Financial Management Explained: Scope, Objectives & Importance

In business, financial management is the practice of handling a company’s finances in a way that allows it to be successful and compliant with regulations. That takes both a high-level plan and boots-on-the-ground execution.

What Is Financial Management?

At its core, financial management is the practice of making a business plan and then ensuring all departments stay on track. Solid financial management enables the CFO or VP of finance to provide data that supports creation of a long-range vision, informs decisions on where to invest, and yields insights on how to fund those investments, liquidity, profitability, cash runway and more.

ERP software can help finance teams achieve these goals: A financial management system combines several financial functions, such as accounting, fixed-asset management, revenue recognition and payment processing. By integrating these key components, a financial management system ensures real-time visibility into the financial state of a company while facilitating day-to-day operations, like period-end close processes.

Video: What Is Financial Management?

Objectives of Financial Management

Building on those pillars, financial managers help their companies in a variety of ways, including but not limited to:

- Maximizing profits: Provide insights on, for example, rising costs of raw materials that might trigger an increase in the cost of goods sold.

- Tracking liquidity and cash flow: Ensure the company has enough money on hand to meet its obligations.

- Ensuring compliance: Keep up with state, federal and industry-specific regulations.

- Developing financial scenarios: These are based on the business’ current state and forecasts that assume a wide range of outcomes based on possible market conditions.

- Manage relationships: Dealing effectively with investors and the boards of directors .

Ultimately, it’s about applying effective management principles to the company’s financial structure.

Scope of Financial Management

Financial management encompasses four major areas:

The financial manager projects how much money the company will need in order to maintain positive cash flow, allocate funds to grow or add new products or services and cope with unexpected events, and shares that information with business colleagues.

Planning may be broken down into categories including capital expenses, T&E and workforce and indirect and operational expenses.

The financial manager allocates the company’s available funds to meet costs, such as mortgages or rents, salaries, raw materials, employee T&E and other obligations. Ideally there will be some left to put aside for emergencies and to fund new business opportunities.

Companies generally have a master budget and may have separate sub documents covering, for example, cash flow and operations; budgets may be static or flexible .

Static vs. Flexible Budgeting

Managing and assessing risk.

Line-of-business executives look to their financial managers to assess and provide compensating controls for a variety of risks, including:

Affects the business’ investments as well as, for public companies, reporting and stock performance. May also reflect financial risk particular to the industry, such as a pandemic affecting restaurants or the shift of retail to a direct-to-consumer model .

The effects of, for example, customers not paying their invoices on time and thus the business not having funds to meet obligations, which may adversely affect creditworthiness and valuation, which dictates ability to borrow at favorable rates .

Finance teams must track current cash flow, estimate future cash needs and be prepared to free up working capital as needed.

This is a catch-all category, and one new to some finance teams. It may include, for example, the risk of a cyber-attack and whether to purchase cybersecurity insurance , what disaster recovery and business continuity plans are in place and what crisis management practices are triggered if a senior executive is accused of fraud or misconduct.

The financial manager sets procedures regarding how the finance team will process and distribute financial data, like invoices, payments and reports, with security and accuracy. These written procedures also outline who is responsible for making financial decisions at the company — and who signs off on those decisions.

Companies don’t need to start from scratch; there are policy and procedure templates available for a variety of organization types, such as this one for nonprofits.

Functions of Financial Management

More practically, a financial manager’s activities in the above areas revolve around planning and forecasting and controlling expenditures.

The FP&A function includes issuing P&L statements, analyzing which product lines or services have the highest profit margin or contribute the most to net profitability, maintaining the budget and forecasting the company’s future financial performance and scenario planning.

Managing cash flow is also key. The financial manager must make sure there’s enough cash on hand for day-to-day operations, like paying workers and purchasing raw materials for production. This involves overseeing cash as it flows both in and out of the business, a practice called cash management.

Along with cash management, financial management includes revenue recognition, or reporting the company’s revenue according to standard accounting principles. Balancing accounts receivable turnover ratios is a key part of strategic cash conservation and management. This may sound simple, but it isn’t always: At some companies, customers might pay months after receiving your service. At what point do you consider that money “yours” — and report the good news to investors?

Finally, managing financial controls involves analyzing how the company is performing financially compared with its plans and budgets. Methods for doing this include financial ratio analysis, in which the financial manager compares line items on the company’s financial statements.

Strategic vs. Tactical Financial Management

On a tactical level, financial management procedures govern how you process daily transactions, perform the monthly financial close, compare actual spending to what’s budgeted and ensure you meet auditor and tax requirements.

On a more strategic level, financial management feeds into vital FP&A (financial planning and analysis) and visioning activities, where finance leaders use data to help line-of-business colleagues plan future investments, spot opportunities and build resilient companies.

Importance of Financial Management

Solid financial management provides the foundation for three pillars of sound fiscal governance:

Strategizing

Identifying what needs to happen financially for the company to achieve its short- and long-term goals. Leaders need insights into current performance for scenario planning , for example.

Decision-making

Helping business leaders decide the best way to execute on plans by providing up-to-date financial reports and data on relevant KPIs.

Controlling

Ensuring each department is contributing to the vision and operating within budget and in alignment with strategy.

With effective financial management, all employees know where the company is headed, and they have visibility into progress.

What Are the Three Types of Financial Management?

The functions above can be grouped into three broader types of financial management:

Capital budgeting

Relates to identifying what needs to happen financially for the company to achieve its short- and long-term goals. Where should capital funds be expended to support growth ?

Capital structure

Determine how to pay for operations and/or growth. If interest rates are low, taking on debt might be the best answer. A company might also seek funding from a private equity firm , consider selling assets like real estate or, where applicable, selling equity.

Working capital management

As discussed above, is making sure there’s enough cash on hand for day-to-day operations, like paying workers and purchasing raw materials for production.

#1 Cloud ERP Software

What Is an Example of Financial Management?

We’ve covered some examples of financial management in the “functions” section above. Now, let’s cover how they all work together:

Say the CEO of a toothpaste company wants to introduce a new product: toothbrushes. She’ll call on her team to estimate the cost of producing the toothbrushes and the financial manager to determine where those funds should come from — for example, a bank loan.

The financial manager will acquire those funds and ensure they’re allocated to manufacture toothbrushes in the most cost-effective way possible. Assuming the toothbrushes sell well, the financial manager will gather data to help the management team decide whether to put the profits toward producing more toothbrushes, start a line of mouthwashes, pay a dividend to shareholders or take some other action.

Throughout the process, the financial manager will ensure the company has enough cash on hand to pay the new workers producing the toothbrushes. She’ll also analyze whether the company is spending and generating as much money as she estimated when she budgeted for the project.

NetSuite: Financial Management for Startups and Beyond

At the outset, financial management responsibilities within a startup include making and sticking to a budget that aligns with the business plan, evaluating what to do with profits and making sure your bills get paid and that customers pay you.

Financial management gets more complicated as the company grows and adds finance and accounting contractors or staffers. You must ensure your employees get paid with accurate deductions, properly file taxes and financial statements, and watch for errors and fraud.

This all circles back to our opening discussion of balancing strategic and tactical. By building a plan, you can answer the big questions: Are our goods and services profitable? Can we afford to launch a new product or make that hire? What might the coming 12 to 18 months bring for the business? Solid financial management provides the systems and processes to answer those questions.

