Best Practices for Creating a Top-Notch Investment Presentation for Investors

Raising venture capital is challenging, especially for early-stage startups. To attract investors, you need an exceptional investment presentation that effectively communicates your company’s vision, strategy, and potential. Inevitably, you will have to present or pitch to investors during a fundraise (typically using a pitch deck ). An investment presentation, also known as a business presentation for investors, is crucial for sharing your company narrative, showcasing your business model, and convincing investors why they should invest in your venture.

Creating a compelling investment presentation involves more than good storytelling; it requires a well-structured approach highlighting your company’s strengths, market opportunities, and financial projections. This guide covers best practices for creating a top-notch investment presentation, including templates, examples, and critical elements to include for a successful presentation for investors. Whether you are preparing for a seed round, Series A, or beyond, these insights will help you craft a presentation that captures investor interest and secures the funding you need.

Related resource: 11 Presentation Design Trends for Startup Pitch Decks in 2024

What is an Investment Presentation?

An investment presentation, often called a pitch deck, is a strategic tool startups and businesses use to communicate their vision, business model, market opportunity, and financial projections to potential investors. It is designed to persuade investors to fund the company by clearly articulating the value proposition and growth potential.

An investment presentation is more than just a set of slides; it's a powerful tool for storytelling and persuasion. As you prepare your investment presentation, focus on clarity, conciseness, and compelling content to make a lasting impact on your potential investors.

Related Resource: How To Write the Perfect Investor Update (Tips and Templates)

Purpose of an Investment Presentation

The primary purpose of an investment presentation is to secure funding from venture capitalists, angel investors, or other financial backers. It serves as a visual and narrative representation of your business plan, highlighting the most compelling aspects of your company to attract investor interest. Here are some key objectives:

- Communicate Your Vision: Present your company's mission, vision, and long-term goals.

- Showcase Your Team: Introduce the key team members, emphasizing their experience and capabilities.

- Explain the Problem and Solution: Define the market problem you are addressing and how your product or service solves it.

- Demonstrate Market Opportunity: Highlight your target market's size and growth potential.

- Outline Your Business Model: Explain how your company plans to make money and sustain growth.

- Present Financial Projections: Provide detailed financial forecasts, including revenue models, profit margins, and funding requirements.

- Illustrate Traction and Milestones: Show any progress or traction you have made, such as user growth, revenue milestones, or strategic partnerships.

Why is an Investment Presentation Crucial?

For startups and businesses seeking funding, an investment presentation is crucial for several reasons:

- First Impressions Matter: Often, this presentation is your first formal introduction to potential investors. A well-crafted presentation can make a solid first impression, setting the stage for further discussions.

- Storytelling and Persuasion: It allows you to tell your company's story compellingly, persuading investors of your business's viability and potential.

- Structured Communication: An investment presentation provides a structured format to present complex information clearly and concisely. This helps investors quickly understand your business and its potential.

- Highlighting Value Proposition: It highlights your unique value proposition, differentiating your company from competitors in the eyes of investors.

- Facilitating Due Diligence: A thorough and well-organized presentation can simplify the due diligence process for investors, making it easier for them to evaluate your business.

- Building Investor Confidence: By presenting well-researched data and realistic financial projections, you build confidence in your business acumen and readiness for investment.

Key Elements of an Investment Presentation

Creating an effective investment presentation involves including key elements that convey your company’s vision, strategy, and potential to investors. Here’s a detailed look at what to include and how to structure your presentation for maximum impact.

Related resource: How to Create Impactful Problem/Solution Slides for Your Pitch Deck

How to Present an Investment Opportunity

Presenting an investment opportunity to potential investors requires a blend of compelling storytelling, clear data, and strategic insights. Here are some tips to help you make a strong impression:

- Elevator Pitch: Begin with a concise and engaging elevator pitch that captures the essence of your business. This should be a brief overview that explains what your company does, the problem it solves, and why it’s unique.

- Hook Your Audience: Use a compelling story or statistic to grab the investors’ attention immediately.

- Problem Statement: Clearly articulate the problem your product or service addresses. Use real-world examples or data to illustrate the significance of this problem.

- Solution Description: Explain how your product or service effectively solves the problem. Highlight any unique features or innovations that set you apart from competitors.

- Market Size and Growth: Present data on your target market's size and growth potential. This demonstrates the scope of the opportunity and the potential for significant returns.

- Target Audience: Define your ideal customer and explain why your product is well-suited to meet their needs.

- Revenue Streams: Detail how your company makes money. Include different revenue streams, pricing strategies, and the scalability of your model.

- Business Strategy: Outline your go-to-market strategy, customer acquisition plans, and sales channels.

- Forecasts: Present realistic financial projections for the next 3-5 years. Include revenue, expenses, profit margins, and key financial metrics.

- Funding Requirements: Clearly state the amount of funding you are seeking, how it will be used, and the expected outcomes from this investment.

- Key Members: Highlight the key members of your team, emphasizing their relevant experience and expertise.

- Advisors and Partners: Mention any notable advisors, partners, or investors backing your company.

- Progress to Date: Share any significant achievements, such as user growth, revenue milestones, partnerships, or product developments.

- Future Milestones: Outline your roadmap and key milestones you plan to achieve with the new funding.

- Next Steps: Clearly state what you are asking from the investors and the next steps. Be confident and direct in your request for funding and support.

What is the purpose of an investment presentation?

An investment presentation or pitch is a tool to help founders share their company story and vision with investors. An investor presentation is a visual representation of your company narrative and includes things like metrics, roadmaps, team members, etc.

Kristian Andersen of High Alpha breaks down how founders should think about crafting their pitch deck and story below:

Related Resource: Tips for Creating an Investor Pitch Deck

How an Investment Presentation Fits into the Broader Category of Presentations for Investors

While all business presentations aim to communicate important information, an investment presentation is specifically tailored to attract financial backing. Here’s how it fits within the broader category of presentations for investors:

- Focus on Investment Opportunity: Unlike other business presentations that might focus on operational updates or strategic planning, an investment presentation is solely focused on showcasing the investment potential of your business.

- Detailed Financial Insights: Investment presentations require detailed financial forecasts and funding needs, which are typically more comprehensive than in other types of business presentations.

- Strategic Persuasion: The goal is to persuade investors of the viability and potential return on investment, necessitating a higher level of strategic storytelling and data-driven argumentation.

- Investor-Centric Approach: Tailored specifically to the interests and concerns of investors, these presentations address aspects like market opportunity, competitive landscape, and growth potential more deeply.

How Long Should an Investment Presentation Be?

The length of an investment presentation is crucial for maintaining investor interest and ensuring all key points are communicated effectively. While there is no one-size-fits-all answer, there are general guidelines that can help you determine the optimal length for your investment presentation.

Different businesses and pitches will require different pitch decks, but we have found that as a rule of thumb founders should shoot for a pitch deck that is 12 slides or less.

We studied our own data from our pitch deck sharing tool and found that the average number of slides in a pitch deck (where 100% of slides were viewed) was 12.2 slides.

General Recommendations

For investment presentations, the ideal length typically falls between 10 to 15 slides. This range is based on industry standards and feedback from investors, ensuring that you provide enough information without overwhelming your audience.

Alex Iskold of 2048 recommends a short pitch deck that should be 10 or fewer slides.

Related Resource: Pitch Deck 101: How Many Slides Should My Pitch Deck Have?

- Concise and Focused: Keep your presentation concise, focusing on the most critical aspects of your business. Each slide should deliver a clear and impactful message.

- Engagement: Investors have limited attention spans, and a concise presentation helps maintain their interest and engagement throughout.

- Title Slide: 1 slide

- Executive Summary: 1 slide

- Problem Statement: 1 slide

- Solution: 1 slide

- Market Opportunity: 1-2 slides

- Product or Service: 1 slide

- Business Model: 1 slide

- Go-to-Market Strategy: 1 slide

- Competitive Analysis: 1 slide

- Traction and Milestones: 1 slide

- Financial Projections: 1-2 slides

- Team: 1 slide

- Ask and Closing: 1 slide

What Your Pitch Deck Should Look Like for Your Investment Presentation

Every business is unique, and the specific needs for slides and narratives will vary. However, there are key elements that are essential for any successful investment presentation. Below are the crucial slides that should be included in your pitch deck, ensuring you effectively communicate your business potential to investors:

- Objective: Clearly present your company and its purpose.

- Content: Provide a brief and digestible summary of what your company does, including its mission, vision, and core values. Make sure it's easy for investors to understand.

- Objective: Define the problem you are solving.

- Content: Use data, stories, or compelling examples to illustrate the problem your target market faces. Help your audience grasp the significance and urgency of the problem.

- Objective: Explain how your product or service addresses the problem.

- Content: Detail your solution and make a strong case for why your approach is the best way to solve the problem. Highlight any unique features or innovations.

- Objective: Define your ideal customer and market.

- Content: Lay out the target market, including demographics and psychographics. Explain why this market is relevant and ready for your solution, helping investors answer the “why now?” question.

