- Search Search Please fill out this field.

What Is Investment Banking?

Understanding investment banking.

- IPO Underwriting

The Bottom Line

- Investing Basics

Investment Banking: What It Is and What Investment Bankers Do

Julia Kagan is a financial/consumer journalist and former senior editor, personal finance, of Investopedia.

:max_bytes(150000):strip_icc():format(webp)/Julia_Kagan_BW_web_ready-4-4e918378cc90496d84ee23642957234b.jpg)

Charlene Rhinehart is a CPA , CFE, chair of an Illinois CPA Society committee, and has a degree in accounting and finance from DePaul University.

:max_bytes(150000):strip_icc():format(webp)/CharleneRhinehartHeadshot-CharleneRhinehart-ca4b769506e94a92bc29e4acc6f0f9a5.jpg)

Pete Rathburn is a copy editor and fact-checker with expertise in economics and personal finance and over twenty years of experience in the classroom.

:max_bytes(150000):strip_icc():format(webp)/E7F37E3D-4C78-4BDA-9393-6F3C581602EB-2c2c94499d514e079e915307db536454.jpeg)

Investment banking is a type of banking that organizes large, complex financial transactions such as mergers or initial public offering (IPO) underwriting. These banks may raise money for companies in a variety of ways, including underwriting the issuance of new securities for a corporation, municipality, or other institution. They may manage a corporation's IPO. Investment banks also provide advice in mergers, acquisitions, and reorganizations.

In essence, investment bankers are experts who have their fingers on the pulse of the current investment climate. They help their clients navigate the complex world of high finance.

Key Takeaways

- Investment banking deals primarily with raising money for companies, governments, and other entities.

- Investment banking activities include underwriting new debt and equity securities for all types of corporations.

- Investment banks will also facilitate mergers and acquisitions, reorganizations, and broker trades for institutions and private investors.

- Investment bankers work with corporations, governments, and other groups. They plan and manage the financial aspects of large projects.

- Investment banks were legally separated from other types of commercial banks in the United States from 1933 to 1999, when the Glass-Steagall Act that segregated them was repealed.

Ellen Lindner / Investopedia

Investment banks underwrite new debt and equity securities for all types of corporations, aid in the sale of securities, and help facilitate mergers and acquisitions , reorganizations, and broker trades for institutions and private investors. Investment banks also provide guidance to issuers regarding the offering and placement of stock.

Many large investment banking systems are affiliated with or subsidiaries of larger banking institutions, and many have become household names, the largest being Goldman Sachs, Morgan Stanley, JPMorgan Chase, Bank of America Merrill Lynch, and Deutsche Bank.

Broadly speaking, investment banks assist in large, complicated financial transactions. They may provide advice on how much a company is worth and how best to structure a deal if the investment banker's client is considering an acquisition, merger, or sale.

Investment banks' activities also may include issuing securities as a means of raising money for client groups and creating the documentation for the U.S. Securities and Exchange Commission (SEC) necessary for a company to go public.

Investment banks employ investment bankers who help corporations, governments, and other groups plan and manage large projects , saving their clients time and money by identifying risks associated with the project before the client moves forward.

In theory, investment bankers are experts who have their finger on the pulse of the current investing climate, so businesses and institutions turn to investment banks for advice on how best to plan their development, as investment bankers can tailor their recommendations to the present state of economic affairs.

Regulation and Investment Banking

The Glass-Steagall Act was passed in 1933 after the 1929 stock market crash led to massive bank failures. The purpose of the law was to separate commercial and investment banking activities. The mixing of commercial and investment banking activities was considered very risky and may have worsened the 1929 crash.

This is because, when the stock market crashed, investors rushed to draw their money from banks to meet margin calls and for other purposes, but some banks were unable to honor these requests because they too had invested their clients' money in the stock market.

Before Glass-Steagall was passed, banks could divert retail depositors' funds into speculative operations such as investing in the equity markets. As such operations became more lucrative, banks took larger and larger speculative positions, eventually putting depositors' funds at risk.

However, the stipulations of the act were considered harsh by some in the financial sector, and Congress eventually repealed the Glass-Steagall Act in 1999. The Gramm-Leach-Bliley Act of 1999 thus eliminated the separation between investment and commercial banks. Since the repeal, most major banks have resumed combined investment and commercial banking operations.

Initial Public Offering (IPO) Underwriting

Essentially, investment banks serve as middlemen between a company and investors when the company wants to issue stock or bonds. The investment bank assists with pricing financial instruments to maximize revenue and with navigating regulatory requirements.

