- 5.3 Does Not Include Non Economic or Non Monetary Exchanges

- 5.4 Does Not Include Externalities

- 5.5 Does not consider a change in prices

- 5.6 Composition of GDP

- 5.7 Contribution of Some Products in GDP may be Negative

- 6.1 Lack of Proper Accounts and Information

- 6.2 Rapid Increase in Population

- 6.3 Double Counting

- 6.4 Low Productivity of Agriculture

- 6.5 Non Availability of Goods and Services for Exchange

- 6.6 Problems of Non-Monetary Economy

- 6.7 Poor Industrial Development

- 6.8 Defective Classification

- 6.9 Problems of New Products and Services

- 6.10 Problems of Constituents of National Income

- 6.11 Regional Imbalances

- 6.12 Problem of Collection of Correct Data

- 6.13 Difficult to Know the Value of Services

- 7.1 Development of Industrial Sector

- 7.2 Practical Training for Effective Administration

- 7.3 Proper Utilisation of Resources

- 7.4 Development of Science and Technology

- 7.5 Double Counting

- 7.6 Development of Credit Facilities

- 7.7 Vocational Guidance

- 7.8 Technical Training and Public Health Facilities

- 7.9 Equal Distribution of Wealth

- 8.1 What is the national income and how it is calculated?

- 8.2 What is Importance of National Income?

- 8.3 What are the limitations of national income?

What is National Income?

A national income estimate measures the volume of commodities and services turned out during a given period counted without duplication. In other words, Is defined as the total market value of all the final goods and services produced in an economy in a given period of time.

Thus it measures the monetary value of the flow of output of final goods and services produced in an economy over a period of time.

Components of National Income

These are the component of national income discussed below:

Gross Domestic Product GDP

Gross national product gnp, net national product nnp, net national product at factor cost nnpfc, net domestic product at market prices ndpmp, income from domestic product accruing to private sector, private income, personal income, personal disposable income.

Gross domestic product relates to the product of the factors of production employed within the political boundaries i.e., within domestic territory. It is defined as a measure of the total flow of goods and services produced by an economy over a specified time period, usually a year.

All value of intermediate products is excluded. So only the market value of final products is included to define GDP.

Gross National Product has been defined as the total market value of all final goods and services produced in a year. It is the money value of all the final goods and services that the labour and capital of a country working on its natural resources have produced in a year.

It includes not only the part of the production which is brought to the market for sale but also that part of the product that is kept for self-consumption.

Formula: GNP= GDP + Net income from abroad(X-M) , where X= Export, M= Import

If the value of (X-M) is negative then, GDP > GNP

Net National Product (NNP) refers to the value of the net output of the economy during the year. It is obtained by deducting the value of depreciation or replacement allowance of the capital assets from the GNP. IN other words, The amount which comes after subtracting the depreciation or consumption of fixed capital from the gross domestic product is known as NDP.

F ormula: NNP = GNP – D

where D = depreciation allowances

This value is measured at current prices, while GNP is expressed at the current market price. Net National Product, in fact, is the value of total consumption plus the value of net investment of the community.

It is the sum total of net values added by each producer in the productive process of an economy during one year period.

Net national product at factor cost is the net output evaluated at factor prices. It includes income earned by factors of production through participation in the production process such as wages and salaries, rents profits, etc. NNP at factor cost is also called National Income .

Formula: NNPmp = NNPfc – S + (IT+ GS) or, NNPmp or,

NNPmp = NNPfc – subsidies + (indirect tax+ surpluses from government enterprises)

NNPfc = NNPmp + S – (IT+ GS) or,

NNPfc = NNPmp + subsidies – (indirect tax+ surpluses from government enterprises)

Normally, NNP at market prices is higher than NNP at factor cost because indirect taxes exceed government subsidies. However, NNP at market prices can be less than NNP at factor cost when government subsidies exceed indirect taxes.

When net domestic product value is measured on the basis of the current prices in the market then it is known as a net domestic product at market prices. (NDPMP=NNPMP-NFIA).

In other words, NDPmp refers to the market value of final goods and services produced by all the production units in the domestic territory of a country during a given time period. It excludes depreciation and includes indirect taxes. It is equal to the net value added at market price.

In India, the creation of domestic income is being made by both the sectors i.e. public sector and the private sector. Income from domestic products accruing to the private sector refers to that part of the domestic product at factor cost which is accrued by the private sector. It may be calculated by applying the following formula:- income from domestic product accruing to private sector=NDFC- govt income – non-departmental and enterprises savings.

Private income is income obtained by private individuals from any source, produce or otherwise, and retained income of corporations. It can be obtained from NNP at factor cost by making certain additions and deductions.

