- Search Search Please fill out this field.

- Cost of Goods Sold (COGS)

- Understanding COGS

What Is Included in the Cost of Goods Sold (COGS)?

- Formula and Calculation

- Accounting Methods

What Type of Companies Are Excluded From a COGS Deduction?

Cost of revenue vs. cogs, operating expenses vs. cogs.

- Cost of Sales vs. COGS

- Limitations

The Bottom Line

- Corporate Finance

- Financial Ratios

Cost of Goods Sold (COGS) Explained With Methods to Calculate It

:max_bytes(150000):strip_icc():format(webp)/jason_mugshot__jason_fernando-5bfc261946e0fb00260a1cea.jpg)

What Is Cost of Goods Sold (COGS)?

Cost of goods sold (COGS) refers to the direct costs of producing the goods sold by a company. This amount includes the cost of the materials and labor directly used to create the good. It excludes indirect expenses, such as distribution costs and sales force costs.

Cost of goods sold is also referred to as "cost of sales."

Key Takeaways

- Cost of goods sold (COGS) includes all of the costs and expenses directly related to the production of goods.

- COGS excludes indirect costs such as overhead and sales and marketing.

- COGS is deducted from revenues (sales) in order to calculate gross profit and gross margin. Higher COGS results in lower margins.

- The value of COGS will change depending on the accounting standards used in the calculation.

- COGS differs from operating expenses (OPEX) in that OPEX includes expenditures that are not directly tied to the production of goods or services.

Investopedia / Xiaojie Liu

Why Is Cost of Goods Sold (COGS) Important?

COGS is an important metric on financial statements as it is subtracted from a company’s revenues to determine its gross profit . Gross profit is a profitability measure that evaluates how efficient a company is in managing its labor and supplies in the production process.

Because COGS is a cost of doing business , it is recorded as a business expense on income statements. Knowing the cost of goods sold helps analysts, investors, and managers estimate a company’s bottom line. If COGS increases, net income will decrease. While this movement is beneficial for income tax purposes, the business will have less profit for its shareholders. Businesses thus try to keep their COGS low so that net profits will be higher.

Cost of goods sold (COGS) is the cost of acquiring or manufacturing the products or finished goods that a company then sells during a period, so the only costs included in the measure are those that are directly tied to the production of the products, including the cost of labor , materials, and manufacturing overhead.

For example, COGS for an automaker would include the material costs for the parts that go into making the car plus the labor costs used to put the car together. The cost of sending the cars to dealerships and the cost of the labor used to sell the car would be excluded.

Furthermore, costs incurred on the cars that were not sold during the year will not be included when calculating COGS, whether the costs are direct or indirect. In other words, COGS includes the direct cost of producing goods or services that were purchased by customers during the year. As a rule of thumb, if you want to know if an expense falls under COGS, ask: "Would this expense have been an expense even if no sales were generated?"

COGS only applies to those costs directly related to producing goods intended for sale.

What Is the Cost of Goods Sold (COGS) Formula?

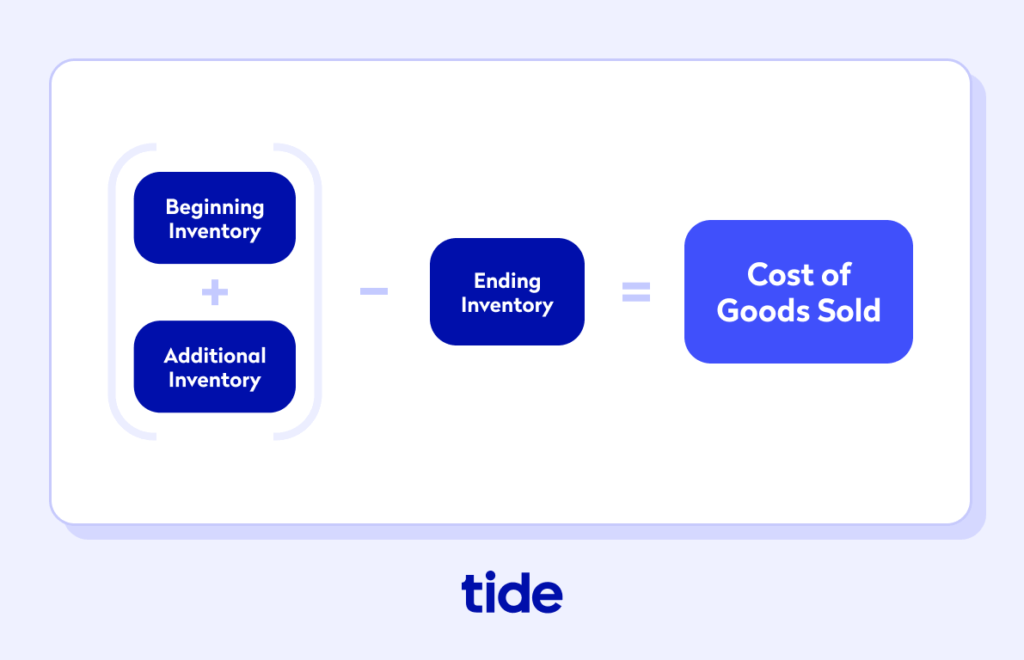

COGS = Beginning Inventory + P − Ending Inventory where P = Purchases during the period \begin{aligned} &\text{COGS}=\text{Beginning Inventory}+\text{P}-\text{Ending Inventory}\\ &\textbf{where}\\ &\text{P}=\text{Purchases during the period}\\ \end{aligned} COGS = Beginning Inventory + P − Ending Inventory where P = Purchases during the period

Inventory that is sold appears in the income statement under the COGS account. The beginning inventory for the year is the inventory left over from the previous year—that is, the merchandise that was not sold in the previous year.

Any additional productions or purchases made by a manufacturing or retail company are added to the beginning inventory. At the end of the year, the products that were not sold are subtracted from the sum of beginning inventory and additional purchases. The final number derived from the calculation is the cost of goods sold for the year.

The balance sheet has an account called the current assets account. Under this account is an item called inventory. The balance sheet only captures a company’s financial health at the end of an accounting period. This means that the inventory value recorded under current assets is the ending inventory.

What Are Different Accounting Methods For COGS?

The value of the cost of goods sold depends on the inventory valuation method adopted by a company. There are three methods that a company can use when recording the level of inventory sold during a period: first in, first out (FIFO) , last in, first out (LIFO), and the average cost method. The special identification method is used for high-ticket or unique items.

FIFO Method

The earliest goods to be purchased or manufactured are sold first. Since prices tend to go up over time, a company that uses the FIFO method will sell its least expensive products first, which translates to a lower COGS than the COGS recorded under LIFO. Hence, the net income using the FIFO method increases over time.

LIFO Method

LIFO is where the latest goods added to the inventory are sold first. During periods of rising prices, goods with higher costs are sold first, leading to a higher COGS amount. Over time, the net income tends to decrease.

Average Cost Method

The average price of all the goods in stock, regardless of purchase date, is used to value the goods sold. Taking the average product cost over a time period has a smoothing effect that prevents COGS from being highly impacted by the extreme costs of one or more acquisitions or purchases.

Special Identification Method

The special identification method uses the specific cost of each unit of merchandise (also called inventory or goods) to calculate the ending inventory and COGS for each period. In this method, a business knows precisely which item was sold and the exact cost . Further, this method is typically used in industries that sell unique items like cars, real estate, and rare and precious jewels.

Many service companies do not have any cost of goods sold at all. COGS is not addressed in any detail in generally accepted accounting principles (GAAP) , but COGS is defined as only the cost of inventory items sold during a given period. Not only do service companies have no goods to sell, but purely service companies also do not have inventories. If COGS is not listed on a company's income statement, no deduction can be applied for those costs.