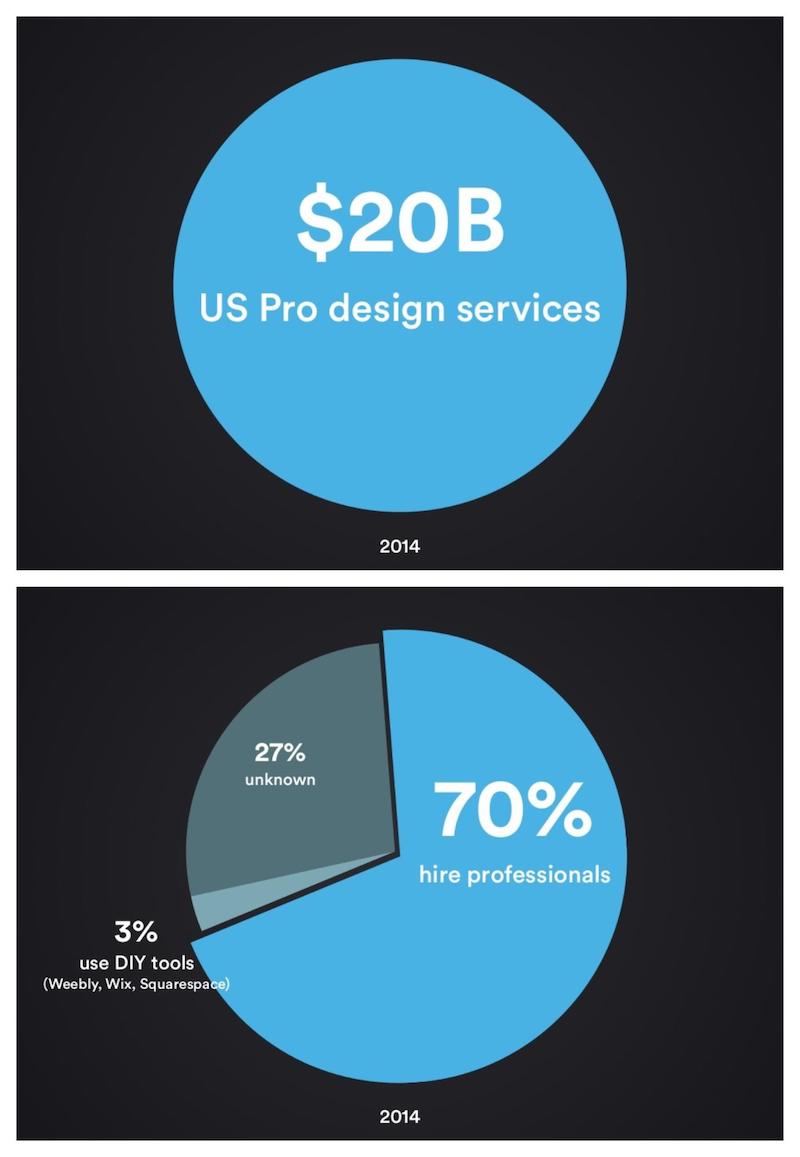

- Objective: Demonstrate the potential size and growth of the market.

- Content: Provide data on market size, growth trends, and potential for scalability. Investors want to see that there is a substantial opportunity for your business to grow and succeed.

- Objective: Identify your competitors and your differentiators.

- Content: Present an analysis of your competitors, detailing their strengths and weaknesses. Explain how your business stands out and what gives you a competitive edge.

- Objective: Highlight the status and future plans for your product.

- Content: Showcase your product with current status, features, and future development plans. Use data, customer testimonials, or case studies to demonstrate its value and effectiveness.

- Objective: Introduce the team that will execute the business plan.

- Content: Highlight key members of your executive team, emphasizing their relevant experience and skills. Show why your team is uniquely positioned to solve the problem and drive the company’s success.

- Objective: Explain how your business will generate revenue and grow.

- Content: Detail your business model, including revenue streams, pricing strategy, and scalability. Outline your sales and marketing strategy, including customer acquisition and retention plans.

- Objective: Provide a clear picture of your business’s financial health and potential.

- Content: Present key financial data, such as revenue, expenses, profit margins, and growth projections. Include important metrics like customer acquisition cost, lifetime value, and burn rate. Clearly state your funding requirements and how the investment will be used.

Best Practices and Tips for Creating a Compelling Investment Presentation

As we’ve mentioned, different investors will look for different attributes in a presentation. However, most things investors look for can be boiled down to a few key areas. Below we lay out a few best practices for putting together a top-notch investor presentation.

Practice your pitch

This should go without saying but make sure you practice your pitch. You should know the ins and outs of your presentation and business. Of course, practicing in front of a mirror or friend can only go so far.

Some founders and investors recommend “ranking” your investors before approaching investors. E.g. Tier 1 investors are the best fit, Tier 3 are less of a fit for your business. If you rank your investors you’ll be able to spend some of your earliest pitches on “Tier 3” (or lower fit) investors to dial in your pitch and prepare for your pitches with better fit investors later on in your fundraise.

Related Resource: How to Pitch a Perfect Series B Round (With Deck Template)

Keep your message simple and clear

Investors see hundreds or thousands of pitches over a given year. Being able to clearly articulate your message and pitch is a surefire way to remove any confusion. By keeping your message simple and clear, you’ll remove any back-and-forth wasted on small details and be able to spend time on what matters most — having a conversation about your business.

Find ways to connect with the investors and know your audience

Understand who you are presenting to and tailor your content accordingly. Research the investors' backgrounds, interests, and previous investments to align your pitch with their preferences and expectations.

At the end of the day, a founder is selling their company to potential investors. Like a good sales process, a good investor pitch starts by building a relationship and trust. When pitching potential investors, find ways to connect with them in advance of the pitch. This could be everything from following and interacting with them on Twitter to going to in-person events where they are present.

Highlight early successes and wins

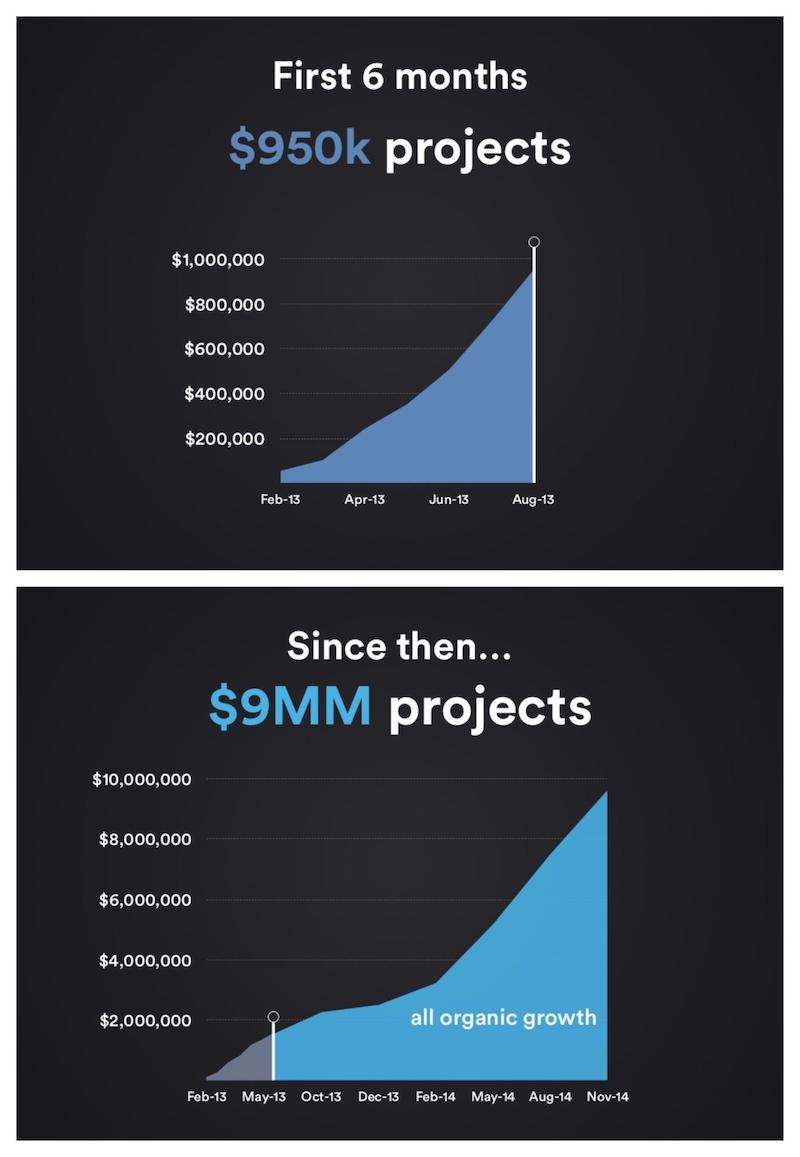

Get potential investors excited about your business by sharing early successes and wins. This will get the presentation off on the right foot and allow everyone to build excitement around your business. Of course, try to back up your early successes and wins with data when possible.

Know your metrics

Inevitably, investors will want to dig into the metrics and data behind your business. For most investors, this is used to evaluate your business and could be considered the best predictor of success for your business.

However, metrics can also be a barometer for how well you know your business. You don’t need to remember every data point behind your business but need to know how different metrics are calculated and what causes any major fluctuations.

