Free PDF Business Plan Templates and Samples

By Joe Weller | September 9, 2020

- Share on Facebook

- Share on LinkedIn

Link copied

We’ve gathered the most useful collection of business plan PDF templates and samples, including options for organizations of any size and type.

On this page, you’ll find free PDF templates for a simple business plan , small business plan , startup business plan , and more.

Simple Business Plan PDF Templates

These simple business plan PDF templates are ready to use and customizable to fit the needs of any organization.

Simple Business Plan Template PDF

This template contains a traditional business plan layout to help you map out each aspect, from a company overview to sales projections and a marketing strategy. This template includes a table of contents, as well as space for financing details that startups looking for funding may need to provide.

Download Simple Business Plan Template - PDF

Lean Business Plan Template PDF

This scannable business plan template allows you to easily identify the most important elements of your plan. Use this template to outline key details pertaining to your business and industry, product or service offerings, target customer segments (and channels to reach them), and to identify sources of revenue. There is also space to include key performance metrics and a timeline of activities.

Download Lean Business Plan Template - PDF

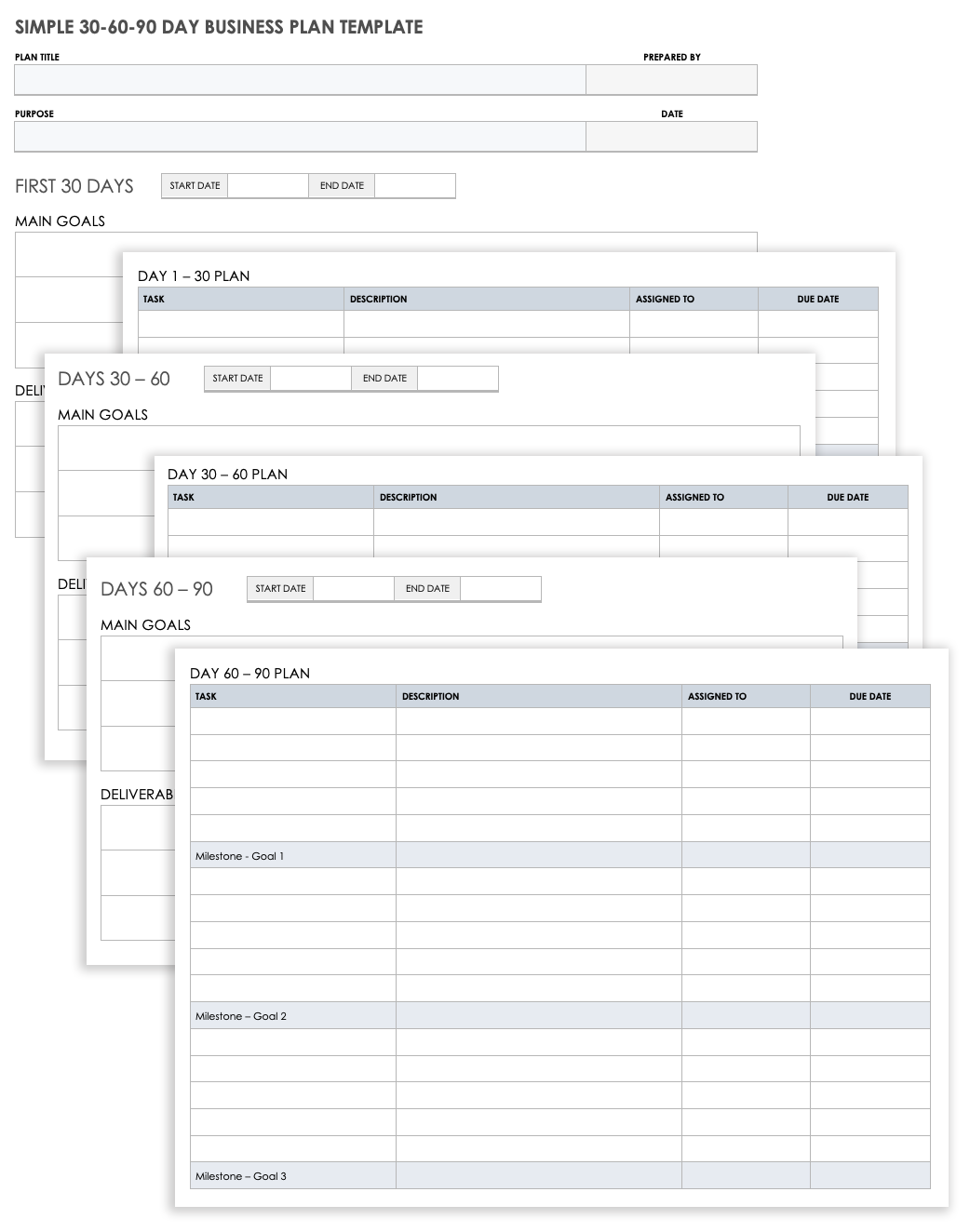

Simple 30-60-90 Day Business Plan Template PDF

This template is designed to help you develop and implement a 90-day business plan by breaking it down into manageable chunks of time. Use the space provided to detail your main goals and deliverables for each timeframe, and then add the steps necessary to achieve your objectives. Assign task ownership and enter deadlines to ensure your plan stays on track every step of the way.