Examples of pure service companies include accounting firms, law offices, real estate appraisers, business consultants, and professional dancers, among others. Even though all of these industries have business expenses and normally spend money to provide their services, they do not list COGS. Instead, they have what is called "cost of services," which does not count towards a COGS deduction.

Costs of revenue exist for ongoing contract services that can include raw materials, direct labor, shipping costs, and commissions paid to sales employees. These items cannot be claimed as COGS without a physically produced product to sell, however. The IRS website even lists some examples of "personal service businesses" that do not calculate COGS on their income statements. These include doctors, lawyers, carpenters, and painters.

Many service-based companies have some products to sell. For example, airlines and hotels are primarily providers of services such as transport and lodging, respectively, yet they also sell gifts, food, beverages, and other items. These items are definitely considered goods, and these companies certainly have inventories of such goods. Both of these industries can list COGS on their income statements and claim them for tax purposes.

Both operating expenses and cost of goods sold (COGS) are expenditures that companies incur with running their business; however, the expenses are segregated on the income statement. Unlike COGS, operating expenses (OPEX) are expenditures that are not directly tied to the production of goods or services.

Typically, SG&A (selling, general, and administrative expenses ) are included under operating expenses as a separate line item. SG&A expenses are expenditures, such as overhead costs, that are not directly tied to a product. Examples of operating expenses include the following:

- Office supplies

- Legal costs

- Sales and marketing

- Insurance costs

What Is the Difference Between Cost of Sales and Cost of Goods Sold?

While these terms are often used interchangeably, there's a subtle difference between the two . COGS specifically refers to the direct costs associated with producing goods or acquiring inventory that has been sold during a particular period. By contrast, COS includes not only the direct costs of goods sold but also other costs directly related to generating revenue, such as direct labor and direct overhead. Essentially, COS encompasses a broader range of expenses than COGS, as it may include additional costs associated with delivering the product or service to the customer.

What Are the Limitations of COGS?

COGS can easily be manipulated by accountants or managers looking to cook the books. It can be altered by:

- Allocating to inventory higher manufacturing overhead costs than those incurred

- Overstating discounts

- Overstating returns to suppliers

- Altering the amount of inventory in stock at the end of an accounting period

- Overvaluing inventory on hand

- Failing to write off obsolete inventory

When inventory is artificially inflated, COGS will be under-reported which, in turn, will lead to a higher-than-actual gross profit margin, and hence, an inflated net income.

Investors looking through a company’s financial statements can spot unscrupulous inventory accounting by checking for inventory buildup, such as inventory rising faster than revenue or total assets reported.

How Do You Calculate Cost of Goods Sold (COGS)?

Cost of goods sold (COGS) is calculated by adding up the various direct costs required to generate a company’s revenues. Importantly, COGS is based only on the costs that are directly utilized in producing that revenue, such as the company’s inventory or labor costs that can be attributed to specific sales. By contrast, fixed costs such as managerial salaries, rent, and utilities are not included in COGS. Inventory is a particularly important component of COGS, and accounting rules permit several different approaches for how to include it in the calculation.

What Is Included in the Cost of Goods Sold?

Cost of Goods Sold represents the direct costs attributable to the production of goods sold by a company. It includes various costs directly associated with the production or acquisition of the goods that a company sells during a specific period. These costs typically include:

- Direct materials

- Direct labor

- Manufacturing overhead

- Freight and shipping costs (but not the cost of shipping products to customers)

- Direct costs of production

Are Salaries Included in COGS?

COGS does not include salaries and other general and administrative expenses; however, certain types of labor costs can be included in COGS, provided that they can be directly associated with specific sales. For example, a company that uses contractors to generate revenues might pay those contractors a commission based on the price charged to the customer. In that scenario, the commission earned by the contractors might be included in the company’s COGS, since that labor cost is directly connected to the revenues being generated.

How Does Inventory Affect COGS?

In theory, COGS should include the cost of all inventory that was sold during the accounting period. In practice, however, companies often don’t know exactly which units of inventory were sold. Instead, they rely on accounting methods such as the first in, first out (FIFO) and last in, first out (LIFO) rules to estimate what value of inventory was actually sold in the period. If the inventory value included in COGS is relatively high, then this will place downward pressure on the company’s gross profit. For this reason, companies sometimes choose accounting methods that will produce a lower COGS figure, in an attempt to boost their reported profitability.

Cost of goods sold is the direct cost of producing a good, which includes the cost of the materials and labor used to create the good. COGS directly impacts a company's profits as COGS is subtracted from revenue. Companies must manage their COGS to ensure higher profits. If a company can reduce its COGS through better deals with suppliers or through more efficiency in the production process, it can be more profitable.

Internal Revenue Service. " Publication 535 (2022), Business Expenses ."

Mitchell Franklin, Patty Graybeal, and Dixon Cooper. " Principles of Accounting, Volume 1: Financial Accounting ," Pages 373 and 407.

Mitchell Franklin, Patty Graybeal, and Dixon Cooper. " Principles of Accounting, Volume 1: Financial Accounting ," Pages 652-654.

Internal Revenue Service. " Publication 334: Tax Guide for Small Business ," Page 27.

Mitchell Franklin, Patty Graybeal, and Dixon Cooper. " Principles of Accounting, Volume 1: Financial Accounting ," Page 405.

Internal Revenue Service. " Publication 334: Tax Guide for Small Business ," Pages 28-29.

:max_bytes(150000):strip_icc():format(webp)/GettyImages-499163667-046b2b7e5f7445dba7256cced22711e1.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Cost of Goods Sold (COGS): Definition and How to Calculate It

Whitney Vandiver writes for NerdWallet, currently focusing on home services, and has been published in the The Washington Post, the Los Angeles Times, The Seattle Times and The Independent. When she's not writing, she enjoys reading with a good cup of coffee and spending time with her husband and son. She is based in Houston.

Claire Tsosie is an assigning editor for the team responsible for expanding NerdWallet content to additional topics within personal finance. She has edited articles on a variety of topics, including home improvement, Social Security, estate planning, Medicare, crypto and business software. Previously, she was a credit cards writer at NerdWallet. Her work was featured by Forbes, USA Today and The Associated Press.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What is cost of goods sold?

What's included in cost of goods sold, what does cost of goods sold exclude, how is cost of goods sold calculated, cost of goods sold example, why you need to know the cost of goods sold.

Calculating the cost of goods sold, often referred to as COGS in accounting , is essential to determining whether your business is making a profit. It involves a simple formula and can be calculated monthly to keep track of progress or even less frequently for more established businesses.

Cost of goods sold, or COGS, is the total cost a business has paid out of pocket to sell a product or service. It represents the amount that the business must recover when selling an item to break even before bringing in a profit. Cost of goods sold includes any direct costs that a business incurs in the manufacture, purchase and sale or resale of products.

» MORE: Best inventory management software for small businesses

advertisement

QuickBooks Online

Costs of goods sold can include costs for:

Purchasing items for resale, including shipping.

Materials to make or manufacture products.

Packaging such as boxes to ship orders.

Costs for shipping and freight.

Direct labor for making or manufacturing products.

Sales costs such as commissions paid to salespeople.

Whether your business manufactures goods or orders them for resale will influence what types of costs you are likely to include. And not all service-based businesses keep track of cost of goods sold — it depends on how they use inventory .

For example, a massage therapist who keeps massage oil, towels and candles on hand to use when providing massages would not need to calculate the cost of goods sold because they are not selling the items to customers. Instead, they would include the cost of those items as tax deductions for operational costs.

