Everything that you need to know to start your own business. From business ideas to researching the competition.

Practical and real-world advice on how to run your business — from managing employees to keeping the books.

Our best expert advice on how to grow your business — from attracting new customers to keeping existing customers happy and having the capital to do it.

Entrepreneurs and industry leaders share their best advice on how to take your company to the next level.

- Business Ideas

- Human Resources

- Business Financing

- Growth Studio

- Ask the Board

Looking for your local chamber?

Interested in partnering with us?

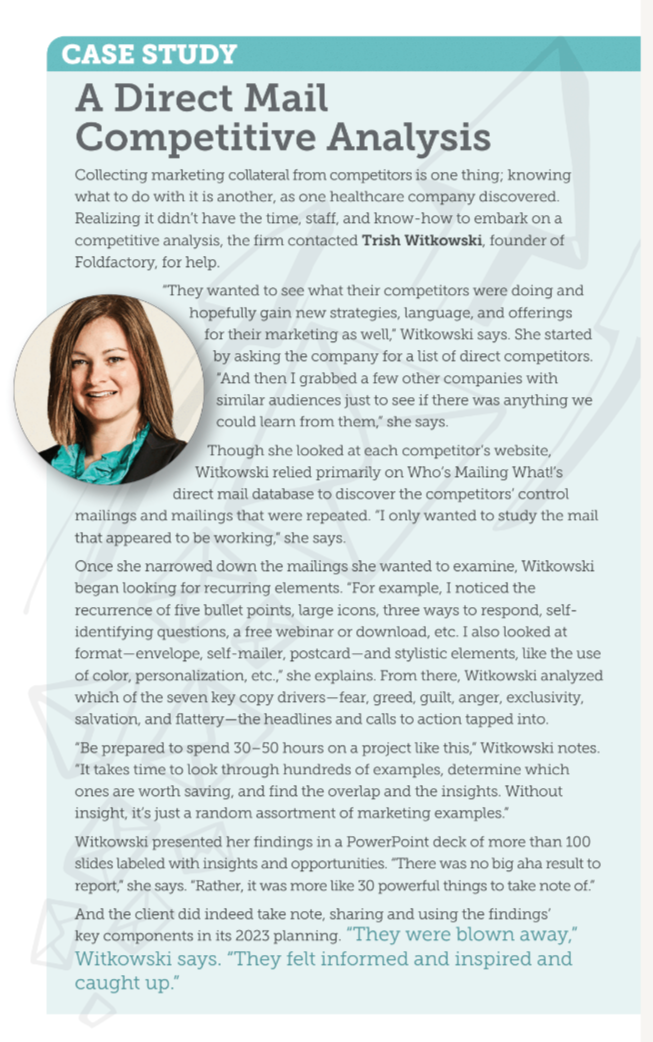

Start » strategy, sizing up the competition: how to conduct competitive research.

Competitive research can reveal trends in the marketplace and gaps in your own business plan.

Competitive research is a crucial part of any good marketing plan. This term may elicit some negative images but competitive research has nothing to do with spying. It has everything to do with paying attention to your competition and what they are doing.

Many people will lose out on business to competitors they have never even heard of simply because they’ve never taken the time to do competitive research. Understanding what your competition is doing will help you position yourself, and your product or service, within the market.

What is competitive research?

Competitive research involves identifying your competitors, evaluating their strengths and weaknesses and evaluating the strengths and weaknesses of their products and services. By looking at your biggest competitors, you can see how your own products and services stack up and what kind of threat they pose to your business. It also helps you identify industry trends you may have been missing.

Four benefits to doing competitive research are:

- Understanding your market . Competitive research can reveal trends in the marketplace that might have otherwise been missed. The ability to identify and predict trends is a huge asset for any business, helping to improve value proposition for customers. This is an important component of competitive research that you should constantly be doing.

- Improving your marketing . Your customers care about how your product or service is going to make their lives better. If they are leaving to go to one of your competitors, it’s probably because that company does a better job of explaining the benefits to the customer base, or does in fact provide a better product or service. Competitive research helps you understand why customers choose to buy from you or your competitors and how your competition is marketing their products. Over time, this can help you improve your own marketing programs.

- Identifying market gaps . When you do competitive research, you’re analyzing the strengths and weaknesses of your competitors. You’ll often find that, by looking at the data, there is a segment of the population that is being underserved. This could put your business in a unique position to reach those customers.

- Planning for the future . The most important byproduct of competitive research is that it will help you create a strategic plan for your business. This includes things like improving your product or service, using more strategic pricing strategies, and improving the promotion of your products.

Good competitive research could put your business in a unique position to reach customers who are being underserved.

6 steps to competitive research

It may sound obvious, but the first step is to simply identify who your top competitors are . There are two different types of competitors to identify: direct and indirect.

Direct competitors are targeting the same customer base you’re targeting. They are solving the same problem that you are trying to solve and sell a similar product or service.

Indirect competitors may sell something similar to your product or service but target a different audience, or they may target your same customer base but have a slightly different product or service.

It’s important to understand this segment of your market for two reasons: (1) it could provide you with growth opportunities for your own business, and (2) it could also highlight a threat to your business of which you would otherwise be unaware.

Here are six steps to getting started on competitive research:

Identify main competitors.

The most obvious way to do this is simply by searching your product or service category on the web and seeing what comes up. You can also check websites like Crunchbase or Product Hunt . You may find competitors that you might not have noticed before.

The goal is to cast a wide net and get an idea of who your main competitors are. Another good way to identify direct and indirect competitors is to ask your potential customers what services they are already using.