In other words, It refers to the income earned by individuals from whatever sources it also includes the retained income of companies

Formula : Private Income = National income (NNP at factor cost) +Transfer Payments + Interest on

Public Debt – Social Security – Profits and Surpluses of Public Undertakings.

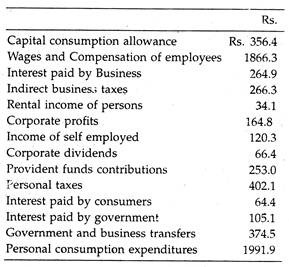

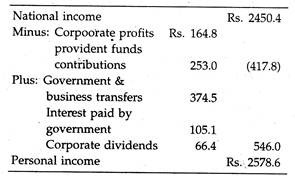

Personal income is the total income received by the individuals of a country from all sources before direct taxes in one year. Personal income is never equal to the national income because the former includes the transfer payments whereas they are not included in national income.

Personal income is derived from national income by deducting undistributed corporate profits, profit taxes, and employee’s contributions to social security schemes. Personal income differs from private income actually it is less than private income because it excludes undistributed corporate profits.

Formula : Personal Income = National Income – Undistributed Corporate Profits – Profit Taxes – Social

Security Contributions + Transfer Payments + Interest on Public Debt.

It refers to that part of the personal income which is actually available to the consumers for consumption purposes or saving.

Though the concepts of national income are very clear in India there is difficulty is measuring it because there is a considerable non monetized section. The central statistical organization (CSO) who estimates the national income has gradually fined the method of estimation and has made estimates more accurate.

Formula: Disposable Income = National Income – Business Savings – Indirect taxes plus Subsidies –

Direct Taxes on persons – Direct Taxes on Business – Social Security

Importance of National Income

The followings are the importance of national income :

Comparison of Real and Nominal Income

Indication of prosperity, regional comparison, reflect sectoral contribution, guide to economic planning and policy formulation, inflationary and deflationary gaps, basis of economic welfare, basis of economic policy, basis of economic structure, basis of distribution of national income, basis of budgetary policies, national expenditur, international sphere, distribution of grants and aids, facilitates business forecasting, indicator of economic progress.

If the national income data for a number of years is available in the form of income and physical product, a comparison between real and nominal or money income can easily be made. This type of comparison will exhibit the trends of economic growth in a decade, a few decades or a century.

The national income data is an index of national progress and economic growth. Per capita income can indicate the rise or fall in the standard of living of the people.

National income data and other statistics help us to find out the contribution of a particular region in our total national product. the comparison between different regions will reflect the level of economic development and disparities between various regions.

The economy is generally divided into different sectors and sub-sectors. Through national income statistics, we can obtain a clear picture of the sectoral contribution to gross national product. This will determine the relative importance of each sector in the economy.

We know very well that the government plays an important role in the economy in modern times. Planning has come to stay as an important tool for economic growth. National income data shows its distribution between various sections of the society.

Free education, medical aid and social security schemes go a long way to reducing income and inequalities. National income statistics are helpful in formulating necessary plans to develop backward areas and sectors.

National income statistics enable us to have an idea of inflationary or deflationary forces in an economy. In fact, inflationary and deflationary gaps are the result of inconsistencies of certain sub totals related to national product and aggregate expenditure. The excess expenditure over the value of available output at the base level of prices will result in an inflationary gap.

National income analysis reflects the well being of the inhabitants of the country. They enable us to compare the standard of living of the people in different countries or the people living in the same country at different times. We can measure the increase or decrease in the standard of living of the people with the help of national income.

In the era of planning, national income statistics are regarded as a comprehensive tool of economic policy. They throw light on the data pertaining to the country’s gross income, output, saving, consumption etc. Without these estimates, planning is almost impossible.

National income statistics enable us to have a detailed knowledge of the economic structure of the country. By this, we can know the contribution made to national income by different sectors like mining, agriculture, industry, trade etc.

By national income, we can get data pertaining to wages, profits and interest which enables us to learn about the disparities in income among the different sections of the society.

National income statistics enable the government to prepare its budgetary policies. The taxation and borrowing policies can be framed to neutralize the fluctuations in the level of employment.

By national income, different departments can get the information on how to divide and use the national expenditure between consumption expenditure and investment expenditure.

National income statistics play a pioneering role in fixing the burden of international payments among different countries and to determine quotas of different countries to international organizations like IMF, IBRD, and UNO.

In the federal setup, national income estimates enable the central government to distribute the quantum of grants in aid among the state government and other constituent units.