However, a physical therapist who keeps an inventory of at-home equipment to resell to patients would likely want to keep track of the cost of goods sold. While they might use those items in the office during appointments, reselling that same equipment for patients to use at home plays a different role in cost calculations.

Service-based businesses might refer to cost of goods sold as cost of sales or cost of revenues.

Cost of goods sold does not include costs unrelated to making or purchasing products for sale or resale or providing services. General business expenses, such as marketing, are often incurred regardless of if you sell certain products and are commonly classified as overhead costs .

Examples of costs that are not included in the cost of goods sold include:

Rent or mortgage payments.

Equipment purchases.

Salaries of management-level employees.

Insurance premiums.

Administrative costs, such as office supplies.

To calculate the cost of goods sold, use the following formula for your chosen time period:

Beginning inventory + Inventory costs - Ending inventory = Cost of goods sold

Here’s an explanation of each variable:

Beginning inventory: This is the cost of goods sold for your inventory at the beginning of the time period. For example, if you started with 10 products that cost $100 each to make, your beginning inventory would be $1,000.

Inventory costs: This amount refers to additional costs incurred for inventory purchased or produced during the time period (aside from the beginning inventory you started with).

Ending inventory: This refers to the cost of inventory that you did not sell during the period.

Your business’s inventory cost accounting method determines how your inventory is valued, which ultimately affects your cost of goods sold, too. Here are the four most common inventory costing methods:

FIFO: Your business’s oldest inventory is sold first, according to the first in, first out (FIFO) method.

LIFO: If your business uses the last in, first out (LIFO) method, your newest inventory is sold first.

Weighted average: This method is one of the simplest and averages product costs. The date inventory was purchased or produced doesn’t matter as much as it does in the FIFO and LIFO methods.

Special identification: Each unique unit, which may be labeled with a serial number, is tracked and has its own precise cost.

If you haven’t decided on a method yet, factor in how each may affect your cost of goods sold. For more information on how to pick an inventory valuation method, read our FIFO vs. LIFO explainer .

Let’s look at an example. Alexis started the month with stock that had a cost of $8,300, which is her beginning inventory. Over the month, she ordered materials to make new items and ordered some products to resale, spending $4,000, which are her inventory costs. At the end of the month, she calculated that she still had $5,600 in stock, which is her ending inventory.

To calculate her cost of goods sold for the month, her formula would be:

8,300 + 4,000 - 5,600 = $6,700

If the COGS formula is confusing, think of it this way. When you add your inventory purchases to your beginning inventory, you see the total available inventory that could be sold in the period. By subtracting what inventory was leftover at the end of the period, you calculate the total cost of the goods you sold of that available inventory.

To calculate your cost of goods sold, use our calculator below.

Calculating profit

Correctly calculating the cost of goods sold is an important step in accounting. Any money your business brings in over the cost of goods sold for a time period can be allotted to overhead costs, and whatever is leftover is your business’s profit. Without properly calculating the cost of goods sold, you will not be able to determine your profit margin , or if your business is making a profit in the first place.

Adjusting pricing

A business’s cost of goods sold can also shine a light on areas where it can cut back to make more profit. You might be surprised to find that you’re making less profit than you expected with certain products. By analyzing the cost of goods sold for certain products, you can change vendors to order cheaper materials or raise your prices to increase your profit.

Completing financial statements

A business needs to know its cost of goods sold to complete an income statement to show how it’s calculated its gross profit. Businesses can use this form to not only track their revenue but also apply for loans and financial support.

» MORE: Best accounting software for small businesses

| Product | Starting at | Promotion | Learn more |

|---|---|---|---|

| QuickBooks Online 5.0 on QuickBooks' website | $30/month | 50% off | on QuickBooks' website |

| Xero 5.0 on Xero's website | $15/month | 30-day free trial | on Xero's website |

| Zoho Books 4.5 on Zoho Books' website | $0 | 14-day free trial | on Zoho Books' website |

| FreshBooks 4.5 on FreshBooks' website | $19/month | 30-day free trial | on FreshBooks' website |

- Send a message

- Partnering with Unleashed

- (NA) +1 888 813 6691

- (GB) +44 117 205 1394

- (AU) +61 3 7003 6819

- (NZ) +64 9 801 6337

- +64 9 801 6337

- General Enquiries

- Product Feedback

- Get Support

- Help Articles & How-tos

- Community Forum

- Company News

- Contact Sales

- Start a free trial

- Benefits of Unleashed

- The ROI of Unleashed

- Support & Onboarding

- Customer Success Stories

- Purchase Costs

- Purchase Orders

- Purchase Order Recosting

- Supplier Management

- Supplier Returns

- Receipt Purchases

- Purchase Order Management

- Batch Tracking

- Product Management

- Serial Number Tracking

- Barcode Scanning

- Inventory Optimization

- Demand Planning

- Disassembly

- Sales Orders

- Sales Quotes

- Freight and Charges

- Order Management

- Customer Pricing

- Quantity Discounts

- Business Intelligence

- Advanced Inventory Manager

- Integrations

- Manufacturing

- Distribution

- Food Manufacturing

- Health Supplements

- Coffee Roasters

- Solar and electronics

- Medical Devices

- The Unleashed Basics

- Advanced Unleashed Training

- Business Insights and Advice

- What's New in Unleashed

- Supply Chain Podcast

- Inventory Calculators

- The Backorder Newsletter

- Manufacturing Health Index Report

- Inventory Management Guide

- Inventory Accounting Guide

- Modern Manufacturing Guide

- Supply Chain Management Guide

- Manufacturing Productivity Guide

- Send a Message

What is Cost of Sales? Definition, Formula, & Examples

- Oliver Munro

- 10 months ago

- August 29, 2023

The cost of sales is an inventory accounting metric that measures the accumulated costs in getting finished goods to market. It represents your true cost of creating and selling a product.

This article will help you understand the cost of sales formula, how it can help you calculate profitability, and the steps you must take to reduce the cost of sales in your business.

What is cost of sales?

Cost of sales is the accrued total of all the costs of supplying a product. It only relates to those products you have sold. The cost of sales metric is most commonly used in the retail and eCommerce industries, whereas manufacturing businesses typically calculate profitability using the cost of goods sold formula instead.

Cost of sales and profitability

Cost of sales is a key indicator of profitability. It measures the cost of raw materials, labour, and overhead costs associated with producing finished goods . A high cost of sales doesn’t always imply lower profit margins . But if your costs of sales are disproportionate to your revenue, you should consider ways to manage your costs and improve profitability.

Cost of sales vs cost of goods sold

The difference between the cost of sales and the cost of goods sold (COGS) is in how your changes in inventories are managed. Both accounting approaches achieve the same result because your income and expenses will differ by equal amounts.

COGS measures the cost of producing a product from raw materials and parts. The cost of sales is the total cost of producing goods and services. However, those service providers who do not offer goods for sale will not include the cost of sales on their income statements.

Cost of sales vs operating expenses

Cost of sales and operating expenses are both important measures in assessing the profitability of a business. However, there are key differences in what they measure.

Cost of sales directly relates to a product or service. On the other hand, operating expenses support the whole business.

Costs that contribute to the production of a product or service – for example, raw materials, packaging, and the wages of employees directly involved in the delivery of goods – can be measured using the cost of sales. In contrast, operating expenses measure how much you spend on overhead costs such as rent, insurance, utilities, and office supplies.

While your cost of sales breaks down more readily identifiable expenses, your operating expenses look at general overall costs that are harder to classify.

Cost of sales formula

The cost of sales formula combines all the raw materials, labour, and direct purchases necessary to produce goods for sale. It includes employee wages and any shipping costs of the finished product.