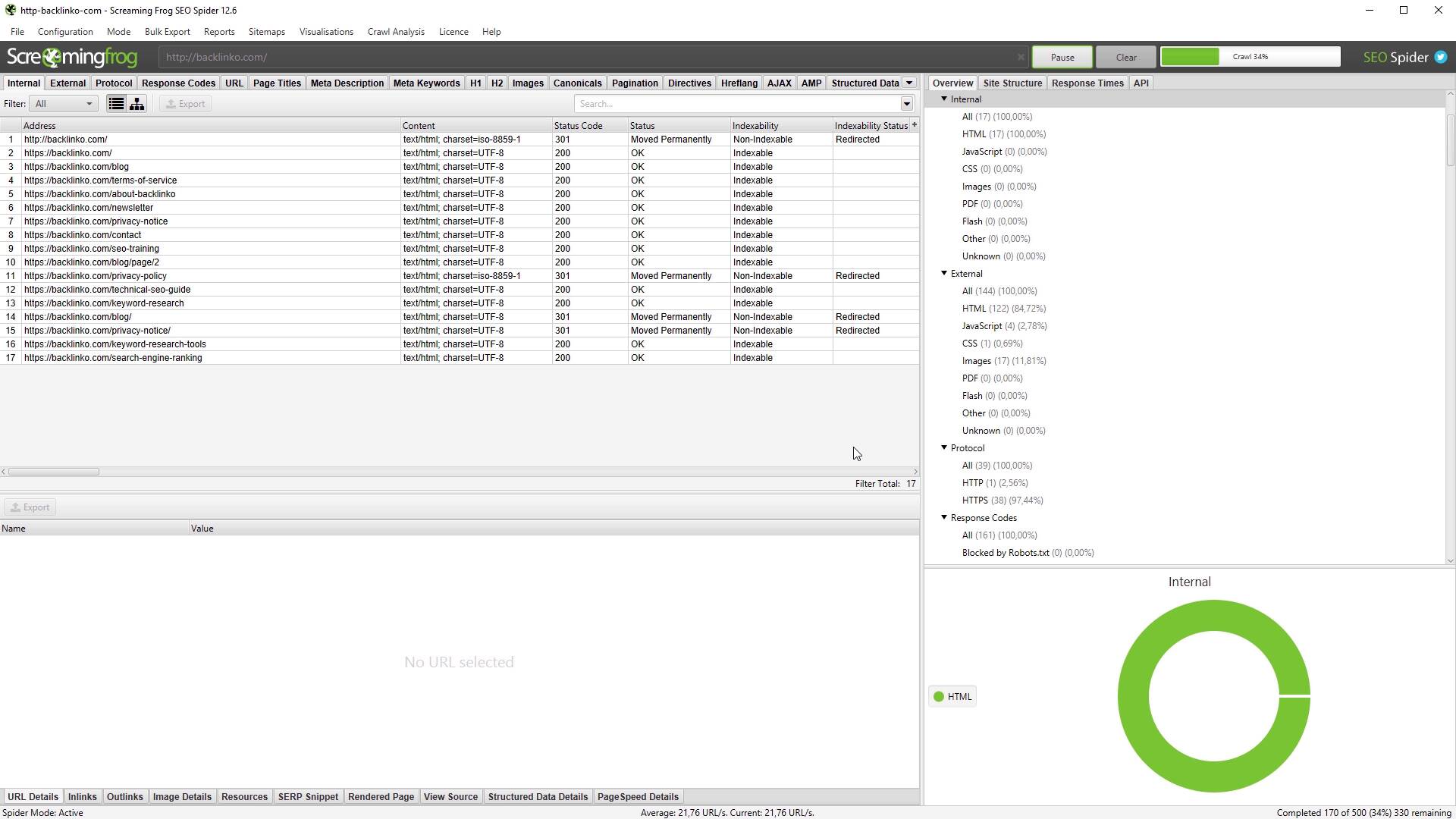

Analyze competitors' online presence

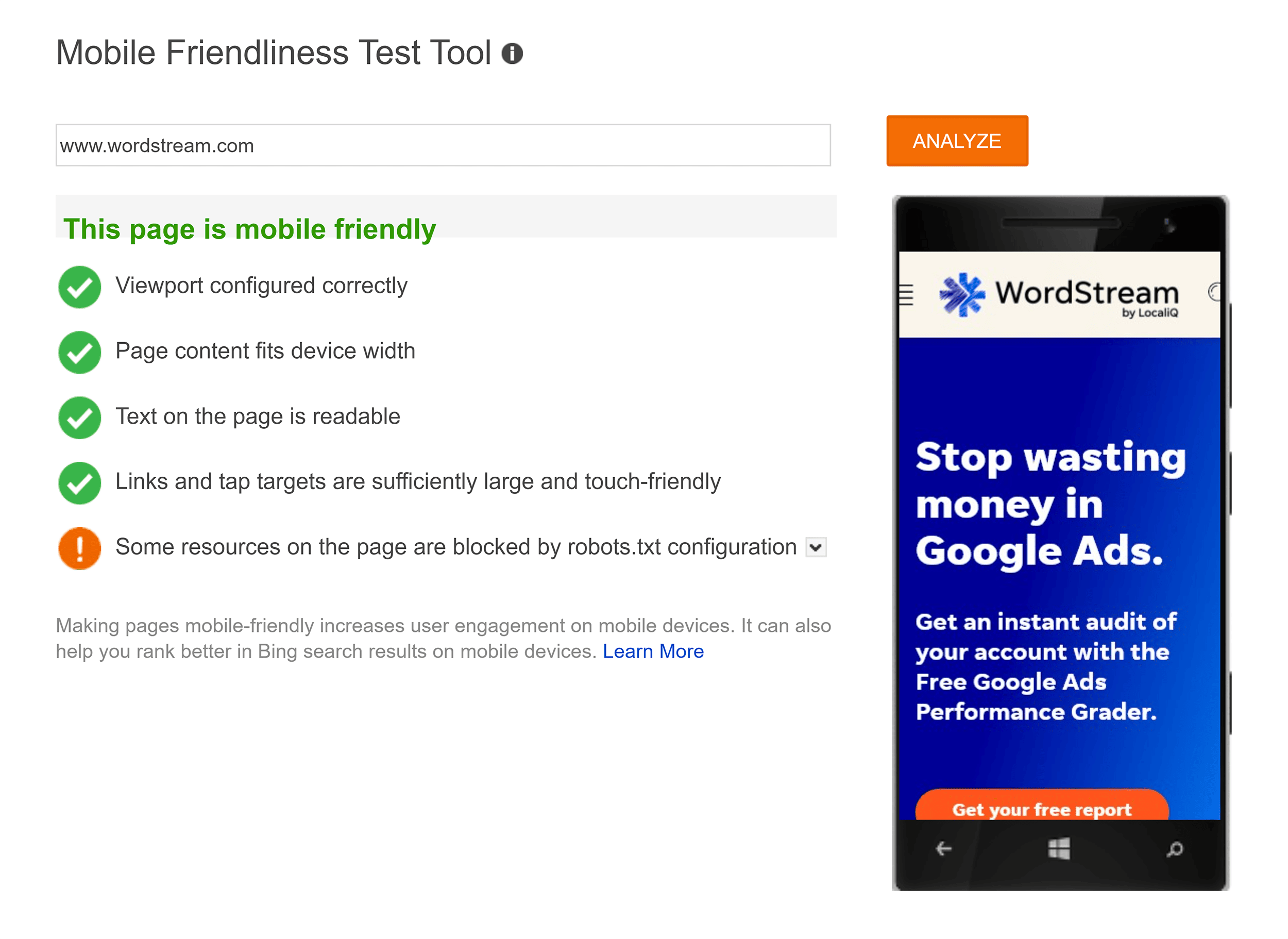

Once you’ve identified your main competitors, you want to look at their website, the type of content they are publishing, and their social media presence. Then, look for any blogs, white papers, and social media content being provided about their products and how to use them. Ask yourself these questions:

- What is the user experience like on their website?

- Is it easy to navigate?

- Do you clearly understand the products or services they offer?

- Is their website mobile-optimized?

- How often do they blog and most importantly, is the quality of their content good?

- What topics do they blog about most frequently?

- What social platforms are they actively using to talk about their products and services?

- Is this content engaging their target audience?

The answers to these questions show you opportunities where you can outperform your competitors. You will want to pay close attention to anything they are doing well that you aren’t doing. This will help give you a better understanding of where you should be focusing your attention and resources.

Gather information

The best way to gather information about your competitors is by acting like one of their customers. Sign up for their email list so you can get an idea of how they communicate.

Also, follow their blog and social media accounts and watch how they interact with their customers online. What kind of experience do customers have with your competitors?

You should consider shopping from them so you can see what their product looks like and what the experience is like from a customer perspective.

Track your findings

Make sure you track your competitors' findings on a spreadsheet; it will help with ongoing monitoring. This isn’t a complicated process, you just need to keep track of what they are doing over time so that you can see how they change everything from pricing to marketing and promotional activities.

You’ll start by dividing your competitors into direct and indirect customer columns. You’ll then track the following information:

- Company name

- Social media sites

- Unique features

- Pros and cons

- Screenshots and additional links

Check online reviews

Try to find as many reviews of your competitors as possible. Read their social media reviews, comments on their blogs, and case studies on their website. If they offer and present Google reviews, read them as well. It’s a good idea to understand not only the good things that your competitors may be doing, but the bad things as well. Include mentions with the Better Business Bureau about them in your research.

How customer-focused are they? This could be an opportunity for you to stand out. And, if they sell a product similar to yours, this will be a good way to find out if a lot of people are interested in it.

Any negative feedback will help you identify areas where you can improve your own product or service.

Identify areas for improvement

Now that you’ve taken note of some of the biggest differences between you and your competitors, it’s time to think about how you can use this information to improve your own business results.

Your competitive research should reveal at least one area your business can stand to improve in. This will help you learn how to engage better with your customers and online followers.

Keep in mind that competitive research is never a "one-and-done" event. Ongoing monitoring, such as observing how competitors evolve, is necessary to ensure that you are staying competitive in the marketplace.

Tools for competitive research

Software and technology now make it easier than ever to conduct competitive research. However, there are hundreds of competitive research tools on the market and narrowing down the right software can feel overwhelming.

This is why we’ve done the legwork and narrowed it down for you. Here are four tools you should consider using to conduct your competitive research:

SEMrush : This is one of the best competitive research tools on the market. It contains over 30 tools that can track things like SEO, PPC, keyword research, competitive research, and more. SEMrush will help you discover new competitors, find their best-used keywords, and analyze their ad copy. They have flexible pricing plans depending on your business needs.

SpyFu : This search analytics tool reveals the keywords websites buy on Google. So, once you’ve identified your biggest competitors, you can track every keyword they’ve bought. Plus, you can track every keyword they are ranking for and find the content and backlinks that helped them rank in the first place.

BuzzSumo : BuzzSumo lets you see how your content is matching up to your competitors’ content. You can see which content is shared more frequently on social media compared to others, and you can even schedule alerts on your competitors’ content which will make it easier to continue tracking them.

Owletter : Owletter tracks and analyzes emails sent from a website. This allows you to track your competitors’ email marketing and see what is and isn’t working for them. To get started, you’ll need to sign up to join your competitors’ email list. Then, every time you receive an email, Owletter will take a screenshot, analyze it, and alert you to any useful information.

Competitive research can seem daunting at first but it’s an essential part of running a successful business. When you incorporate the right tools into your research, you may find that it’s not as difficult as you imagined.

On some level, understanding your competitors is just as important as understanding your customers. Your competitors have valuable lessons to teach you and it’s important to regularly monitor their online activity. Doing so will strengthen your business and improve your own value for your customers.

CO— aims to bring you inspiration from leading respected experts. However, before making any business decision, you should consult a professional who can advise you based on your individual situation.

CO—is committed to helping you start, run and grow your small business. Learn more about the benefits of small business membership in the U.S. Chamber of Commerce, here .

Join us for our Small Business Day event!

Join us at our next event on Wednesday, May 1, at 12:00 p.m., where we’ll be kicking off Small Business Month alongside business experts and entrepreneurs. Register to attend in person at our Washington, D.C., headquarters, or join us virtually!

Subscribe to our newsletter, Midnight Oil

Expert business advice, news, and trends, delivered weekly

By signing up you agree to the CO— Privacy Policy. You can opt out anytime.

By continuing on our website, you agree to our use of cookies for statistical and personalisation purposes. Know More

Welcome to CO—

Designed for business owners, CO— is a site that connects like minds and delivers actionable insights for next-level growth.

U.S. Chamber of Commerce 1615 H Street, NW Washington, DC 20062

Social links

Looking for local chamber, stay in touch.

What is a Competitive Analysis — and How Do You Conduct One?

Published: November 10, 2022

When was the last time you ran a competitive analysis for your brand? And most importantly, do you know how to do one efficiently?

If you‘re unsure or if the last "analysis" you ran was a quick perusal of a competitor’s website, you're likely missing out on important intelligence that could help your brand grow.

![competitive research work Download Now: 10 Competitive Analysis Templates [Free Templates]](https://no-cache.hubspot.com/cta/default/53/b3ec18aa-f4b2-45e9-851f-6d359263e671.png)

In this detailed guide, you'll learn how to conduct a competitive analysis to give your business an advantage.

Table of Contents

What is a competitive analysis?

- Understanding Competitive Market Research

Competitive Analysis in Marketing

How to do a competitive analysis, competitive product analysis, competitive analysis example, competitive analysis templates, competitive analysis: faqs, what is a competitive market analysis.

A competitive analysis is a strategy that involves researching major competitors to gain insight into their products, sales, and marketing tactics. Implementing stronger business strategies, warding off competitors, and capturing market share are just a few benefits of conducting a competitive market analysis.

A competitive analysis can help you learn the ins and outs of how your competition works and identify potential opportunities where you can outperform them. It also enables you to stay atop of industry trends and ensure your product is consistently meeting — and exceeding — industry standards.

Let's dive into a few more benefits of conducting competitive analyses:

- Helps you identify your product's unique value proposition and what makes your product different from your competitors, which can inform future marketing efforts.

- Enables you to identify what your competitor is doing right. This information is critical for staying relevant and ensuring your product and marketing campaigns outperform industry standards.

- Tells you where your competitors are falling short — which helps you identify areas of opportunities in the marketplace and test out new, unique marketing strategies they haven't taken advantage of.