Financial management challenges can be daunting for both startups and growing businesses. This is where NetSuite's financial management software comes into play. With its comprehensive, cloud-based solutions, NetSuite ensures that your financial data is accurate, up-to-date, and accessible anytime, anywhere.

From automating complex financial processes to offering real-time visibility into performance, NetSuite is the go-to solution for businesses aiming for seamless integration and efficient financial operations. As your company expands, NetSuite scales with you, ensuring you have the right tools to make informed strategic decisions at every stage. Make the smart choice for your business's financial future with NetSuite.

Financial Management

What is Financial Contingency Plan? A Step-by-Step Guide to Creating One

Creating a financial contingency plan is a wise move for any business. Crises and setbacks can strike suddenly, from natural disasters to economic downturns, technical failures, partner bankruptcies and customer…

Trending Articles

Learn How NetSuite Can Streamline Your Business

NetSuite has packaged the experience gained from tens of thousands of worldwide deployments over two decades into a set of leading practices that pave a clear path to success and are proven to deliver rapid business value. With NetSuite, you go live in a predictable timeframe — smart, stepped implementations begin with sales and span the entire customer lifecycle, so there’s continuity from sales to services to support.

Before you go...

Discover the products that 37,000+ customers depend on to fuel their growth.

Before you go. Talk with our team or check out these resources.

Want to set up a chat later? Let us do the lifting.

NetSuite ERP

Explore what NetSuite ERP can do for you.

Business Guide

Complete Guide to Cloud ERP Implementation

All Courses

- Free Courses

- Career Guide

- PGP in Data Science and Business Analytics

- PG Program in Data Science and Business Analytics Classroom

- PGP in Data Science and Engineering (Data Science Specialization)

- PGP in Data Science and Engineering (Bootcamp)

- PGP in Data Science & Engineering (Data Engineering Specialization)

- Master of Data Science (Global) – Deakin University

- MIT Data Science and Machine Learning Course Online

- Master’s (MS) in Data Science Online Degree Programme

- MTech in Data Science & Machine Learning by PES University

- Data Analytics Essentials by UT Austin

- Data Science & Business Analytics Program by McCombs School of Business

- MTech In Big Data Analytics by SRM

- M.Tech in Data Engineering Specialization by SRM University

- M.Tech in Big Data Analytics by SRM University

- PG in AI & Machine Learning Course

- Weekend Classroom PG Program For AI & ML

- AI for Leaders & Managers (PG Certificate Course)

- Artificial Intelligence Course for School Students

- IIIT Delhi: PG Diploma in Artificial Intelligence

- Machine Learning PG Program

- MIT No-Code AI and Machine Learning Course

- Study Abroad: Masters Programs

- MS in Information Science: Machine Learning From University of Arizon

- SRM M Tech in AI and ML for Working Professionals Program

- UT Austin Artificial Intelligence (AI) for Leaders & Managers

- UT Austin Artificial Intelligence and Machine Learning Program Online

- MS in Machine Learning

- IIT Roorkee Full Stack Developer Course

- IIT Madras Blockchain Course (Online Software Engineering)

- IIIT Hyderabad Software Engg for Data Science Course (Comprehensive)

- IIIT Hyderabad Software Engg for Data Science Course (Accelerated)

- IIT Bombay UX Design Course – Online PG Certificate Program

- Online MCA Degree Course by JAIN (Deemed-to-be University)

- Cybersecurity PG Course

- Online Post Graduate Executive Management Program

- Product Management Course Online in India

- NUS Future Leadership Program for Business Managers and Leaders

- PES Executive MBA Degree Program for Working Professionals

- Online BBA Degree Course by JAIN (Deemed-to-be University)

- MBA in Digital Marketing or Data Science by JAIN (Deemed-to-be University)

- Master of Business Administration- Shiva Nadar University

- Post Graduate Diploma in Management (Online) by Great Lakes

- Online MBA Program by Shiv Nadar University

- Cloud Computing PG Program by Great Lakes

- University Programs

- Stanford Design Thinking Course Online

- Design Thinking : From Insights to Viability

- PGP In Strategic Digital Marketing

- Post Graduate Diploma in Management

- Master of Business Administration Degree Program

- MS in Business Analytics in USA

- MS in Machine Learning in USA

- Study MBA in Germany at FOM University

- M.Sc in Big Data & Business Analytics in Germany

- Study MBA in USA at Walsh College

- MS Data Analytics

- MS Artificial Intelligence and Machine Learning

- MS in Data Analytics

- Master of Business Administration (MBA)

- MS in Information Science: Machine Learning

- MS in Machine Learning Online

- MIT Data Science Program

- AI For Leaders Course

- Data Science and Business Analytics Course

- Cyber Security Course

- PG Program Online Artificial Intelligence Machine Learning

- PG Program Online Cloud Computing Course

- Data Analytics Essentials Online Course

- MIT Programa Ciencia De Dados Machine Learning

- MIT Programa Ciencia De Datos Aprendizaje Automatico

- Program PG Ciencia Datos Analitica Empresarial Curso Online

- Mit Programa Ciencia De Datos Aprendizaje Automatico

- Online Data Science Business Analytics Course

- Online Ai Machine Learning Course

- Online Full Stack Software Development Course

- Online Cloud Computing Course

- Cybersecurity Course Online

- Online Data Analytics Essentials Course

- Ai for Business Leaders Course

- Mit Data Science Program

- No Code Artificial Intelligence Machine Learning Program

- MS Information Science Machine Learning University Arizona

- Wharton Online Advanced Digital Marketing Program

- Data Science

- Introduction to Data Science

- Data Scientist Skills

- Get Into Data Science From Non IT Background

- Data Scientist Salary

- Data Science Job Roles

- Data Science Resume

- Data Scientist Interview Questions

- Data Science Solving Real Business Problems

- Business Analyst Vs Data Scientist

- Data Science Applications

- Must Watch Data Science Movies

- Data Science Projects

- Free Datasets for Analytics

- Data Analytics Project Ideas

- Mean Square Error Explained

- Hypothesis Testing in R

- Understanding Distributions in Statistics

- Bernoulli Distribution

- Inferential Statistics

- Analysis of Variance (ANOVA)

- Sampling Techniques

- Outlier Analysis Explained

- Outlier Detection

- Data Science with K-Means Clustering

- Support Vector Regression

- Multivariate Analysis

- What is Regression?

- An Introduction to R – Square

- Why is Time Complexity essential?

- Gaussian Mixture Model

- Genetic Algorithm

Introduction to Financial Management – A Complete Guide

- What is Financial Management?

- Importance of Financial Management

- Objectives of Financial Management

- Elements of Financial Management

- Functions of Financial Management

- An Example of Financial Management

- Frequently Answered Questions

Financial Management is one of the most important aspects for individuals and organisations in this rapidly growing world. It is no longer about saving money; it is about managing and growing money. To run a business efficiently and effectively and achieve business goals , one needs to have a good knowledge and understanding of financial accounting and management.

According to the Financial Experts Guthman and Dougal,

“Financial management is the activity concerned with planning, raising, controlling and administering of funds used in the business.”

It manages the finances in a way where the business/organization is profitable and scalable in the near future.