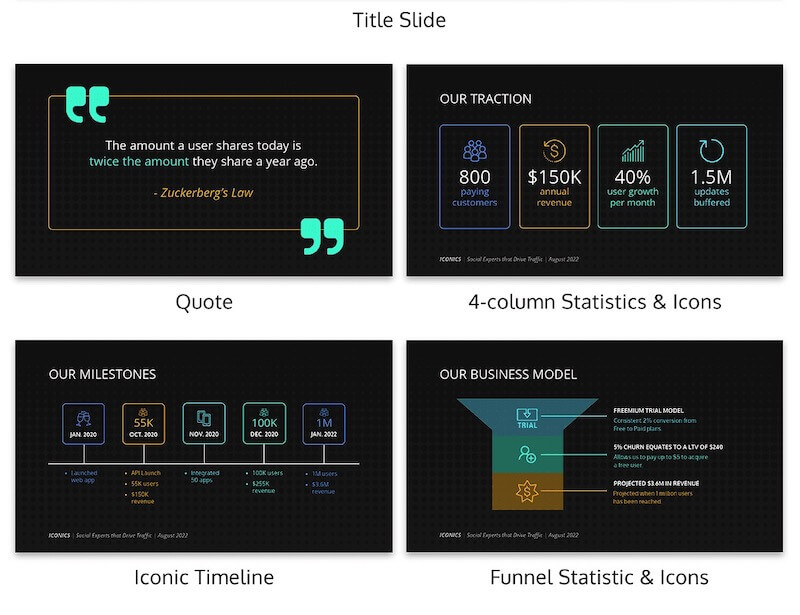

Include engaging visuals and graphics

Visuals can make your presentation more engaging and easier to understand. An investor presentation is a tool used to pitch your business. In order to best engage with your audience, you should aim to have engaging visuals and graphics throughout your presentation. Of course, the underlying data is what is most important but having engaging and easy-to-understand visuals and graphics is a great way to support and improve your pitch.

- High-Quality Images: Use professional images and graphics to illustrate points.

- Charts and Graphs: Simplify complex data with easy-to-read charts and graphs.

- Consistent Design: Maintain a consistent and professional design throughout the presentation.

Leave time for questions

The best pitches and presentations tend to be more conversational. You’ll want to balance feeding your investors with the material they need and also be able to have a constructive conversation about your business. By coming prepared, having a clear and simple presentation, and engaging with your investors beforehand is a surefire way to have a conversation about your business.

- Q&A Session: Allocate a portion of your presentation time for a Q&A session.

- Prepare Answers: Anticipate common questions and prepare thoughtful responses.

Communicate before your presentation

Investors need months of data and interactions to make a decision about a potential investment. In order to best help investors build conviction and have more meaningful conversations, make sure you are engaging with potential investors on a regular basis. This can be in the form of your monthly investor updates or sharing your pitch deck in advance before a meeting.

Sharing your pitch deck in advance of a meeting is a hot topic. Some investors will say you should and some will say the opposite. At the end of the day, it is important for you to feel out the investor and do what you believe is best for you and your business.

Related Resource: 18 Pitch Deck Examples for Any Startup

Qualities Investors Want to See

An investor’s primary goal is to generate returns for their investors (limited partners, LPs). While specific criteria can vary from firm to firm, there are common attributes that most investors look for in a founder and their business. Understanding these qualities can help you tailor your investment presentation to meet investor expectations.

Large Market

- Market Size and Potential: Investors seek businesses with the potential to capture significant market share in a large or rapidly growing market. Clearly articulate the size and growth prospects of your target market.

Clear Customer Acquisition Strategy

- Go-to-Market Plan: Demonstrate a well-defined strategy for acquiring and retaining customers. Investors want to see a scalable and cost-effective approach to growing your customer base.

Experienced Team

- Relevant Expertise: Highlight the experience and skills of your team members, particularly those relevant to your industry. An experienced team can significantly increase investor confidence.

- Track Record: Showcase past successes and relevant achievements of your team members.

Strong Leadership

- Visionary Leaders: Investors look for founders who are not only capable of executing the business plan but also possess a clear vision for the company’s future.

- Decision-Making: Demonstrate your ability to make strategic decisions and lead the company through challenges.

Traction and Growth

- Evidence of Progress: Provide concrete evidence of traction, such as user growth, revenue milestones, partnerships, or product development progress. Traction is a key indicator of potential success.

- Growth Metrics: Highlight key growth metrics and explain how you plan to sustain and accelerate growth.

- Long-Term Goals: Articulate a compelling long-term vision for your company. Investors want to invest in businesses that aim to create significant impact and value over time.

- Innovation: Emphasize any innovative aspects of your business that set you apart from competitors and position you for future success.

Coachability

- Willingness to Learn: Investors appreciate founders who are open to feedback and willing to adapt. Show that you value input from experienced advisors and are willing to make changes to improve the business.

- Collaborative Attitude: Demonstrate your ability to work collaboratively with investors and other stakeholders.

Related Resource: Startup Metrics You Need to Monitor

In-person vs. Remote Investment Presentations

The format of your investment presentation can significantly impact its effectiveness. With the rise of remote work, understanding the nuances of both in-person and remote investment presentations is crucial. Here’s a comparison to help you decide which format is best for your needs and how to optimize each type.

In-Person Presentation

Advantages:

- Personal Connection: In-person presentations allow for stronger personal connections. You can read body language, engage more naturally, and build rapport with potential investors.

- Undivided Attention: Investors are more likely to give you their full attention in a face-to-face meeting, reducing the risk of distractions.

- Interactive Demonstrations: Demonstrating your product or service is often more effective in person, where investors can experience it firsthand.

Disadvantages:

- Logistics and Costs: Traveling for in-person meetings can be time-consuming and costly, especially if you need to meet investors in different locations.

- Limited Reach: You may be limited to investors within a certain geographical area, potentially missing out on opportunities with investors elsewhere.

Tips for In-Person Presentations:

- Preparation: Ensure all materials are ready and that you have practiced your pitch thoroughly.

- Engage the Audience: Make eye contact, use hand gestures, and move around the room to keep investors engaged.

- Interactive Elements: Include live product demonstrations or prototypes to make your presentation more impactful.

Remote Presentation

- Wider Reach: Remote presentations allow you to connect with investors from all over the world without the need for travel.

- Cost-Effective: Eliminating travel reduces costs and time commitments, allowing you to schedule more meetings.

- Flexibility: Remote meetings can be more easily scheduled, offering flexibility for both you and the investors.

- Technical Challenges: Technical issues such as poor internet connection or software glitches can disrupt the flow of your presentation.

- Reduced Personal Connection: Building rapport and reading body language can be more challenging in a virtual setting.

Tips for Remote Presentations:

- Technical Preparation: Test your equipment and internet connection before the meeting. Ensure you have backups in case of technical issues.

- Engaging Visuals: Use high-quality visuals and animations to keep the audience engaged. Make your slides more visually appealing to compensate for the lack of physical presence.

- Interactive Tools: Utilize features like screen sharing, polls, and Q&A sessions to make the presentation interactive.

- Clear Communication: Speak clearly and at a moderate pace. Use gestures and facial expressions to convey enthusiasm and maintain engagement.

Key Elements of a Business Presentation for Investors

A business presentation is a structured communication tool used to convey information, ideas, or proposals to an audience. The purposes of a business presentation can vary, including:

- Informing: Providing important updates, data, or insights about your company or industry.

- Persuading: Convincing the audience to take a specific action, such as investing in your business.

- Educating: Teaching the audience about a new concept, product, or strategy.

- Engaging: Building relationships and fostering interaction with stakeholders.

For investors, the primary purpose of a business presentation is to persuade them of the viability and potential of your business as an investment opportunity.

How a Business Presentation Sets the Stage for Successful Investment Pitches

Understanding the foundational elements of a business presentation is crucial for creating a compelling investment pitch. A well-structured business presentation lays the groundwork for effectively communicating your business idea, strategy, and potential to investors, ensuring you capture their interest and secure the funding you need.

Introduction to Business Presentations

A business presentation is a structured communication tool used to convey important information, ideas, or proposals to an audience. The primary purposes of a business presentation can vary, but they generally include:

- Informing: Providing updates, data, or insights about your company or industry.

For investors, the main purpose of a business presentation is to persuade them of the viability and potential of your business as an investment opportunity.

Structure of a Business Presentation

A well-structured business presentation typically includes the following elements, which are equally essential in an investment pitch:

- Contents: Company name, logo, tagline, and presentation date.

- Purpose: To introduce the presentation and set the stage for what is to come.

- Contents: A brief overview of the main points of your presentation.

- Purpose: To provide a snapshot of your business, key metrics, and the investment opportunity.

- Contents: Description of your company, mission statement, and core values.

- Purpose: To introduce your business and its vision to the audience.

- Contents: A clear explanation of the problem your business aims to solve.

- Purpose: To highlight the need for your product or service.

- Contents: Description of your product or service and how it addresses the problem.

- Purpose: To demonstrate the value and effectiveness of your solution.

- Contents: Data on market size, growth potential, and trends.

- Purpose: To show the potential scale and impact of your business.

- Contents: Detailed information about your product or service, including features and benefits.

- Purpose: To showcase what you offer and why it stands out.

- Contents: Explanation of how your business makes money.

- Purpose: To illustrate the financial viability and scalability of your business.