- Learn through customer reviews what‘s missing in a competitor’s product, and consider how you might add features to your own product to meet those needs.

- Provides you with a benchmark against which you can measure your growth.

Competitive analysis is a meticulous strategy that dives deep into the operations of your prime competitors.

It's not just about knowing what they offer. You need to understand their sales strategies, marketing tactics, and the ethos driving their brand.

.webp)

10 Free Competitive Analysis Templates

Track and analyze your competitors with these ten free planning templates.

- SWOT Analysis

- Battle Cards

- Feature Comparison

- Strategic Overview

You're all set!

Click this link to access this resource at any time.

10 Competitive Analysis Templates

Fill out the form to access the templates., why is a competitive analysis important.

The ripple effects of a well-executed competitive analysis are manifold:

- Strategic business decisions. Anchoring your business strategies on solid, data-driven insights ensures you stay ahead in the game.

- Fortifying defenses. By knowing what your competitors are up to, you can better defend your market share and even capture new territories.

- Unearth golden opportunities. Delving into the intricacies of your competition’s operations can spotlight areas where you can shine brighter.

Beyond Just the Basics

While it's essential to understand how your competition operates, the real magic happens when you can:

- Spot your unique value. What sets you apart? How can you amplify that difference in your marketing efforts?

- Learn from their triumphs. Your competitors might just be doing something genius. Identifying their strengths ensures you're always at par, if not ahead.

- Discover their shortcomings. Every brand has its Achilles' heel. Find it. This knowledge can carve out opportunities and new strategies for your business.

- Tap into customer sentiments. Dive into customer reviews. What’s lacking in their product? Can you incorporate those missing features into your offerings?

- Benchmark your progress. Your journey is unique. However, setting a benchmark based on your competitors can offer valuable growth metrics.

What is competitive market research?

Competitive market research is a vital exercise that goes beyond merely comparing products or services.

It involves an in-depth analysis of the market metrics that distinguish your offerings from those of your competitors.

A thorough market research doesn't just highlight these differences but leverages them, laying a solid foundation for a sales and marketing strategy that truly differentiates your business in a bustling market.

In the next section, we’ll explore the nuts and bolts of conducting a detailed competitive analysis tailored to your brand.

Every brand can benefit from regular competitor analysis. By performing a competitor analysis, you'll be able to:

- Identify gaps in the market.

- Develop new products and services.

- Uncover market trends.

- Market and sell more effectively.

As you can see, learning any of these four components will lead your brand down the path of achievement.

Next, let's dive into some steps you can take to conduct a comprehensive competitive analysis.

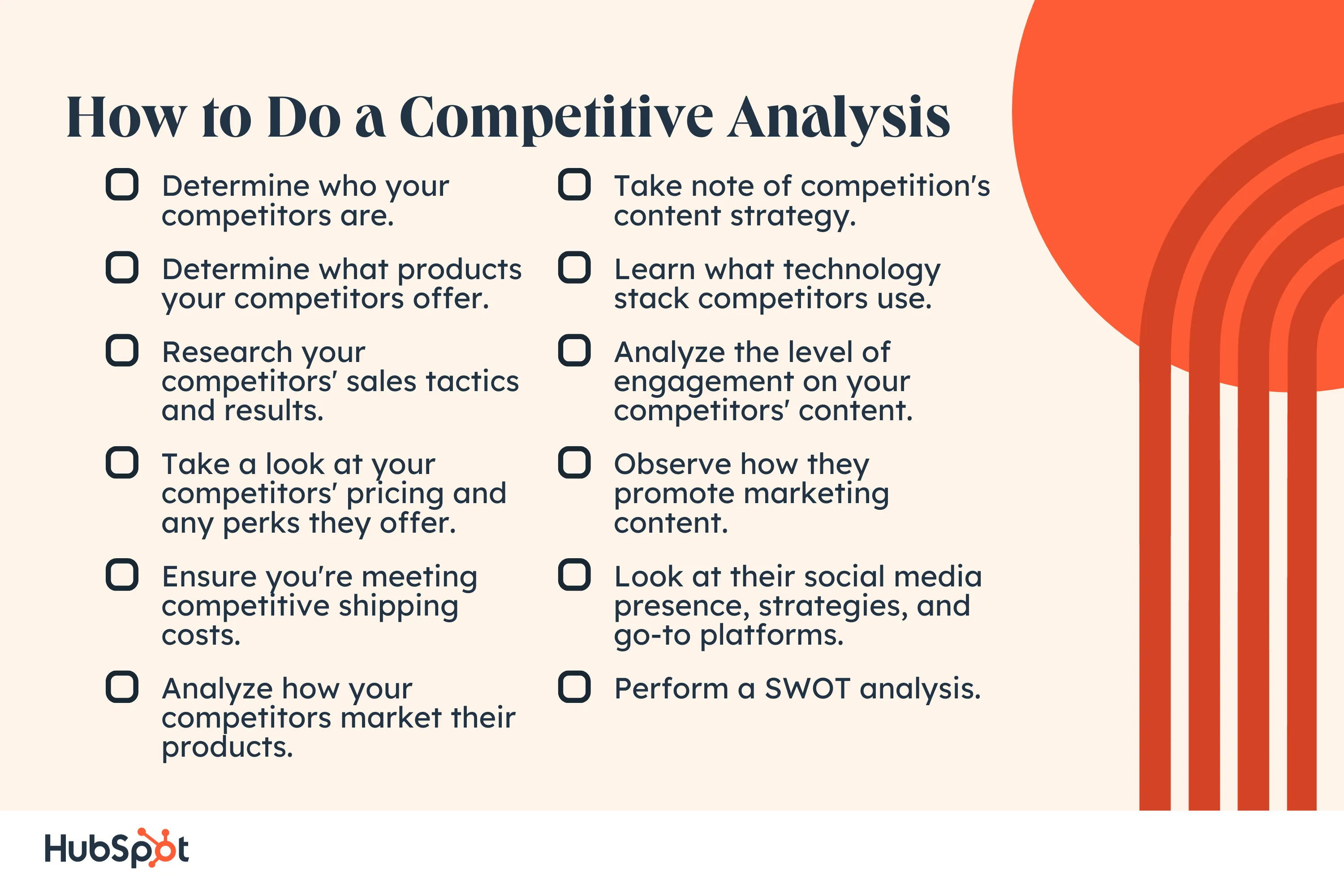

- Determine who your competitors are.

- Determine what products your competitors offer.

- Research your competitors' sales tactics and results.

- Take a look at your competitors' pricing, as well as any perks they offer.

- Ensure you're meeting competitive shipping costs.

- Analyze how your competitors market their products.

- Take note of your competition's content strategy.

- Learn what technology stack your competitors use.

- Analyze the level of engagement on your competitors' content.

- Observe how they promote marketing content.

- Look at their social media presence, strategies, and go-to platforms.

- Perform a SWOT Analysis to learn their strengths, weaknesses, opportunities, and threats.

Don't forget to share this post!

Related articles.

Market Research: A How-To Guide and Template

![competitive research work SWOT Analysis: How To Do One [With Template & Examples]](https://blog.hubspot.com/hubfs/marketingplan_20.webp)

SWOT Analysis: How To Do One [With Template & Examples]

20+ Tools & Resources for Conducting Market Research

What's a Competitive Analysis & How Do You Conduct One?

TAM SAM SOM: What Do They Mean & How Do You Calculate Them?

![competitive research work How to Run a Competitor Analysis [Free Guide]](https://blog.hubspot.com/hubfs/Google%20Drive%20Integration/how%20to%20do%20a%20competitor%20analysis_122022.jpeg)

How to Run a Competitor Analysis [Free Guide]

![competitive research work 5 Challenges Marketers Face in Understanding Audiences [New Data + Market Researcher Tips]](https://blog.hubspot.com/hubfs/challenges%20marketers%20face%20in%20understanding%20the%20customer%20.png)

5 Challenges Marketers Face in Understanding Audiences [New Data + Market Researcher Tips]

Causal Research: The Complete Guide

Total Addressable Market (TAM): What It Is & How You Can Calculate It

What Is Market Share & How Do You Calculate It?

10 free templates to help you understand and beat the competition.

Marketing software that helps you drive revenue, save time and resources, and measure and optimize your investments — all on one easy-to-use platform

Advisory boards aren’t only for executives. Join the LogRocket Content Advisory Board today →

- Product Management

- Solve User-Reported Issues

- Find Issues Faster

- Optimize Conversion and Adoption

What is competitive analysis? Template, examples, and how-to

In this comprehensive guide, we’ll define what a competitive analysis is, describe the benefits product teams stand to gain from conducting one, and walk through the steps of how to do a competitive analysis.

Through the tutorial, we’ll refer to examples to demonstrate how each step of a competitive analysis works in practice. We’ll also provide a list of customizable, free competitive analysis templates for you to use when completing these steps on your own.

Complete guide to competitive analysis

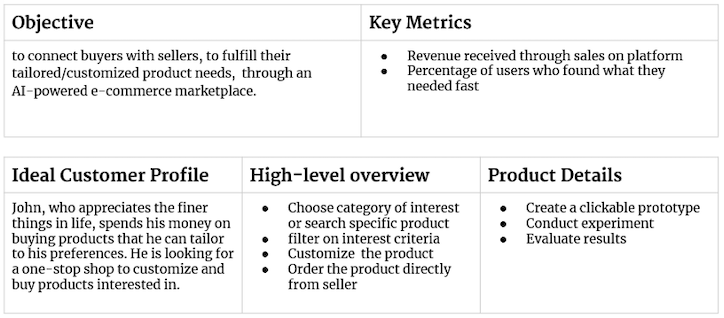

Picture this: you just came up with the next disruptive, game changing, AI-powered e-commerce marketplace. The objective is to connect buyers with sellers to fulfill their tailored and customized product needs.

You’re confident your product will take on Etsy and other big players in the market. You did some market and user research and have a good idea of your ideal customer and their (underserved) needs. Based on this data, you believe your marketplace can reach product-market fit quickly.

It’s now time for you to dust off your copy of Sun Tzu’s T he Art of War . Why is that, you ask?