Often, when a company holds its IPO, an investment bank will buy all or much of that company's shares directly from the company.

Subsequently, as a proxy for the company launching the IPO, the investment bank will sell the shares on the market. This makes things much easier for the company itself, as it effectively contracts out the IPO to the investment bank.

Moreover, the investment bank stands to make a profit, as it will generally price its shares at a markup from what it initially paid for them. In doing so, it also takes on a substantial amount of risk.

Although experienced analysts use their expertise to accurately price the stock as best they can, the investment bank can lose money on the deal if it turns out that it has overvalued the stock, as in this case, it will often have to sell the stock for less than it initially paid for it.

Example of Investment Banking

Suppose that Pete's Paints Co., a chain supplying paints and other hardware, wants to go public. Pete, the owner, gets in touch with José, an investment banker working for a larger investment banking firm.

Pete and José strike a deal wherein José (on behalf of his firm) agrees to buy 100,000 shares of Pete's Paints for the company's IPO at the price of $24 per share, a price at which the investment bank's analysts arrived after careful consideration.

The investment bank pays $2.4 million for the 100,000 shares and, after filing the appropriate paperwork, begins selling the stock for $26 per share. However, the investment bank is unable to sell more than 20% of the shares at this price and is forced to reduce the price to $23 per share to sell the remaining shares.

For the IPO deal with Pete's Paints, then, the investment bank has made $2.36 million [(20,000 × $26) + (80,000 × $23) = $520,000 + $1,840,000 = $2,360,000]. In other words, José's firm has lost $40,000 on the deal because it overvalued Pete's Paints.

Investment banks often compete with one another to secure IPO projects, which can force them to increase the price they are willing to pay to secure the deal with the company that is going public. If competition is particularly fierce, this can lead to a substantial blow to the investment bank's bottom line.

Most often, however, there will be more than one investment bank underwriting securities in this way, rather than just one. While this means that each investment bank has less to gain, it also means that each one will have reduced risk.

What Do Investment Banks Do?

Broadly speaking, investment banks assist in large, complicated financial transactions . They may provide advice on how much a company is worth and how best to structure a deal if the investment banker's client is considering an acquisition, merger, or sale.

Essentially, their services include underwriting new debt and equity securities for all types of corporations, providing aid in the sale of securities, and helping to facilitate mergers and acquisitions, reorganizations, and broker trades for both institutions and private investors. They also may issue securities as a means of raising money for the client groups and create the necessary U.S. Securities and Exchange Commission (SEC) documentation for a company to go public.

What Is the Role of Investment Bankers?

Investment banks employ people who help corporations, governments, and other groups plan and manage large projects, saving their clients time and money by identifying risks associated with the project before the client moves forward. In theory, investment bankers should be experts who have their finger on the pulse of the current investing climate. Businesses and institutions turn to investment banks for advice on how best to plan their development. Investment bankers, using their expertise, tailor their recommendations to the present state of economic affairs.

What Is an Initial Public Offering (IPO)?

An initial public offering (IPO) refers to the process of offering shares of a private corporation to the public in a new stock issuance. Public share issuance allows a company to raise capital from public investors. Companies must meet requirements set by exchanges and the SEC to hold an IPO. Companies hire investment banks to underwrite their IPOs. The underwriters are involved in every aspect of the IPO due diligence, document preparation, filing, marketing, and issuance.

The names of investment banks like Goldman Sachs and Morgan Stanley come up frequently in discussions about the financial market, highlighting the importance of these institutions in the financial world.

In general, investment banks assist clients with large and complex financial transactions. This includes underwriting new debt and equity securities, aiding in the sale of securities, and helping to facilitate mergers and acquisitions, reorganizations, and broker trades. Investment banks may help other organizations raise capital by underwriting initial public offerings (IPOs) and creating the documentation required for a company to go public.

Federal Reserve History. " Banking Act of 1933 (Glass-Steagall Act) ."

Federal Trade Commission. " Gramm-Leach-Bliley Act ."

:max_bytes(150000):strip_icc():format(webp)/investing6-5bfc2b8ec9e77c005143f13b.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Join 307,012+ Monthly Readers

Get Free and Instant Access To The Banker Blueprint : 57 Pages Of Career Boosting Advice Already Downloaded By 115,341+ Industry Peers.

- Break Into Investment Banking

- Write A Resume or Cover Letter

- Win Investment Banking Interviews

- Ace Your Investment Banking Interviews

- Win Investment Banking Internships

- Master Financial Modeling

- Get Into Private Equity

- Get A Job At A Hedge Fund

- Recent Posts

- Articles By Category

Investment Banking Pitch Books: Design, Examples & Templates

If you're new here, please click here to get my FREE 57-page investment banking recruiting guide - plus, get weekly updates so that you can break into investment banking . Thanks for visiting!