On the basis of national income, producers can do changes in production and marketing mechanisms. Forecasting of long term trends of business activities is also made.

National income provides information about economic progress, and whether the nation is progressing well on the path of development or not.

Methods of Measuring National Income

According to this method, the incomes accruing to all the factors of production during the process of production are aggregated together to arrive at the national income of the country. This is known as national income at factor cost.

As is well known the various factors of production are paid remuneration for the services rendered by them in production. These payments are known as factor payments. They represent the cost of the producers

thus according to this method, the national product is obtained by adding up the factor incomes accruing to the concerned factors during the process of production.

Following are methods of measuring national income :

Census of Product Method

Census of income method, census of expenditure method, value added method.

According to this method, the aggregate production of the final goods and services in an economy in any one year is equivalent in terms of money. The entire output of final goods and services is multiplied by their respective market prices to find out the gross national product.

From the gross national product so estimated, we have to deduct the depreciation of equipment and machinery involved in the process of production to arrive at the country’s national income. This method is sometimes referred to as the inventory method.

As is well known the various factors of production are paid remuneration for the services rendered by them in production.

These payments are known as factor payments. They represent the cost of the producers; thus according to this method, the national product is obtained by adding up the factor incomes accruing to the concerned factors during the process of production.

According to this method, the national product is obtained by adding up :

- Personal Consumption Expenditure

- Gross domestic Private Investment

- Govts Purchase of goods and services

- Net foreign investment

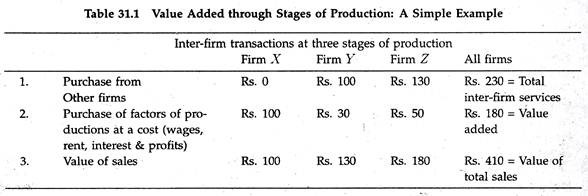

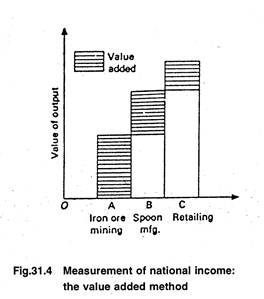

The difference between the value of national outputs and inputs at each stage of production is the value-added.

In other words, the Product or value-added method is a way of computing the national income of a country. This system is also known as the output or inventory method. This method calculates national income by adding value to a product at every stage of its production.

Limitations of National Income Accounting

Following are the limitations of national income accounting :

Does Not Include the Rate of Growth of Population

Does not reflect the distribution of gdp, does not include non economic or non monetary exchanges, does not include externalities, does not consider a change in prices, composition of gdp, contribution of some products in gdp may be negative.

Real GDP indicates the overall performance of the country. But Real GDP does not consider the changes in the population of a country. The prosperity of the country is better judged by the per capita real GDP. The per capita real GDP equals total real GDP divided by population.

An increase in per capita real GDP indicates an increase in the per capita availability of goods and services. If the rate of growth of the population is higher than the rate of growth of real GDP, then it will decrease the per capita availability of goods and services, which will adversely affect the economic welfare .

There is inequality in the distribution of income in the economy. GDP does not take into account changes in inequalities in the distribution of income. If with an increase in per capita real income or GDP, the inequality in the distribution of income/ GDP increases i.e. rich becoming richer and poor becoming poorer, then it may lead to a decline in welfare (because the utility of a rupee of income to the poor is more than to the rich).

In such a situation, if welfare rises, it may rise in less proportion as compared to the rise in per capita GDP.

There are many goods and services which contribute to economic welfare but are not included in the GDP. For example services of housewives and other family members (leisure time activities) etc.

These are non-monetary exchanges i.e. those exchanges and activities which are left out from the estimation of GDP or national income on account of non-availability of data and problems of valuation. Since these activities do not command a price i.e. no price is attached to them, although they contribute to economic welfare.

Externalities refer to benefits or harms accompanying the production process for which no payment is made or received. They are excluded from the estimation of GDP. There are two types of externalities:

- Positive Externalities: These are the benefits that accompany the production process but for which no payment is received. They are not included in GDP although they result in an increase in welfare. For example, the construction of flyovers or highways reduces transport costs and journey time of its users who have not contributed anything towards its cost. Expenditure on construction is included in GDP but not the positive effects flowing from it hence underestimating the welfare indicated by GDP.

- Negative Externalities: These are the negative effects which accompany the production process and decrease the welfare of the people for which they are not penalized. For example environmental pollution caused by industrial plants. The output produced by plants is included in GDP but a decrease in welfare arising out of pollution of water and air caused by plants is not considered in the estimation of GDP. This pollution adversely affects the health of the people thus producing goods increases welfare but creating pollution decreases welfare. Therefore, taking only GDP as an index of welfare overstates the welfare.