Download Simple 30-60-90 Day Business Plan Template

PDF | Smartsheet

One-Page Business Plan PDF Templates

The following single page business plan templates are designed to help you download your key ideas on paper, and can be used to create a pitch document to gain buy-in from partners, investors, and stakeholders.

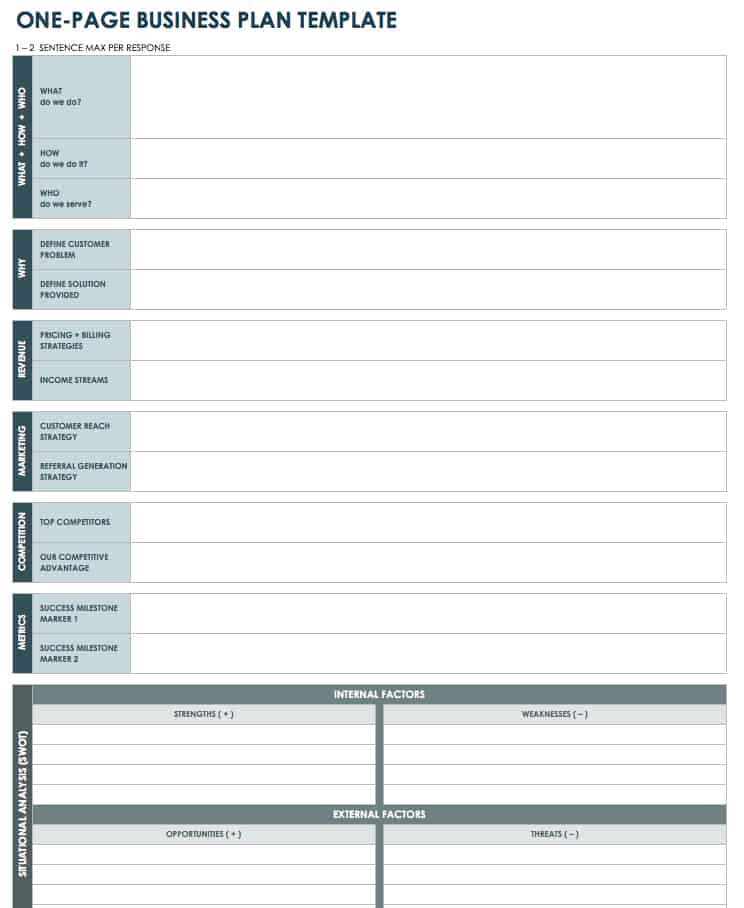

One-Page Business Plan Template PDF

Use this one-page template to summarize each aspect of your business concept in a clear and concise manner. Define the who, what, why, and how of your idea, and use the space at the bottom to create a SWOT analysis (strengths, weaknesses, opportunities, and threats) for your business.

Download One-Page Business Plan Template

If you’re looking for a specific type of analysis, check out our collection of SWOT templates .

One-Page Lean Business Plan PDF

This one-page business plan template employs the Lean management concept, and encourages you to focus on the key assumptions of your business idea. A Lean plan is not stagnant, so update it as goals and objectives change — the visual timeline at the bottom is ideal for detailing milestones.

Download One-Page Lean Business Plan Template - PDF

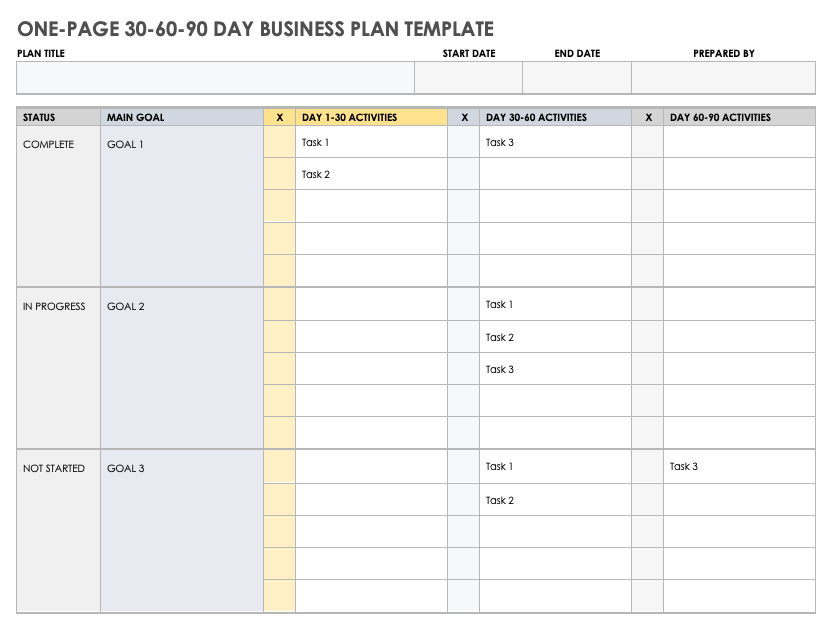

One-Page 30-60-90 Day Business Plan Template

Use this business plan template to identify main goals and outline the necessary activities to achieve those goals in 30, 60, and 90-day increments. Easily customize this template to fit your needs while you track the status of each task and goal to keep your business plan on target.