- Contents: Plan for acquiring and retaining customers.

- Purpose: To show how you will reach your target market and grow your customer base.

- Contents: Overview of the competitive landscape and your unique advantages.

- Purpose: To highlight how your business differentiates itself from competitors.

- Contents: Key achievements and milestones reached to date.

- Purpose: To demonstrate progress and potential for future growth.

- Contents: Revenue forecasts, profit margins, and key financial metrics.

- Purpose: To provide a clear picture of your business’s financial future.

- Contents: Introductions to key team members and their qualifications.

- Purpose: To build confidence in the team’s ability to execute the business plan.

- Contents: Specific funding request and next steps.

- Purpose: To clearly communicate what you need from investors and how they can get involved.

Share your pitch deck with Visible

With our suite of fundraising tools, you can easily find investors , share your pitch deck, and track your fundraising funnel. Learn more about our pitch deck sharing tool and give it a free try here .

We use essential cookies to make Venngage work. By clicking “Accept All Cookies”, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts.

Manage Cookies

Cookies and similar technologies collect certain information about how you’re using our website. Some of them are essential, and without them you wouldn’t be able to use Venngage. But others are optional, and you get to choose whether we use them or not.

Strictly Necessary Cookies

These cookies are always on, as they’re essential for making Venngage work, and making it safe. Without these cookies, services you’ve asked for can’t be provided.

Show cookie providers

- Google Login

Functionality Cookies

These cookies help us provide enhanced functionality and personalisation, and remember your settings. They may be set by us or by third party providers.

Performance Cookies

These cookies help us analyze how many people are using Venngage, where they come from and how they're using it. If you opt out of these cookies, we can’t get feedback to make Venngage better for you and all our users.

- Google Analytics

Targeting Cookies

These cookies are set by our advertising partners to track your activity and show you relevant Venngage ads on other sites as you browse the internet.

- Google Tag Manager

- Infographics

- Daily Infographics

- Popular Templates

- Accessibility

- Graphic Design

- Graphs and Charts

- Data Visualization

- Human Resources

- Beginner Guides

Blog Graphic Design 30 Startup Investment Pitch Deck Examples (+Templates)

30 Startup Investment Pitch Deck Examples (+Templates)

Written by: Ryan McCready Jul 04, 2023

A startup is, by definition, a fast-growing company. And to grow you need funding.

Enter the pitch deck.

In this post, we’ll look at the best startup pitch deck templates from heavy-hitters such as Guy Kawasaki, Airbnb, Uber and Facebook. We’ll also uncover the secrets of their successful startup pitch decks, and how you can leverage them to attract investor dollars, bring on new business partners and win new client contracts.

Haven’t created a winning pitch deck before? Then, use Venngage’s Presentation Maker to easily edit the templates — no technical expertise required.

Table of contents:

What is a pitch deck?

Best pitch deck examples for startups investment, what makes a good pitch deck, how to create a pitch deck in 4 easy steps, pitch deck faq.

A pitch deck is a presentation created to raise venture capital for your business. In order to gain buy-in and drum up financial support from potential investors, these presentations outline everything from why your business exists, to your business model, progress or milestones , your team, and a call-to-action.

Buffer is a social media management platform that helps users schedule posts, analyze results, and engage with their customers. It can be used on the web and mobile, and is designed for small businesses.

Stage : Seed Round

Amount raised: $500,000, according to Buffer’s co-founder Leo Widrich .

Industry: Social Media Management

Business model: Subscription-based SaaS (Software as a Service)

Headquarters: 2443 Fillmore St #380-7163, San Francisco, CA 94115

Website: Buffer.com

Key takeaway : The traction slide was key for Buffer: it showed they had a great product/market fit. If you have great traction, it’s much easier to raise funding.

What’s interesting about Buffer’s pitching process was the issue of competition, as that’s where many talks stalled. Investors became confused, since the social media landscape looked crowded and no one was sure how Buffer differed.

Eventually, they created this slide to clear the air:

To be frank, I’m still confused by this addition to the Buffer pitch deck, but perhaps their presentation would have cleared things up.

In any case, we’ve recreated Buffer’s pitch deck with its own traction, timeline and competitor slides, plus a clean new layout and some easy-to-customize icons:

Design tip : don’t forget to add a contact slide at the end of your pitch deck, like in the business pitch example below.

Because sometimes you’re going to pitch to a small room of investors. Other times, it will be to an auditorium full of random people in your industry. And I can guarantee that not everyone is going to know your brand off the top of their head.

You should make it extremely easy for people to find out more info or contact your team with any questions. I would recommend adding this to the last slide, as shown below.

Alternatively, you could add it to the slide that will be seen the longest in your pitch deck, like the title slide. This will help anyone interested write down your information as event organizers get things ready.

Related: Creating a Pitch Deck? 5 Ways to Design a Winner

Industry: Hospitality, Travel, and Technology

Business model: Online marketplace (peer-to-peer) for lodging and travel experiences

Amount raised: $20k at three months and $600k at eight months (seed), according to Vator .

Location: San Francisco, California, USA

Website: airbnb.com

Key takeaway: A large marketplace, impressive rate of traction and a market ready for a new competitor are the factors which made Airbnb stand out early on, says Fast Company. The organization’s slide deck clearly demonstrates these points.

Your pitch deck should explain the core information in your business plan in a simple and straightforward way. Few startups have done this as well as Airbnb.

We’ve re-designed Airbnb’s famous deck as two light and airy sample pitch deck templates. The focus here is on engaging visuals, with minimal text used.

Airbnb fundraising slide deck

This type of deck is also called a demo day presentation. Since its going to be viewed from a distance by investors while you present, you don’t need lots of text to get your message across. The point is to complement your speech, not distract from it.

Another great thing about Airbnb’s fundraising slide deck format is that every slide has a maximum of three sections of information:

As one of the most popular presentation layouts , the rule of three design principle has been drilled into my head. And for good reason!

Here’s one of the slides that demonstrates why this pitch deck design tip works:

VIDEO TUTORIAL: Learn how to customize this pitch deck template by watching this quick 8-minute video.

Minimalist Airbnb pitch deck template

This simple sample pitch deck template is clean and incredibly easy to customize, making it perfect for presentation newbies.

Don’t forget to insert your own tagline instead of the famous “Book rooms with locals, rather than hotels” slogan. Hint: your tagline should similarly convey what your business offers. Airbnb’s pitch deck offers up tantalizing benefits: cost savings, an insider’s perspective on a location and new possibilities.

Design tip : Click the text boxes in our online editor and add your own words to the pitch decks. Duplicate slides you like, or delete the ones you don’t.

Related: How to Create an Effective Pitch Deck Design [+Examples]

Industry: Transportation, Technology, and Logistics

Business model: On-demand transportation network and logistics platform

Amount raised: $1.57M in seed funding in 2010, reports Business Insider .

Website: uber.com

Key takeaway : Successful pitch decks clearly highlight the key pain point (the inefficiency of cabs) and a tantalizing solution (fast, convenient 1-click ordering).

Uber co-founder Garrett Camp shared the company’s very first pitch deck from 2008 via a Medium post .

While there’s a surprising amount of text, it still manages to hit on every major part of their business plan succinctly — including key differentiators, use cases and best/worst-case scenarios.

Want something similar? We’ve updated the classic Uber pitch deck template with a sharp layout:

Uber investor deck

Many of the best pitch deck presentations out there are rather brief, only covering a few main points across a handful of slides. But sometimes your deck needs to provide more information.

There’s nothing wrong with having a longer investor pitch deck, as long as you switch up the slide layouts throughout — no one wants to see basically the same slide (just with different metrics or points) 25 times over.

This sample pitch deck template we created based on the infamous Uber deck has 20 or more slides and a diversity of layout options:

Design tip : Replace the photos with your own or browse our in-editor library with thousands of free professional stock images. To do so, double click any image to open our “replace” feature. Then, search for photos by keyword.

Blue Uber slide deck

In this navy version of the Uber pitch deck template, we’ve added bright colors and creative layouts.

Again, it’s easy to swap out the icons in our online editor. Choose from thousands of free icons in our in-editor library to make it your own.

4. Guy Kawasaki

How much did they raise? Guy Kawasaki’s Garage Capital raised more than $315 million dollars for its clients, according to one estimate .

Key takeaway : Avoid in-depth technical discussions in your pitch deck. Focus on the pain point you’re solving, how you’ll solve it, how you’ll make money and how you’ll reach customers.

Guy Kawasaki’s 10 slide outline is famous for its laser focus. He’s renowned for coining the 10/20/30 rule : 10 slides, 20 minutes and no fonts smaller than 30 point.

While you may be tempted to include as much of your business plan as possible in your pitch deck, his outline forces you to tease out your most important content and engage investors or clients within a short time span.

We’re recreated his famous outline in two winning templates you can adapt and make your own:

Gradient Guy Kawasaki pitch deck

This clean pitch deck template has all the sections you need and nothing you don’t.

Kawasaki’s format steers you towards what venture capitalists really care about : problem/solution, technology, competition, marketing plan, your team, financial projections and timeline.

Read our blog post on persuasive presentations for more design and speaking tips.

Design tip : Quickly add in charts and graphs with our in-editor chart maker. You can even import data from Excel or Google sheets.