Improve Your Knowledge on Financial Management from these free courses

Financial Management is vital for businesses and organisations as it lays the right pathway to achieve business goals and objectives. Here are some of the reasons why financial management is essential in a business:

- Helps in Financial Planning

- Assists in acquiring and managing funds

- Helps in funds allocation

- Provides insights to make critical financial decisions

- Cuts down financial costs

- Improves profitability and value of the organization

- Makes employees aware of financial savings and investments

- Helps in planning the future growth of the organization

- Helps in achieveing economic stability

Just like we all used to save money during our student life and be mindful about it while spending, organisations need to manage the finances effectively to scale and be successful. Here are some crucial objectives that organisations need to be kept in mind:

1. Profit Maximisation

One of the most critical objectives is to ensure maximum profits in both the short and long run. A finance manager should consider this on top of his priority list and ensure that outcomes related to business performance are profitable.

2. Proper Mobilization

Just like you do not waste your savings all in one go to buy something and have nothing in hand, managing funds is crucial for any business. Financial managers need to evaluate and make vital decisions on the allocation and utilization of various funds. Whether it is shares, products, or investing in small companies, all the critical factors must be considered before investing.

3. High Efficiency

Financial Management tries to increase the efficiency of all the departments of the company. Proper distribution of finances or funds to all the departments considering the resources and work involved increases the organization’s efficiency as a whole.

4. Reduce Risks

There are always risks involved in running a business, especially with the uncertainties that come along. Financial managers need to avoid high-risk situations/opportunities and take calculated risks under the consultation of experienced leaders and subject matter experts.

5. Business Survival

Amidst the competitive world, the survival of the business is a primary goal. Darwin said, “Survival of the fittest” in Biology, which is applicable for companies. Companies need to make decisions intuitively. They can always take the help of expert consultants if needed.

6. Balanced Structure

Like they say – Balance is key to everything. This applies not just in life but to businesses too. Financial managers need to prepare a robust capital structure considering all capital sources. This balance is vital for liquidity, flexibility, economy, and stability.

Quick check – Learn Business Finance Foundations

Financial Management is made of the following key elements. These are:

1. Financial Planning

Financial Planning is a way of calculating the capital required by an organization and adequately allocating resources accordingly. To do this effectively, one needs to have answers to the following questions:

- Do you have well-established business goals and objectives?

- What is your long-term plan as a brand?

- What is the capital required for the organization to sustain itself?

- What are the different policies and regulations involved in your business?

Answers to each of these questions and many more are all related to Financial Management. So, it is crucial to plan things properly that help you achieve your business goals.

2. Financial Control

It is a pivotal activity to ensure the business is working to meet its objectives. It is more about setting proper KIPs rather than reducing costs. It is essential to ensure everyone in the team is aware of both financial and business goals.

3. Financial Decision-making

Once you have a proper plan and understanding of all the financial aspects, decision-makers should access and decide on fundings, resource allocations, profit distributions, and many more.

The financial management team in any organization is led mainly by the Finance Manager or someone from the Core Leadership team. Here are a few functions which the team generally is responsible for:

1. Capital Estimation

A finance manager has to estimate the capital required for the company. This will include expected costs, profits, future programs, and expected losses, if any. The estimate had to be made in such a way that the earning capability of the company increases steadily.

2. Deciding Capital Structure

Once the estimate has been made, it is now time to form the capital structure. This includes debt analysis in both the short and long term and is dependent on the capital the firm owns and raised external fundings(if any).

3. Choice of Funds

When significant funds are required, the capital structure needs to be expanded. The organization can take options like Bank Loans and Issues of Share and Debentures. It is essential to evaluate these options considering the interest rates, returns and risk involved. A pro and con list of each of these options will be helpful.

4. Investments

The organization cannot just sit on funds or profits. Growing money is more important than saving money for sustainable growth. The finance Manager needs to allocate funds into profitable ventures or make investments that give reasonable returns with safety on the investment made.

5. Profit Allocation

Profit allocation plays an important role. Once the business makes profits, it is essential to allot them properly. Various factors to be considered here are – employee bonuses, dividends, returns to investors, funds for future growth, and other basic cashflows. It is essential to plan and allocate profits to achieve business objectives.

6. Money Management

The team is also responsible for money or cash management. Cash is required for various purposes such as salaries, electricity and water bills, real estate bills, buying raw materials, storage costs, etc.

7. Financial controls

The finance manager has to plan and utilize the funds and needs to have complete control over the finances considering both short term and long term. This can be achieved using risk analysis and mitigation tools, financial forecasting, ratio analysis, cost reduction, and profit control.

Now you have had a fair idea of Financial Management, let us look at an example of Financial Management.

Suppose you decide to start your own business along with 4-5 partners. You choose to rent a small office in Bengaluru, Karnataka. You will need to consider the following:

- Which area is best suited for office locations?

- Should I go for a small independent office or go for a co-working space?

- What will be the rent cost per annum?

- What if I buy the property? What will be the evaluation 15 years from now? Will it be lesser than the rental cost for the next 15 years?

You might not have answers to all these questions and might decide to consult a real estate agent. Basis his advice, you might also consult the finance team on how much % of the funds should be invested in real estate so that it does not affect business profitability.

So basis all this financial information, you might decide whether to rent an office or buy a property. Even Work from Home is an option during the initial stages until the team grows.

Learn Financial Accounting and Management for FREE

1. What are the different types of job roles in financial Management?

- Financial Manager

- Investment Banker

- Corporate Manager

- Budget Analyst

- Financial Planner

2. What is the average salary of a Finance Manager in USA?

The average salary of a Finance Manager in USA is $1,03,000/yr.

3. What is the average salary of a Finance Manager in India?

The average salary of a Finance Manager in India is ₹11,00,000/yr.

4. What are the courses available to learn Financial Management?

There are several courses available online. You can go for free short-term courses to kick-start your financial management journey and later pick up a PG Program or an MBA in Finance. Here are a few courses for you:

- Business Finance Foundations

- Basic Accounting Certificate

- Executive PG Program in Management

- Online MBA Degree

Quick Read: Scope of MBA Finance in 2021: Top Job Roles, Skills & Opportunities

Top Free Courses

Understanding Henri Fayol’s 14 Principles of Management

Top 6 Career Options after MBA in Business Analytics in 2024

Scope of MBA in HR in 2024: Top Job Roles, Skills & Opportunities

Latest Technologies in Computer Science in 2024

Top 8 Essential Digital Marketing Skills in 2024

Salary Negotiation with HR: A Simple Guide

Leave a comment cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Table of contents

Essay on Financial Management

After reading this essay you will learn about:- 1. Introduction to Financial Management 2. Definition of Financial Management 3. Scope 4. Role in a Business 5. Financial Goals and Objectives 6. Functions.

Essay Contents:

- Essay on the Functions of Financial Management

Essay # 1. Introduction to Financial Management:

A business organisation seek to achieve their objectives by obtaining funds from various sources and then investing them in different types of assets, such as plant, buildings, machinery, vehicles etc. Financial management is managing the finances through scientific decision-making.

For making right decisions, financial management needs to understand financial environment within which these decisions operate. Financial management will then be able to analyse these financial information’s to predict likely future results and to plan more carefully their proposed course of action.

ADVERTISEMENTS:

Financial management is concerned with the acquisition (investment), financing (arranging funds), and management of assets with some overall goal in mind. Investment decisions begin with a determination of the total amount of assets required by the firm and to determine the money value of the same. Assets that cannot be economically justified, may be reduced, eliminated or replaced.

Financing decisions include decisions regarding mix of financing, type of financing employed, dividend policy and method of acquiring funds i.e., getting a short term loan, or a long term lease arrangement, sale of bonds or stock.