Download One-Page 30-60-90 Day Business Plan Template

For additional single page plans, including an example of a one-page business plan , visit " One-Page Business Plan Templates with a Quick How-To Guide ."

Small Business Plan PDF Templates

These business plan templates are useful for small businesses that want to map out a way to meet organizational objectives, including how to structure, operate, and expand their business.

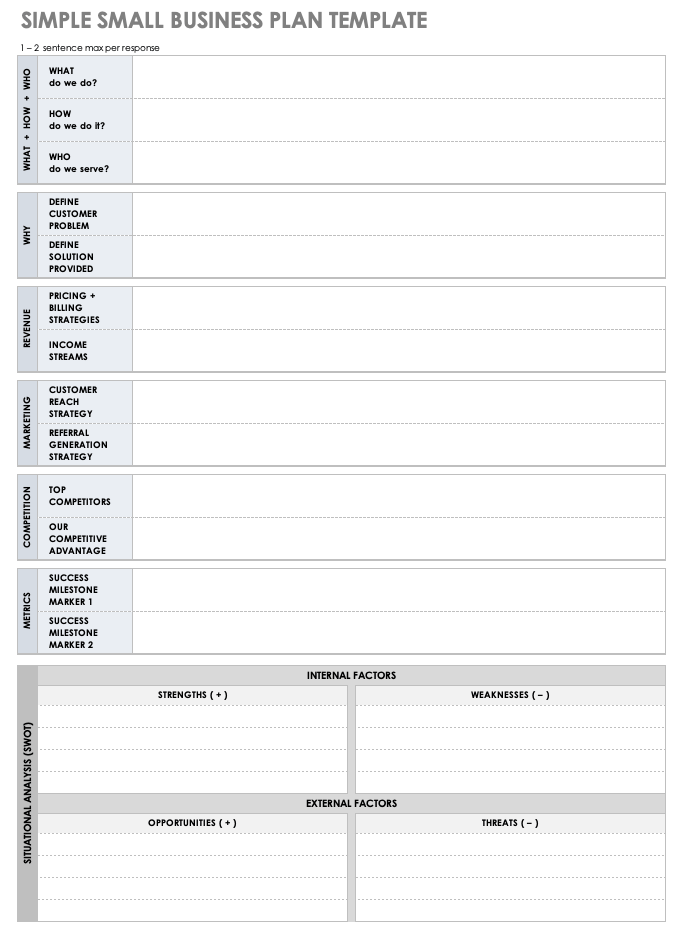

Simple Small Business Plan Template PDF

A small business can use this template to outline each critical component of a business plan. There is space to provide details about product or service offerings, target audience, customer reach strategy, competitive advantage, and more. Plus, there is space at the bottom of the document to include a SWOT analysis. Once complete, you can use the template as a basis to build out a more elaborate plan.