Use this formula to calculate the total cost of sales in your business:

Beginning Inventory + Purchases – Ending Inventory = Cost of Sales

As an example, let’s say you have $35,000 in on-hand inventory at the beginning of your financial quarter. Throughout that quarter you spend $15,000 on raw materials, wages, and delivery costs.

With $7,000 worth of inventory left at the end of the period, you calculate the cost of sales for the period using the cost of sales formula:

$35,000 + $15,000 – $7,000 = $43,000

Total Cost of Sales = $43,000

How to calculate cost of sales

The main challenge with calculating the cost of sales is understanding which of your outgoings relate to your cost of sales. A simple way to determine what to include in the cost of sales is to look at the expenses you are currently paying.

For example, you could still manufacture your products if you stopped paying for marketing activities . Marketing expenses, therefore, should not be included in your cost of sales formula.

But if you stopped paying for, say, a plastic button that’s needed to produce a finished good, then you would be unable to get the product to market. That means this expense should be included in your cost of sales calculation.

Cost of sales combines all the costs associated with selling goods, from production through to retail.

What’s included in cost of sales?

What is and what is not included in your cost of sales calculation will largely depend on your business, the industry you’re in, and the types of products you are producing. If any cost is not directly or indirectly part of your production, it should not be included in your cost of sales.

Expenses that are often included in cost of sales:

- Raw materials required for production

- Salaries and wages for production staff

- Software licensing, website hosting fees, and cloud storage costs that are not part of your operating expenses

- Product packaging and packing material

- Storage costs incurred for storing both raw materials and finished goods

Expenses that are typically not included in cost of sales:

- Operating or fixed costs like rent and utilities

- Product development costs

- Commissions for your sales team

- Specific overhead costs not directly tied to production

- Administration costs

- Advertising and promotion

In retail, the cost of sales will also include any payments made to manufacturers and suppliers for the purchase of merchandise that you have sold.

Cost of sales examples

Cost of sales and COGS are used in different ways depending on the industry a business serves. Let’s look at some cost of sales examples across common sectors.

A manufacturer will determine cost of sales or COGS by calculating all the manufacturing costs that go into producing goods. This can mean adding up production staff wages, raw material costs, and any purchases made that directly impact the manufacturing of products.

Once a manufacturer knows their cost of sales , they can investigate how much the market is willing to pay for their products and set a strategically competitive price that maximises profitability and sales.

Small business

If a small business purchases goods from a wholesaler, adds a personal touch to them, and resells the product then you could calculate the cost of sales by combining those purchase costs with the costs to prepare the goods for sale. For example, a small business’s cost of sales calculation could include the purchasing cost of inventory and shipping from its suppliers along with the costs to customise and repackage the received goods.

Ecommerce and retail

In a retail or eCommerce business , inventory is typically purchased from a wholesaler or manufacturer for resale, either in a retail outlet or through an online store. The cost of sales will include the purchase price, any storage costs, and the cost of shipping goods to the customer.

Cost of sales accounting

Cost of sales accounting calculates the accumulated total of all costs you use to create a product that is sold. The cost of sales is a key performance indicator of your business. It measures your ability to design, source, or manufacture goods at a reasonable price – and can be compared with revenue to determine profitability.

If you’re using the periodic inventory method to calculate your cost of sales, then the costs of goods purchased are typically debited to your purchase account and credited to your accounts payable account.

Your balance of purchases account, at the end of the reporting period, is moved to your inventory account. This is shown as a debit to your inventory and credited to your purchases account. The result is a book balance in your inventory account that equals your actual ending inventory amount.

This variance is then written off as your cost of goods sales. It is debited to your cost of goods sold account and credited to your inventory account.

If you’re using the perpetual inventory method to calculate your cost of sales, then the cost of sales or COGS account increases as the product gets sold. In other words, the cost of sales is recorded with every sale in separate journal entries , rather than at the end of the period in a single entry.

Is cost of sales an expense?

Yes, your cost of sales is an expense. It is neither what your business owns (an asset), nor a liability that you owe. Cost of sales is directly related to the amount of money your business spends to acquire or produce a product you sell.

Cost of sales is one of the most important business expenses to consider when calculating profitability.

How to minimise your cost of sales

The purpose of reducing your cost of sales is to increase overall profitability within the business. The less it costs to produce goods, the better your profit margins.

There are several ways to minimise the cost of sales, including:

- Automate your manual processes

- Reduce wasteful activities

- Remove unnecessary product features

- Negotiate with suppliers for better pricing

- Optimise your inventory management

- Improve your warehouse logistics

- Invest in the growth of your employees

Let’s break these down.

1. Automate manual processes

Automation helps to lower the cost of sales while increasing your sales and productivity and supports business growth. Around 30% of sales tasks are automatable using current technology.

Some of those tasks include:

- Order management

- Lead identification

- Sales and operations planning

- Analytics and reporting

Review your entire sales chain to identify areas that will benefit from automation.

Implement chatbots to help generate leads, increase your sales, and free up your sales team’s time. Chatbot technology offers substantial benefits to both your business and your customers.

Analytic tools can be utilised to increase customer acquisition and engagement, create a more personalised customer experience, and reduce customer churn.

2. Reduce waste

Look for opportunities to reduce physical waste and inefficiencies in your production processes. This includes raw material waste, shrinkage, and damaged or stolen goods.

If your material waste is high, look at ways to redesign your manufacturing process to reduce this waste.

Operational lost time or shipping process delays can also adversely affect your cost of sales.

Scrutinize all areas of your supply chain to identify instances of waste. Implement lean manufacturing methods to reduce or eliminate waste where possible.

3. Remove unnecessary product features

In some cases, it may be possible to reduce the cost of sales by changing the ingredients, components, or materials used to produce your products.

It’s important when removing product features as a cost-cutting measure that you are not removing product qualities that your customers value.

Research your customers’ reasons for purchasing your products. What are the features and benefits they look for? Is it low cost, unique features, or high quality?

When you establish which product features are important to your customers, you can selectively scale back those elements they see little value in.

4. Leverage suppliers

Negotiate with your suppliers to source better prices or discounts on bulk purchases.

In leveraging suppliers, you can take advantage of economies of scale that offer cost savings proportionate to increased production or sales. Take care to ensure any savings on bulk purchases are not lost to increased storage charges or the additional carrying costs associated with holding large amounts of inventory.

You can also work with suppliers to streamline purchase order cycle times to improve inventory lead times. This enables you to order less and frequently reduce inventory costs.

5. Optimise inventory management

Inventory ties up working capital, reduces cash flow and costs money the longer you keep it in storage. In some cases, goods can perish or become obsolete before they’re able to be sold.

It’s important to carefully manage your inventory to lower your cost of sales and increase profitability. Inventory management software and an optimised warehouse can help you efficiently manage and lower the cost of inventory.

In addition to these benefits, inventory software helps you make smarter purchasing decisions based on historical data and demand forecasts.

6. Improve warehouse operations

Organised warehouses and workspaces aid productivity because staff are not wasting time searching for tools and equipment.

Create an organised floor plan that is easy to navigate and supports operational flow and processes. Expand the footprint of your warehouse by making use of vertical space.

Ensure staff can access it easily and safely with the right equipment for efficient storage and picking. Standardise bins and keep selves neat and orderly. Label everything.

Production, employee, and storage expenses all represent aspects of your cost of sales; an efficient warehouse can reduce the cost of sales by improving productivity.

7. Invest in your employees

Employee labour costs represent a significant portion of the cost of sales. While the automation of manual tasks can minimise some of these labour costs, investing in employee development and upskilling their technical skills will save you money in the long term.

Disengaged, unhappy, and undervalued employees result in high staff turnover. High employee turnover will cost your business lost time, operational problems, reduced productivity, and the expense of recruiting and inducting new staff.