Asset management decisions means managing the assets efficiently after their acquisition.

Success of a firm depends on the ability to raise funds, invest in assets and manage wisely.

Essay # 2. Definition of Financial Management:

Financial management is an internal part of overall management and not a staff function of the organization. It is not only restricted to fund raising process but also covers utilization of funds and monitoring its uses. The finance function is concerned with the process of acquiring an efficient utilization of funds of a business system, in order to maximize the value of the enterprise.

Financial management involves the application of principles of general management to the finance function. These functions influence the operations of other crucial functional areas of the enterprise or firm such as marketing production and personnel. Thus the overall survival of the firm is effected by it financial operations.

“The financial management deals with how the corporation obtains the funds and how it uses them.” —Hoagland

“The financial management refers to the application of skills in the manipulation, use and control of funds.” —Mock, Schultz and Schuckectat

Financial management can also be defined as that part of management, which is related mainly with raising or acquiring the funds for the enterprise or firm in the most economical way, utilizing those funds as profitably as possible, for a given risk level, planning the future investment of those funds and controlling the current performance plus future development by adopting budgeting, cost accounting and financial accounting.

Essay # 3. Scope and Functions of Financial Management :

The main objectives of financial management are to arrange the sufficient funds for meeting short term long term requirements of the enterprise. These finances are procured at minimum cost in order to maximize the profitability.

In view of these factors the financial management scope concentrates on the following areas of finance function.

(i) Estimating the Financial Requirements :

The first job of the finance manager of an enterprise is to estimate short term and long term financial requirements of his business. He will prepare a financial plan for present as well as future for this purpose.

The finance required for procuring fixed assets as well as the working capital needs will have to be ascertained. The estimations should be based on sound financial principles so that funds available with the firm are neither inadequate nor excess.

(ii) Determining the Capital Structure :

After estimating the financial requirements, the finance executives have to decide about the composition of capital. The capital structure refers to the type and proportion of different securities for raising funds. After deciding the quantum of funds needed it should be decided which type of securities should be raised.

The finance executives have to determine the relative proportions of owner’s risk capital and borrowed capital along with short term and long term debt equity ratio.

A decision regarding various sources of funds should be linked with the cost of raising funds. A decision about the kind of securities to be employed and the proportion in which these should be utilized is an important decision which affects the short term and long term financial planning of an enterprise.

(iii) Choice of Sources of Finance :

After preparing a capital structure an appropriate source of finance is chosen. Various sources from which finance may be raised include: shareholders’ debenture holders, banks and other financial institutions and public deposits etc. Finance executive has to evaluate each source or method of finance and select the best source keeping in view the various factors.

The need, purpose, objective, cost involved may be the factors affecting the selection of a suitable source of financing, for instance, if the finances are required for short periods then banks, public deposits and financial institutions may be appropriate, and for long term financial requirements, the share capital and debentures may be useful.

(iv) Investment Decisions :

When the funds have been poured then a decision regarding pattern of investment has to be taken. The funds raised are to be intelligently invested in various assets so as to optimize the returns on investment. The funds will have to be used first for the purchase of fixed assets and then an appropriate part will be retained as working capital.

The utilisation of long term funds requires a proper assessment of different alternatives through capital budgeting and opportunity cost analysis. While spending on various assets, management should be guided by three important principles of safety, liquidity and profitability. A balance should be struck even in these principles for the purpose of optimum returns on investment.

(v) Management of Profits :

The utilisation of surpluses or earnings is also an important factor in financial management. A judicious utilisation of earnings is essential for expansion and diversification plans of the enterprise.

A certain amount out of the total profit may be kept as reserve voluntarily, a portion of surplus may be distributed among the ordinary and preference shareholders, yet another portion may be reinvested. The finance executive must take into consideration the merits and demerits of the alternative scheme of utilizing the funds generated from the enterprise’s own earnings.

(vi) Management of Cash Flow :

Cash flow management is also an important task of finance executive. He has to assess the various cash requirements at different times and then make arrangements for cash needed. Cash may be required to (i) make payments to creditors (ii) for purchase of materials (iii) to meet wage bill (iv) to meet everyday expenses.

The cash management should be such that neither there is shortage of it and nor it is idle. Any shortage of cash will damage the credit worthiness of the firm. The idle cash with the enterprise will mean that it is not properly utilized. In order to know the cash requirements during different periods, the management should arrange for the preparation of cash flow statement in advance.

(vii) Implementation of Financial Controls :

An efficient system of financial management needs the use of various control of devices. Financial control devices generally adopted are (i) Return on Investment (ii) Budgetrary Control (iii) Cost control (iv) Break Even analysis (v) Ratio analysis. The use of various control techniques by the Finance Manager will help him in evaluating the performance in different areas and take corrective action whenever needed.

Essay # 4. Role of Financial Management in a Business:

An effective financial management plays a dynamic role in a modern company’s development.

In earlier days, financial managers were primarily engaged in:

(a) Raising funds, and

(b) Managing the firms cash flow.

But now-a-days with the developments and increasing complexities in the business, responsibility of the financial managers have increased and they are now concerned with the decision-making process involving finance, i.e., capital investment.

Today external factors, like competition, technological change, economic uncertainty, inflation problem etc., create financial managers problem more complicated. He must have flexibility to adopt to the changing external environment for the survival of his firm.

Thus in addition to the job of acquisition, financing and managing the assets, the financial manager is supposed to contribute to the fortunes of the firm and to the optimal growth of the economy as a whole.

He is required to take decisions on:

(i) Investing funds in assets, and

(ii) Obtaining best mix of financing and dividends.

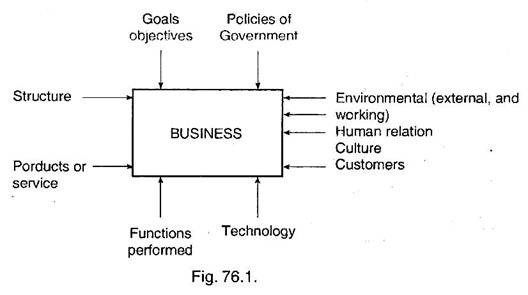

In order to understand the environment in which a finance manager is required to take decision, a sketch indicating business system is given hereunder:

The Financial Management’s main role is therefore to create profit on the capital invested (fixed as well as working capital). Each and every decision related to finance/economy must be optimal. Every business enterprise is set up to earn profit, and no one is interested in taking risk unless he is assured of fair return on the investment. However government organisations have no profit motive but are created to serve the public.

The profit earned by a firm is used for:

(a) Future expansion.

(b) Distributing profit as rewards to owners/shareholders.

Profit earned also serves as an indicator of efficiency and performance of the firm. So as to enable to perform the role of financial management, financial managers must be given proper authority, autonomy, freedom of actions, supporting staff, system for providing necessary information. He should be accountable also for his role.

Essay # 5. Financial Goals and Objectives :

There may be various objectives of a firm, but the goal of a firm is to maximise the wealth of the firm’s owners. Thus we can say that, “the improvement of shareholders value is the one mission that continually guides all corporate decisions and actions” or “the goal of a firm is maximizing the shareholders’ value”. This maximisation of value should be achieved from long term point of view.

The financial goal can be expressed as:

(a) Required profit levels,

(b) Earnings per shares, and

(c) Required rate of return on investment.

For a large firm, where shareholders do not have direct say and the firm is managed by the management, an ordinary shareholder can judge the performance by the market price of the firm’s share. Market price serves as a gauge for business performance, it indicates how well management is doing on behalf of its shareholders.