The Art of War is an ancient Chinese military textbook that, although dated somewhere between ~500–400 B.C., is one of the most influential management books out there to this day. It provides great strategic and tactical advice. Moreover, it provides guidance to help you assess yourself and your competition to gain an advantage.

Maintaining a competitive advantage is the goal. Even if you have the best product in the world and you know there is a market for it, if you don’t understand your competition, you‘re bound to fail. That’s why you need to perform a competitive analysis.

As the band Rage Against the Machine would say, know your enemy .

What is competitive analysis?

Competitive analysis (sometimes called a competitor analysis or competition analysis) is exactly what it sounds like: a structured approach to identifying and analyzing your competitors. More concretely, it’s an assessment of your competition’s offerings, strategy, strengths, and weaknesses.

A competitive analysis helps you answer questions such as:

- Which other companies are providing a solution similar to ours?

- What are the ideal customer’s minimum expectations?

- What are they currently not getting from our product with regard to those expectations?

- What barriers do competitors in the market fce?

- What should we avoid introducing in our product?

- What price are customers willing to pay for our product?

- What value do we need to provide to make our product stand out in the market?

- What trends are happening and how might they change the playing field?

When conducted thoroughly and regularly, a competitive analysis provides you with tons of information that can be used to improve and optimize your product. The end result is a holistic overview of your competitor landscape.

Why do a competitive analysis?

Competitive analysis is a fundamental product management instrument. It helps PMs learn what works and what doesn’t when trying to acquire market share, identify market trends, and locate gaps in their product offering.

Competitive analysis exists to help you avoid making mistakes and empower you to beat competitors to the punch in the pursuit of product growth and success.

Knowing your competition will bring you great rewards. Conducting a competitive analysis will help you more effectively:

- Create benchmarks

- Identify opportunities to better serve customers

- Make strategic decisions

- Determine your pricing strategy

- Identify market gaps

- Determine distribution and marketing strategies

Typically, the first time you create a competitor analysis is when doing your market research. This helps you get an idea of the product-market fit , which will evolve along your journey.

As a product manager, your role is not to analyze how well your competitors are able to showcase themselves. It is your job to make the product what the customer needs it to be. Understanding your competitor’s capabilities, pricing, and product positioning helps you in this.

Keep in mind that your competitors will likely showcase themselves to appear better than they probably are. You’ll be able to acquire tons of information about them, but you should take that information with a pinch of salt.

How to do a competitive analysis

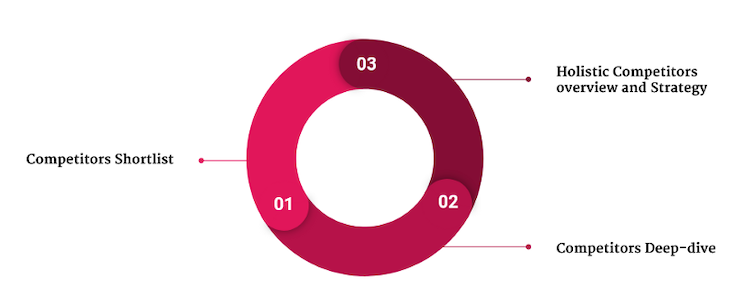

There is no a single way to do a competitive analysis. In general, a competitive analysis is made up of three fundamental components:

- A shortlist of competitors

- A competitor deep dive

- A holistic overview and strategy

To demonstrate how to do a competitor analysis, we’ll refer back to the example outlined in the introduction.

Over 200k developers and product managers use LogRocket to create better digital experiences

Remember, in our example, we’re looking to disrupt the market with an AI-powered e-commerce marketplace app that helps buyers and sellers connect to fulfill highly customized orders. Let’s call our innovative new product AGORA.

1. Create a shortlist of your competitors

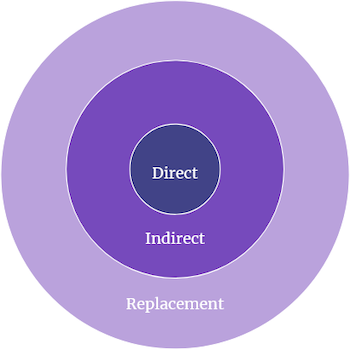

There are three types of competitors:

- Direct — Competitors that offer the same product and target the same ideal customer; you are battling direct competitors heads-on

- Indirect — Competitors that either offer a somewhat similar product or target the same ideal customer

- Replacement — Competitors that offer a different product but target the same ideal customer

For a competitive analysis, you need to identify at least your direct and indirect competitors. So how do you do that? By looking inward and researching obsessively .

Look inward

To figure out who your direct and indirect competitors are, you need to look inward first to understand your product positioning: who are you servicing and what is the offering you are providing?

You can answer these questions by doing a self-assessment using the product canvas . Originally introduced by Roman Pichler, the product canvas has since tbeen tweaked and refined.

In its core, the product canvas covers:

- The name of the product

- Objectives and key metrics for success

- The ideal customer

- A high-level overview of what’s required to meet the customer’s needs

- Just enough product details about short-term goals

For our example product, the competitive analysis might look something like this:

Research obsessively

A simple Google search using keywords from your self-assessment can get you pretty far. Other resources that can help you identify your competitors include tools such as Crunchbase, Similarweb, Statista, etc.

As the old saying goes, the customer knows best. If you don’t have many customers yet, review sites such G2, Capterra, Trustpilot, and Google Reviews can help you.

If you do have customers, go ask them. Most customers try and evaluate several products before deciding on the right product to buy. Nothing is stopping you from asking them which other brands they considered and why they ultimately chose yours.

Once you have established who your competitors are, you might find yourself in a market with many direct and indirect competitors. If that is the case, select about seven of the most relevant competitors to include in your competitor deep dive.

2. Do a deep dive on each competitor

From your a shortlist of competitors, choose about seven of your most important and dig up all the relevant information on each one.

The research conducted during the previous step will help you capture the most relevant information about your competitors for the following categories:

Company profile

Ideal customer profile, product information, market approach, swot analysis.

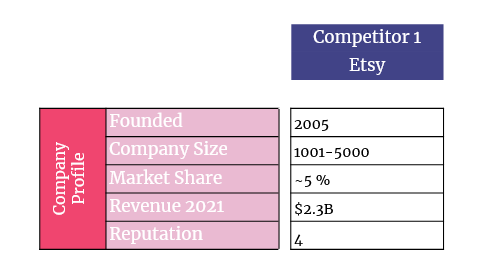

Start by creating a company profile for each of your competitors to gain a better understanding of who they are. Include the following information:

- Name — What is the name of your competitor?

- Founding date — When was the company founded? How long has it been in the market?

- Company size — How many employees does the company have? Are they equipped to service the market and innovate?

- Market share — The portion of the market controlled by the competitor’s product

- Revenue — The income the competitor generates from its product

- Reputation — What do customers think of your competitor’s product on a scale from one to five?

Let’s apply this framework to our AGORA competitive analysis example:

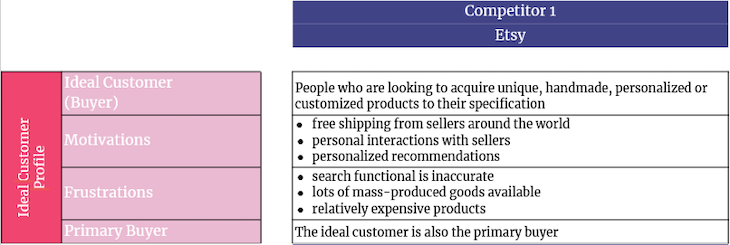

It’s important to understand who your competitors are serving and who is buying the product. This not only to reconfirm that the competitor is indeed a direct (or indirect) competitor, but also to understand what customers like and dislike about the competitor’s product.

The information you’re looking for includes:

- Ideal customer — Who is the competitor’s target customer and what defines them?

- Motivations — What does the customer enjoy about your competitor’s product?

- Frustrations — What does the customer hate about the product?

- Primary buyer — Who is the primary buyer of the product? Is it the as the ideal customer, or is it a different persona?

Let’s see what this would look like following our AGORA example. Below is an example ideal customer profile for Etsy. First, for the buyer:

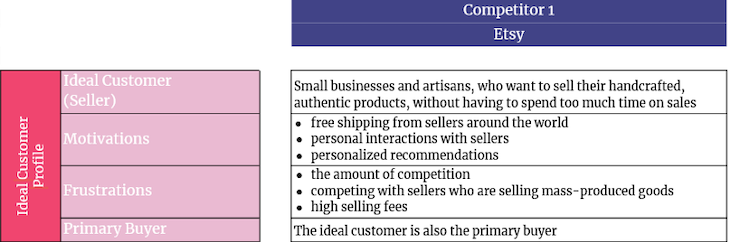

And the ideal customer profile for Etsy sellers:

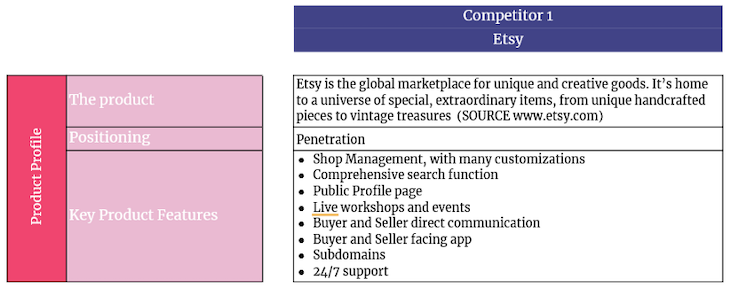

Not to be captain obvious, but you want to capture more details about the product your competitor is offering and its positioning.

The information we’re looking for at this step includes:

- The product — What is the tagline your competitor is using to market its product?

- Positioning — Based on the quality and price of the product, place the product into a one of several buckets. For example, Economy (low quality, low price), Skimming (low quality, high price), Penetration (high quality, low price), and Premium (high quality, high price)

- Product features — What are the key features being marketed and promoted?