Blue Guy Kawasaki pitch deck

This more conservative pitch deck template design keeps all the focus on the core information.

Remember: opt for a 30-point font or larger. This will force you to stick to your key points and explain them clearly. Anything smaller, and you’ll risk losing your audience — especially if they’re busy reading while tuning out what you’re actually saying.

5. Sequoia capital

How much did they raise? Sequoia Capital is actually a Venture Capital firm. According to TechCrunch , they’ve raised almost $1B for later-stage U.S. investments.

Key takeaway : “If you can’t tell the story of the company in five minutes, then you’re either overthinking it or you haven’t simplified it down enough.” – Mike Vernal, Sequoia Capital

VC firm Sequoia Capital has its own 10-slide pitch deck format to rival Guy Kawasaki’s famous example that we’ll take a look at a little later on. Its highly-curated, clarified format shines a spotlight on innovative ideas.

As the video above suggests, effectively communicating your mission, not just listing features, is key. Below is our take on the Sequoia Capital pitch deck example; you’ll find it clean, clear and easy to create.

Design tip : Click the blue background and select a new color from our color wheel (or one of your own brand colors via My Brand Kit, available with Venngage for Business ) to create a pitch deck with your branding.

Related: How to Make Successful Financial Pitch Decks For Startups

Blue and pink iconic pitch deck

Ready to try it for yourself? Add a pop of color to your version of the Sequoia pitch deck template with this pink and blue slide deck. The contrasting colors will make your information stand out.

6. Facebook

How much did they raise? $500K in angel funding from venture capitalist Peter Thiel (first round).

Key takeaway : If you don’t have revenue traction yet, lean heavily on other metrics , like customer base, user engagement and growth. Use a timeline to tell a story about your company.

The best pitch decks tell the real story about your company or brand. You should not only want to sell the audience on your product but also on the hard work you’ve done building it from the ground up.

Design tip: Try data visualizations to relay a company or product timeline . Since people are familiar with the format and know how to read them quickly, you can convey the information impactfully and save room while you’re at it.

Here, Facebook’s classic pitch deck shows the incredible schools that’ve already signed on and describe when future launches will happen.

The sample pitch deck template featured below shows another example of a company or product timeline . This would have been a great fit in the Facebook pitch deck, don’t you think?

Plus you can summarize a ton of information about your brand on a single slide. Check out how well the timeline fits into this pitch deck template below:

If the designer wouldn’t have used a timeline, the same information could have been spread over five or six extra slides! Luckily, Venngage’s timeline maker can help you visualize progress across a period of time without any design experience required.

7. TikTok

How much did they raise? $150.4M in funding in 2014 (back when TikTok was called Musical.ly), says Crunchbase .

Key takeaway : Use icons as visual anchors for written information.

(The full slide deck is available to Digiday subscribers , though you can view some of the key slides in this Medium post . Keep in mind: this TikTok pitch deck was created for potential advertisers, not investors. No other TikTok pitch decks are publicly available.)

What TikTok does really well in the above example is use icons as visual anchors for their stats. (I could write a whole article about using icons in your presentations correctly. There are so many ways you can use them to upgrade your slides.)

If you’re not sure what I’m talking about, just look at the slide deck template below.

Each of the main points has an icon that gives instant visual context about what the stat is about to the audience. These icons draw the eye immediately to these important facts and figures as well.

Design tip: Remember to use icons that have a similar style and color palette. Otherwise, you run the risk of them becoming a distraction.

8. Y Combinator

How much did they raise? This startup accelerator has invested in over 3,500 startups to date, according to the company website . They state their combined valuation nears $1 trillion.

Key takeaway : Create clear, concise pitch deck slides that tell a story investors can understand in seconds.

The classic Y Combinator pitch deck is incredibly simple, and for good reason. Seed stage companies can’t provide much detail, so they should focus on telling a story about their company.

That means your slides should tell a story investors can immediately understand in a glance.

Note that one of Y Combinator’s key components is the problem (above) and solution (below) slides.

Explaining how your startup is going to solve a pain point is a vital part of any slide deck. According to Y Combinator , startups should use the problem slide to show the problem your business solves, and how this problem currently affects businesses and/or people. Additionally, if you’re starting a new startup, forming an LLC could be a great choice to launch your business in the right direction, especially if you are focused on asset protection. It’s also worth considering some of the best LLC states to form your LLC , which can make a significant difference in terms of taxes, fees, and regulations.

Without that information, investors are going to be left with more questions than answers.

The solution slide should show the real-world benefits of your product/service. I recommend using data visualization to show traction, like the chart above, with a couple of notes for context.

To ensure your problem and solutions slides are easily understood, use a similar layout for both, as shown below.

This will help the audience quickly recall the main problem you want to solve, and connect it to your solution (even if the slides are separated by a few other points or ideas).

9. Front

How much did they raise ? $10M in Series A funding

Key takeaway : Use a simple flowchart to visualize a problem your product/service solves.

Not everyone is going to be able to explain their problem and solution as succinctly as the previous examples. Some will need to take a unique approach to get their point across.

That’s why I want to highlight how Front masterfully communicated the problem to be solved. They likely realized it would be a lot easier (and cleaner) to create a flow chart that visualizes the problem instead of text. (Did I mention you can make your own flowcharts with Venngage?)

Also, I really like how they distilled each down to a single phrase. That approach, combined with the visuals, will help it stick in investors’ minds as one of the best pitch decks.

Here’s another example pitch deck that uses a chart to convey their problem/solution:

It splits the competition slide right down the middle to illustrate the differences. It also shows exactly how the processes differ between the two entities using mini flowcharts.

Helping the audience make the right conclusions about your company should be an important part of your pitch deck strategy. Without saying a word, the visual choices you make can greatly impact your message.

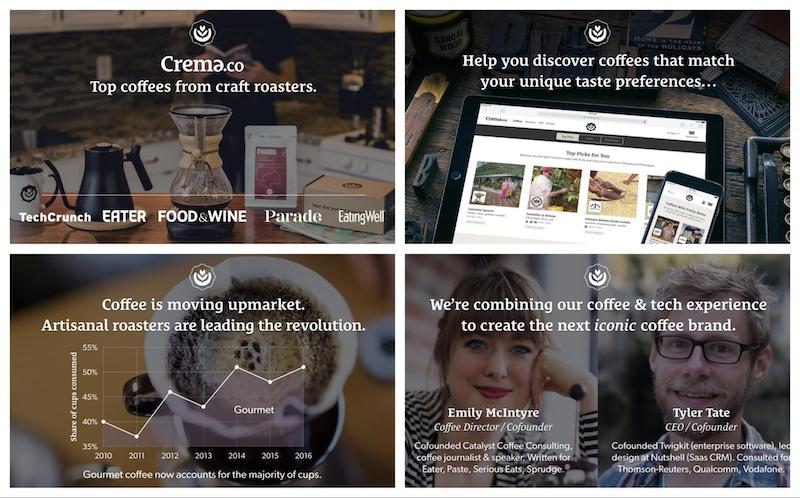

10. Crema

How much did they raise? $175K in seed funding 403 .

Key takeaway : Choose background images carefully — making sure they have a similar color palette.

The best pitch decks keep things consistent, mainly because there are so many moving parts in any presentation. You want each of your slides to feel like they’re connected by a singular feeling or theme. An out-of-place presentation background 429 image can throw that off.

Keeping things consistent when you use a solid background color or pattern isn’t hard. But things can get tricky if you want to use different photos for your backgrounds.

However, if you pick presentation background images that have a similar color palette, you’ll be fine. Check out the images Crema used in their startup pitch deck below:

If you’re struggling to find exactly the same colored photos, you can use a color filter to make things more uniform.

11. WeWork

How much did they raise? $6.9M in seed funding in 2011, says Crunchbase 403 .

Key takeaway : Put your metrics on display.

The behemoths at WeWork still have one of the best software pitch decks, despite recent troubles (layoffs, and a valuation that dropped from $47 billion to $2.9 billion).

In fact, this investor pitch deck actually helped them raise money at a $5 billion valuation.

My favorite thing from this is how their key metrics are on the second slide. They waste no time getting down to business!

A lot of the time brands hide these metrics at the end of their presentation, but WeWork made sure to put it front and center in their slide deck.

This approach puts the audience in a positive state of mind, helping them be more receptive to the pitch.

12. Crew (Dribble)

How much did they raise? $2M in seed funding

Key takeaway : Start your presentation with a simple statement to set the tone.

Sometimes you have to set the mood of the room before you jump into your slide deck. A simple way to do this is by adding a powerful statement or famous quote at the beginning of your slides.

This may sound cliche, but the creatives over at Crew (now Dribbble ) used this approach well in their pitch presentation.

By claiming that every business is an online business, they instantly change the way that people think about the business sector.

Additionally, the designers used this straightforward statement to set up the rest of the presentation. In the next few slides, the potential market is explained. Without the statement, I don’t think these numbers would be as impactful.

Let’s take a look at the graphs and charts the Dribble team used in their slide deck. In the below business pitch example, you can see that the line charts use the same color palette, size, and typography.

One of my favorite tips from my presentation ideas roundup article states you should never make the audience do the math.