Management is the agents of the owners or shareholders, and financial management acts for achieving the goal of profit maximization in the shareholders’ best interests.

Social Goals :

While profit maximisation is the primary goal for any business organisation, social responsibility is also important for them. In case of Government organisations and public sector organisations, social responsibility is the primary goal and profit is secondary.

Social responsibility includes service to the people, protecting the consumer, paying fare wages to the employees, upliftment of the weaker sections, welfare facilities like medical education, environment improvement programmes etc.

Financial Objectives :

In making financial decisions, it is important to set out clear objectives.

Following are the basic financial objectives:

(a) Profit maximisation.

(b) Maximisation of shareholders’ owners’ wealth.

(c) Reduction in cost.

(d) Minimising risks.

(e) Sustained increase in the value of firm

(f) Wealth maximisation.

Essay # 6. Functions of Financial Management :

Financial manager is concerned with the following aspects:

1. Identifying the present strengths and weaknesses of the organisation, and the scope for improvement, by conducting the financial analysis.

2. Planning the financial strategies. This involves the consideration of methods and levels of funds raising, profitability and the financing of expansion plan of the organisation.

3. Arranging the funds when required, in the form needed in the most economical way.

4. Conducting financial appraisal of the possible courses of action. The appraisals are needed in respect of possible take overs and mergers, analysis of capital projects, or alternative methods of funding.

5. Advising about capital structure.

6. Consideration of an appropriate level for drawings by dividends to the owners/ shareholders.

7. Ensuring that assets are controlled and used in an efficient manner.

8. Cash management. Preparation of detailed cash budgets and/or forecast funds flow statement so that future problems can be foreseen and remedial measures taken in advance. These take care of both shortage and excess of cash. Finance managers must find ways of raising more funds needed, or investing excess funds for an appropriate length of time.

9. Finance managers are likely to draw attention on other disciplines also, like accounting and budgeting.

In order to enable financial managers to perform above functions satisfactorily, he must have good knowledge of accounting, economics, mathematics, statistics, law especially taxation, financial market etc.

The functions of finance thus involve three major decisions the firm must make:

(a) The investment decisions,

(b) The financing decisions, and

(c) The dividend decisions.

Each of these decisions are taken in relation to the objective of the firm, an optimal combination of these three will maximise the value of the firm to its shareholders. Since the decisions are interrelated, their joint impact on the market price of the firm’s stock must be considered.

(a) Investment Decisions:

This is the most important decision. Capital investment, i.e., allocation of capital to investment proposals is the most important aspect, whose benefits are to be realised in future. As future benefits are not known with certainty, the investment proposals involve risk.

These should, therefore, be evaluated in relation to expected return and risk. Considerable attention is paid to determine the appropriate required rate of return on the investment.

In addition to taking capital investment decisions, finance managers are concerned with the management of current assets efficiently in order to maximise profitability relative to the amount of funds tied up in asset. Investment decisions also include the decisions about mergers and acquisition of another company.

(b) Financing Decisions:

Finance manager is required to determine the best financing mix or capital structure. An optimal financing mix is one in which market price per share could be maximised. Financing decision are taken in relation to the overall valuation of the firm.

Various methods of obtaining short, intermediate, and long term financing are also explored, examined, analysed and a decision is taken. While taking financing decisions, the influence of inflammation on financial markets and on the cost of funds to the firm is also considered.

(c) Dividend Decision:

The dividend decision includes the percentage of earnings paid to stockholders in cash dividends, stock dividends and splits, and the repurchase of stock.

To Meet Funds Requirement of a Firm :

Funds requirement is assessed for different purposes, namely for feasibility study of a project, detailed planning of a project, and for operation and expansion of the business.

For feasibility study, only broad estimates are sufficient and are generally obtained from the past experience of the similar works by interpolating the present trends and the condition of the proposed project in comparison to the one whose figures are being adopted. While during detailed planning, estimated requirement is comparatively more realistic, and prepared after going into details more thoroughly.

Here we are discussing the funds requirement for a running business including its long term planning for expansion.

The main function of financial management is to ensure that the firm must have sufficient funds to meet financial obligations when they are needed and to take advantage of investment opportunities. To achieve this objective, a thorough study is conducted about ‘flow of funds’ i.e., statement of funds requirement indicating the amount of fund needed and at what time.

This ‘statement of funds’ is a summary of a firm’s changes in financial position from one period to another. This indicates that how the funds will be used and how it will be financed over specific period of time. This includes the cash as well as non-cash transactions.

Forecast, financial statements are prepared for selected future dates, generally for middle term and long term plans of the firm. Budgets are used for one year, and are prepared only to fulfill the firms’ objectives envisaged in the forecast for that particular year.

These forecast financial statements are based on the sales forecast and future strategies for expanding the business, and includes, forecast income statements, forecast assets, liabilities, shareholders, equity etc.

Related Articles:

- Essay on Financial Management: Objectives, Scope and Functions

- Essay on Financial Management: Top 5 Essays | Branches | Management

- Top 3 Types of Financial Decisions

- Shareholder Value Analysis (SVA) | Firm | Financial Management

We use cookies

Privacy overview.

- Personal Finance

- Visit MyMoneySouq

Why is Financial Management important in life?

Financial Management is an essential aspect of our daily life. We are caught up in our daily life so much that we forget to realise the importance of financial management.

Without the knowledge of financial management it is not possible to live a life of bondage and know how to adequately pay your bills and get out of your financial debts. Having necessary financial management skills will make sure that your money is managed well.

Here we discuss financial management at an individual level. It includes how you manage your money through Savings, investments and manage your expenditure. Broadly speaking other aspects of financial management are banking, budgeting, insurance, retirement planning and others.

Importance of financial management in life

Financial Management is about meeting long term and short term financial goals. There are numerous reasons why Financial Management is important but here we focus on a few of them.

- Ensures that financial needs are fulfilled

- Helps in managing your income

- Budgeting, Savings and expenses

- Personal Finance

- Ensures financial security

- Increase your Assets

- Increase in Standard of Living

Check Here: What financial lessons you can learn from the COVID-19 crisis?

1. Ensures that financial needs are fulfilled

Money matters are most important for any individual. Earning money is one aspect and ensuring that money fulfills your needs is another aspect.

Having a plan that establishes how much is an individual income, what are the expenses, making plans about spending the income, planning for future goals are important aspects that ensure financial needs are fulfilled.

Financial management ensures the financial needs of an individual are fulfilled if the following are managed effectively.

- Creating a monthly budget and following it

- Payment of bills on time

- loan management

- Savings for retirement

- Managing credit cards and tracking credit score

When you have good knowledge of personal finance and money management skills, you have the advantage of facing financial challenges, use opportunities and work on responsibilities that come your way.

2. Helps in managing your income

If you do not have a plan for your income you will end up spending more than you earn or spend on items that you do not need. With a good financial management plan, you can manage your income effectively.

If you have a good financial plan then you will spend on what is necessary, save money for your future and make proper investments.

Financial management helps in knowing which expense to handle first and which one later. You will effectively make tax payments, do savings and pay monthly bills.

3. Budgeting, Savings and Expenses

If you spend your income without a plan on unnecessary expenses or if you spend your income according to your whims and fancies you will fall into a huge debt. This may happen because you spend more than required and you will become financially unstable.