Training and development of your staff resources can drive value through greater productivity, performance, and increased customer service. Invest in your staff to reduce your costs and achieve higher profits.

Accurately track your cost of sales in real time with Unleashed

Keeping track of all the direct and indirect costs that go into selling a product manually is a time-consuming process.

Worse, it’s prone to producing errors that can hurt your productivity and cut into your bottom line.

Unleashed provides automated inventory management software that automatically tracks and records all your purchasing, sales, and production costs as they occur. It allows you to manage your inventory on the cloud while removing inefficiencies from your key workflows.

To learn more about how Unleashed helps you accurately track cost of sales, follow these next steps:

1. Watch an inventory software demo . Learn how automated inventory software enables you to track all your crucial product costs in real time, slashing hours of admin time and ensuring accurate financial reporting.

2. Sign up for a free 14-day trial . Discover first-hand the ways Unleashed can help you streamlining reporting processes and optimise your inventory management with a risk-free two-week trial of Unleashed.

3. Chat with an expert to assess your needs . Are you ready to take your business to the next step? Lock in a free chat with one of our friendly in-house experts for an honest discussion about improving your operations and cost tracking.

Article by Oliver Munro in collaboration with our team of specialists. Oliver's background is in inventory management and content marketing. He's visited over 50 countries, lived aboard a circus ship, and once completed a Sudoku in under 3 minutes (allegedly).

- (Global) +64 9 801 6337

- B2B eCommerce

- Unleashed Integrations

- Integrate with Us

- Health and Supplements

- Help Center

- Learning Academy

Please wait while you are redirected to the right page...

What is Sales Planning? How to Create a Sales Plan

Published: December 06, 2023

Sales planning is a fundamental component of sound selling. After all, you can‘t structure an effective sales effort if you don’t have, well, structure . Everyone — from the top to the bottom of a sales org — benefits from having solid, actionable, thoughtfully organized sales plans in place.

This kind of planning offers clarity and direction for your sales team — covering everything from the prospects you‘re trying to reach to the goals you’re trying to hit to the insight you're trying to deliver on.

But putting together one of these plans isn‘t always straightforward, so to help you out, I’ve compiled this detailed guide to sales planning — including expert-backed insight and examples — that will ensure your next sales plan is fundamentally sound and effective.

hbspt.cta._relativeUrls=true;hbspt.cta.load(53, 'b91f6ffc-9ab7-4b84-ba51-e70672d7796e', {"useNewLoader":"true","region":"na1"});

In this post, we'll cover:

What is a sales plan?

Sales planning process.

- What goes in a sales plan template?

How to Write a Sales Plan

Tips for creating an effective sales plan, sales plan examples, strategic sales plan examples.

A sales plan lays out your objectives, high-level tactics, target audience, and potential obstacles. It's like a traditional business plan but focuses specifically on your sales strategy. A business plan lays out your goals — a sales plan describes exactly how you'll make those happen.

Sales plans often include information about the business's target customers, revenue goals, team structure, and the strategies and resources necessary for achieving its targets.

Free Sales Plan Template

Outline your company's sales strategy in one simple, coherent sales plan.

- Target Market

- Prospecting Strategy

Download Free

All fields are required.

You're all set!

Click this link to access this resource at any time.

What are the goals of an effective sales plan?

And if (or more likely when ) those goals change over time, you need to regularly communicate those shifts and the strategic adjustments that come with them to your team.

Your sales strategy keeps your sales process productive — it offers the actionable steps your reps can take to deliver on your vision and realize the goals you set. So naturally, you need to communicate it effectively. A sales plan offers a solid resource for that.

For instance, your sales org might notice that your SDRs are posting lackluster cold call conversion rates. In turn, you might want to have them focus primarily on email outreach, or you could experiment with new sales messaging on calls.

Regardless of how you want to approach the situation, a thoughtfully structured sales plan will give both you and your reps a high-level perspective that would inform more cohesive, effective efforts across the team.

An effective sales org is a machine — one where each part has a specific function that serves a specific purpose that needs to be executed in a specific fashion. That's why everyone who comprises that org needs to have a clear understanding of how they specifically play into the company's broader sales strategy.

Outlining roles and responsibilities while sales planning lends itself to more efficient task delegation, improved collaboration, overlap reduction, and increased accountability. All of which amount to more streamlined, smooth, successful sales efforts.

Sales planning can set the framework for gauging how well your team is delivering on your sales strategy. It can inform the benchmarks and milestones reps can use to see how their performance stacks up against your goals and expectations.

It also gives sales leadership a holistic view of how well a sales org is functioning as a whole — giving them the necessary perspective to understand whether they have the right people and tools in place to be as successful as possible.

Sales planning isn‘t (and shouldn’t) be limited to the actual sales plan document it produces. If that document is going to have any substance or practical value, it needs to be the byproduct of a thorough, well-informed, high-level strategy.

When sales planning, you have some key steps you need to cover — including:

- Gather sales data and search for trends.

- Define your objectives.

- Determine metrics for success.

- Assess the current situation.

- Start sales forecasting.

- Identify gaps.

- Ideate new initiatives.

- Involve stakeholders.

- Outline action items.

When putting this list together, I consulted Zach Drollinger — Senior Director of Sales at edtech provider Coursedog — to ensure the examples detailed below are sound and accurate.

Step 1: Gather sales data and search for trends.

To plan for the present and future, your company needs to look to the past. What did sales look like during the previous year? What about the last five years? Using this information can help you identify trends in your industry. While it's not foolproof, it helps establish a foundation for your sales planning process.

For the sake of example, let‘s say that I’m a new sales director for an edtech company that sells curriculum planning software to higher education institutions. My vertical is community colleges, and my territory is the East Coast.

Once I assume this new role, I‘m going to want to gather as much context as possible about my vertical and how my company has approached it historically. I would pull information about how we’ve sold to this vertical.

How much new business have we closed within it in the past five years? How does that compare to how we perform with other kinds of institutions? Are we seeing significant churn from these customers?

I would also want to get context about the general needs, interests, and pain points of the kinds of institutions I‘m selling to. I’d look for insight into figures like degree velocity, staff retention, and enrollment.

Ultimately, I would get a comprehensive perspective on my sales process — a thorough understanding of where I stand and what my prospects are dealing with. That will ensure that I can deliver on the next step as effectively as possible.

Step 2: Define your objectives.

How do you know your business is doing well if you have no goals? As you can tell from its placement on this list, defining your goals and objectives is one of the first steps you should take in your sales planning process. Once you have them defined, you can move forward with executing them.

To extend the example from the previous step, I would leverage the context I gathered through the research I conducted about both my and my prospect's circumstances. I would start setting both broader goals and more granular operational objectives .

For instance, I might want to set a goal of increasing sales revenue from my vertical. From there, I would start putting together the kind of specific objectives that will facilitate that process — like connecting with administrators from at least 30 community colleges, booking demos with at least 10 schools, and successfully closing at least five institutions.

Obviously, those steps represent a streamlined (and unrealistically straightforward) sales process, but you get the idea — I would set a concrete goal, supplemented by SMART objectives , that will serve as a solid reference point for my org's efforts as the sales process progresses.

Step 3: Determine metrics for success.

Every business is different. One thing we can all agree on is that you need metrics for success. These metrics are key performance indicators (KPIs). What are you going to use to determine if your business is successful? KPIs differ based on your medium, but standard metrics are gross profit margins, return on investment (ROI), daily web traffic users, conversion rate, and more.

I kind of covered this step in the previous example, but it still warrants a bit more elaboration. The “M” in SMART goals (“measurable”) is there for a reason. You can‘t tell if your efforts were successful if you don’t know what “successful” actually means.