Download Simple Small Business Plan Template

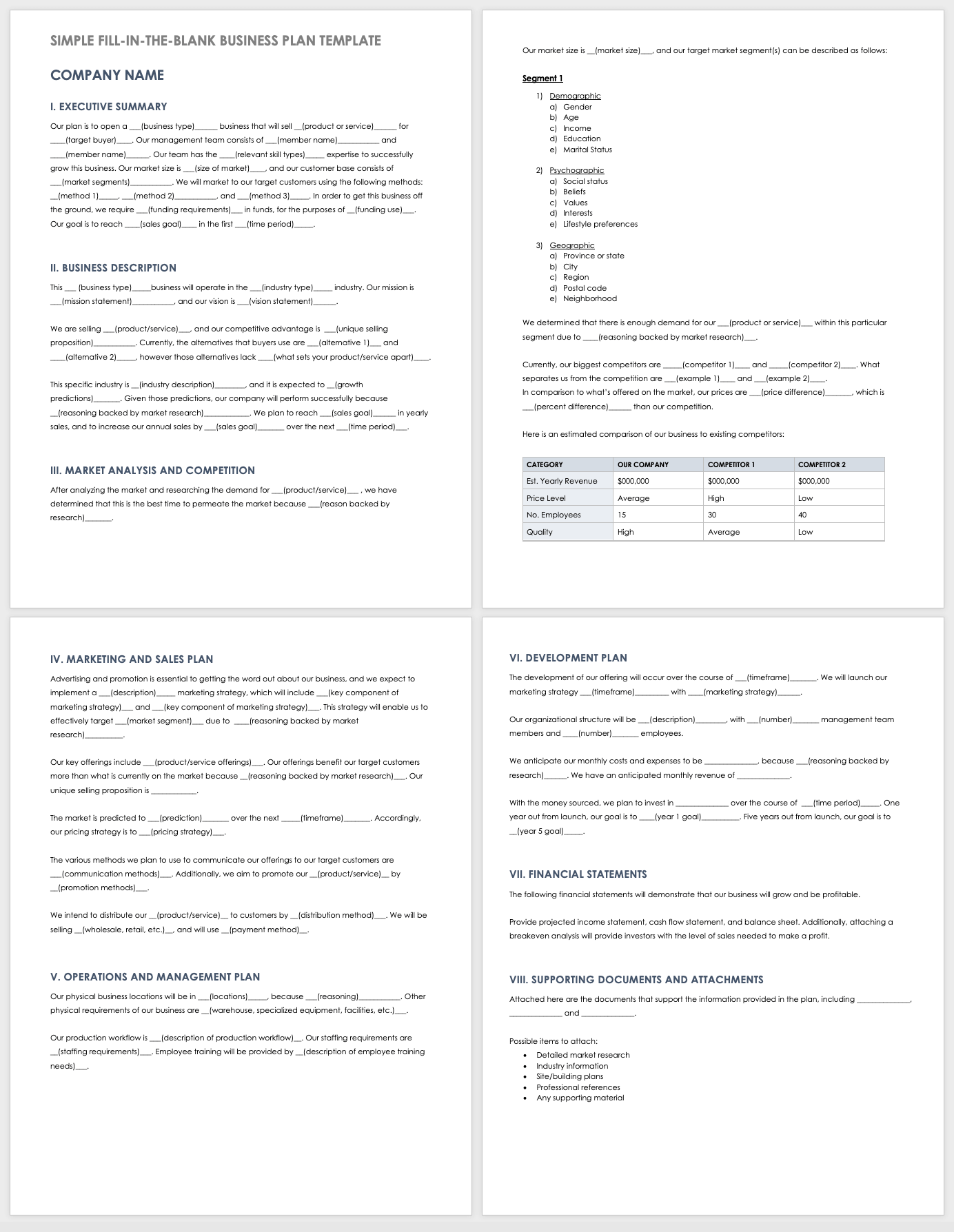

Fill-In-the-Blank Small Business Plan Template PDF

This fill-in-the-blank template walks you through each section of a business plan. Build upon the fill-in-the-blank content provided in each section to add information about your company, business idea, market analysis, implementation plan, timeline of milestones, and much more.

Download Fill-In-the-Blank Small Business Plan Template - PDF

One-Page Small Business Plan Template PDF

Use this one-page template to create a scannable business plan that highlights the most essential parts of your organization’s strategy. Provide your business overview and management team details at the top, and then outline the target market, market size, competitive offerings, key objectives and success metrics, financial plan, and more.

Download One-Page Business Plan for Small Business - PDF

Startup Business Plan PDF Templates

Startups can use these business plan templates to check the feasibility of their idea, and articulate their vision to potential investors.