Financial management helps you in Budgeting your income. Budgeting helps in planning your income where your money should be spent, how much income should be saved, how much should be invested.

According to your lifestyle plan, stick to what you have budgeted, avoid overspending and direct your money towards savings. Savings and Investments money will rescue you in tough times.

Check Here: What is a budget and how to make a budget?

4. Personal Finance

Personal finance helps you to increase your cash flow. Financial management helps you in tracking your expenses and spending patterns. It helps you to easily increase your cash flows.

Cash flow can be increased through the following.

- Tax planning

- Spending wisely

- Proper Budgeting

When you follow all these it will ensure that your money is not spent unnecessarily. Having a personal financial plan is very important because it ensures the right financial track.

5. Ensures Financial Security

Financial management ensures financial security for you and your family. Proper management of finance gives financial freedom. By having the Financial freedom it gives financial security.

Having a right investment plan, right insurance plan, proper savings, will ensure that it gives you and your family financial security.

Check Here: 9 golden rules for financial success

6. Increase your Assets

When you better understand your finances you have a possible chance of increasing your assets. When you own assets you are in a good financial position. Sometimes assets are attached with liabilities. Determining the value of assets you own will increase your net worth.

Financial management will help you to increase your assets. Settlement of your liabilities by paying off your debts and increasing your investments in fixed assets will make you financially sound. This way you can grow your assets by effectively managing your finances.

Check: Today’s Live Gold Rate in Dubai

7. Increase your Standard of Living

Financial management increases your standard of living. The more you are planning for your savings, the more you are increasing your net worth. The more you plan for your finances, the more your savings will be. Savings can help you to face financial challenges. Effective financial management will increase your wealth thereby increasing your standard of living.

Conclusion

Understanding your finances is the first step in financial management. If financial management is not effective then you will fall into a deep financial crisis. Make financial management so effective that it will make your future safe.

About the author

Vinay Kumar

Vinay Kumar Goguru is a finance professional with more than 8 years of diverse experience as a researcher, instructor and Industry work experience with both public and private entities. Prior to MyMoneySouq, he spent 6 years in Berkadia, It's a commercial mortgage banking company. He has a "Doctoral Degree in Commerce" and two master's degrees with a specialization in Finance, one as Master of Commerce and other as Master of Business Administration. He has written several articles on personal finance, published by different International journals. He loves traveling, reading and writing is his passion. He has a dream of writing a book on his favorite finance topics.

- Vinay Kumar https://www.mymoneysouq.com/financial-blog/author/vinay-kumar/ Celebrate UAE National day with best discounts and offers

- Vinay Kumar https://www.mymoneysouq.com/financial-blog/author/vinay-kumar/ My Credit Card is Missing- What Do I Do Now?

- Vinay Kumar https://www.mymoneysouq.com/financial-blog/author/vinay-kumar/ Why your Business loan was rejected? What to do next?

- Vinay Kumar https://www.mymoneysouq.com/financial-blog/author/vinay-kumar/ How Inflation affects your life in Dubai? What you should do?

RELATED ARTICLES

How to check salik balance, how to activate fab credit card in uae, oman insurance, leave a reply.

Save my name, email, and website in this browser for the next time I comment.

Popular Articles

Zero balance accounts in uae – 2024, discount on dubai traffic fines and make fine payment, 19 ways to make money online in dubai, uae, 13 best savings accounts in dubai, uae (march 2024), list of top 10 banks in uae 2024, featured articles, how to get discount on abu dhabi traffic fines – latest update, 2023, best credit cards to get free airport lounge access in dubai – march 2024, top 10 places to get your car washed in dubai, list of visa free countries for uae residents, top 12 e wallets in the uae, bank of baroda, uae, ways to manage financial stress and anxiety during this..., all about emirates vehicle gate, mymoneysouq.

Smart way to compare Loans, Insurances, and Bank Accounts | Assistance in choosing the right financial product | Bring awareness on financial products

Personal Loan

- Rakbank Personal Loan

- HSBC Personal Loan

- Emirates Islamic Bank Personal Loan

- Noor Bank Personal Loan

- FAB Personal Loan

Popular Credit Cards

- Dubai Islamic Bank Credit Card

- Emirates Islamic Credit Card

- FAB Credit Card

- HSBC Credit Card

- Mashreq Credit Card

Credit Cards

- ADCB Credit Card

- RAKBANK Credit Card

- CBD Credit Card

- CBI Bank Credit Card

- Al Hilal Bank Car Loan

- Emirates NBD Car Loan

- Standard Chartered Car Loan

- ADIB Car Loan

- HSBC Bank Car Loan

Bank Customer Care & Helpline contact details

- Abu Dhabi Finance Customer Care

- ADCB Customer Care

- ADIB Customer Care

- Ajman Bank Customer Care

- Al Hilal Bank Customer Care

- Al Khaliji France Customer Care

- AMEX Customer Care

- Amlak Finance Customer Care

- Arab Bank Customer Care

- CBD Customer Care

- CBI Customer Care

- Citibank Customer Care

- Dubai First Customer Care

- Dubai Islamic Bank Customer Care

- Dunia Finance Customer Care

- Emirates Islamic Customer Care

- Emirates NBD Customer Care

- FAB Customer Care

- Finance House Customer Care

- Gulf Finance Customer Care

- Habib Bank Customer Care

- HSBC Customer Care

- Majid Al Futtaim Finance (Najm) Customer Care

- Mashreq Customer Care

- Mawarid Finance Customer Care

- National Bank of Fujairah Customer Care

- Noor Bank Customer Care

- Rakbank Customer Care

- SAMBA Customer Care

- Sharjah Islamic Bank Customer Care

- Standard Chartered Customer Care

- United Arab Bank Customer Care

Useful Tools

- Currency Convertor

- Airport Lounges

Follow Us On

- [email protected]

- Iesoft Technologies FZC

- Business Center, UAQ Free Trade Zone P.O.Box: 7073 Umm Al Quwain, UAE.

The information provided on MyMoneySouq is for illustrative purposes only. It may vary with the information provided on the financial institute website. We don't decide any quotes, rates, or fees on any of the financial products listed on MyMoneySouq. Visit or talk to the bank personnel before taking any decision. Check these " Terms Of Use " before getting started

Essay on Financial Management

Students are often asked to write an essay on Financial Management in their schools and colleges. And if you’re also looking for the same, we have created 100-word, 250-word, and 500-word essays on the topic.

Let’s take a look…

100 Words Essay on Financial Management

What is financial management.

Financial management is taking care of money. It’s like being smart with your allowance. You plan how to spend and save. Companies do this too. They decide where to use their money to grow and make more.

Why It’s Important

Good financial management helps you not run out of money. It’s like making sure you have enough lunch money for the whole week. For businesses, it means they can pay workers and buy what they need.

Making a Budget

A budget is a plan for your money. You write down what you earn and what you spend. It’s like planning your snacks so you don’t eat them all at once.

Saving and Investing

Saving money means keeping it for later. Investing is using your money to try to make more money, like buying a lemonade stand to earn more.

Being Careful with Debt

Debt is borrowing money. It can help you when you need it but remember to pay it back. It’s like borrowing a toy and making sure to return it.

Also check:

- Advantages and Disadvantages of Financial Management

250 Words Essay on Financial Management

Financial management is about how to handle money in a way that is smart and helps achieve goals. It’s like planning a budget for a family or figuring out how to save up for a big purchase. In businesses, it’s about making sure they have enough money to run smoothly and grow.