If the increase in GDP is due to an increase in prices and not due to an increase in physical output, then it will not be a reliable index of economic welfare.

GDP includes different types of products like clothes, food articles, police and military services, house etc. Some of these products contribute more to the welfare of the people like food, clothes etc. whereas other products like police services and military services etc. may comparatively contribute less and may not directly affect the standard of living of the people.

Thus, if GDP increases, the increase in welfare may not be in the same proportion. Therefore, how much is the economic welfare, should depend more on the types of goods and services produced and not simply on how much is produced.

GDP includes all final goods whether it is milk or liquor, some goods included in GDP measurement may reduce economic welfare. For example, liquor, cigarettes etc. because of their harmful effect on health. GDP includes only the monetary value of the products and not their contribution to welfare.

Therefore, economic welfare depends not only on the volume of consumption but also on the type of goods and services consumed. This should be considered while drawing conclusions about economic welfare from GDP.

Problems in Calculating National Income

These some problems in calculating national income are given below:

Lack of Proper Accounts and Information

Rapid increase in population, double counting, low productivity of agriculture.

- Non Availability of Goods and Services for Exchang e

Problems of Non-Monetary Economy

Poor industrial development, defective classification, problems of new products and services, problems of constituents of national income, regional imbalances, problem of collection of correct data, difficult to know the value of services.

In developing countries, the economy is based on a small sector. The income of this sector is very low but the numbers of units are very large. These units are operated by very small artisans and uneducated and unskilled persons. In this sector, the accounts are not maintained properly, these industrialists do not keep proper accounts and records of their income.

The information provided by them is generally inaccurate and wrong and hence it is not possible to collect reliable information for national income.

The major reason for low per capita income is the speedy growth of the population along with the slower growth of the NI. Hence, to improve the rate of growth of per capita income in the country, it would be necessary to have a two-pronged attack. One is to step up the growth of NI and the second is to take necessary steps to bring down the rate of growth of the population.

This is the most important difficulty in the measurement of national income. Several commodities and services are such which are used in the production process more than once. In such conditions possibilities exist of there being counted repeatedly. It is also difficult to correctly and clearly distinguish between intermediary and final products.

Agriculture plays an important role in developing the economy, but in India, this sector has low productivity and poor performance.

Non Availability of Goods and Services for Exchange

We have studied that in the computation of national income only those commodities and services are included which are commercially used. In most the developing countries, people in rural areas do not incur many types of expenditure on the production of primary goods like villagers produce the required raw materials themselves.

Since their raw material is not sold in the market, it is not included in the national income. In such situations, national income is estimated on the lower side.

As we know, nearly 70% of the population of our country lives in the villages. In villages non-monetary transactions are common. Most of the activities are not brought by money but by the barter system . In such conditions, the non-monetary transactions are not methods of national income and it results in the computation of national production on the lower side.

In developing countries, industrial development is not proper. The causes of poor industrial development are lack of sufficient capital formation, failure of the public sector to play the assigned role in spite of its dominance; defective fiscal policy and the under-utilisation of the capacity in the industrial sector etc.

We calculate national income according to industries. But in developing countries, most of the workers are engaged in different activities partially in the agriculture sector or partially in the industrial sector. So it is difficult to calculate the true national income.

National income is estimated at constant prices, as also at current prices. Some products are such, which are being produced, at present but were not produced in the base year. The important problem that arises from such goods is how to know the prices for the base year?

This problem arises when we want to compare the national incomes of two or more countries. The problem is the constituents of national income are not the same in all countries of the world. therefore, it becomes difficult to compare the national income of various countries.

Many states in India are extremely backward and underdeveloped. So regional imbalance creates problems in calculating accurate national income.

Data collection methods are not reliable in developing countries like India because several defects exist in various methods applied for the collection of data required for the measurement of national income.

For example, data related to agriculture in India are collected by Gram Sevaks or Patvaries, who are not trained in the art of data collection. They are not able to devote adequate time to data collection. Hence, such data are also neither accurate nor reliable.

Various types of services are included in the computation of national income. For example, the nurses or doctors provide their services in extra hours also, in addition to their assigned duty hours. It is difficult to know the values of such services. Hence, estimation of national income is also difficult for dispensation of such services.

How to Increase National Income?

Some suggestions are here to overcome or increase the national incom e. These are:

Development of Industrial Sector

Practical training for effective administration, proper utilisation of resources, development of science and technology, development of credit facilities, vocational guidance, technical training and public health facilities, equal distribution of wealth.