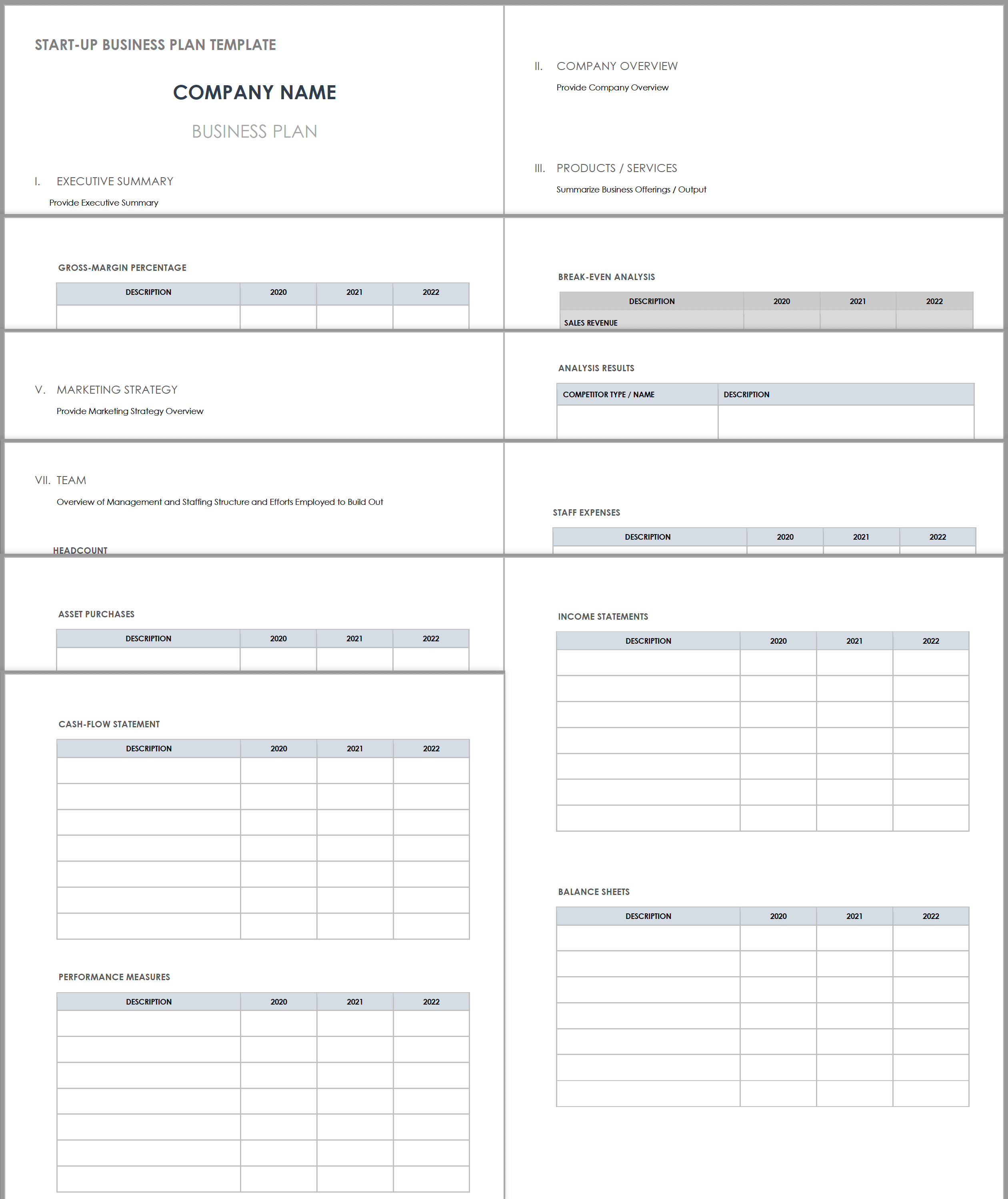

Startup Business Plan Template

Use this business plan template to organize and prepare each essential component of your startup plan. Outline key details relevant to your concept and organization, including your mission and vision statement, product or services offered, pricing structure, marketing strategy, financial plan, and more.