Referring to our example AGORA app, the product information associated with Etsy on a competitor analysis might look as follows:

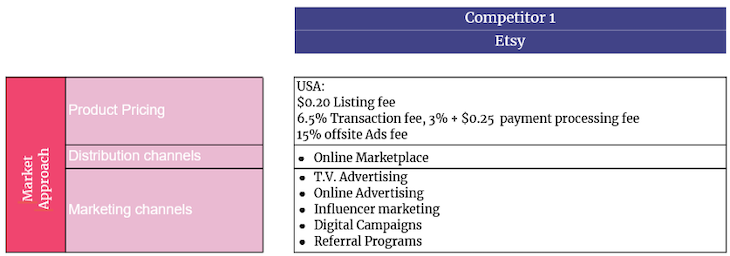

Next, seek to understand how your competitors are bringing the product to market .

List the following information:

- Pricing — What does the product costs? If there is a tiered pricing model, what does it look like?

- Distribution channels — Through which channels is your competitor selling the product?

- Marketing channels — Through which channels is the product being promoted?

In our AGORA competitor analysis example, this section would look something like:

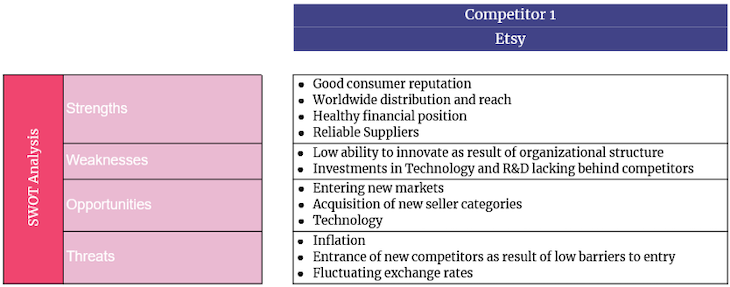

With all the information you’ve collected, you’ll find yourself in a good place to do a SWOT analysis . This is one of the most common and popular competitive analysis frameworks.

SWOT stands for strengths, weaknesses, opportunities, and threats:

- Strengths — What is going well for the competitor?

- Weaknesses — What is not going well? What obvious flaws are there?

- Opportunities — What could give your competitor an advantage?

- Threats — What might harm your competitor’s product?

For AGORA, our example competitive analysis might include a SWOT analysis that looks like this:

3. Develop a holistic overview and strategy

Now that you have a better view of your competitors, it’s time to determine how you want to approach them in the market: do you want to avoid your competitors or attack them?

Two extremely useful tools that can help you make this assessment are the competitive matrix and battle cards .

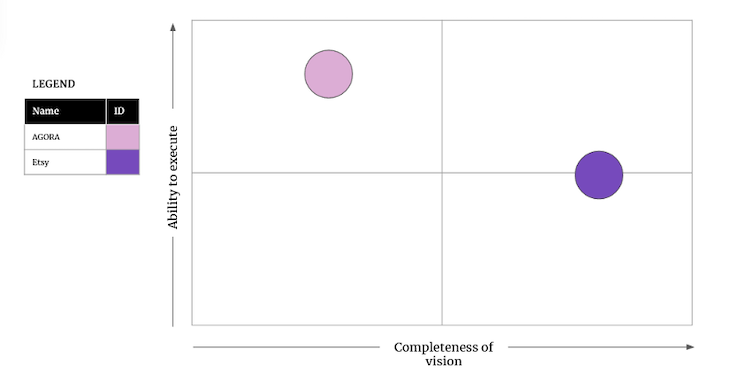

Competitive matrix

One way to operationalize the data you gathered during your competitive analysis is to plot out a four-quadrant competitive matrix.

Define key factors for the and x and y axes and plot yourself and your competition accordingly to see how you stack up. This approach is also known as perceptual mapping.

A competitive matrix for our example would look like this:

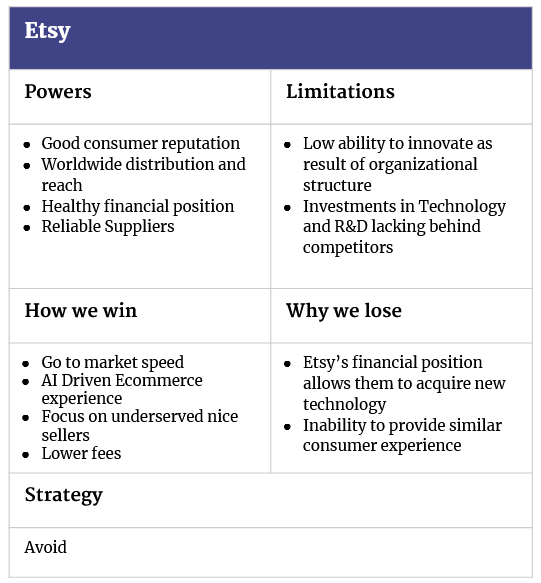

Battle cards

You can use the four-quadrant competitive matrix and competitor insights to create battle cards for each of your competitors.

Battle cards are a visual aid that help you compare your product against those of your competitors at a glance. It’s a quick and easy way to see how you stack up in key areas of performance and value. It’s also a neat way to help sales in their conversations with customers.

Here’s what you should include on each battle card:

- Company name — Name of your competitor

- Powers — What makes this competitor stand out from the rest?

- How we win — What should we do to gain a competitive advantage over this competitor?

- Why we lose — What is this competitor better at? What should we avoid so we don’t lose market share?

- Pricing — How much of a threat is the competitor’s product to our market share (low, medium, or high)?

- Strategy — Should we attack or avoid this competitor?

A battle card for our example competitive analysis might look as follows:

Alternative competitive analysis frameworks

If you‘ve followed the framework described above, you should have solid insight into your competitors, your product opportunities, and the best strategy to attack or avoid your competitors in the market.

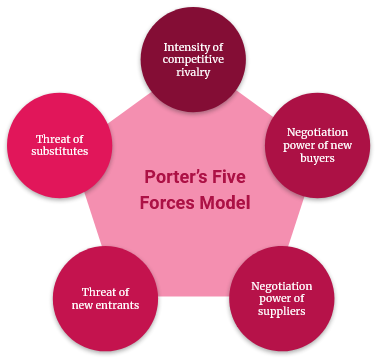

If you want to dig deeper, you can follow up your competitive analysis by producing a Five Forces analysis and/or customer journey map .

The Five Forces model

You still might want to consider gaining more insights into the competitive structure of the market you are in — in other words, gain a better understanding of how easy it is to either enter or be replaced by a competitor in the market.

A great framework to use for this type of competitor analysis is the Five Forces model , originally conceived by Michael Porter.

According to the Five Forces model, you can assess the market you are in by looking at:

- Intensity of competitive rivalry

- Negotiation power of new buyers

- Negotiation power of suppliers

- Threat of new entrants

- Threat of substitutes

Customer journey map

Instead of zooming out, you can also zoom in on the journey ideal customers make when interacting with the product itself, the distribution, or marketing channels.

On a journey map, your touchpoints are the customer, the activity performed, how the customer experiences the activities, and their expectations.

Free competitive analysis templates

A competitive analysis is a continuously updated document packed with information about your most important competitors to help you determine how to approach them in your target market.

The competitive analysis model described in this article consists of three steps that are designed to produce the insights you need to rule the market once and for all.

Below are free, customizable competitive analysis templates for each step of the process described in this article:

- Competitive analysis template

- Product canvas template

- Competitive matrix template

- Battle card template

- Customer journey map template

NOTE : To use and customize the competitive analysis templates above, after opening, select File > Make a copy from the main menu.

Featured image source: IconScout

LogRocket generates product insights that lead to meaningful action

Get your teams on the same page — try LogRocket today.

Share this:

- Click to share on Twitter (Opens in new window)

- Click to share on Reddit (Opens in new window)

- Click to share on LinkedIn (Opens in new window)

- Click to share on Facebook (Opens in new window)

- #market analysis

Stop guessing about your digital experience with LogRocket

Recent posts:.

Leader Spotlight: The importance of challenging assumptions, with Alex Swain

Alex Swain talks about how the key to avoiding building a product that nobody will purchase is to always challenge assumptions.

How to use the PR/FAQ method to drive product innovation

The PR/FAQ method helps you clarify your vision, communicate your strategy, validate your assumptions, and solicit feedback from others.

Leader Spotlight: The nuances of quality localization, with Drew Wrangles

Drew Wrangles, Head of Product & Design at Taskrabbit, shares his experiences leading product localization.

Techniques for gaining insights from customers

A deep understanding of your customers helps you prioritize problems, define solutions, and adjust communications.

Leave a Reply Cancel reply

How to Perform Competitive Research: A Comprehensive Guide

The business environment is constantly evolving. New players are emerging, technologies are advancing, and consumer preferences are changing in the blink of an eye. Staying one step forwards of your competitors is crucial to ensure your business thrives. Read more.

Shaurya Bedi

The business environment is constantly evolving. New players are emerging, technologies are advancing, and consumer preferences are changing in the blink of an eye. Staying one step forwards of your competitors is crucial to ensure your business thrives.

So, how do you "Stay ahead?"

Have you ever wondered why successful companies always seem to be one step ahead of the game?

Well, the secret lies in performing effective competitive research and analysis !

Effective competitive research and analysis help businesses understand their market and leverage their strengths. Companies can uncover valuable insights about industry trends, customer preferences, and emerging opportunities by closely monitoring their competitors.

Effective analysis is also the key ingredient that turns research into action. By thoroughly examining the data, businesses can formulate winning strategies, refine their products/services, and stay ahead of the curve.

What is Competitive Research?

Competitive research gathers and analyzes information about your industry rivals to gain a competitive edge. It involves identifying who your competitors are and analyzing their strengths and weaknesses. This lets you understand what they're doing well and where they fall short. Learning from their strategies and mistakes is like peeking over their shoulders.

Competitive research helps you uncover market trends and customer preferences. Understanding what your target audience desires and how your competitors meet those needs helps you develop a USP that sets you apart.

Competitive research also enables you to spot new opportunities and potential threats. Keeping a close eye on your competitor helps identify gaps in the market or anticipate any challenges that may come your way.