The industrial and agricultural sectors should be developed rapidly. In this context, new agricultural techniques must be provided to the farmers and implemented in all agricultural areas. The fertilisers, pesticides, agricultural implements etc. should be used to improve the production. More stress should be laid on the development of cottage, small and rural industries.

The official should be trained for effective administration. An effective administrative arrangement should be made for the maintenance of proper accounts and the collection of reliable and complete information and data regarding national income.

The factors causing the underutilisation of productivity capacity must be removed. Natural resources and productive capacity should be utilised more effectively. Facilities for irrigation and power should be increased sufficiently.

The production techniques should be improved. More emphasis should be laid on the development of science and technology.

To overcome the problem of double counting Value of finally produce commodities and services alone should be included in national income estimates.

Capital formation should be stepped up. Saving schemes should be popularised more.

The problem of unemployment and under-employment must be tackled more effectively. Self-employment should be encouraged.

Technical training and public health facilities should be strengthened in order to increase the efficiency of labour. The regional inequalities must be eliminated from the backward regions.

Inequalities in the distribution of wealth income and economic opportunities should also be mitigated.

FAQ Related to National Income

What is the national income and how it is calculated.

National income in the general sense means the total value of commodities and services produced in any country during a year, it is a term which is used interchangeably with national dividend, national output and national expenditure. National income is related to any particular country and is also calculated for a year. The national income has various concepts like GNP, NNP, Personal income, Disposable income, Per Capita income etc.

What is Importance of National Income?

National Income is a way to find out about a country’s growth. National Income enables the calculation growth of a country.

What are the limitations of national income?

In National Income estimation some problems are faced. These are lack of proper accounts and information, double counting, low productivity of agriculture, non-availability of goods and services for exchange, problems of the non-monetary economy, and difficulty to know the value of services etc.

You Might Also Like

Central bank: characteristics, methods, quantitative and qualitative.

Rural Development Class 12 Notes PDF

Foreign Exchange Rate Notes Class 12 PDF

Cost Output Relationship in Long Run

Consumer behavior: meaning, definitions, features, natures, importance, problems of growth in business environment.

Government Budget and the Economy Class 12 Notes PDF

Welfare Economics: Pigovian Welfare Economics

Liberalisation Privatisation and Globalisation Notes PDF

Demand: Definition, Importance, Types, Factors, Law, Demand Schedule

CBSE Indian Economy Class 12 | CBSE Revision Notes

Supply of money: definition, determinants, approaches, 7 factors affecting,.

Pricing: Methods, Objectives, Determinants, Factors Influencing, Approach

Utility Analysis: Definitions, Characteristics, Features, Measurement

Business Cycle: Definitions, Characteristics, Stages, Types, Control

Balance of Payments Class 12 Notes PDF

Methods of Calculating National Income Class 12 Notes PDF

Microeconomics and Macroeconomics: Importance, Features, Difference

Monopolistic Competition: Characteristics, Features, Equilibrium Under

7 role of commercial bank in economic development, leave a reply cancel reply.

Save my name, email, and website in this browser for the next time I comment.

- Entrepreneurship

- Organizational Behavior

- Financial Management

- Communication

- Human Resource Management

- Sales Management

- Marketing Management

- Privacy Policy

- Search Search Please fill out this field.

- National Income Accounting

- How It Works

- Economic Policy

The Bottom Line

- Corporate Finance

What Is National Income Accounting? How It Works and Examples

:max_bytes(150000):strip_icc():format(webp)/wk_headshot_aug_2018_02__william_kenton-5bfc261446e0fb005118afc9.jpg)

What Is National Income Accounting?

National income accounting is a bookkeeping system that a government uses to measure the level of the country's economic activity in a given time period. Accounting records of this nature include data regarding total revenues earned by domestic corporations, wages paid to foreign and domestic workers, and the amount spent on sales and income taxes by corporations and individuals residing in the country.

Key Takeaways

- National income accounting is a government bookkeeping system that measures a country's economic activity—offering insight into how an economy is performing.

- Such a system will include total revenues by domestic corporations, wages paid, and sales and income tax data for companies.

- National income accounting systems allow countries to assess the current standard of living or the distribution of income within a population, as well as assess the effects of various economic policies.

- However, the accuracy of analysis relating to national income accounting is only as accurate as the data collected.

Investopedia / Matthew Collins

Understanding National Income Accounting

Although national income accounting is not an exact science, it provides useful insight into how well an economy is functioning, and where money is being generated and spent. When combined with information regarding the associated population, data regarding per capita income and growth can be examined over a period of time.