You can also use this mantra when you’re adding data visualizations to your slides. Make each slide extra easy to consume, as well as, easy to compare to other visualizations.

Below the pie charts use the exact same color palette, size, and typography as well:

If the designers would have used a different example, the audience would be distracted trying to decipher the information.

But consistent design across multiple visualizations will ensure your audience can make comparisons that lead to the right conclusions.

Pro Tip: You can use a comparison infographic to summarize key points you’re comparing.

13. Aspire Food Group

How much did they raise? $1M from the Hult Prize in 2013 to scale their project.

Key takeaway : Simple graphics clearly illustrate the problem (food security), the size of the market and Aspire’s unique farming project (spoiler alert: it’s insects).

Nonprofits pitching donors or social enterprises pitching for funding have a slightly different challenge than other organizations. They need to present a unique solution and make an emotional connection to their audience.

Aspire’s simple pitch deck graphics allow investors to grasp their unique business idea at a glance. Plus, by introducing the audience to one of their customers and describing how insect farming has impacted her food budget, the concept is made relatable to many.

Another simple design hack is to choose a unique background for your nonprofit or social enterprise pick deck. Take this sample pitch deck template:

There are millions of stock photos out there for you to pick from, so finding one that will work shouldn’t be too hard.

However, when you’re picking your presentation background images , it’s important to make sure it matches your message or brand.

In the above example, the pitch deck’s slightly crumpled paper background fits an eco-friendly startup well. Especially because eco-friendly living and minimalism share similar tenants.

Another great example is this sponsorship pitch deck above. It elevates the message by opting for a simplistic background choice.

With a beautiful yet minimalistic slide deck like this, who wouldn’t want to donate?

Most of the time your pitch deck background images are supposed to be used in a supporting role. However, you can also design your presentation around the background images to create some of the best pitch decks out there.

As you can see in this pitch deck template, we added written content to the white space in each of the stock photos:

Plus no one can really copy your pitch deck layout, so you will instantly stand out from other companies.

Be sure to pick photos that share the same color palette and theme. Otherwise, the benefits of using these presentation backgrounds will be lost.

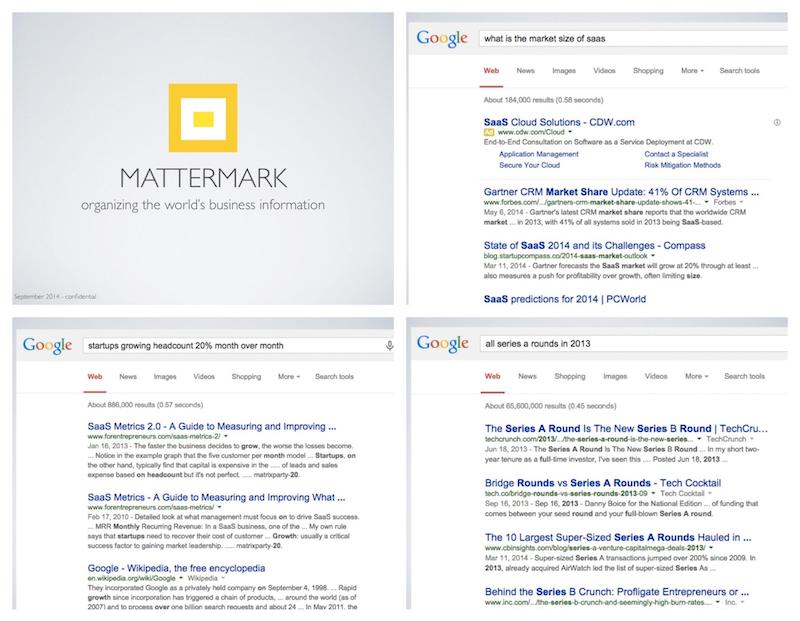

14. Mattermark

How much did they raise? A total of $17.2M so far, says Crunchbase .

Key takeaway : Use screenshots in your pitch deck to show the problem you’re solving.

Highlighting digital problems is tough when you have limited space and time…like when you’re pitching your new digital product to a room full of investors.

That’s why some of the best pitch decks include screenshots of the problem being solved.

As you can see above, the people from Mattermark used screenshots to show how unorganized SAAS reporting was. At that time it was spread over a ton of different sites, with different reporting standards and values.

It would be difficult to sell an investor on their product just by talking about the market. Mainly because not a lot of people have experience in that specific niche.

But with a handful of screenshots, they were able to highlight the product potential almost instantly.

In terms of design, the team at Mattermark stuck to the rule of three (see slide below). This rule will help you keep your team from overwhelming the audience with a flood of stats or figures.

They also decided to make these figures easier to consume by highlighting them in different colors

Compared to a boring list of figures, it’s a lot easier to remember three distinct colored numbers. Plus because the background colors darken as they go, it naturally guides the reader’s eyes down the slide.

15. Dwolla

How much did they raise? $12M in funding as of 2018.

Key takeaway : Give the reason your company was founded in one quick sentence.

In many of our own presentations, we talk about how Venngage started from humble beginnings before undergoing tremendous growth in just a few years.

That’s because people love origin stories — they help your audience connect with your brand and appreciate all the work put into it.

Take a look at the pitch deck slide from Dwolla above. In a single sentence, they outline their reason for doing business, and what they hope to solve.

Just be sure to talk about your company founding in the first few slides of your pitch. Otherwise, it won’t have the same impact.

On another note, as a design company, we always love to see people create great visualizations in their pitch decks — particularly when these visuals communicate key information well….like when it comes to your ideal users!

I have seen a lot of brands just talk about their users, but I recommend creating visual user personas instead. Our persona guides can help you with this!

As you can see above, Dwolla visualized their user personas for each use case.

These visual user personas allow audiences to put a “real” face to your user base. And if you have many ideal users (like Dwolla), it helps keep each group organized.

16. Kickfolio (App.io)

How much did they raise? $1M in seed funding.

Key takeaway : Go for huge graphs! The bigger, the better.

Be proud of your brand’s growth and metrics in your slide deck.

You worked hard to grow a company from nothing, and that’s a big achievement! So why would you want to make that growth hard to see?

However, I’ve seen a lot of people inadvertently hide their key metrics by using small graphs or charts.

The only solution to this problem is…get bigger with your graphs! And I mean huge, like the ones App.io deployed in the pitch deck above. Their graph is so large and imposing, every audience member could see it clearly.

Venngage’s graph maker can help you do this for your own pitch decks too.

17. Yalochat

How much did they raise? $15M in Series B funding, says TechCrunch.

Key takeaway : Use icons as illustrations to add instant context.

Icons have been making a comeback in the design world over the past few years. According to recent reports on graphic design trends , they’ll continue to be popular.

This presentation from Yalochat is one of the best examples of how to use illustrated icons correctly.

Each icon perfectly illustrates the point being made on each slide, giving instant context. They will definitely catch the eyes of any audience member.

Just remember to follow their lead and use consistently designed icons !

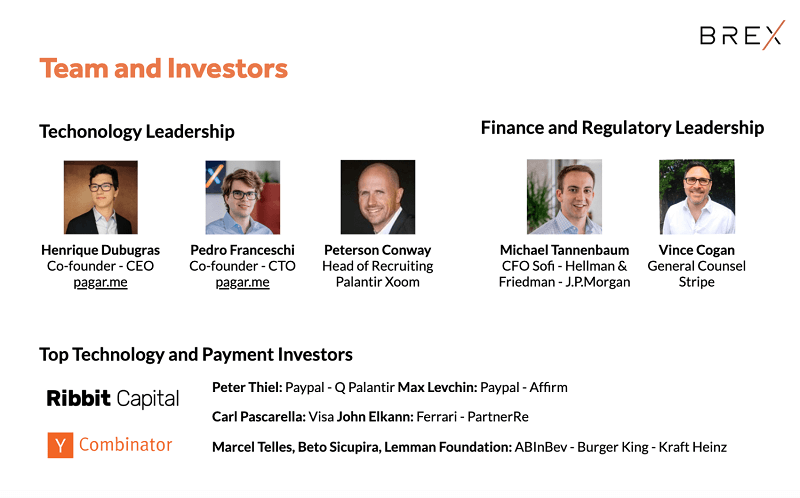

18. Brex

How much did they raise? $1.5 billion to date.

Key takeaway : Include a single slide about your team and highlight what makes them truly exceptional.

Another important part of your story is the people who helped you build your company. These people are the lifeblood of your brand, and what helps it stand out from the competitors.

Corporate card startup Brex does this well by using team member photos, and including their titles and company affiliations to build credibility. You can download the Brex slides for free, thanks to Business Insider .

Let’s tale a look at a sample pitch deck that employs a similar philosophy.

I’m guessing you already planned on adding something similar to your pitch deck. Again, I would recommend using only a single team slide like they did.

You can use a team photo if you want to talk about the whole team, or add an organizational chart instead. Alternatively, like Brex, you can highlight the most important individuals, like this business pitch example:

Whatever you choose to do, don’t forget to talk about your team on a team slide, and highlight the people who make your company truly great.

Read More: 12+ Organizational Chart Examples and Templates

19. Purple Go

How much did they raise? Undisclosed.

Key takeaway : Use a contrasting hue to draw your audience’s attention to key information.