The edtech sales example I‘ve been running with revolves mostly around me assuming ownership of an existing vertical and getting more out of it. So it’s fair to assume that sales growth rate — the increase or decrease of sales revenue in a given period, typically expressed as a percentage — would be an effective way to gauge success.

I might want to structure my goals and objectives around a sales growth rate of 20% Y/Y within my vertical. I would make sure my org was familiar with that figure and offer some context about what it would take to reach it — namely, how many institutions we would need to close and retain.

Step 4: Assess the current situation.

How is your business fairing right now? This information is relevant to determining how your current situation holds up to the goals and objectives you set during step two. What are your roadblocks? What are your strengths? Create a list of the obstacles hindering your success. Identify the assets you can use as an advantage. These factors will guide you as you build your sales plan.

Continuing the edtech example, I would use the historical context I gathered and the objectives I set to frame how I look at my current circumstances. I might start by considering my goal of increasing revenue by 20% Y/Y. In that case, I would look at the company's retention figures — ideally, that would give me a sense of whether that needs to be a major area of focus.

I would also try to pin down trends in the colleges that we've already closed — are there any pain points we consistently sell on? I might take a closer look at how we demo to see if we might be glossing over key elements of our value proposition. Maybe, I would use conversation intelligence to get a better sense of how reps are handling their calls.

Ultimately, I would try to identify why we're performing the way we are, the inefficiencies that might be resulting from our current strategy, and how we can best set ourselves up to sell as effectively as possible.

Step 5: Start sales forecasting.

Sales forecasting is an in-depth report that predicts what a salesperson, team, or company will sell weekly, monthly, quarterly, or annually. While it is finicky, it can help your company make better decisions when hiring, budgeting, prospecting, and setting goals.

After the COVID-19 pandemic, economics has become less predictable. Claire Fenton , the owner of StrActGro — a professional training and coaching company — states, “Many economic forecasters won't predict beyond three months at a time.” This makes sales forecasting difficult. However, there are tools at your disposal to create accurate sales forecasts .

In our edtech example, I would approach this step by trying to estimate how my sales org is going to fare with the specific vertical we‘re pursuing in the time window we’ve allotted.

The method I decide to go with will depend on factors like how many concrete opportunities we have lined up — in addition to elements like the kind of historical data we have handy, how the reps working these deals tend to perform, and the degree of insight we have about our potential customers.

Let's say I consider those factors and decide to run something called a multivariable analysis. In that case, I could start by taking stock of the opportunities my reps have lined up. Then, I could look at the reps working those deals, their typical win rates, and the time they have to close — among other factors.

For instance, I might calculate that a rep working with a particularly large institution has a 50% chance of closing within the window we‘ve allotted. Using that insight, we could attribute 50% of the potential deal size to our forecast — we’d repeat that process with all of the opportunities in question and ideally get a solid sense of the revenue we can expect to generate in this window.

Step 6: Identify gaps.

When identifying gaps in your business, consider what your company needs now and what you might need in the future. First, identify the skills you feel your employees need to reach your goal. Second, evaluate the skills of your current employees. Once you have this information, you can train employees or hire new ones to fill the gaps.

Continuing the edtech example, let‘s say my forecast turned up results that weren’t in keeping with what we need to reach our goals. If that were the case, I would take a holistic look at our process, operations, and resources to pin down inefficiencies or areas for improvement.

In my search, I find that our sales content and marketing collateral are dated — with case studies that don‘t cover our product’s newest and most relevant features. I also might see that our reps don‘t seem to have too much trouble booking demos, but the demos themselves aren’t converting due to a lack of training and inconsistent messaging.

And finally, I find that a lack of alignment with marketing has prospects focusing on unrealistic outcomes our sales team can‘t deliver on. Once I’ve identified those gaps, I would start to hone in on ways to remedy those issues and improve those elements.

Step 7: Ideate new initiatives.

Many industry trends are cyclical. They phase in and out of “style.” As you build your sales plan, ideate new initiatives based on opportunities you may have passed on in previous years.

If your business exclusively focused on word-of-mouth and social media marketing in the past, consider adding webinars or special promotions to your plan.

In the edtech example we've been running with, I would likely ideate initiatives based on the gaps I identified in the previous step. I would start a push to ensure that our sales content and marketing collateral are up-to-date and impressive.

I would also consider new training programs to ensure that our coaching infrastructure is prioritizing how to conduct effective demos. Finally, I would start to work on a plan with marketing to ensure our messaging is aligned with theirs — so we can make sure prospects' expectations are realistic and effective.

One way or another, I would take the gaps I found and find concrete, actionable ways to fill them. I would make sure that these initiatives aren't abstract. Just saying, " We're going to be better at demos," isn‘t a plan — it’s a sentiment, and sentiments don't translate to hard sales.

Step 8: Involve stakeholders.

Stakeholders are individuals, groups, or organizations with a vested interest in your company. They are typically investors, employees, or customers and often have deciding power in your business. Towards the end of your sales planning process, involve stakeholders from departments that affect your outcomes, such as marketing and product. It leads to an efficient and actionable sales planning process.

This step is sort of an extension of the previous two — once I‘ve identified the key issues and roadblocks obstructing my edtech startup’s sales org, I would start identifying the right people to fulfill the necessary initiatives I've put together.

In this example, I would tap some stakeholders in charge of our sales content and marketing collateral to produce newer, more relevant case studies and whitepapers we can pass along to the institutions we're working with.

I would also go to middle management and either offer more direction for coaching on demos or bring in a third-party training service to offer more focused, professional insight on the issue.

Finally, I would connect with marketing leadership to align on the benefits and outcomes we generally stress when pitching the schools we sell to. That way, we can ensure that the institutions we're connecting with have realistic expectations of our product or service that we can speak to more clearly and effectively.

Step 9: Outline action items.

Once you have implemented this strategy to create your sales planning process, the final step is outlining your action items. Using your company's capacity and quota numbers, build a list of steps that take you through the sales process. Examples of action items are writing a sales call script, identifying industry competitors, or strategizing new incentives or perks.

In our edtech example, some key action items might be:

- Revamp our prospecting strategy via more involved coaching and re-tooled sales messaging.

- Revamp administrator and college dean buyer personas.

- Conduct new trainings on demoing our software.

- See our new prospecting strategy from ideation to execution.

- Align with our sales enablement stakeholders for new, more relevant case studies and whitepapers.

Obviously, that list isn‘t exhaustive — but those are still the kinds of steps we would need to clarify and take to structure a more effective high-level strategy to produce different (ideally much better) results than we’ve been seeing.

One thing to keep in mind is that sales planning shouldn't end with creating the document.

You‘ll want to reiterate this process every year to maintain your organization's sales excellence.

Now that you‘re committed to the sales planning process, let's dive into the written execution component of sales planning.

Featured Resource: Sales Plan Template

Don't forget to share this post!

Related articles.

Outcome-Based Selling: An Overview + Practical Tips

The Ins & Outs of Cold Emailing That Delivers Results

![cost of sales in business plan What Is Cross-Selling? Intro, Steps, and Pro Tips [+Data]](https://knowledge.hubspot.com/hubfs/ft-cross-selling.webp)

What Is Cross-Selling? Intro, Steps, and Pro Tips [+Data]

Company Growth Strategy: 7 Key Steps for Business Growth & Expansion

9 Bad Sales Habits (& How to Break Them In 2024), According to Sales Leaders

![cost of sales in business plan 22 Best Sales Strategies, Plans, & Initiatives for Success [Templates]](https://www.hubspot.com/hubfs/Best-Sales-Strategies-1.png)

22 Best Sales Strategies, Plans, & Initiatives for Success [Templates]

9 Key Social Selling Tips, According to Experts

![cost of sales in business plan 7 Social Selling Trends to Leverage This Year [New Data]](https://www.hubspot.com/hubfs/social%20selling%20trends.png)

7 Social Selling Trends to Leverage This Year [New Data]

![cost of sales in business plan How Do Buyers Prefer to Interact With Sales Reps? [New Data]](https://www.hubspot.com/hubfs/person%20phone%20or%20online%20sales%20FI.png)

How Do Buyers Prefer to Interact With Sales Reps? [New Data]

![cost of sales in business plan 7 Sales Tips You Need to Know For 2024 [Expert Insights]](https://www.hubspot.com/hubfs/Sales%20Tips%202024%20FI.png)

7 Sales Tips You Need to Know For 2024 [Expert Insights]

Outline your company's sales strategy in one simple, coherent plan.