Some of the metrics calculated by using national income accounting include the gross domestic product (GDP) , gross national product (GNP) , and gross national income (GNI) . The GDP is widely used for economic analysis on the domestic level and represents the total market value of the goods and services produced within a specific nation over a selected period of time.

In the U.S., the Bureau of Economic Analysis (BEA) prepares and publishes data on national income accounts. Examples of national income accounts published by the BEA include domestic product and income, personal product and income, savings and investments, and foreign transactions.

Uses of National Income Accounting

The information collected through national income accounting can be used for a variety of purposes, such as assessing the current standard of living or the distribution of income within a population.

Additionally, national income accounting provides a method for comparing activities within different sectors of an economy, as well as changes within those sectors over time. A thorough analysis can assist in determining overall economic stability within a nation.

For example, the U.S. uses information regarding the current GDP in the formation of various policies. The commonly used formula for calculating GDP—the expenditure approach—is also known as the national income accounting equation. The formula is:

GDP = C + G + I + NX

- C = consumption;

- G = government spending;

- I = Investment

- NX = net exports (exports - imports)

National Income Accounting vs. Economic Policy

The quantitative information associated with national income accounting can be used to determine the effect of various economic policies.

Considered an aggregate of the economic activity within a nation, national income accounting provides economists and statisticians with detailed information that can be used to track the health of an economy and to forecast future growth and development.

The data can provide guidance regarding inflation policy and can be especially useful in the transitioning economies of developing nations, as well as statistics regarding production levels as related to shifting labor forces.

This data is also used by central banks to set and adjust monetary policy and affect the risk-free rate of interest that they set. Governments also look at figures such as GDP growth and unemployment to set fiscal policy in terms of tax rates and infrastructure spending.

Globally, the International Monetary Fund (IMF), the World Bank, and the Organization for Economic Cooperation and Development (OECD) put together national income accounting information and publish it.

Criticisms of National Income Accounting

The accuracy of analysis relating to national income accounting is only as accurate as the data collected. Failure to provide the data in a timely fashion can render it useless in regard to policy analysis and creation.

Additionally, certain data points are not examined, such as the impact of the underground economy and illegal production. This means these activities are not reflected in the analysis even if their effect on the economy is strong.

As a result, it can be argued that certain national accounts, such as GDP or the consumer price index (CPI) used to measure inflation do not accurately capture the real economic output of the economy.

What Is a Primary Use for National Income Accounting?

National income accounting is used to measure economic growth and activity. It can also be useful in tracking trends and guiding monetary policy, such as policy tax rate setting.

What Are the Problems of National Income Accounting?

The key issues with national income accounting are the exclusion of goods or services that have no monetary value and the possible double counting of goods. Other issues include the fact that black market goods are excluded and reliable and adequate data is generally lacking.

What Government Purchases Are Included in National Income Accounting?

National income accounting includes government purchases, such as any federal, state, or local government spending. Government purchases include infrastructure spending, such as buying steel for a project and paying employees. However, transfer payments, such as Social Security payments, are not included.

National income accounting assesses the economic activity of a nation, from wages to corporate revenues to taxes and more. The information allows policymakers, economists, and investors to make decisions in their respective fields based on the data analyzed.

Without understanding the economic data of a nation, it would be hard for policymakers to adjust monetary policy, for example, for investors to gauge where stocks may move, and for economists to understand how economic factors impact all facets of life.

Bureau of Economic Analysis. " National Income and Product Accounts ."

:max_bytes(150000):strip_icc():format(webp)/abstract-mirror-building-texture-1027237872-b3b9afe0ea6a43298085e6b8710f5c4f.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

National Income: Concept, Measurement and Classes (With Diagram)

In this article we will discuss about National Income:- 1. Concept of National Income 2. Circular Flow of National Income 3. Major Types of Production 4. Measurement 5. Major Classes 6. Expenditure Approach 7. National Income as the Generic Term 8. Statistics 9. Interpreting Measures 10. National Income (Output) and Per Capita Income 11. Measurement Problems and Others.

- National Income and Welfare

1. Concept of National Income:

One of the most important concepts in all economic systems is the national income. Technically, it is called the gross national product (GNP). Economic growth is symptomized by an upward movement in GN P as the key variable. So GNP measures the economic performance. A more reliable indicator of the performance of the economy is per capital income.

ADVERTISEMENTS:

It may be recalled that macroeconomics is the study of those forces, economic and physiological, that determine the four key macro variables, aggregate employment, production, real income, and the price level.