Download Startup Business Plan Template

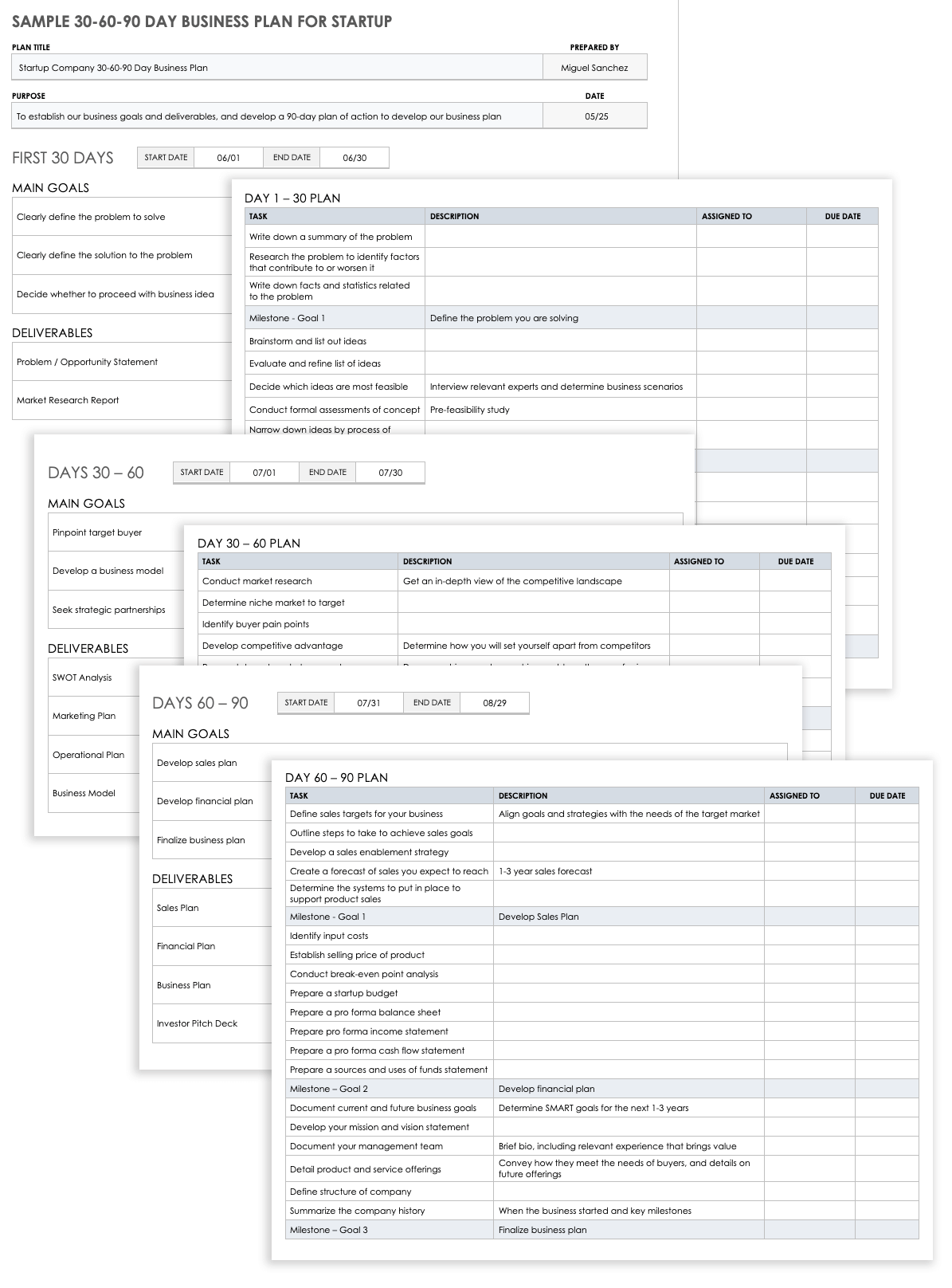

Sample 30-60-90 Day Business Plan for Startup

Startups can use this sample 30-60-90 day plan to establish main goals and deliverables spanning a 90-day period. Customize the sample goals, deliverables, and activities provided on this template according to the needs of your business. Then, assign task owners and set due dates to help ensure your 90-day plan stays on track.

Download Sample 30-60-90 Day Business Plan for Startup Template

For additional resources to create your plan, visit “ Free Startup Business Plan Templates and Examples .”

Nonprofit Business Plan PDF Templates

Use these business plan PDF templates to outline your organization’s mission, your plan to make a positive impact in your community, and the steps you will take to achieve your nonprofit’s goals.

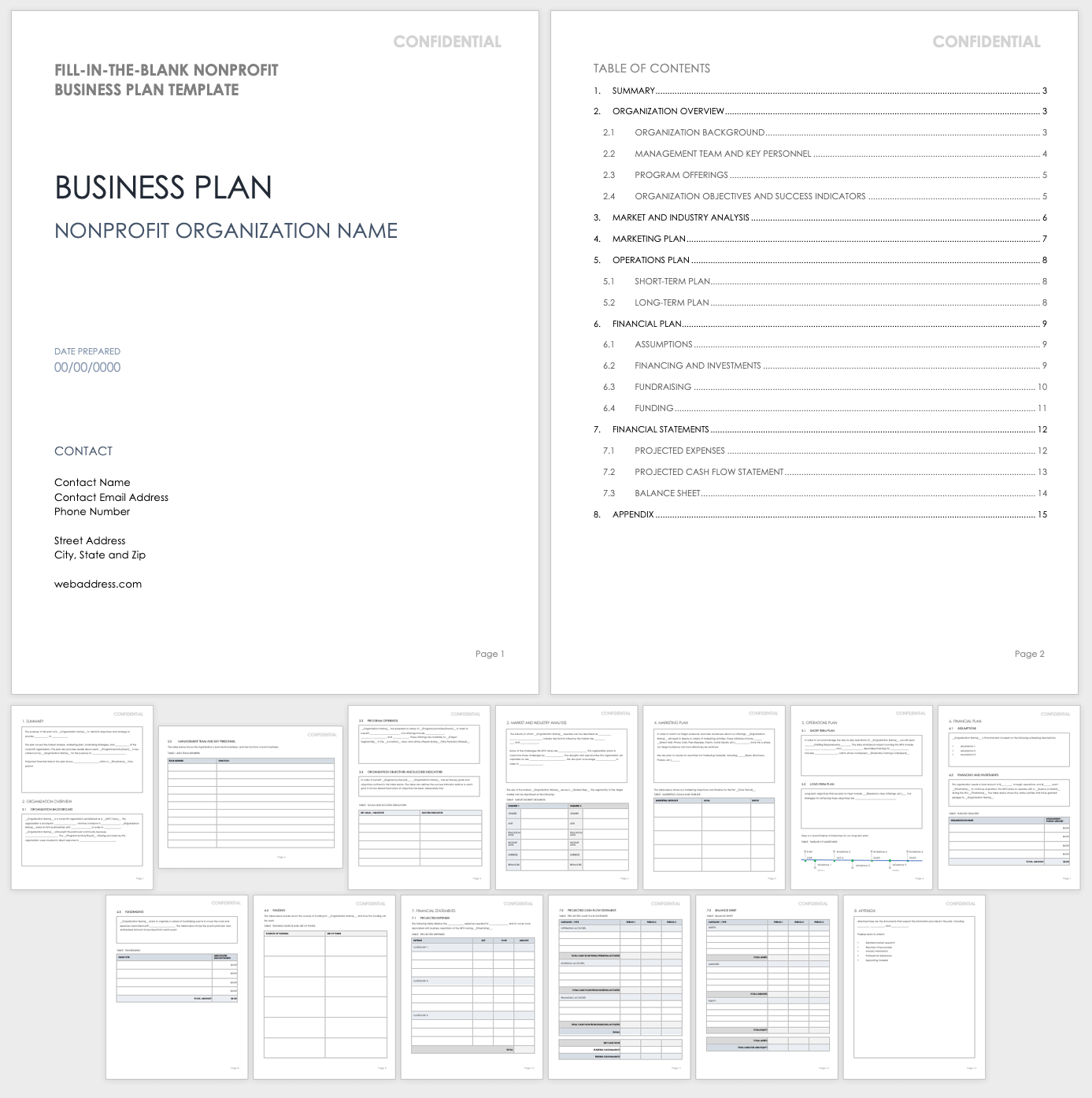

Nonprofit Business Plan Template PDF

Use this customizable PDF template to develop a plan that details your organization’s purpose, objectives, and strategy. This template features a table of contents, with room to include your nonprofit’s mission and vision, key team and board members, program offerings, a market and industry analysis, promotional plan, financial plan, and more. This template also contains a visual timeline to display historic and future milestones.