What is a Competitive Market Analysis?

Competitive market analysis is a valuable tool for businesses to evaluate their market position and gain a competitive edge. It involves analyzing key factors such as market trends, competitor strategies, pricing, and customer preferences. Studying the weaknesses and strengths of your competitors can help identify opportunities to distinguish yourself and better serve your target audience.

A competitive analysis report helps you understand the market dynamics and gives you insights into what your customers truly want. It also allows you to adapt and stay ahead by fine-tuning your marketing strategy and identifying potential threats.

Knowledge is power. Understanding your competition is the key to flourishing in today's fast-paced business environment. So, whether you're a small business or a large corporation, conducting a competitive market analysis is necessary. It helps you make informed decisions and sets you on the path to success.

How do you conduct a Competitive Analysis?

Now that you know what is a competitive analysis, here's how you can perform a comprehensive competitive analysis:

Identify competitors

To get started, it's important to distinguish your direct rivals who offer similar products or services from your indirect rivals who cater to the same target audience. Make a comprehensive list of all potential competitors, including industry leaders, emerging players, and startups. Use online research tools, social media channels, and trade publications to gather information.

Analyze market positioning

Next, analyze your competitors' market positioning. Understand their value proposition, target market, and unique selling points. Compare their products or services with yours, identifying gaps or areas where you can differentiate yourself. Research their pricing strategies, promotions, and customer relationships to gain insights into their competitive advantage.

Assess strengths and weaknesses

Evaluate your competitors' strengths and weaknesses. Identify aspects where they excel and what sets them apart from others. Simultaneously, identify any weaknesses or shortcomings that you can leverage. Consider product quality, customer service, marketing efforts, innovation, and customer loyalty programs.

Evaluate marketing strategies

Examine your competitors' marketing strategies, including digital marketing campaigns, advertising, social media presence, and search engine optimization. Assess their branding, messaging, and engagement with customers. Look for opportunities to improve your brand image or capitalize on unexplored marketing channels.

Importance of Competitive Research

Let's explore the importance of competitive research and discover how it can give you that competitive edge!

- Understanding the market landscape : Competitive research allows you to understand the current market landscape comprehensively. You can discover untapped opportunities and potential threats by analyzing your competitors' strengths, weaknesses, and market positioning. This information helps you make informed decisions and adjust your business strategies accordingly.

- Setting benchmarks : Competitive research also enables you to set criteria for your own business. By evaluating your rivals' successes and failures, you can establish attainable goals and strive to exceed them. Setting standards provides a clear direction and helps you track your progress concerning the competition.

- Innovating and differentiating : Staying stagnant in a rapidly evolving market is a recipe for disaster. Competitive research helps you identify gaps in the market that your competitors might be overlooking. You can innovate and differentiate your products or services by leveraging these opportunities. This attracts new customers and helps you retain existing ones by offering unique value propositions.

- Customer-centric approach : Understanding your competitors lets you gain insights into their customer base. You can make insightful decisions about your marketing strategies by identifying their target audience and analyzing customer feedback. You can tailor your messaging, branding, and customer experience to cater to your target market more effectively.

- Adaptability : Competitive research encourages adaptability and agility. You can swiftly respond to market trends and changes by monitoring your rivals' actions. This flexibility helps you stay competitive and maintain an edge over those who are slow to adapt.

Competitive Analysis Best Practices

Let's now explore some competitive analysis best practices that can give your business an edge.

- Gather information. Identify your competitors and evaluate their strengths, weaknesses, and strategies. Look into their product offerings, marketing tactics, customer feedback, and online presence. This will help you identify areas where you can differentiate yourself and target potential customers.

- Analyze the data collected. Compare your performance to theirs, considering factors like sales figures, market share, and customer satisfaction. Examine trends and patterns to identify your key competitive advantages and areas for improvement.

- Constantly monitor and track your competitors. Keep an eye on their new product launches, marketing campaigns, pricing changes, and any other moves they make. This will help you anticipate their next steps and stay one step ahead.

- Conduct a SWOT analysis . Evaluate your strengths, weaknesses, opportunities, and threats. Then, do the same for your competitors. This will help you unravel potential gaps in the market to exploit and areas to strengthen your position.

- Compare your performance metrics with industry standards to understand your market standing. This will help you set realistic goals and targets for your business.

Virtual Assistants for Best Competitive Research

If you are wondering how to find the time to do competitive research while managing your day-to-day tasks, the answer is Virtual Assistants.

Finding time for competitive research can be as elusive as the golden ticket in Willy Wonka's chocolate factory. But fear not, because just as Oompa Loompas kept the factory running smoothly, virtual assistants are your golden ticket to managing day-to-day tasks and conducting competitive research with efficiency and precision.

Let's find out in detail:

- Conduct initial research to identify direct and indirect competitors. Your VA will begin by recognizing your direct competitors. These are organizations that offer similar products or services within your target market. Once done, they will analyze indirect competitors, which include businesses that offer alternative solutions or serve a different target audience.

- Compile a comprehensive list of competitors in the industry. From established giants to emerging startups, your VA will compile a list of competitors.

- Gather market intelligence through industry reports and market studies. Your VA will collect and analyze data from various sources, extract valuable insights, and present them in comprehensive industry reports. The information includes industry trends, customer preferences, and market dynamics.

- Analyze competitors' websites for product/service offerings and positioning. Your VA will analyze your competitors' websites for their product and service offerings and their positioning in the market. The information will help you identify your competitors' strengths and weaknesses. You can then improve your offerings and stay ahead in the market.

- Monitor competitors' social media channels for engagement and promotional strategies. Your VA will start following your competitors' social media channels. Monitoring your competitors' channels for engagement and promotional strategies can provide valuable information to boost your brand.

- Review customer reviews on Yelp, Google, and industry-specific review sites. Your VA will diligently review the customer reviews to identify improvement areas. A deeper understanding of customer feedback helps businesses refine their service offerings, improve customer satisfaction, and ultimately secure a competitive edge in the market.

- Investigate competitors' marketing campaigns, content, and advertising efforts. Investigating competitors' marketing campaigns helps to understand the tactics they employ. Analyzing competitors' content helps identify gaps and focus on areas where you can excel. Examining competitors' advertising efforts enables you to evaluate the effectiveness of different advertising channels.

- Compare product/service pricing among competitors. Your VA will scour the market to gather data and compare product/service pricing across your industry. The detailed insights will help you make informed decisions on adjusting prices, positioning your business, and developing effective marketing strategies.

- Conduct each competitor's SWOT analysis (Strengths, Weaknesses, Opportunities, Threats). By examining your competitors' websites, social media presence, customer feedback, and industry reports, the VA accumulates insightful data for the SWOT analysis. This information can help your business refine its strategies, develop new products/services, and anticipate market challenges.

- Benchmark your business performance against key competitors. Your VA will collect data from various sources, including market research reports, industry analyses, customer surveys, and competitive intelligence tools. They will then analyze this data, cross-referencing it with your business performance metrics, to provide a clear picture of how you measure up against your competitors.

- Provide insights into areas where your business can capitalize on competitors' weaknesses. By examining your competitors' weaknesses, a VA can help you identify potential market gaps that you can fill. Through in-depth research, they can reveal untapped customer needs that competitors have failed to address adequately. With this knowledge, you can tailor your offerings or introduce new products or services, positioning your business as the go-to solution for these unmet demands.

- Offer recommendations for adapting and refining business strategies based on competitive insights. A VA can recommend refining existing strategies and developing new ones based on competitive insights.

- Continuously monitor and update competitive landscape information. By constantly monitoring the market, your VA can provide timely updates on industry trends, pricing strategies, customer preferences, and more.

Wishup: Your Ultimate Research Partner

Wishup's virtual assistants are highly trained professionals who excel in handling administrative tasks, managing social media, organizing calendars, and much more. They can help you with competitive research - in all the ways mentioned above.

Wishup's services provide entrepreneurs and small business owners with an efficient and organized solution. Our team of skilled professionals handles all your business needs, from recording transactions to generating reports. Wishup utilizes modern tools and software to streamline your processes, making it hassle-free and time-efficient. Also, Wishup ensures the highest level of accuracy and confidentiality when handling your information.

Enjoy affordable services.

Wishup offers all of its incredible services at an affordable price. We understand the value of your time and work tirelessly to ensure your tasks are completed efficiently.

Collaborate with the most exceptional 0.1% of talent.

Wishup offers the cream of the crop for virtual assistants. Whether handling administrative tasks, managing your calendar, or organizing your finances, Wishup ensures you are paired with the best of the best.

Easily bring your virtual assistant on board in just one day.

With Wishup , you can bring a talented and dedicated virtual assistant on board in just one day. It's as simple as signing up and discussing your requirements.

Say goodbye to the need for a training budget.

With Wishup, you can now hire highly trained and skilled virtual assistants who are experts in their fields. No more spending on expensive training programs or workshops.

Take advantage of Wishup's amazing replacement policy, no questions asked!

Wishup understands that sometimes things don't work out how we want them to. That's why they have a "no questions asked" replacement policy. If you're not satisfied with the virtual assistant provided to you, simply reach out to our customer support team, and they'll arrange a replacement for you.

Give your virtual assistant a try with our 7-day Risk-Free Trial.

With our Risk-Free Trial, you can experience the convenience and productivity of having a virtual assistant without any commitment.

Competitive research is an essential part of any successful business strategy. It helps you scout out the competition, understand their strategies, and use this knowledge to position your own business for success.

Start by identifying your main competitors. Once you understand your competition, it's time to analyze their strengths and weaknesses. Identify areas where you can outshine them and capitalize on their shortcomings.

Keep up with ongoing research and analysis. The market is ever-changing, so staying ahead of the game is crucial.

Remember that competitive research isn't a one-time deal - it's an ongoing process.

Wishup can be an effective partner for you in conducting competitive research. Contact us to schedule a free consultation . You may also drop us an email at [email protected] .

FAQs: Competitive Research

How do you do competitive market research.