Bankers like to complain about almost everything, but near the top of the complaint list is “investment banking pitch books.”

Some Analysts claim that you’ll devote all your waking hours to creating these documents, while others say they’re time-consuming but not that terrible to create.

Some senior bankers swear by pitch book presentations, claiming that they help to win and close deals, while others think they’re over-hyped.

We’ll look at all those points and more in this article, including downloadable pitch book examples and templates for you to use.

Table Of Contents:

- What Is An Investment Banking Pitch Book?

How to Create a Pitch Book

Pitch book presentation, part 1: pitching your team as the advisor of choice, pitch book presentation, part 2: providing background and context, pitch book presentation, part 3: choose your own adventure, sell-side pitch books for sell-side mandates, buy-side pitch book examples, equity pitch book and debt pitch book examples for financing mandates, other types of pitch books, why do you spend so much time on investment banking pitch books as a junior banker, what do you need to know about pitch books as an intern or new hire, what is an investment banking pitch book.

Pitch Book Definition: In investment banking, pitch books refer to sales presentations that a bank uses to persuade a client or potential client to take action and pay for the bank’s services. Pitch books typically contain sections on the merits of the transaction; analysis of potential buyers or sellers; pricing and valuation information; as well as key risks to mitigate.

That is the classic definition, but in practice, people use the term “pitch book” to refer to almost any presentation created by a bank.

We’re going to focus on presentations to potential clients here because they tend to be the most time-consuming ones, and they generate the most horror stories as well.

There’s no way to “measure” how much pitch books matter, but it’s safe to say that they’re less important than the time spent on them implies.

Bankers win deals primarily because of relationships cultivated over a long time ; a pretty presentation right before a company goes public means little compared with the 5-10 years of meeting the CEO and CFO before that point.

Pitch books matter to you as an investment banking analyst or associate primarily because you’ll spend a good amount of time creating them – and you can’t screw up if you want a good bonus .

Almost all investment banking pitch books use a structure similar to the following:

- Situation, 0r “Current State”: Your prospective client is looking for growth.

- Complication, or “Problem”: The potential client’s growth rate has been slowing down.

- Hypothesis, or “Solution”: Acquiring a growing company can meet the potential client’s need for growth.

Then, you go into detail showing why the hypothesis might be true – including why your team is qualified to lead this transaction, similar transactions you’ve led before, and the valuation this company can expect to receive.

Investment Banking Pitch Book Sample PPT and PDF Files and Downloadable Templates

Here are a number of example pitch books in editable Powerpoint (PPT, PPTX) and PDF versions, drawn from some of the case studies within our investment banking courses :

- Jazz Pharmaceuticals – Valuation and Sell-Side M&A Pitch Book (PPT)

- Jazz Pharmaceuticals – Valuation and Sell-Side M&A Pitch Book (PDF)

- KeyBank and First Niagara – FIG M&A Pitch Book (PPT)

- KeyBank and First Niagara – FIG M&A Pitch Book (PDF)

- Netflix – Equity, Debt, and Convertible Bond Financing Pitch Book (PPT)

- Netflix – Equity, Debt, and Convertible Bond Financing Pitch Book (PDF)

Here’s what you can expect in the first few parts of any pitch book, including many examples from actual bank presentations:

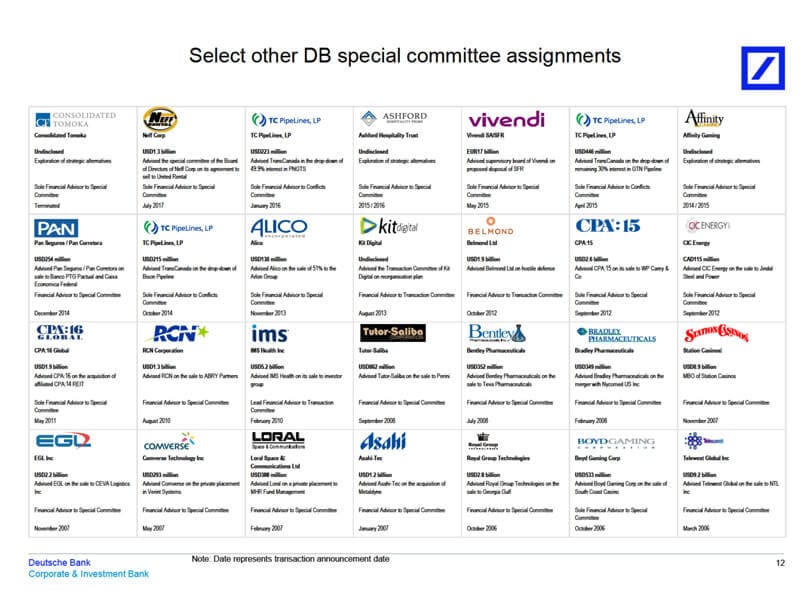

The first section of investment banking pitch books introduces your firm’s platform, recent transactions, and team.