Download Nonprofit Business Plan Template - PDF

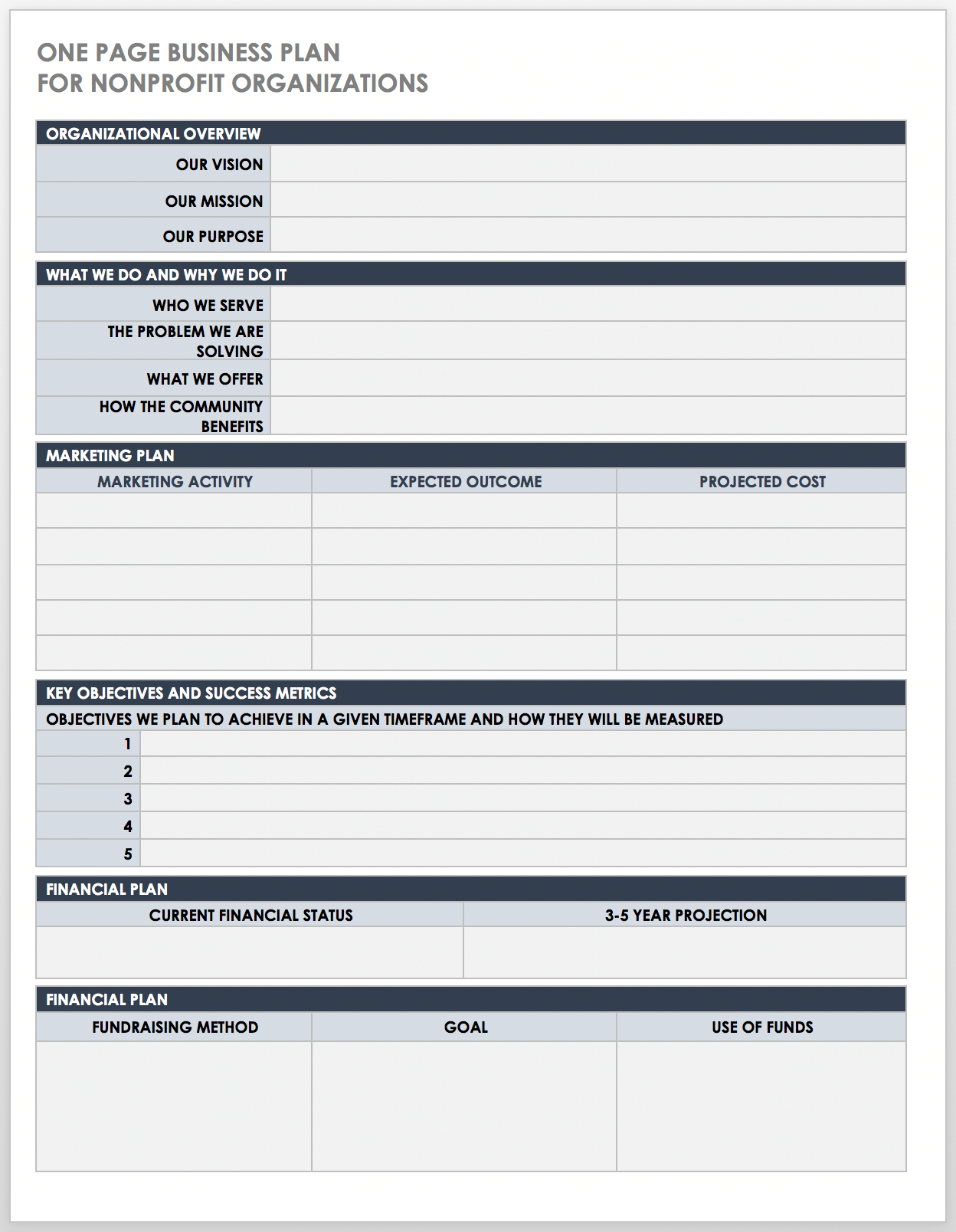

One-Page Business Plan for Nonprofit Organization PDF

This one-page plan serves as a good starting point for established and startup nonprofit organizations to jot down their fundamental goals and objectives. This template contains all the essential aspects of a business plan in a concise and scannable format, including the organizational overview, purpose, promotional plan, key objectives and success metrics, fundraising goals, and more.