Start by identifying your main competitors and gathering information on their products, pricing, and marketing strategies. Analyze their strengths and weaknesses, and use this knowledge to improve your own offering. Don't forget to keep an eye on emerging trends and consumer behavior.

What are competitive examples?

Competitive examples are real-life situations or instances that demonstrate competitiveness in a particular industry or field. These examples showcase how different companies or individuals constantly strive to outperform each other and gain a competitive advantage. For instance, consider tech giants like Apple and Samsung battling it out in the smartphone market with innovative features and designs.

Request consultation has been made.

Virtual Assistants | Software Testers | Bookkeepers

* Valid for new signups only

The Past and the Future of Competitiveness Research: A Review in an Emerging Context of Innovation and EMNEs

- Published: 20 January 2020

- Volume 14 , pages 1–10, ( 2019 )

Cite this article

- Kirankumar S. Momaya ORCID: orcid.org/0000-0002-7658-2006 1

11k Accesses

62 Citations

Explore all metrics

Fields of strategy, competitiveness, and international business research are evolving steadily as more vexing challenges emerge and demand innovation. Key objective of this study is to longitudinally review literature on competitiveness and innovation to identify future sustainable directions. We adapt a systematic literature review approach to discern patterns in individual fields and at the intersection. This, complemented by review of patterns of trends in contributions by select countries and longitudinal experiential view of more than a quarter century of journey of author across select countries, provided new insights. We use the insights to evolve high-potential future topics for research, clustered by contexts, theory, and practices. This review—at the interfaces of theory and practice, and fields across disciplines—will help readers understand the gaps and explore opportunities for research projects in new directions. Synthesis of findings at the interface would facilitate pathways to further research and practice to enhance competitiveness across levels and sustainability.

Avoid common mistakes on your manuscript.

Introduction

Competitiveness shapes’ opportunities for youth, productivity of firms, and prosperity and sustainability of clusters, cities and regions, and international business (Porter 1990 ; Aiginger et al. 2013 ; Huggins and Izushi 2015 ; Huggins and Thompson 2017 ). Competitiveness has a long history (Fagerberg and Srholec 2017 ). Surge of interest in field of competitiveness has linkages with changes in the world economy, e.g., rapid increase in role of Japan (in the 1970s and the 1980s) and other industrializing countries in Asia (Hamel and Prahalad 1996 ). Popular use of the term by politicians, the media, business people, and its persistence (e.g., Aiginger and Vogel 2015 ) in different contexts does create opportunities, challenges, and the need for research. The utility and high potential of understanding, experimenting, and learning about competitiveness—having relevance and linkages across levels, from product, firm, industry to cluster, city or state—particularly in contexts of large emerging countries such as India does not need much debate if one considers vast opportunities for improvement. Longitudinal review of the trends in research in past is necessary to evolve directions of research for future, as has been demonstrated for select fields of international business (IB) research (e.g., Rialp et al. 2005 ; Keupp and Gassman 2009 ; Paul et al. 2017 ).

Pioneering work on competitiveness by Porter and associates provided major thrust to research and practice. With the “Competitive Advantage of Nations (CAON)” project and the publication, Porter ( 1990 ) opened up a whole new perspective on competitiveness that shaped research and practice. Through the project, they showed that traditional views on competitiveness could not account for differences in firm competitiveness (e.g., Sölvell 2015 ), they evolved fundamental questions and model such as Diamond model that continue to shape debates about competitiveness. However, several limitations of the model in practical contexts, e.g., of Asia as well as North America, indicates exciting opportunities for research at interfaces of competitiveness and international business (IB).

Several discontinues in two decades of the new century are demanding transitions and rethink on definitions, factors of competitiveness and measurement. The global financial crisis of 2008 that engulfed many countries shaped “crisis of competitiveness” in several industries beyond finance and prompted transitions. For instance, welfare, wealth, work project in Europe (WWW for Europe) aimed to analyse the preconditions necessary for a transition to a more socio-ecological European growth path and new perspectives on competitiveness (Aiginger and Vogel 2015 ). Near 10 trillion dollar injected by central banks, since 2008 is reaching limits. Two large countries—India and China—are likely to shape practices of competitiveness and patterns in their trends can help shape context.

Divergent patterns of country and firm competitiveness in India and China indicate some fertile arenas of research at interfaces of strategy, competitiveness, IB, and policy. India and China, both have been climbing quite well on select dimensions of country competitiveness. From the 50s and the 40s, to enter into the 30s in terms of country competitiveness ranks for India (e.g., Momaya 2011 ) can be considered a matter of significant progress for India, considering huge population and complexities. An effort to understand patterns at the firm level—the real level for international competitiveness—threw some surprising findings. For instance, in the sample of Global 500, while contribution from India, over the period 2005–2018, has stagnated at 8, China has leapfrogged 10× in terms of firms ahead. Such divergent patterns between country and firm competitiveness indicate major opportunities for research on competitiveness, particularly at interfaces of IB (assumed to have high overlap with strategy, so word strategy is used to include IB in this paper).

We need to review interfaces of competitiveness and related fields of strategy and IB. Since competitiveness has relevance across levels, insights from disciplines having higher relevance at micro to macro can be useful to address the vexing problems the world is facing. For instance, for firm-level competitiveness, interfaces with functional areas such as strategy, human resources, operations, finance, technology, and innovation management need to be appreciated to diagnose a firm’s problems related to international competitiveness and business. Competitiveness and innovation are important and significant fields with high-potential interfaces with strategy and IB, with high potential to contribute, as to best of our knowledge, no such longitudinal review balancing many aspects exist.

The aim of this paper is threefold: first to review the literature related to competitiveness quantitatively as well as qualitatively, particularly for potential linkages of firm competitiveness to IB. Second, we want to explore linkages among competitiveness, innovation, and EMNE internationalization in context of the vexing problems affecting sustainability, a glimpse of that was given above. Third, from the longitudinal review, we want to evolve high-potential topics for further research and practice. This desire to shape practice, is a unique dimension of contribution, as linkages between theory and practice seems to have vast opportunities for improvement in strategy, IB, and competitiveness.

Longitudinal Qualitative Literature Review

Competitiveness has quite exciting and practical research literature at the intersection of business, management, engineering, and economics. While macro-dimensions of competitiveness (e.g., at country or state or regional competitiveness) are also important, the focus of this study is on micro-dimensions related to strategy, IB, and innovation or technology management. In this context, theoretical linkages of competitiveness may be strong with IB strategy, technology, or innovation management and operations. We will get some quantitative facts to understand patterns, after we start from brief review of classical works clustered in sub-sections below.

Macro-dimensions of Competitiveness

With urge to understand dynamics of competitiveness, research, and experimentation got major boost in the 1990s. Michael Porter ( 1990 ) introduced an exciting framework for country competitiveness aimed at redefinition of the foundations of national wealth. Porter’s diamond model was extended to address some limitations. The double diamond model (Rugman and D’cruz 1993 ) tried to incorporate multinational activities. Efforts by Momaya to enhance utility and generalizability of competitiveness frameworks helped evolve competitiveness Assets–Processes–Performance framework (APP framework) that was tested in context of select industries in select countries (e.g., Canada, Japan and USA; Momaya 1998 ). The APP framework has also been used in a variety of industries and micro-contexts, such as firm level. Extension by human factors (e.g., Cho 1994 ) evolved into new comprehensive model that was tested to measure competitiveness of countries (e.g., Cho et al. 2016 ; Moon et al. 2015 ). Recognizing linkages among three levels of competitiveness, Banwet et al. ( 2003 ) and Bhawsar and Chattopadhyay ( 2015 ) reconfirm importance of firms as root or source of creation of economic value and competitiveness.

Connecting competitiveness with new developments in the theory of the firm, Aiginger and Vogel ( 2015 ) emphasize social investment, ecological ambitions, and the share of eco-industries as drivers as they redefine competitiveness as the “ability of a country (region, location) to deliver the beyond-GDP goals for its citizens”. They emphasize quality, sophisticated products and productivity as competitive advantages and on capabilities as drivers of competitiveness.

Micro-dimensions of Competitiveness

Why firms from a particular country are able to create and sustain competitive advantage in a particular industry has been a fundamental question of competitiveness since long (e.g., Porter 1990 ; Momaya 2001 ). The answers are of great significance to firms that have strategic intent and must compete in international or regional markets. Relevance of select constructs for competitiveness of firms started attracting research attention. Theories of strategy have provided many useful linkages to address sources of competitiveness. Views such as industry structure view (ISV) and complementary resource-based view [e.g., Penrose ( 1959 ), Barney ( 1986 ), Hamel and Prahlad ( 1990 )] were quite popular to address some issues. Teece et al. ( 1997 ) introduced a new approach called the dynamic-capability view (DCW) as an extension of the RBV. Dynamic capabilities are organizational processes embedded within the firm, are path-dependent and hence can help build deeper competitiveness. Relevance of aforementioned theories for competitiveness of firms is enormous. Still, these theories were less able to explain competitiveness of firms in emerging countries, where societal and governmental institutions are much stronger than market-based institutions. Institution-based view (e.g., Peng 2002 ; Peng et al. 2009 ) tries to address the limitations.

Learning from such profound contributions from strategy and other streams of management, alternate frameworks are evolving that can provide simpler and generalizable approaches to define and measure competitiveness. Research aimed at exploring competitiveness linkages across levels gave generic framework competitiveness Assets-Processes-Performance (APP, Momaya 2001 ) that is being tested across mature to emerging industries (e.g., software, Banwet et al. ( 2003 ), Ambastha and Momaya ( 2004 ), nanotech, Momaya 2011 ) and firms. Krishnan ( 2010 ) emphasized role of a critical mass of new, innovative, technology-driven firms (e.g., technology ventures that scale-up, Momaya and Bardeja 2005 ) for shift from ‘Jugaad to Systematic Innovation’.