You might include stats on your firm’s position in the league tables , or explain its growth story and how it’s different from its competitors. Here are a couple of examples:

You might also write about distribution partnerships and other strategic developments here.

The next section consists of credentials , which include similar transactions your team has completed. Since turnover at banks is high, these lists often include transactions completed by team members when they were at other banks.

Here are a few examples:

These pages look simple, but they can be time-consuming to put together because you need to find the most relevant deals and rearrange elements from other presentations.

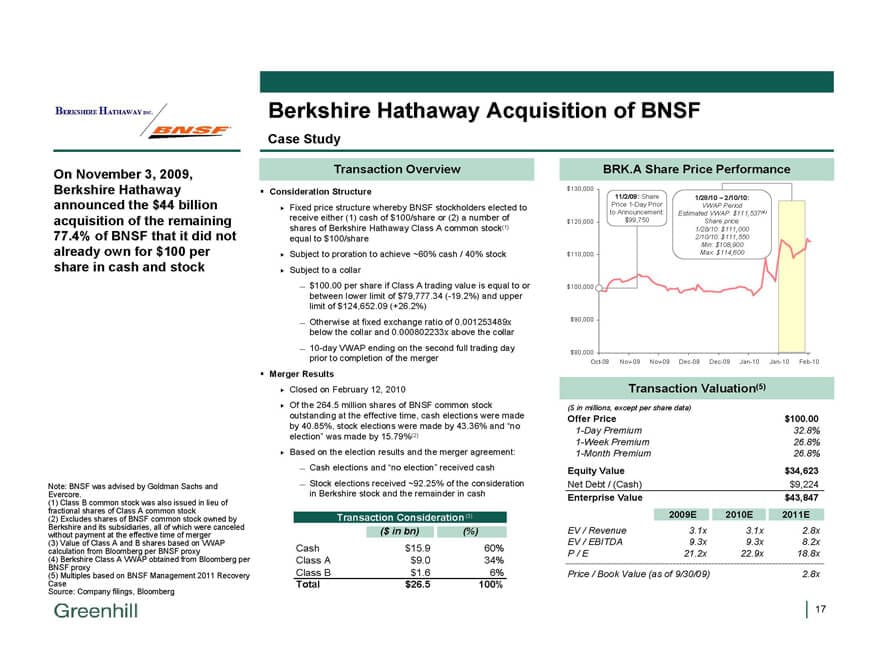

You may also go into more detail on a few deals and devote entire pages to them.

Banks often call these 1-page descriptions “ case studies ,” and you can see a few examples below:

Finally, this section will include a team biography , including previous firms, relevant deals/clients, and education for each member:

Before you move into the specific situation of the company you’re meeting, you’ll usually share some updates on the industry as a whole and recent deal activity in the sector.

Unlike the first part, which was about your team ’s experience, this one is more about general trends that affect everyone.

For example, if a tech startup is considering an initial public offering , you’ll review tech IPOs from the past 6-12 months, explain how they’ve performed, and discuss the types of companies that tend to go public.

Here are a few examples of industry updates:

And here are a few examples of deal/transaction updates:

After these first few sections, which are similar in any pitch book, the structure and content start to differ based on what the bank is pitching.

We’ll look at three broad categories here:

- Sell-side mandates (i.e., convince a company to sell itself)

- Buy-side mandates (convince a company to acquire another company)

- Financing mandates (raise debt or equity).

You’ll start by including a few slides on how your bank would position the company and make it attractive to potential buyers.

For example, if the firm is a traditional services provider with a growing online presence, you might attempt to spin it as a “SaaS” (Software-as-a-Service) company – within reason.

If you’re pitching a large company on a divestiture, you might explain how you’ll make the division sound like more of a standalone entity – meaning that buyers won’t have to spend as much time and money integrating it.

Next, you’ll lay out the company’s valuation and the price it might expect to receive in a sale.

This valuation section might be only 1-2 slides in a short pitch book or 20+ slides in a longer one.