Color isn’t just about making your designs look good — it can also draw your audience’s attention to important information.

For example, take a look at this simple pitch deck from Purple Go . They contrast deep purple with white to help certain sentences pop.

This is a simple way to make your slides have a lot of impact; pick colors that contrast boldly with each other.

How much did they raise? $31M to date, according to Mint.

Key takeaway : Add visual cues, such as illustrations and icons, to help explain your brand to investors.

I’m guessing your pitch deck is already going to touch on how you stand out from the competition. But just listing a few things that set you apart may not be enough on your slide deck!

You may need to add some visual cues to help the audience out.

We decided to redesign Mint’s original deck for a contemporary take on this.

In this minimalist pitch deck template, our designers used visuals to make the main company stand out even more. And best of all, it doesn’t distract from the minimalist theme.

This simple addition to your slides will help your information jump off the page, providing a rewarding visual break from related companies.

21. Park Evergreen (Plot)

How much did they raise? $400k in seed funding.

Key takeaway : Give each metric its own slide.

Generally, slide decks are full of important metrics that you’re supposed to remember. But not all of those numbers are presented in a way that would make them easy to.

Some are hidden in long paragraphs, while others are smashed together with less important findings.

That’s why I’m a huge fan of how Park Evergreen (now called Plot ) included important numbers in this slide deck. As you can see below, each metric is given its own slide:

With this approach, the audience members place their full attention on that number. And they’ll be able to recall the information a lot quicker.

It may look overly simple to some, but the best pitch decks use this tactic a lot.

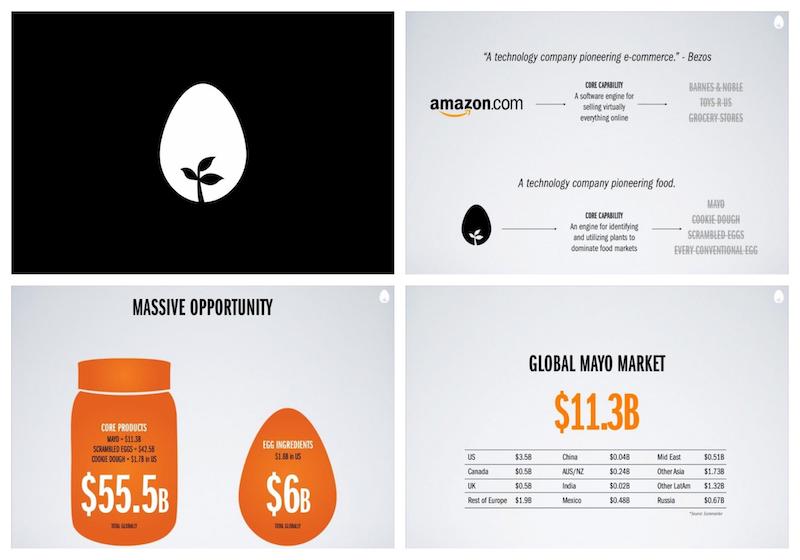

22. Hampton Creek (Eat Just)

How much did they raise? $1.5M in Series A.

Key takeaway : Create a minimalist title slide to build anticipation for your presentation.

You probably know that presentations don’t always run as smoothly as planned. With long breaks and technical problems, the time between presentations can end up running rather long.

Translation: you might spend more time looking at the title slide than the actual presentation itself.

So if you really want to build some anticipation for your pitch, create a minimalist (some might even say, mysterious) title slide. As you can see, the team at Eat Just (once known as Hampton Creek) did just that.

The lack of information makes spectators want to learn more about your brand, effortlessly engaging them.

The only negative is that no one is going to know the name of your company — yet.

23. Sickweather

How much did they raise? $2.6M to date, according to Crunchbase.

Key takeaway : Pull out the main metrics from your graphs and charts to make your slide a snap to understand.

Remember when I said: “Don’t make your audience do the math”?

Yeah. That’s because people hate doing math — so you never want to make investors try to calculate your data themselves. Especially when dealing with millions of dollars, tiny percent changes or other complicated numbers.

Out of all the tips in this article, this one might be the most important. Mainly because forgetting this idea all but guarantees your failure.

That’s why I recommend you “do the math” on every slide where you include a graph or chart — like how Sickweather did above.

By pulling out the main growth metrics from the graph, they made this slide a lot more consumable, and showed the audience exactly what they should pay attention to.

24. Dutchie

How much did they raise? $35M in 2020, according to TechCrunch .

Key takeaway : Set the tone by putting your most impressive stat(s) in the introduction.

Dutchie, an all-in-one technology platform for eCommerce, POS and payments, wastes no time coming out the gates with one impressive insight: “10% of all legal cannabis in the world” is purchased through their product.

Now I don’t know about you, but that’s pretty tantalizing.

So it makes perfect sense they would pull it out from their market share figures and feature it in their introduction. By doing so, investors get an idea how successful and established Dutchie is right off the bat.

25. Studysmarter

How much did they raise? $15M according to TechCrunch .

Key takeaway : Illustrate your vision over several slides.

Rather than dedicate one slide to their vision for the company, digital learning company Studysmarter continuously brings up how their product will be understood in the future — as “the world’s central hub” for “lifelong” learning, becoming the “largest learning platform in Europe” by 2021.

While this visionary sentiment is not new to the pitch deck industry, it makes sense Studysmarter would want to focus much of their presentation slide deck on this idea: the idea of an unlimited target market and use cases.

Design wise, their illustrations are consistent, using visuals to illustrate their message and various target demographics.

These graphics build off the sleek, modern interface Studysmarter’s brand image invokes. It also illustrates what they want investors to envision for the future of the brand.

26. Clearbanc (Clearco)

How much did they raise? $70M in series A funding, according to TechCrunch.

Key takeaway : Use flow charts to communicate complicated processes.

As a company that offers startups “growth capital for the new economy” through non-dilutive revenue-share agreements, Clearco (previously known as Clearbanc) wins big by communicating how the process works in less than a slide’s time.

That’s right: the company uses a flowchart .

For complicated business processes that would normally take several slides of text to communicate, a flowchart is a smart way to visualize a process while saving space and keeping your audience engaged.

Particularly for a company like Clearco, this is key for getting investors up to speed. Then you can move on to the other facts and figures they’ll surely want to hear.

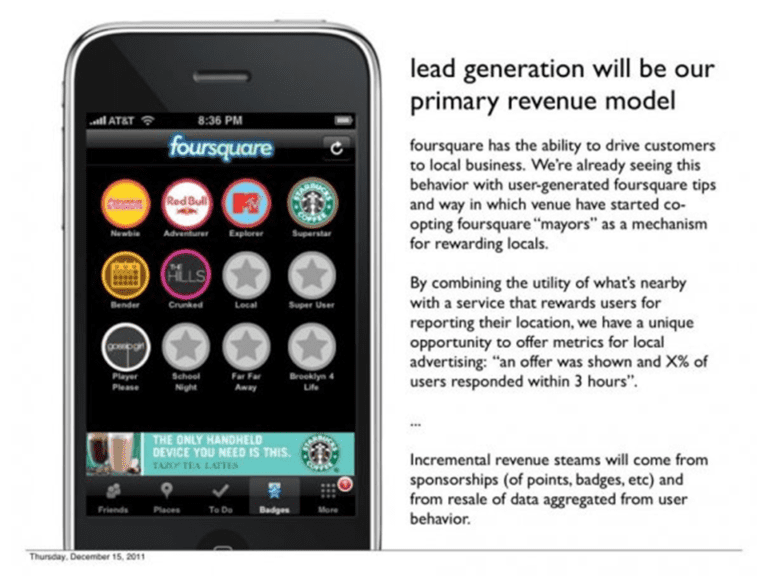

27. Foursquare

Key takeaway : Show how the end-product looks in your presentation.

Okay look, I get it. This slide deck from 2009 is certainly behind on times when it comes to design tips in this current day and age…

BUT take it back to more than a decade ago, and you’ll see why Foursquare’s pitch deck won big with investors.

As one of the first businesses to employ gamification, the company lets this selling proposition shine by using an iPhone graphic to show how the app’s points and badges look to the end-user. These visuals communicate the appeal by showcasing exactly how consumers will interact with, and understand, the product.

In essence, it takes the guesswork out of their pitch.

So while the text-heavy aspect of this sample pitch deck isn’t exactly ideal, their use of visuals can teach us a lesson.

28. TalentBase

How much did they raise? $330K to date.

Key takeaway : Let the numbers do the talking.

Rather than take up a ton of slide space in this pitch deck example, TalentBase, an affordable payroll solution , focused their real estate on the real deal-closers: the numbers.

While this won’t work for every business, as you may need to add more slides to truly explain the environment your organization exists in and your processes, TalentBase uses their positioning to drive forward a captivating narrative.

And this narrative utilizes only numbers to connect the dots in the mind of potential investors about the value TalentBase offers, in terms of market capture.

29. Peloton

Key takeaway : Discuss both the tangible and intangible benefits your product offers.

In 2018, back before the real pandemic hey-day of this tech unicorn, Peloton dazzled in a funding round and managed to capture in $550M funding.

Part of this can be attributed to Peloton’s emphasis on the benefits it brings customers.