Creating a Budget

One part of financial management is making a budget. A budget is a plan that shows how much money you expect to get and how you plan to spend it. It’s like when you decide to save part of your allowance for a new bike. Companies do the same by setting aside money for new projects or to pay workers.

Saving money is another key point. It means keeping some money aside for later rather than spending it all. Investing is a step further, where you use your savings to make more money, like buying shares in a company or saving in a bank account that earns interest.

Making Smart Choices

Financial management also involves making decisions about what to buy and when. It’s important to think about if something is really worth the money or if there might be a better way to use it. This can help avoid wasting money and make sure there’s enough for important things.

Good financial management helps avoid money troubles and can even lead to having more money in the future. It’s a skill that is useful for everyone, from kids saving their allowance to adults running a big company. Learning about it early can make life a lot easier and more successful.

500 Words Essay on Financial Management

Financial management is like being the boss of your money. Imagine you have a piggy bank; taking care of it, deciding when to put money in, and when to take some out is a bit like financial management. But for grown-ups, it’s more complex because they deal with things like budgets, savings, investments, and loans. It’s all about making sure that money is used wisely and that there’s enough for the things we need, both now and in the future.

The Importance of Budgeting

A budget is like a shopping list for your money. It helps you keep track of how much money you have, what you need to spend it on, like food and rent, and how much you can save for fun things, like toys or vacations. By making a budget, you can make sure you don’t spend too much and end up with no money when you need it. It’s like planning your spending so that you can always buy what you need and sometimes what you want.

Saving money means putting it away for later, like in a savings account. It’s important because it can help you buy big things in the future, like a car or a house. Investing is a bit like planting a seed and watching it grow. You use your money to buy things that could make more money over time, like stocks or bonds. Both saving and investing are ways to make sure you have enough money for the future.

Financial management also means making smart choices with your money. This means thinking carefully before you buy something. Ask yourself, do you really need it? Can you afford it? Sometimes, it’s better to wait and save more money before buying something big or expensive. This helps you avoid debts, which is money you owe to others.

Understanding Loans and Debts

Loans are like borrowing money from a friend, but you have to pay it back with a little extra, called interest. Debts are the total amount of money you owe others. Managing loans and debts is important because if you borrow too much, it can be hard to pay back. It’s like taking too much food on your plate and not being able to eat it all. You need to be careful and borrow only what you can pay back.

Planning for Surprises

Sometimes, things happen that we don’t expect, like a bike breaking down or getting sick. That’s why part of financial management is putting some money aside for emergencies. This money can help pay for these surprises so that they don’t cause big problems with your finances.

Financial management is all about taking good care of your money. It helps you make smart choices, save for the future, and be ready for unexpected events. Just like you take care of your toys and belongings, taking care of your money is important too. It means you’ll always have enough for the things you need and some of the things you want. Remember, being the boss of your money is a big responsibility, but it can also be fun when you do it right!

That’s it! I hope the essay helped you.

If you’re looking for more, here are essays on other interesting topics:

- Essay on Financial Crisis 2008

- Essay on Festival Holi

- Essay on Festival

Apart from these, you can look at all the essays by clicking here .

Happy studying!

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

116 Financial Management Essay Topics

🏆 best essay topics on financial management, ✍️ financial management essay topics for college, 👍 good financial management research topics & essay examples, 🎓 most interesting financial management research titles, 💡 simple financial management essay ideas.

- Financial Operation Exposure Management Principles

- Strategic Financial Management: The Link Between Valuation and Financial Decisions

- Amazon Company: Financial Management

- Coca-Cola Company’s International Financial Management

- BP and Royal Dutch Shell Companies’ Financial Management

- Nokia Company’s Financial Analysis and Management

- Euroland Foods S.A. Strategic Financial Management

- BMW: Global Financial Management and Summary In the case study, the foreign exchange risk management strategy of BMW, discussed in order to identify the effectiveness of the strategies followed by it to get the optimum results.

- IBM’s Management Accounting & Financial Practices The financial tradition at IBM is that those who are charged with the responsibility to handle finances do that. Accounting is an important part of IBM as a corporation.

- JD Sports and Sports Direct Companies Financial Management This paper focuses on the financial analysis of two companies, JD Sports Fashion PLC and Sports Direct International PLC. Both are based in the UK but have a presence in other parts of the world.

- Financial Management of Marks & Spencer vs. Next Marks and Spencer demonstrates higher profit and liquidity than Next does. However, Next has more capability to pay off its debts judging by its interest cover ratio.

- Financial Planning. Money Management Skill Financial literacy can be defined as knowledge about financial planning and management that allows making reasonable choices about money spending and saving.

- Expo2020 Dubai’s Accounting and Financial Management This paper compares costs and revenues at two levels: state and organizational. Moreover, a comparison with other exhibitions that have been held in the last decade is presented.

- Financial Management Role in Healthcare With the introduction of the Affordable Care Act, electronic health records, and the Medicare billing system, the financial aspect of healthcare requires extra attention.

- Financial Management in Nokia Nokia is part of the mobile communications industry which is now one of the most rapidly growing industries in the world.

- Alibaba Corporation’s Financial Management This report offers an examination of Alibaba’s major financial ratios and performance indicators, assessing the firm’s cash flow, liquidity, solvency, and profitability ratios.

- Personal Financial Management and Financial Literacy By understanding the basic principles and minor aspects of money management such as the compound interest method, people can avoid bankruptcy and enhance their chances for the side income.

- Puma SE: Financial Management The paper examines Puma’s outlook as it will grow through sustainability-based initiatives, profitability options, and potential risks such as the uncertain economic situation.

- British Airways Group: Financial Management In this report, a critical analysis is made of the financial statements of the British Airways Group for the period February 28, 2008 to March 31, 2009.

- Financial Management During the Recession This paper shall set out to establish whether the recent financial crisis was in any way affected by global financial management or by other economic factors.

- Financial Management: Annual Savings for Retirement The paper will focus on estimating the annual savings that the client needs to make in order to achieve the retirement plan.

- Financial Management in the Healthcare Industry In this essay, the author focuses on the significance of financial management and the most crucial data for overall management.

- Project Cost and Finance Management Challenges The cost management functions are complex as projects come with different complexities. Many emerging projects pose different challenges in terms of their characteristics.

- Southwest Airlines’ Financial Management This paper analyzes the financial and trend ratios of Southwest Airlines, predicts future financial performance, and determines the return on equity.

- Accounting and Financial Management for Expo 2020 Dubai The use of technology is a fundamental aspect of the organizational development adopted in every aspect of the innovation exhibitions hosted by the association in Dubai.

- International Finance and Responsible Financial Management COVID-19 has a variety of ramifications for businesses in the future. Due diligence processes should focus on the target industry and the risks.

- EasyJet: Financial Management To ensure its survival during lockdowns and travel bans, EasyJet could take every step necessary to reduce costs, conserve cash burn, and enhance liquidity.

- Children’s Programs: Financing and Management This research paper will examine the domains specific to the financial management and planning of children’s programs.

- Strategic Financial Management: Diageo plc and SAB Miller plc Both Diageo and SAB Miller have strategic financial management that helps make complex decisions that increase their competitive advantages and eventually increase revenue.

- Financial Management of Aldar Properties UAE UAE has seen a massive growth in all business sectors and promises more to the investors, but recent financial scam has cast many things under doubts.