Common elements include the valuation football field , output of a DCF model , comparable public companies , and precedent transactions .

The “football field,” or summary valuation, pages range from simple to more interesting to so complicated they could be eye charts .

Here are a few examples of other valuation-related slides:

It is unusual to include a Contribution Analysis or any M&A analysis in this section unless the deal is highly targeted or has advanced quite far.

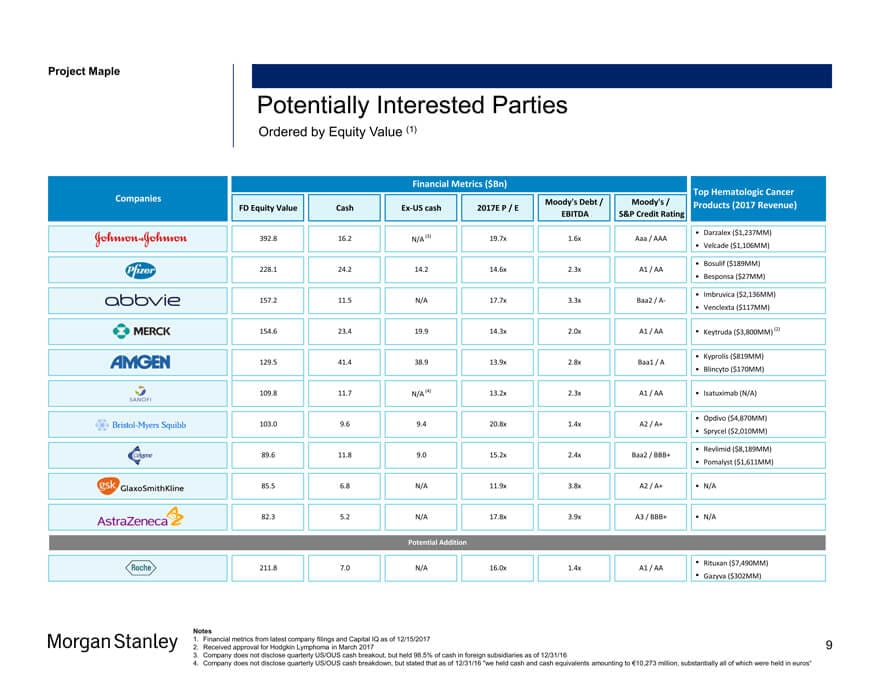

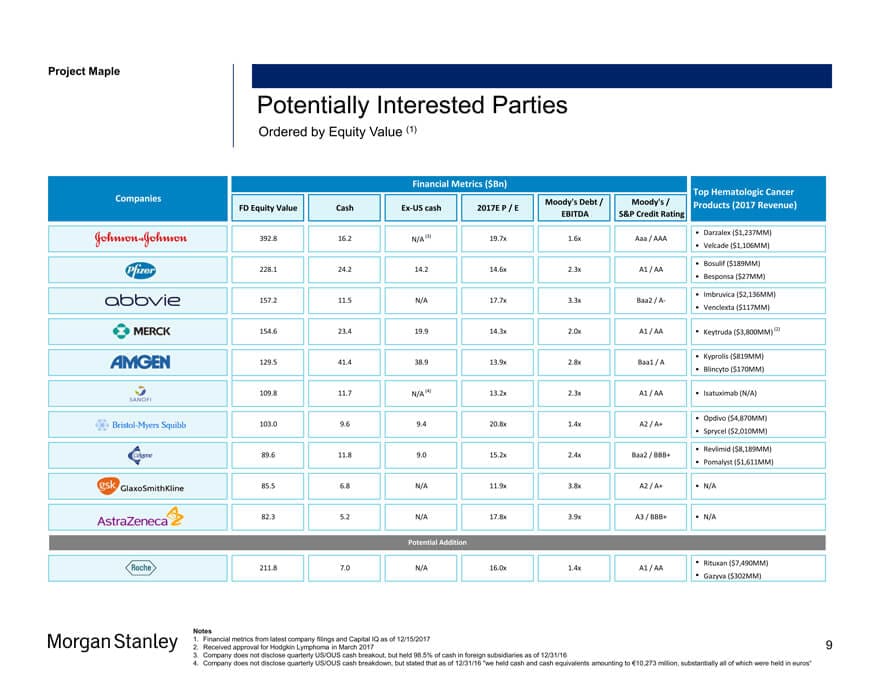

After the valuation section, you’ll discuss “potential buyers,” a list that is sometimes the longest and most time-consuming section of the entire pitch book.