Across multiple slides, the exercise equipment and media company highlights how customers’ lives are improved in various emotional and functional ways. Since this connection lays the groundwork for long-term B2C relationships, investors can immediately identify the value encompassed by this modern fitness tool.

Looking to try something similar? Check out the below Peloton sample pitch deck, reimagined by our Venngage design team.

How much did they raise? $ 10M in September 2021.

Key takeaway : Cut down on space with text and graphics that follow a clear logical narrative.

In just seven slides, the equity management and investor relations platform, Ledgy, was able to convince their audience that their product was worth investing in.

By putting their mission first, and following it up with engaging visuals, the company tells a story despite using minimal text.

Yoko Spirig, CEO and co-founder of Ledgy, echoed this sentiment in an interview : “Starting with the ‘why’ lets you build the business case for the product, and create a logical narrative that investors can follow.”

That’s why, design-wise, this is one of the cleanest pitch deck examples in the bunch. It’s one of the shortest too.

I also appreciate how their brand colors are used in conjunction with white to keep everything consistent (something that Venngage’s automated branding feature My Brand Kit can help you out with).

To summarize, some of my favorite pitch deck design tips include:

- Adding icon headers to your most important insights

- Use similar charts and graphs for easy comparisons across slides

- For longer pitch decks, switch up the slide layouts

- Pick a consistent theme for your presentation background images

- Don’t just list your ideal users, create visual personas

- Use a timeline to show how your company has grown

- Always do the math for your audience

Not a graphic designer? No sweat — creating your own pitch deck is a breeze using Venngage’s Presentation Maker . (We’ll go over the basics here; for a more in-depth look, check out this article .)

Step 1: Sign up on Venngage for free using your email, Gmail or Facebook account. If you already have an account, log in to access the platform.

Step 2: Browse through our selection of professionally designed pitch deck templates and select one that suits your needs and preferences.

Step 3: Once you’ve selected a template, start customizing it to match your branding and content. Venngage’s drag-and-drop editor allows you to easily modify every aspect of the template, including colors, fonts, images and layout. Replace the placeholder text with your own content, such as your company information, product or service details, market analysis and financial projections.

Note: there are hundreds of templates available that you can design and share for free. If you want to access certain designs, take advantage of in-editor features like My Brand Kit/Team collaboration .

Step 4: Once you’re satisfied with your design, you can download it in various formats such as PDF or PNG. Alternatively, you can use also Venngage’s sharing options to present your pitch deck directly from the platform or share it with others via a generated link.

To leave a lasting impression on your audience, consider transforming your slides into an interactive presentation. Here are 15 interactive presentation ideas to enhance interactivity and engagement.

Now that you know how to create the best pitch decks to communicate your ideas, present your startup or raise venture capital, take action and start designing your own pitch deck today!

What should a pitch deck contain?

A well-crafted pitch deck should contain key information that effectively communicates your business concept, value proposition, and growth potential. While the specific content may vary depending on your industry and target audience, here are the essential elements that a pitch deck should typically include:

- Problem statement

- Market opportunity

- Business model

- Competitive analysis

- Marketing and sales strategy

- Team members

- Financial projections

- Milestones and timeline

- Investment opportunity

What is a pitch deck presentation?

A pitch deck presentation is a slideshow that introduces a business idea, product, or service to investors. Typically consisting of 10–20 slides, a pitch deck is used to persuade potential investors to provide funding for a business. It serves as a comprehensive overview of your company, outlining your business model, the problem you solve, the market opportunity you address, your key team members, and your financial projections.

And if you want to learn more, there are a ton of other presentation design resources you can take a look at next:

- 20+ Business Pitch Deck Templates and Design Best Practices

- 120+ Best Presentation Ideas, Design Tips & Examples

- 15 Presentation Design Statistics to Know For 2019

- 7 Tips for Designing a Persuasive Presentation [Presentation Design Guide + Templates]

- 20+ Consulting Proposal Templates

Discover popular designs

Infographic maker

Brochure maker

White paper online

Newsletter creator

Flyer maker

Timeline maker

Letterhead maker

Mind map maker

Ebook maker

21 Pitch Deck Examples That Work & Why (2024)

Get the best investor pitch deck examples and learn what to include in a pitch presentations from successful fundraising decks that VCs and angels couldn’t resist.

5 minute read

helped business professionals at:

Short answer

What do all successful pitch decks have in common?

6 things successful startup pitch decks have in common:

- They showcase a market gap

- They present a unique solution

- They include a synergetic and capable team

- They outline a solid business model

- They deliver impressive (realistic) financial projections

- They wrap it all up in a "before-and-after" narrative with the startup as the disruptive force behind the change

Why do most pitch decks fail?

99% of startup decks fail to secure funding. But that doesn’t have to be you.

Most founders make bad pitch presentations because they fail to communicate critical information investors need to qualify them. Which means they are automatically disqualified.

If you look at the best pitch decks (those that managed to get noticed and get funded), they all use a similar content structure.

It’s the same pitch deck template advised as a winning outline by Y Combinator and Sequoia Capital.

Don’t invent the wheel. Just learn from other’s successes and failures.

Let me show you some enviable pitch deck examples, and see why they worked so well.

Let’s go!

21 Successful pitch deck examples to learn from

It’s a basic fact that some pitch deck presentations work better than others.

I’m not gonna go into how to make a winning pitch deck here, but here’s the jist According to Naval Ravikant , Angellist co-founder and former CEO.

A fundable pitch deck showcases a fundable startup. To do this you need to demonstrate that you have 3 critical things 100% of investors are looking for: (1) exceptional team, (2) exceptional product, and (3) exceptional traction.

All the examples I’ll bring you here do this . Learn from them and make the adaptations to your own startup pitch.

NOTE: the deck presentations on this page are remakes of the original decks, using the orignial content but made interactive with Storydoc.

The originals would look quite old to you by now, and these interactive versions would most likely work better. Our data backs this up every day.

View our list of startup pitch deck examples:

Airbnb startup pitch presentation

The Airbnb pitch deck is almost the perfect pitch deck in my opinion (that’s why it’s number 1 on the list). And now that we gave it an interactive remake I think it’s perfected.

This investor deck example covers everything an investor would need to want to get in on it.

The deck showcases a great product, market size and opportunity, business model, traction, competitors and competitive advantage, a serious team, financials, and even user testimonials.

It presents a broad (and universally felt) problem in simple terms, it presents the solution just as simply. And I love how it shows how the product is used in action in such simplicity. Makes it seem effortless.

Uber funding pitch deck

The Uber pitch deck example does everything right.

It grasps the transformation it promised to do in just 4 words “Next-Generation Car Service” (though I would replace “car” with “transportation”). It has a clear and crisp description of the problem in a single paragraph.

It outlines a massive market that they mean to disrupt. They present an evolving 4-stage revenue model far into the future (Uber Cab > Uber Driver > Uber Delivery > Uber Pay), and they present amazing traction.

No wonder Uber was so successful at raising money .

Netflix startup deck

Netflix had a great idea but they also weaved it into a great problem-solution narrative pitch deck. The problem? Outdated entertainment distribution. The solution? Streamed entertainment that’s accessible, personalized, and ad-free.

The Netflix pitch deck example also uses their team to “sell” their dream by playing on Netflix’s strong company culture .

This pitch deck could have been slightly better if it had a comprehensive outline of the market gap.

Tinder pitch presentation

Tinder's pitch deck is a masterclass in simplicity .

Starting from their title: “The dating game: it starts with a swipe”. Which wasn’t true at the time but is now (like it or not) the new normal.

And down to their summary of the user flow: “Match. Chat. Date.”

Simple, yet super clear.

Tinder’s deck is also one of the most fun decks I’ve ever seen . I’ve breezed through it maybe a dozen times but still, it gets me excited about the app every time.

WeWork startup pitch deck

The WeWork pitch deck example is probably the most famous on this list. What makes it so great (beyond its fundraising success) is that it managed to sell a great vision.

WeWork’s deck is all about its grand vision - “Empowering Tomorrow's World at Work”.

They only topped it off with a bit of promising financials to quiet an uneasy investor’s mind.

After all, WeWork managed to sell a low-return real estate company as a fast-growing high-tech solution.

Slack company intro deck

Slack’s startup company intro deck uses a transformational narrative framework to take potential investors from Slack’s history to Slack’s future and tempt investors to join the journey.

The snappy and descriptive title for the deck and company - “Collaboration platform for 21st century” encapsulates this contrast between past and future.

It’s a beautiful piece of copywriting.

The transformational narrative sets the stage for winners (who embrace the change Slack represents) and losers who stay behind.

This plays on an investor’s biggest fear - missing a great opportunity and staying behind.

Dropbox pitch deck

The DropBox pitch deck is another example of a very well-made pitch deck. So it’s no surprise they were backed by Sequoia .

They did great work in applying Sequoia’s pitch deck template with an emphasis on “ why now? ” and “ why you? ”.

But they did even better. The deck includes a crisp and simple breakdown of the problem and their groundbreaking solution, and an attractive product demo.

If I may say so, I think we improved the deck by turning bullet points into dynamic content and adding their amusing and tempting video in their “about us” slide.

Tesla investor deck

The Tesla pitch deck is unique on this list because of its emphasis on the team and product specifications rather than the “big idea”.