Powerful and easy-to-use sales software that drives productivity, enables customer connection, and supports growing sales orgs

Blog / Small business tips / How to calculate cost of sales (with examples provided)

How to calculate cost of sales (with examples provided)

Cost of sales, or cost of goods sold (COGS), can be daunting when running a business. For your company to be profitable, you must be well-versed in managing cash flow and operating at optimum efficiency.

While the definition of cost of sales is straightforward to understand, the calculation can be complex depending on your products. The cost of sales formula includes various direct and indirect costs, which can make things more complicated.

In this article, we’ll have a closer look at these costs and show you how to carry out the cost of sales calculations alongside various other metrics.

Quick Tip: It’s important that you have a general understanding of small business accounting as a whole. This includes how to open a business bank account , track your expenses , calculate your business tax, and more. To gain a high-level overview, we recommend reading our beginner’s guide to small business accounting .

Table of contents

What to include in your cost of sales, cost of sales formula, examples of cost of sales, what is excluded from cost of sales, other important ratios to consider, manage your cash flow with ease.

Before we look at the cost of sales formula, let’s explore the three values you’ll need to complete the calculation: beginning inventory, ending inventory and additional inventory .

Beginning Inventory: This is the inventory when you start a new accounting period. It includes the products and raw materials left over from the previous period.

Additional Inventory: This is the inventory purchased during the specified period.

Ending Inventory: This is the inventory the company has left at the end of the specified period, including the products and raw materials that didn’t sell during that time.

Now that you have a deeper understanding of what contributes to your cost of sales, let’s put all of them together into the final formula:

Cost of sales = (Beginning Inventory + New Inventory) – Ending Inventory.

You’ll need to know the inventory cost method that your business or accountant is using.

Different approaches are used depending on how your company manages its costs, which impacts the value of cost of sales.

Businesses use the following three inventory cost methods :

- FIFO (First in, first out)

- LIFO (Last in, first out)

- Average cost method

In this method, the earliest manufactured or purchased goods are sold first. Considering prices rise over time, you sell your least expensive items first.

Therefore, the value of cost of sales using FIFO will be relatively lower . You can apply this method when selling items with a shorter shelf life.

This method is the opposite of FIFO, where the most recently manufactured or purchased goods get sold first. During periods of inflation, you will sell your items that came at a higher cost first.

Therefore, the value of cost of sales using LIFO will be relatively higher than when using the FIFO method.

Weighted average cost

In this method, the average cost of all purchased or manufactured inventory is used, regardless of the purchase or production date.

It prevents inaccurate or extreme values , making it much easier to calculate cost of sales, profitability, and taxes.

To better understand how to calculate cost of sales, we’ve given an example of a fictional business below. These calculations can look different if there’s inflation in inventory, which brings the inventory cost methods into play.

1. No inventory inflation

Let’s start with calculating cost of sales for TERRA T-shirts, a company that recently began operating.

Beginning inventory: 0.

Additional inventory: They bought 500 t-shirts from a wholesaler for £5 each at the beginning of the year. Thus, 500 x £5 = £2,500.

Ending inventory: By the end of the year, they had sold 350 t-shirts for £8, leaving 150 unsold. Thus, (500-350) x £5 = £750.

Next, we plug these numbers into the cost of sales formula:

Cost of sales = Beginning Inventory + Additional Inventory – Ending Inventory

= 0 + £2,500 – £750

2. Inventory inflation included

Now, let’s see how cost of sales is calculated when applying the three inventory cost methods .

This time, TERRA T-shirts bought 250 t-shirts for £5 in January, then another 250 t-shirts for the inflated price of £7 in February.

Beginning Inventory: 0.

Additional Inventory:

| Month | Units Purchased | Cost per Shirt | Value |

|---|---|---|---|

| January | 250 | £5 | £1,250 |

| February | 250 | £7 | £1,750 |

Ending Inventory: By the end of the year, they had sold 225 t-shirts for £8, leaving 275 unsold.

Depending on the inventory cost method used, the cost of sales value will differ:

| FIFO (first in, first out) | LIFO (last in, first out) | Avg weight cost | |

|---|---|---|---|

| Units Sold | 225 | 225 | 225 |

| Cost per Shirt | £5 | £7 | £6 |

| | 500 x £5 = £2,500 | 500 x £7 = £3,500 | 500 x £6 = £3,000 |

| | (500-225) x £5 =£1,125 | (500-225) x £7 =£1,575 | (500-225) x £6 =£1,350 |

| | 0 + £2,500 – £1,125 | 0 + £3,500 – £1,575 | 0 + £3,000 – £1,350 |

According to the Generally Accepted Accounting Principles (GAAP) , cost of sales is the cost of inventory sold during any given period.

But what about companies that don’t have any inventory at all? These could include:

- SaaS businesses

- Business consultants

- Professional dancers

- Accounting firms

As they have zero cost of sales, this won’t be visible on income statements.

That doesn’t mean they don’t have any expenses. Such companies may still be subject to operating expenses (OpEx) .

Examples of typical operating expenses for small business owners:

- Office stationery and equipment

- Utility bills

Cost of revenue refers to all expenses involved in delivering a product or service to customers. As such, it extends beyond the manufacturing costs covered by COGS to include marketing and distribution expenses.

Examples of cost of revenue expenses :

- Direct labour

- Cost of shipping

- Raw materials

Cost of sales are used in various other metrics and ratios to help you keep the financial health of your business on track. Here are a few ratios where cost of sales is used :

1. Gross Margin

What is it? The percentage of sales revenue a company retains after incurring all cost of sales.

Formula: Gross margin = (Sales Revenue – Cost of Sales) / Sales Revenue x 100

Example: In 2021, Company X reported their total revenue at £800,000 and cost of sales at £400,000.

Gross margin = (£800,000 – £400,000) / £800,000 x 100 → 50%

2. Cost of Sales Ratio

What is it? It shows the percentage of sales revenue used to pay for expenses that vary directly with sales.

Formula: Cost of sales ratio = Cost of Sales/ Net Sales x 100

Example: At the end of the year, Company X’s total net sales are £700,000, and their cost of sales is £500,000.

Cost of sales ratio = (£500,000 / £700,000) x 100 → 71.4%

3. Inventory Turnover

What is it? It shows how often a company has sold and replaced inventory during a given period.

Formula: Inventory turnover = Cost of Sales / Average Inventory

Example: At the beginning of the year, Company X had £350,000 worth of inventory. They bought £500,000 worth of additional inventory. By the end of the year, they had £250,000 worth of inventory left.

Cost of sales = 350,000 + 500,000 – 250,000 → 600,000 Inventory turnover = 600,000/(350,000+250,000/2) → 2

In our adjoining article Cost of sales: what you need to know for your business , we dive deeper into why it’s important to know these costs, and how they can optimise your cash flow.