Short summaries aren’t too bad, but if a senior banker wants a full page on each acquirer, you can look forward to a lot of monotonous work gathering the information.

Here are a few shorter examples:

You’ll conclude the pitch book with a summary of your recommendations and the company’s next steps.

For example, you might suggest that the company pursue a targeted sale process with the 5-10 best buyers and aim to complete a deal within 12 months.

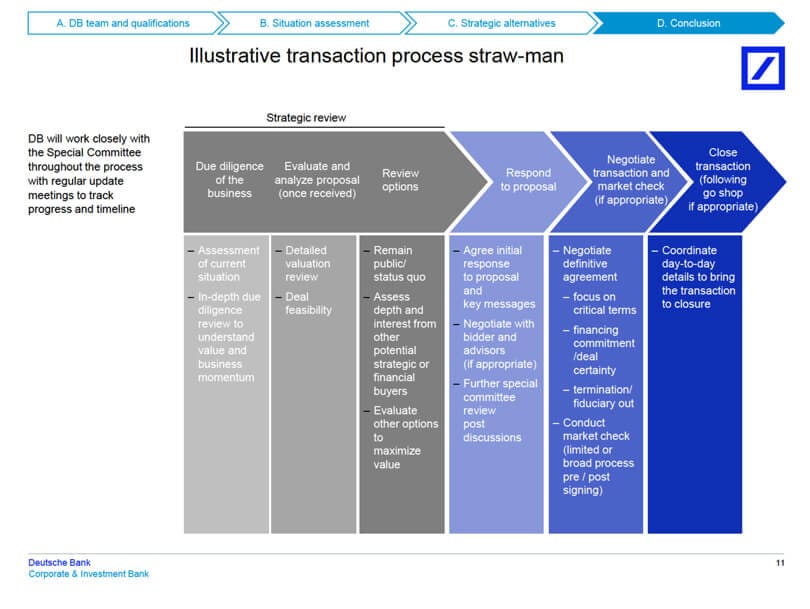

These slides tend to be generic ones, used across multiple presentations:

Finally, in longer investment banking pitch books, there is often an Appendix with more detailed models and data, and sometimes even longer lists of potential acquirers.

No one reads this section, but bankers enjoy spending time on unnecessary work (read: evidence of effort).

Investment banking pitch books for buy-side M&A deals follow a similar structure, with a few key differences:

- The “Positioning” part in the beginning might be more about the types of acquisitions the company should pursue and how your bank will help close these deals.

- There may be valuation information, but the purpose will be different: in buy-side deals, you value the buyer to estimate how much a stock issuance to fund the deal might be worth. You might also include quick valuations of potential targets.

- Instead of profiling potential acquirers, you’ll profile potential targets . This list is often longer than the list of potential buyers because a large company could, in theory, choose from hundreds or thousands of potential targets to acquire.

Buy-side M&A pitch books are often shorter than sell-side ones, but they can be more tedious to create due to the longer profile lists.

As a junior banker, you won’t have much input into the acquisition targets that are profiled in these presentations, but senior bankers try to present ideas that:

- Maintain or exceed the firm’s cost of capital.

- Maintain the firm’s competitive advantage.

- Enhance the firm’s ability to serve clients.

- Help the firm expand into high-growth geographies or industries.

Large companies often meet with dozens of bankers per month, so originality can be important as well; many investment banks pitch the same set of acquisition targets repeatedly.

If you present an idea the company has seen 100 times before, they’re unlikely to be excited – but if you find a company they haven’t considered, or you have some exclusive insight, you’ll capture their attention.

It’s tough to find real investment banking pitch books for these transactions because most buy-side M&A deals never close, so the banks do not disclose any of the documents.

But here are a few company profile and associated commentary slides similar to the ones found in buy-side pitch books:

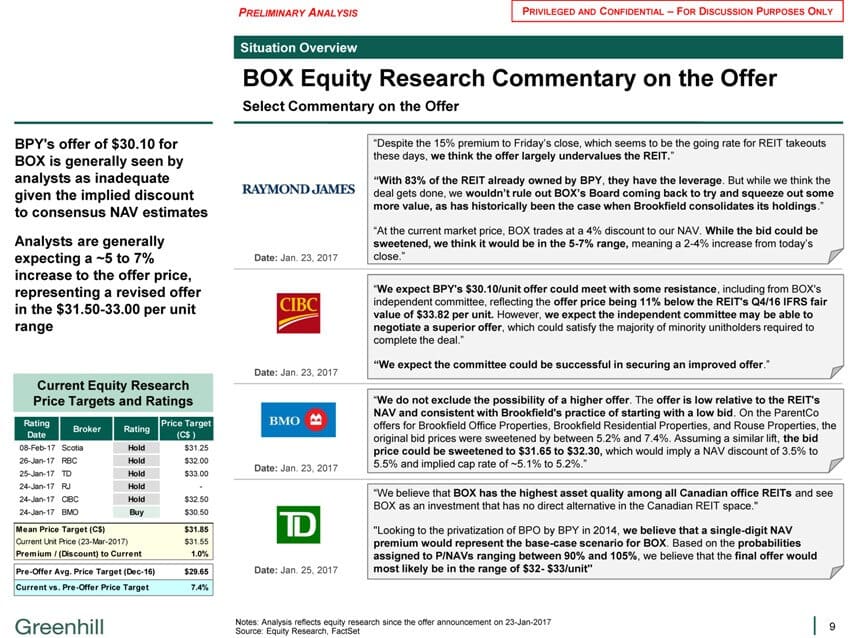

- Brookfield Canada Office Properties by Greenhill

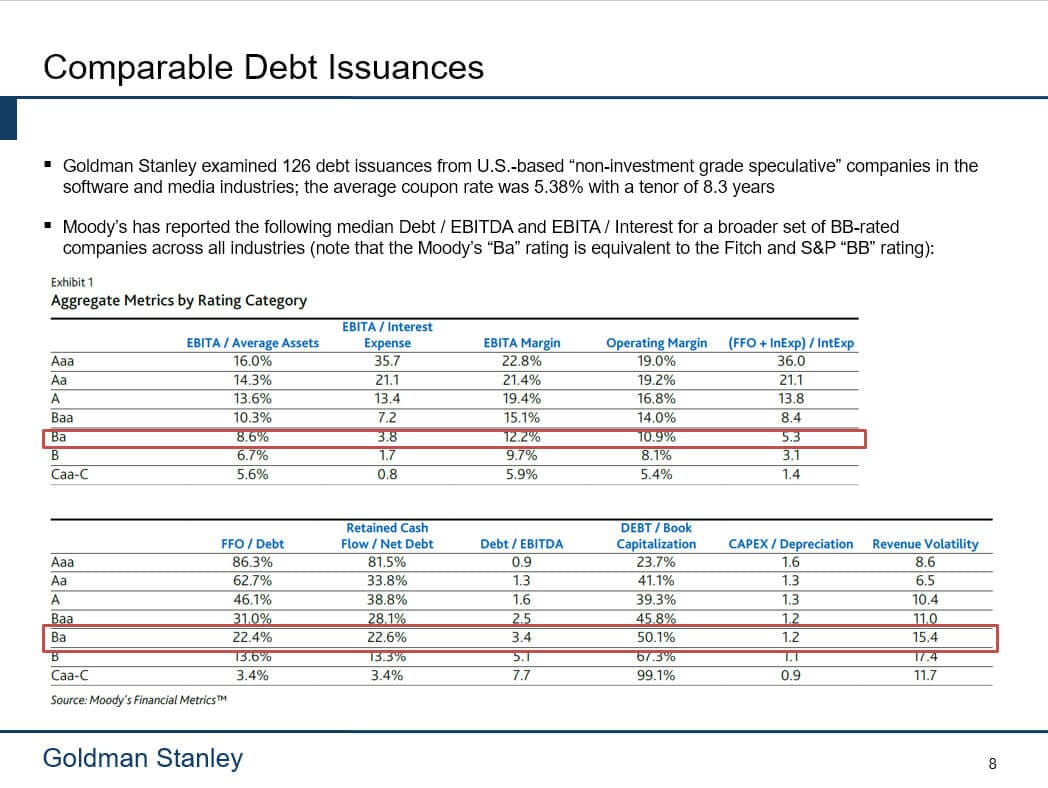

- Banco Santander S.A. by Goldman Sachs

- Side-by-Side Comparison of Buyer and Seller by JP Morgan

- Equity Research Commentary on Buyer’s Offer for Seller by Greenhill

In financing mandates – for equity, debt, and even restructuring deals – there are a few major differences compared with the investment banking pitch books described above:

- No Profiles – You are simply pitching the company on raising capital or restructuring its capital, so there is no need to discuss potential buyers or sellers.

- Financing Models Instead of / or In Addition to Valuation – Valuation still matters for equity and restructuring deals, but you will also have to present additional analyses that are relevant to the deal.

For example, if you’re pitching an IPO, you might show the range of multiples at which the company could go public, the range of proceeds it might receive, and how its value might change after the deal.