Pioneering work on competitiveness by Moon ( 2016 ) and associates has high relevance for firms. While their contributions span across levels (e.g., NCR at country level), their findings based on decades of work on efficient catch-up by Korean firms and industrial houses are perhaps most insightful. After several extensions to diamond framework, Moon proposed the “ABCD” model based on four key factors: agility, benchmarking, convergence, and dedication. Productivity of the people who produce, exchange, and manage technological and other resources is very important for competitiveness of firms. In the above context, we are keen to pursue questions such as:

What topics at interfaces of competitiveness, innovation, strategy, and MNEs provide insights to generate impactful knowledge and practices?

What are future directions of impactful research related to competitiveness in terms of contexts, theory, and practice?

Methodology

For the unique context of this study, we explore an innovative synthesis of mixed methods. Potential of synergy from a more insightful combination of quantitative and qualitative studies with longitudinal horizons have been mentioned by Rialp et al. ( 2005 ). While analysis of quantitative and archival data is a major pillar, we adapt a taxonomy of mixed method proposed by Bryman and Bell ( 2011 ). They suggest the taxonomy based on priority and sequence between quantitative and qualitative research. Considering the complexity of levels and interfaces of competitiveness, qualitative research was given higher priority. Still, patterns that emerged from quantitative methods preceded qualitative research.

For quantitative research, we adapted the approach of systematic literature review (SLR) based on search methods on select databases to find patterns of contributions by sub-disciplines, regions (or countries) and specific centres or institutes. The first step in performing the review was to explore research questions. For keyword-based search approach, we selected the Scopus database for its advantages. After discussions with domain experts and iterative searches, ‘competitiveness’ and ‘innovation’ emerged to be two most important generic keywords to focus on in context of this study.

Two longitudinal independent searches on each keyword were supplemented by a search at intersection to find the patterns. We started with full period of half century from 1968 to 2018, but focused on recent snapshot of 5 years to discern patterns. Among major contributing subject areas, ‘Business, Management and Accounting’ emerged to be distinctly ahead of other areas, e.g., economics, engineering, and social sciences. This is quite commensurate with context and focus on strategy and IB in this study. Since select leading countries accounted for more than 50% contribution of all countries, focus in this study was on these countries.

Emerging Findings

Findings from quantitative review of literature.

Efforts at systematic literature review (SLR) provided some interesting insights about patterns of contributions from different countries. For competitiveness field, the subject area ‘Business, Management and Accounting (BMA)’ emerged to be the largest contributor with 32.6%. The contribution of BMA was found to be even higher for the field of innovation and intersection of ‘innovation and competitiveness’. The percentage contribution increased when we focused on recent period (of 5 years, 2013–18) for each field. In fact, it increased to 49.22% and 51.75% for intersection set of 1363 and 576 papers for total and recent (Table 1 ). For instance, for the intersection sub-sample in recent period (total 1113), BMA (576) was far ahead of the other fields ‘Economics, Econometrics and Finance’(270), Social Sciences (243) and Engineering (231), indicating high interest among researchers of business to contribute at micro level.

Analysis of innovation field and intersection to find synergy with competitiveness provided rich insights and some surprises. As an important field with higher maturity and bigger numbers of journals (including one in related fields such as technology management and R&D), contributions for innovation (93,634) were significant multiples of competitiveness (9702) and again BMA contributed 32% overall (about 36% in recent period). While the USA, Britain and China contribute most (more than 33%), more recent results indicate that Germany, France, The Netherlands, and Switzerland are major drivers of innovation, including practices. Sample in intersection set is bit smaller (2769, of which BMA contributed 1363 or 49%), but provides exciting inferences about interface. In terms of relatively higher contribution as compared to individual samples, China and Italy have better contribution at the intersection, whereas India lags.

Findings from an Analysis of Practical Reality

Analysis of patterns of reality of competitiveness, particularly at the firm level provides some useful insights to enhance contribution of this study to competitiveness practice. We have been watching patterns of contributions of select countries to competitiveness through longitudinal samples. While samples such as Global 2000 are more informative, they face issues such as shorter horizons and volatility. Let us review trends contributions of India and select countries (Table 2 ). India increased contribution from 48 in 2008 to 58 in 2018, a significant jump of 10 firms. Still, this increase is very marginal in context of jump of 157 for Asia that was driven by more than 15× jump of China. In percentage terms of the sample, jump to 2.9% (in 2018) from 2.4% (2008) is too low for an entrepreneurial country of the size of India. In terms of revenue share (1.8%) and profit share (1.5%), India has much worse performance as compared to China and USA. Scenario for India is much worse if one reviews samples such as Global 500 (e.g., Momaya 2015 ) that has better longitudinal views and stability. Worries that comparatively no Indian consumer goods company comes closer to kind of capabilities and global brand recognition of MNEs from Asian peers and that global competition is entrenched in India (e.g., Thompson et al. 2013 ) should not be wished away, particularly by leaders of firms of Indian origin (FIOs).

More insights on competitiveness challenges for firms of Indian origin emerge when we consider qualitative dimensions. For instance, a majority of the FIOs in the 2018 sample (e.g., about 21 out of 58) are from banking and financial services industry (BFSI). They are often classified as ‘Regional banks’ (by international media) and not ‘Major banks’; China has 3 in ‘Top 10’; and India has none in even top 100 in Global 2000. Competitiveness, particularly international, of many of the FIOs from that industry may not be considered high enough to address a fundamental question of international competitiveness—what determines the international competitiveness and success of firms. Even in computer services—one of the most internationally competitive industry of India—there are only three firms, and at ranks beyond 300, e.g., TCS (404), Infosys (643), and Wipro (857). While these firms have high degree of internationalization—both exports as well as FDI (e.g., Parthasarathy et al. 2017 ), big challenges that were diagnosed long ago (Ambastha and Momaya 2004 ; Umamaheswari and Momaya 2008 ) remain less addressed on their journey up the value curve.

Sustained efforts by the author in cooperation with capable professionals and brilliant students at Indian Institutes of Technology (popularly called IITs) provide interesting insights. Many professionals cannot easily see bigger picture of competitiveness at higher levels. It takes a lot of efforts to dispel deeply entrenched myths such as “competitiveness and competition are same”, particularly in India. A key reason may be hyper-competitive environments that prevail in India; one remain trapped in over-competitive mind-set, missing options to cooperate. Many firms fail to think holistically about ‘International competitiveness’ and ultimately face survival crisis, as they lose competitiveness in not only vast domestic market in India, but even regions of India. Many business groups in India have lost massive market shares due to neglect of international competitiveness.

Maturity of competitiveness and its linkages across levels, disciplines seems to be evolving quite well in some countries in Europe and Asia. For instance, in research related to competitiveness, contributions from select countries in Asia and Europe are increasing significantly. A recent dip-stick review found that Italy, Korea, Germany, France, The Netherlands, and Switzerland driving the research (e.g., Momaya 2018 ). More importantly, maturity of translating such research into practice, including at higher levels of city, cluster or nation, seems high or improving fast in the countries, including select countries in Eastern Europe. Slow improvements in countries such as India (with vast gaps) indicate a huge untapped opportunity for research and pilots. While gaps in linkages between firm and higher levels are there, gaps in research on competitiveness at interfaces of functional areas of management is perhaps most promising for strategy, competitiveness, and IB.

Quite popular approaches to competitiveness are needing major rethink. For instance, core competence thinking was a popular, a powerful and widely promoted approach to focus and mobilize an organization’s resources (e.g., Gallon et al. 1995 ), but executives often failed to define the core technical competencies of their companies. They defined a generic method to help organizations to put core competence thinking into practice, but results need to be reviewed. Similar challenges are being faced by several other popular frameworks (e.g., diamond, DDD, and competitiveness APP) and provide major opportunities for research and tools to deploy them in varied contexts.

From theory development view, process nature of competitiveness is emerging to be promising. Whether pragmatic definitions across developed countries (e.g., OECD) or researchers (e.g., Fagerberg and Srholec 2017 ; Momaya 2001 ) focus on abilities is emerging as a core construct of productivity and competitiveness. Actor focus adapted by the World Economic Forum (WEF, e.g., institutions and policies) may be more relevant at macro-level, process-based approach proposed by Momaya (e.g., 2001, where competitiveness processes are made a core pillar) remains important for the context.

Pragmatically, the vexing problems such as “Pre-mature stagnation in capabilities for FIOs” provide enormous opportunities for research and practice. FIOs neither match in strengths with Asian counterparts in assets or innovation capabilities (e.g., intellectual property). Other choice for FIOs is to scale-up mass or muscle or capabilities quickly towards an ideal situation when a company has size, scale, reach or intangible assets such as brands, proprietary knowledge, or innovation capability (Thompson et al. 2013 ).

Transition to a sustainable business model and economic model provides exciting opportunities for competitiveness practice and research. At macro-level, there are no inherent trade-offs between business growth, social, and environmental factors if an organization can adapt a holistic approach to competitiveness. Few progressive firms and countries seem to be already pursuing such approaches and sustainable pathways. Research to evolve linkages among relevant asset and process factors of competitiveness APP framework with international, environmental, and financial factors provide an exciting opportunity for research.

Competitiveness indices are proposed as much needed economic compass (e.g., Klaus 2019 , Global Competitiveness Research {GCR}), but can have some limitations (e.g., gaps in macro or micro-foundations of the model, not grouping similar countries, too many criteria, and interpretation). Hence, there is scope for further research and next section provides some directions.

Directions for Future Research

Since most firms, industries, and countries are quite far from their relevant competitiveness frontiers, there is an enormous scope for further research and practice. Unique methodology of this study based on systematic literature review and longitudinal study provides rich patterns and perspectives. We logically cluster the directions for future research that are emerging under three sections.

Future Directions: Contexts

Since competitiveness has relevance across levels, contexts at different levels can be quite different. For instance, for country competitiveness, economic, political, institutional, international relations, and other contexts become quite important.

Let us highlight contexts of high relevance for firm level. Innovation capabilities were identified to play vital role for sustained success in exporting (e.g., Paul et al. 2017 ). Which innovation capability (e.g., process or product or technology) can be more useful for what market characteristics (e.g., developing or advanced) in what industry context provides an exciting context for research.