The formulas and calculations in this article are stellar for figuring out your profit margins , forecasting your cash flow and maintaining profitability. Keeping track of your cost of sales will help you better understand which areas of production are eating up most of your money and where you can increase efficiency.

At Tide, we automate your small business accounting.

Our accounting software takes care of bookkeeping and taxes, so you can go back to doing what you love. Access P&L reports, insights and more in real-time, giving you a greater understanding of your business’s financial health.

Photo by Andrea Piacquadio, published on Pexels

Subscribe to our FREE business tips newsletter

I am a: Sole Trader Registered Business

By subscribing you agree to receive marketing communications from Tide. You can unsubscribe anytime using the link in the footer of any of our emails. See our privacy policy .

Thanks for signing up.

Related Articles

How to price your services: A guide for agencies and consultants

6 steps on how to price a product and achieve profitable markups

Cost of sales: what you need to know for your business

A business bank account that's free, easy to open, and helps you start doing what you love..

Tide is about doing what you love. That’s why we’re trusted by 575,000+ sole traders, freelancers and limited companies throughout the UK.

Get useful stuff in your inbox

Be the first to hear about our webinars, new features and business tips to help you save time and money.

Welcome to the Tide community!

Contact our Support team now on phone 01277 284499 . They are on hand to answer any questions you may have about opening a Tide account or any of our products, 9am - 6pm daily.

Take a look at all our Webinars and Events!

Elevate Pricing with Elasticity

Optimise Pricing with Sensitivity

Blogs & articles, how to write a pricing strategy for my business plan.

In this blog you will learn about the importance of choosing the right pricing strategy for a successful business plan.

Why is a pricing strategy important for a business plan?

A business plan is a written document outlining a company’s core business practices – from products and services offered to marketing, financial planning and budget, but also pricing strategy. This business plan can be very lengthy, outlining every aspect of the business in detail. Or it can be very short and lean for start ups that want to be as agile as possible.

This plan can be used for external investors and relations or for internal purposes. A business plan can be useful for internal purposes because it can make sure that all the decision makers are on the same page about the most important aspects of the business.

A 1% price increase can lead to an 8% increase in profit margin.

A business plan could be very lengthy and detailed or short and lean, but in all instances, it should have a clear vision for how pricing is tackled. A pricing strategy ultimately greatly determines the profit margin of your product or service and how much revenue the company will make. Thorough research of consultancy agencies also show that pricing is very important. McKinsey even argues that a 1% prices increase can lead up to an 8% increase in profits. That is a real example of how small adjustments can have a huge impact!

It is clear that each business plan should have a section about pricing strategies. How detailed and complicated this pricing strategy should be depends for each individual business and challenges in the business environment. However, businesses should at least take some factors into account when thinking about their pricing strategy.

What factors to take into account?

The pricing strategy can best be explained in the marketing section of your business plan. In this section you should describe what price you will charge for your product or service to customers and your argumentation for why you ask this. However, businesses always balance the challenging scale of charging too much or too little. Ideally you want to find the middle, the optimal price point.

The following questions need to be answered for writing a well-structured pricing strategy in your business plan:

What is the cost of your product or service?

Most companies need to be profitable. They need to pay their expenses, their employees and return a reasonable profit. Unless you are a well-funded-winner-takes-all-growth-company such as Uber or Gorillas, you will need to earn more than you spend on your products. In order to be profitable you need to know how much your expenses are, to remain profitable overall.

How does your price compare to other alternatives in the market?

Most companies have competitors for their products or services, only few companies can act as a monopoly. Therefore, you need to know how your price compares to the other prices in the market. Are you one of the cheapest, the most expensive or somewhere in the middle?

Why is your price competitive?

When you know the prices of your competitors, you need to be able to explain why your price is better or different than that of your competitions. Do you offer more value for the same price? Do you offer less, but are you the cheapest? Or does your company offer something so unique that a premium pricing strategy sounds fair to your customer? You need to be able to stand out from the competition and price is an efficient differentiator.

What is the expected ROI (Return On Investment)?

When you set your price, you need to be able to explain how much you are expeciting to make. Will the price you offer attract enough customers to make your business operate profitable? Let’s say your expenses are 10.000 euros per month, what return will your price get you for your expected amount of sales?

Top pricing strategies for a business plan

Now you know why pricing is important for your business plan, “but what strategies are best for me?” you may ask. Well, let’s talk pricing strategies. There are plenty of pricing strategies and which ones are best for which business depends on various factors and the industry. However, here is a list of 9 pricing strategies that you can use for your business plan.

- Cost-plus pricing

- Competitive pricing

- Key-Value item pricing

- Dynamic pricing

- Premium pricing

- Hourly based pricing

- Customer-value based pricing

- Psychological pricing

- Geographical pricing

Most of the time, businesses do not use a single pricing strategy in their business but rather a combination of pricing strategies. Cost-plus pricing or competitor based pricing can be good starting points for pricing, but if you make these dynamic or take geographical regions into account, then your pricing becomes even more advanced!

Pricing strategies should not be left out of your business plan. Having a clear vision on how you are going to price your product(s) and service(s) helps you to achieve the best possible profit margins and revenue. If you are able to answer thoughtfully on the questions asked in this blog then you know that you have a rather clear vision on your pricing strategy.

If there are still some things unclear or vague, then it would be adviceable to learn more about all the possible pricing strategies . You can always look for inspiration to our business cases. Do you want to know more about pricing or about SYMSON? Do not hesitate to contact us!

Do you want a free demo to try how SYMSON can help your business with margin improvement or pricing management? Do you want to learn more? Schedule a call with a consultant and book a 20 minute brainstorm session!

Get your CEO Book for Intelligent Pricing

- How to become a Hyperlearning organisation

- How to develop your organisational processes

- How to choose an algorithm that fits your business

Get your playbook for behavior-Based Pricing and using AI Driving Tooling

- Increase margin & revenue

- Become a Frontrunner in your market

- Be agile, use AI pricing software & learn from it to become a Hyperlearning Organisation

HAVE A QUESTION?

Frequently asked questions, related blogs.

4 Tips for keeping your pricing manageable

How to implement a new pricing strategy in 4 steps

How To Price Your Products: 5 Most Common Strategies

B2B Price Monitoring: How to Monitor Competitor Prices Beyond B2B Portals Logins

How LLM-Powered Tools Help You Optimise Your Business Processes

Hyperlearning

How to Calculate Business Startup Costs

Starting a business from scratch takes a lot out of you, even before you begin operating—whether it’s about selecting a revenue model, securing startup funding, or estimating startup costs.

I already knew it was challenging for entrepreneurs to calculate the startup costs accurately.

However, when I turned up to my computer, researching this article, I discovered so many challenges new business owners face while estimating startup costs that I had overlooked or didn’t pay much attention to earlier.

Thousands of startups close down every single year. 38% of them fail solely because they underestimated their startup costs and ran out of cash. You can’t ignore something like that, can you?

That said, I’m ready to pour my research into the article to help you calculate your business startup costs .

So, you’re ready to begin? Let’s dive right in.

Key Takeaways

- Startup costs are the expenses a startup must bear in the process of starting a new business, while operational costs are the expenses that are incurred during daily operations.

- Different types of business structures, such as sole proprietorships, partnerships, and corporations, have different costs.

- Business insurance, formation fees, licensing and permits, and marketing are some of the most common business startup costs.

- A modern financial forecasting tool is the most efficient method for calculating startup costs.

How much does it cost to start a business?

Startup costs for a small business depend on various factors like business model, location, industry, and scale of operations. Although it’s tough to estimate precisely, Guidant Financial’s 2023 survey reported that the average cost of starting a small business falls between $50K and $1 million .

You must consider the industry, business category, working capital requirements, and other common expenses associated with the business for the accurate estimation of startup costs.