In a debt deal, you’ll show the credit stats and ratios for the company under different scenarios, such as Term Loans vs. Subordinated Notes, and explain which one is best based on that.

For more examples, please see the articles on ECM , DCM , and Restructuring .

Also, see our coverage of IPO valuation models and debt vs. equity analysis :

Many other presentations get labeled “pitch books” even if banks pitching their own services do not create them.

For example, management presentations for pitching clients to potential buyers are often labeled “pitch books.”

However, they’re just extended versions of the Confidential Information Memorandum (CIM) .

And in the EMEA region, they’re the same thing because CIMs tend to be more like presentations than written documents.

Banks also create presentations to deliver Fairness Opinions , update clients on recent buyer or seller activity, and update clients on the status of M&A deal negotiations.

None of these is a pitch book according to the classic definition, but the slides often look similar, and there may be some common elements, such as the valuation section.

Not all pitch books take days or weeks to complete – shorter ones might require only a few hours of work.

But they can easily spiral into never-ending projects that require all-nighters and extraordinary effort to finish, resulting in those legendary investment banking hours .

That’s because of:

- Attention to Detail – You’ll spend a lot of time making sure your punctuation is consistent, that all the footnotes are in the right spots, and that the dates are correct.

- Dozens of Revisions – Senior bankers love to make changes well past the point of diminishing returns. It’s not uncommon to see “v44” at the end of file names.

- Conflicting Changes – The Associate wants one thing, the VP wants another, and the MD wants something else. And if you implement the MD’s version based on seniority, the others may fight back.

- Random Graphic Design Work – This one is more of an issue at boutique firms that lack presentations departments, but sometimes you’ll have to spend time creating fancy visual elements on slides – which end up being useless once your MD changes his mind and rips out those slides.

If you’re new to the industry, you should familiarize yourself with the layout and design elements of pitch books, but you do not need to be an expert on the creation process.

Different banks use different tools and methods, so it might be counterproductive to learn too much in advance.

You should also learn the key PowerPoint shortcuts very well, including how to customize PowerPoint to make it more efficient (see our tutorial on PowerPoint Shortcuts in Investment Banking below):

https://www.youtube.com/watch?v=tnJ1e2xJmFc

Everyone knows that Excel is important in finance, but people tend to underestimate PowerPoint – even though most junior bankers spend more time in PowerPoint than Excel.

To learn those efficiently, check out our PowerPoint Pro course , which covers the fundamentals of presentation creation, including how to set up PowerPoint properly in the first place, alignment and formatting tricks, slide organization, pasting in Excel data, and applying the “finishing touches.”

There are also practice exercises for creating deal and company profiles and fixing slides with formatting problems.

If you learn all that and understand the structure and layout of investment banking pitch books, you won’t have much to complain about – even as the other interns and analysts around you are whining.

You might be interested in a detailed tutorial on investment banking PowerPoint shortcuts or this article titled Stock Pitch Guide: How to Pitch a Stock in Interviews and Win Offers .

About the Author

Brian DeChesare is the Founder of Mergers & Inquisitions and Breaking Into Wall Street . In his spare time, he enjoys lifting weights, running, traveling, obsessively watching TV shows, and defeating Sauron.

Free Exclusive Report: 57-page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews

Read below or Add a comment

10 thoughts on “ Investment Banking Pitch Books: Design, Examples & Templates ”

Hi Brian. Thank you for valuable information!

I’m currently interning. After sitting in a client presentation. What questions should I ask my supervisor regarding the presentation. As we’re going to have a follow up call

I’m not sure I understand your question. The questions you ask are completely dependent on the presentation, so I can’t really answer this without knowing the contents of the presentation.

Its a great article. Appreciate if you also have a link or article for new PE firm Pitch Deck (presenting to investment banks or FIGs), please. Thanks

Sorry, don’t have anything there.

Great article! The information is very helpful and informative. Where and how can I find other examples of sell-side pitchbooks similar to the ones mentioned in this article?

Thanks, Ryan

Thanks. Unfortunately, sell-side pitch books are hard to find because they’re not disclosed publicly. You can find presentations for recently announced deals by Googling the deal’s name and limiting the search to the sec.gov site and going through those results.

Is an information memorandum informally called a teaser or is this something else?

A teaser is a much shorter document, such as a 1-2-page summary of the company’s key benefits, financials, growth opportunities, etc.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Perfect Your PowerPoint Skills

The BIWS PowerPoint Pro course gives you everything you need to complete pitch books and presentations in half the time and move straight to the front of the "top tier bonus" line.

IMAGES

VIDEO