In the words of P. Samuelson, “The concept of national income is indispensable preparation for tackling the great issues of unemployment, inflation, and growth.” Modern economists are, however, more concerned with the quality of life than with the material growth. And it is in this context that the concept of net economic welfare (NEW) has been developed.

2. Circular Flow of National Income :

The foundation-stone of macroeconomics is the circular flow of national income. In fact, the whole of macroeconomics is built on the simple concept of circular flow. This simple circular flow model now provides the starting point of our study.

We first try to identify the major types of production in the economy. Then we study how the circular flow of income can be measured. We shall observe that there are three ways of arriving at an estimate of national income. The three methods give us identical results.

Any discrepancy among the three measures is largely due to statistical error (also known as rounding off error). We finally discuss a number of conceptual and practical problems associated with the measurement of national income.

Consumers and Households:

A consumer is an individual who purchases goods for his (her) own consumption. This term is used in microeconomics. In macroeconomics we use a broader term, viz., the household.

According to R.G. Lipsey, “A household refers to all people who live under the same roof and who make joint financial decisions about, among other things, the purchase and consumption of goods.” In macroeconomics we use this term ‘household’ to describe the basic purchasing unit for consumption goods.

A Circular Flow of Economic Activity :

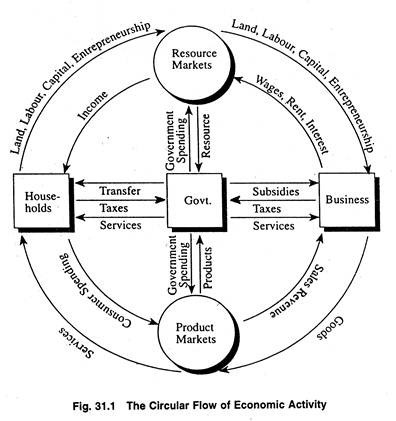

Money, goods, and factor services (also called economic resources or inputs) flow through the economy in a circular manner, as depicted in Fig. 31.1. There are three major transacts (government, business, and households) and two basic kinds of markets (resource markets and product markets).

The participants in free enterprise markets exchange the resources that business and government need in order to operate: land, labour, capital, and entrepreneurial talent.

For example a business buys land, labour, and capital from resource markets and pays rents, wages, and interest for these resources. Households contribute land, labour, capital, and entrepreneurial talent to resource markets in exchange for income.

In product markets, households spend money for consumer goods and services, and government provide these goods and services, such as law court, or police protection to households and businesses. In turn, it receives taxes from them.

It also uses the markets to purchase resources and products (e.g., medicines for hospitals and the services of school teachers) paying for them from its tax resources. So, business, government, and households are interdependent.

Each of these three groups help create and maintain economic activity in a process that continues over and over again, as shown in Fig. 31.1. From this pattern, practicing managers learn that they must keep abreast of changes in households and government, as well as the activities of other businesses.

3. Major Types of Production in National Income :

The circular flow diagram identified two basic units of an economy, viz. producers and consumers. Recall that production is any activity directed to the satisfaction of other people’s want though exchange.

In a modern economy total production is divided into three main categories, viz. consumption goods (like bread, butter, clothing, etc.), investment (or capital) goods like coal, electricity , etc., and services such as (postal service, railway service, banking service, insurance service, etc.)

i. Consumption Goods :

Such goods include the output of all goods and services for consumption by households. Thus along with various commodities we include all types of economic services that are rendered to satisfy human wants (such as haircuts, legal advice, medical care, etc.).

We may now note the following three points about consumption goods and services:

1. Omission of Second-Hand Goods:

Consumption goods include only currently produced goods and services such as new cars produced by PAL in 1994. But we exclude the purchase of second hand (old cars) from the economy’s current production because it is just a transfer of ownership of an existing asset.

However, any commission to be paid to second hand car dealers is a part of current production because the car dealer is providing a useful service (which is paid for). His commission will be treated as part of the economy’s current production and will be reported as a current contribution to national product.

2. Reporting at the Time of Production:

The second point to note is that consumer goods and services are included in the measurement of production when they are produced, not when they are consumed.

For example a 1975 model car that lasted 15 years was produced in one year and its service was consumed over the 15 years. In case of perishable goods like vegetables or services like haircuts, there is hardly any difference between the time .of production and consumption.

3. Treatment of Housing:

Households buy houses. But in national income accounting housing is counted as an investment good and not as consumption good.

ii. Investment (Capital) Goods :

In macroeconomics investment is divided into three parts: fixed capital (like plant, equipment and machinery), circulating capital (including stocks of finished goods, any raw materials) and residential housing.

Society’s total investment in an accounting year consists of the following:

(1) The amount of new capital goods,

(2) New additions to circulating capital and

(3) New residential houses constructed over that period.