- Carnival Corporation’s Financial Management This paper details an account of the cost behavior of Carnival Corporation Inc. – a large multi-vessel cruise operator.

- The Neqi Firm’s Financial Management Due to the face mask sales during COVID-19, the Neqi firm, which creates and markets face masks, rose to the top of the list of profitable businesses.

- ABC Manufacturing: Financial Management In this research paper, it is required to evaluate the effectiveness of the financial management of ABC Manufacturing.

- Ramsay Health Care: Financial Management The results of this analysis reveal that Ramsay Health Care is engaging in desirable efforts and strategies that have led to considerable financial gains.

- Capital Investment and Financial Management A company’s capital investment is the money it spends on fixed assets like land, machinery, and buildings. Cash, assets, or loans may be used to fund the project.

- Rules of Financial Accounting: Economics and Management It is vital to describe control methods to show how an organization works to stop and curtail dishonest behavior and needless mistakes in its accounting records and data.

- Data Management and Financial Strategies By adopting comprehensive supply chain management, businesses can maximize the three main streams in the supply chain— information flow, product flow, and money flow.

- Possum Inc.’s Multinational Financial Management While Possum Inc. wants to become a multinational corporation, it is expected to know the nature of the local currency of the host currency and its conversion rates.

- Anne Arundel County: Public Finance and Management Analysis of revenue sources is extremely important to understand how the financial health of the county can be improved.

- Financial Management: Growth Financing Growth financing is an important topic of consideration for managers to continue the development of a business.

- Financial Management: Where Does the Money Go It is increasingly possible to hear about the importance of financial literacy in the modern world, which largely boils down to thoughtful money management.

- Jim’s Auto Body: Financial Management This paper examines the financial management of Jim’s Auto Body. Profitability is among the core elements considered in evaluating financial performance.

- Importance of Financial Management The implementation of non-monetary policies is proven to be useful as governments were able to overcome the financial recession.

- Valero Energy and Chevron Corporations’ Financial Management Valero Energy and Chevron Corporations faced a drastic decline in total revenues in 2020, mainly due to economic upheaval and uncertainty caused by COVID-19.

- Financial Management and Quality of Healthcare It is important for managers to understand how these facts are used to improve the financial position of the organisation.

- Sarbanes-Oxley Act and Financial Management The main concern regarding the Sarbanes-Oxley Act is whether it offers effective frameworks for preventing the falsification of a firm’s financial statements or not.

- Financial Management. Some Important Generalizations The article identifies several financial management approaches and perspectives, which when put in place are likely to hamper financial performance.

- Financial Management Competencies Discussion This article is about financial management: the author considers the most important competencies of a financial manager, liquidity risk, risk, and return scenarios.

- Healthcare Financial Management Association (HFMA) Healthcare Financial Management Association (HFMA) provides learning, analysis, and direction to its affiliates on the subjects relating to healthcare finance.

- Financial Management: Evaluation of the New Machine This report evaluates the viability of new trucks that are to be purchased by Southern Suburbs Transport by calculating the net present value.

- Stock Ticker Symbol: Financial Management of the Company The analysis of the company shows that the company has hardships with financial sustainability and adequate management of its assets and liabilities.

- Medical Centers Financial Management Factors that affect the financial performance of these hospitals include the indigent care load, case mix, payer mix, which also includes different levels of self-pay.

- Cyberchamp Inc.’s Ethics and Financial Management This paper aims at discussing the factors to consider while resolving ethical issues and making recommendations for the assistant finance manager in the Cyberchamp Inc. scenario.

- Clayton County Library’s Financial Management Study Limited funding has created financial constraints for Clayton County Library, Georgia. American Libraries experience the greatest threat to their financial stability.

- Financial Management of Healthcare Organizations Healthcare is one of the salient aspects of human beings since it determines their ability to do their daily activities. Sick people cannot perform their roles.

- Terms Used in Financial Management It is important to be aware of some of the general terms the organization uses in its financial management system: a balance sheet, an income statement and the operating cash flow.

- Financial Management and the Secondary Market for Common Stocks This paper will focus on the changes that the secondary market for common stocks in the USA has faced since the 1960s as the reflections of the financial situation in the country.

- Financial Management and Investment Banking This paper will focus on the primary markets, analyze the functions that investment bankers perform in the traditional process for issuing new securities.

- Thai-Lay Fashion Company Ltd.’s Financial Management There are several methods that will help managers make capital investment decisions. These will be discussed here with reference to the Thai-Lay Fashion Company Ltd.

- Public Budgeting Leadership and Financial Management To control the field of public budgeting correctly, one should have ideas about the practical methods of work and the theoretical aspects of this practice.

- A Company’s Value: Financial Management The current paper is aimed to discuss the aspects of financial management of an organization and its stakeholders.

- Financial Ratios: Management and Analysis A high price to earnings ratio suggests that the investors are expecting an enhanced earnings growth in the future as compared to other companies having a lower price to earnings ratio.

- Financial Institutions Management and Sources of Finance Finance is important to any business as it serves different functions which allow the business to run effectively. A company may need additional funds to expand its business operations or expenses.

- Management in Organizations: Financial Issues Creating the environment in which the staff delivers the performance of the finest quality is a necessity for managers in the contemporary business environment.

- Healthcare Organizations Financial Management The suggested paper describes the central components of the healthcare finance and lists phenomena that might impact decision-making regarding particular scenarios.

- Government Budgeting and Financial Management The public budgeting leaders have the responsibility of fulfilling various roles including planning, reforming, and budgeting.

- What Is Financial Management and How to Do It Effectively

- The Role of Financial Management in Elaborating and Implementing Organization’s Strategies

- Effective and Ineffective Financial Management Practices in Health Care

- Innovation in Financial Management: The Impact of Technology

- Building Financial Management Capacity in Fragile and Conflict-Affected States

- Debt Elimination Through Financial Management

- How Financial Management and Corporate Strategy Affect a Firm’s Performance

- Profit vs. Wealth Maximization: A Financial Management Perspective

- Financial Statement and Ratio Analysis: Key Tools to Successful Financial Management

- Hierarchical Clustering Algorithms and Data Security in Financial Management

- Public Financial Management Intervention and Its Impact on Corruption

- Financial Management and Forecasting Using Business Intelligence and Big Data Analytics

- Economic Performance and Corporate Financial Management of Shipping Firms

- Microsoft’s International Financial Management: An Analysis

- Financial Management Practices and Their Impact on Organizational Performance

- Computer Applications for Financial Management

- Antecedent Factors of Financial Management Behavior Among Young Adults

- Financial Management Information Systems and Open Budget Data

- Household Financial Management: The Connection Between Knowledge and Behavior

- Modern System of International Financial Management in Multinational Corporations

- International Financial Management: Exchange Rate Exposure

- Fiscal Decentralization and Public Subnational Financial Management

- Best Practices for Non-Profit Financial Management

- Public Financial Management, Health Financing, and Under-Five Mortality: A Comparative Empirical Analysis

- Entrepreneurial Finance: Fundamentals of Financial Planning and Management for Small Business

- How Technological Evolution in Financial Management Implies a Company’s Success

- Challenges Facing Financial Management in Schools

- Time to Reboot: Rethinking Public Financial Management and Budgeting in Greece

- Financial Management of a Non- vs. For-Profit: Which Is Harder?

- Examining Financial Management in Promoting Sustainable Business Practices & Development

- Banking, Finance, and Financial Management: What’s the Difference