An economy’s current output of fixed capital includes the following terms:

(1) Currently constructed factory and

(2) Currently produced capital goods (like machines and equipment).

Circulating Capital:

Circulating capital is known as stocks or inventories. In agriculture, corn is treated as circulating capital because corn is required to produce corn. This is why a farmer sets aside a certain portion of his output every year, to be used as seed next year. So the distinction between output and input gets blurred.

But in industry, circulating capital consists of the following three types of stocks:

1. Stocks of Finished Goods:

These are held because production and sales do not always coincide. A publisher, for example, may print 10,000 copies of a textbook. This may be sold over a period of 10 months or one year.

2. Stocks of Semi-Finished Goods or Goods-in- Process:

Such stocks are held as a matter of routine because the same commodity or resource may have to pass through different stages of production before being finally consumed by households and business firms. An example of this is paper.

A publisher has to keep printed paper for some time to be made available in the form of textbooks at the beginning of the academic year. Or an automobile manufacturer like PAL may keep stocks of car chasis to be made available in the form of finished cars when demand arises.

3. Stocks of Raw Materials:

Business firms have also to keep stocks of raw materials like coal, oil, or steel to ensure uninterrupted production of finished goods. A shortage of raw materials may lead to sudden disruption of production. A firm’s current investment in stock is the difference between end- of-year stocks. We say that there has been an accumulation of stocks or positive investment in stocks.

The converse is also true. If, for instance, stocks held at the end of the year are smaller than stocks held at the beginning of the year, stocks are being reduced. In this case, economically useful things produced in the past have not been replaced.

Two related points may be noted in this context. Firstly, the word ‘stock’ is used in a restricted sense, to denote circulating capital. Secondly, in a general sense the term is used to refer to a quantity that does not have a time dimension.

Investment may be gross or net. Gross investment is net investment plus depreciation (or capital consumption allowance). In other words, net investment is gross investment minus depreciation. There is need to provide for depreciation because capital goods wear out through use and have to be replaced. So differently put, total investment = replacement investment + net addition to society’s existing stock of capital.

Government Production :

It is necessary to distinguish between two main types of government expenditure, viz.,

(1) Current expenditure on goods and services or on factors of production and

(2) Transfer expenditure.

The government’s current (exhaustible) expenditure refers to outlay on such things as road building and maintenance, national health, salary of government employees (such as police personnel, lawyers, managers of public sector enterprises, etc.,) and defence. All government current expenditure is included in national output, i.e., they are counted as producing output of goods and services.

The second type of expenditure is called transfer expenditure because it is merely transfer of purchasing power from one group of people to another. This is expenditure on such things as interest on government bonds, unemployment compensation, retirement pensions, etc. In a modern economy, payments are made to certain sections of society at the cost of the tax-payers.

Those who receive such payments (such as the unemployed, the handicapped, the needy families, etc.) do not provide anything to the government in exchange. This is why such payments are called transfer payments. However, because of such payments the modern mixed economy is called by the name ‘welfare state.’

Transfer expenditures do not add anything to current marketable output: they merely transfer purchasing power from tax-payers to the recipients. Therefore such expenditures or payments made by the government are not treated as a part of the government’s current output of goods and services. So in our discussion of national income we confine ourselves to current expenditures.

4. Measurement (Estimation) of National Income :

There are three different, but interrelated, ways of measuring a country’s national income or the total market value of a nation’s output, viz., the output method, the income method and the expenditure method. These three methods are illustrated in the following circular flow diagram (Fig. 33.3). We may now discuss in detail how national output or income is measured by using each of the three methods (approaches).

1. The Output (or product) Method:

The first approach is to add up the market values of all output produced by business firms. In order to estimate total output of society we have to add up the money values of different types of production such as tonnes of steel, barrels of oil, number of motorcars, etc.

We have to express the market value of every commodity (or service) in terms of money because the units of measurement are different for different commodities. This approach measures the circular ‘flow by going directly to producers and is illustrated by the middle of the circular flow diagram presented in Fig. 31.3.

Double Counting :

When we use this method we face a problem. While measuring the value of each producer’s output, we face the problem of double (multiple) counting. In a modern economy, characterised by division of labour and specialization, the output of one industry (such as iron one) becomes the input of another industry (such as steel).

In other words, the same commodity may pass through different stages of production or the output of almost every commodity occurs over a series of stages, each stage being carried out by separate firms. Thus teaspoons may be made by one firm, from stainless steel provided by a second firm, which, in its turn, used iron ore provided by a third firm, and transported by a fourth.