Download One-Page Business Plan for Nonprofit Organization Template - PDF

Fill-In-the-Blank Business Plan PDF Templates

Use these fill-in-the-blank templates as a foundation for creating a comprehensive roadmap that aligns your business strategy with your marketing, sales, and financial goals.

Simple Fill-In-the-Blank Business Plan PDF

The fill-in-the-blank template contains all the vital parts of a business plan, with sample content that you can customize to fit your needs. There is room to include an executive summary, business description, market analysis, marketing plan, operations plan, financial statements, and more.

Download Simple Fill-In-the-Blank Business Plan Template - PDF

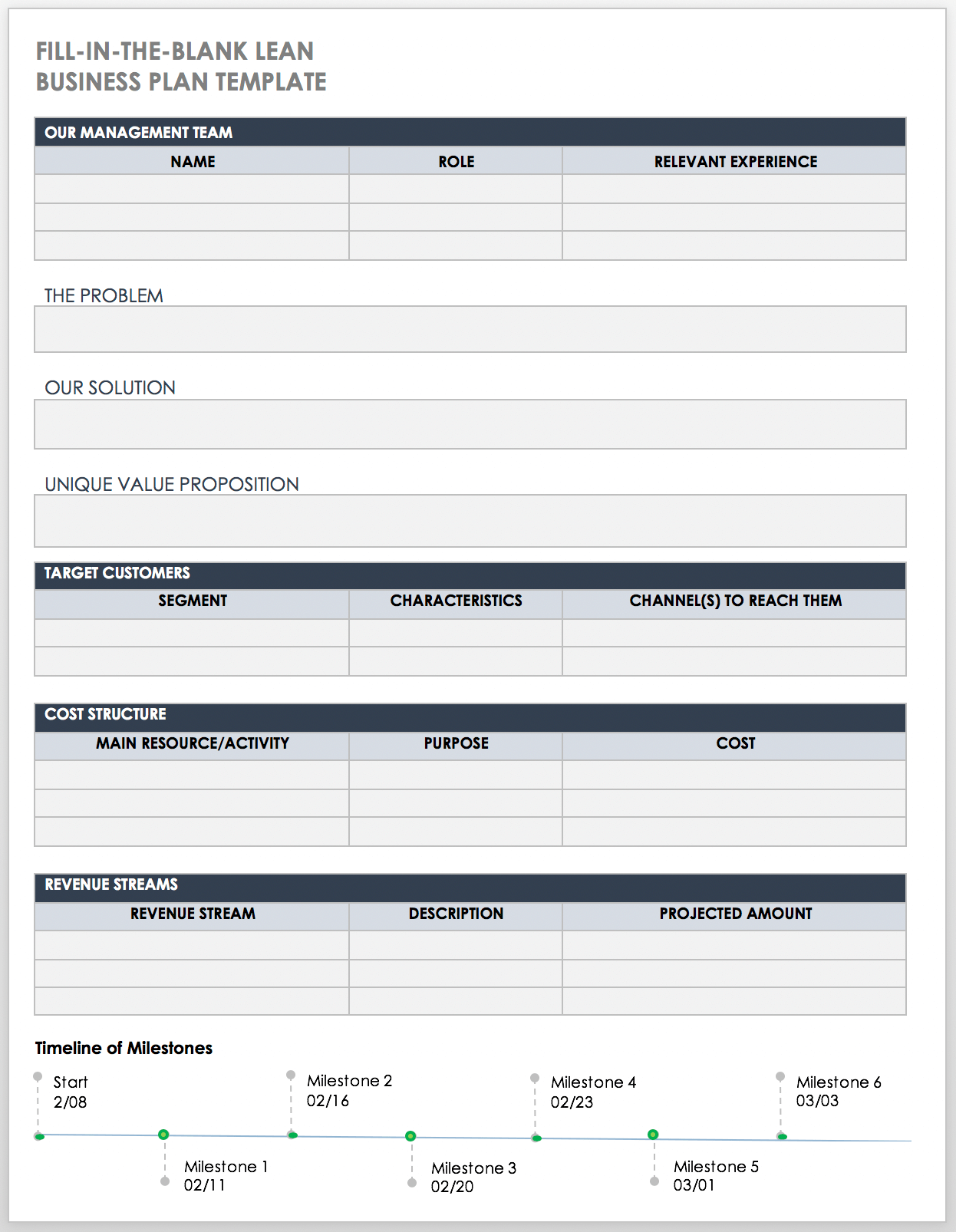

Lean Fill-In-the-Blank Business Plan PDF

This business plan is designed with a Lean approach that encourages you to clarify and communicate your business idea in a clear and concise manner. This single page fill-in-the-blank template includes space to provide details about your management team, the problem you're solving, the solution, target customers, cost structure, and revenue streams. Use the timeline at the bottom to produce a visual illustration of key milestones.

Download Fill-In-the-Blank Lean Business Plan Template - PDF

For additional resources, take a look at " Free Fill-In-the-Blank Business Plan Templates ."

Sample Business Plan PDF Templates

These sample business plan PDF templates can help you to develop an organized, thorough, and professional business plan.

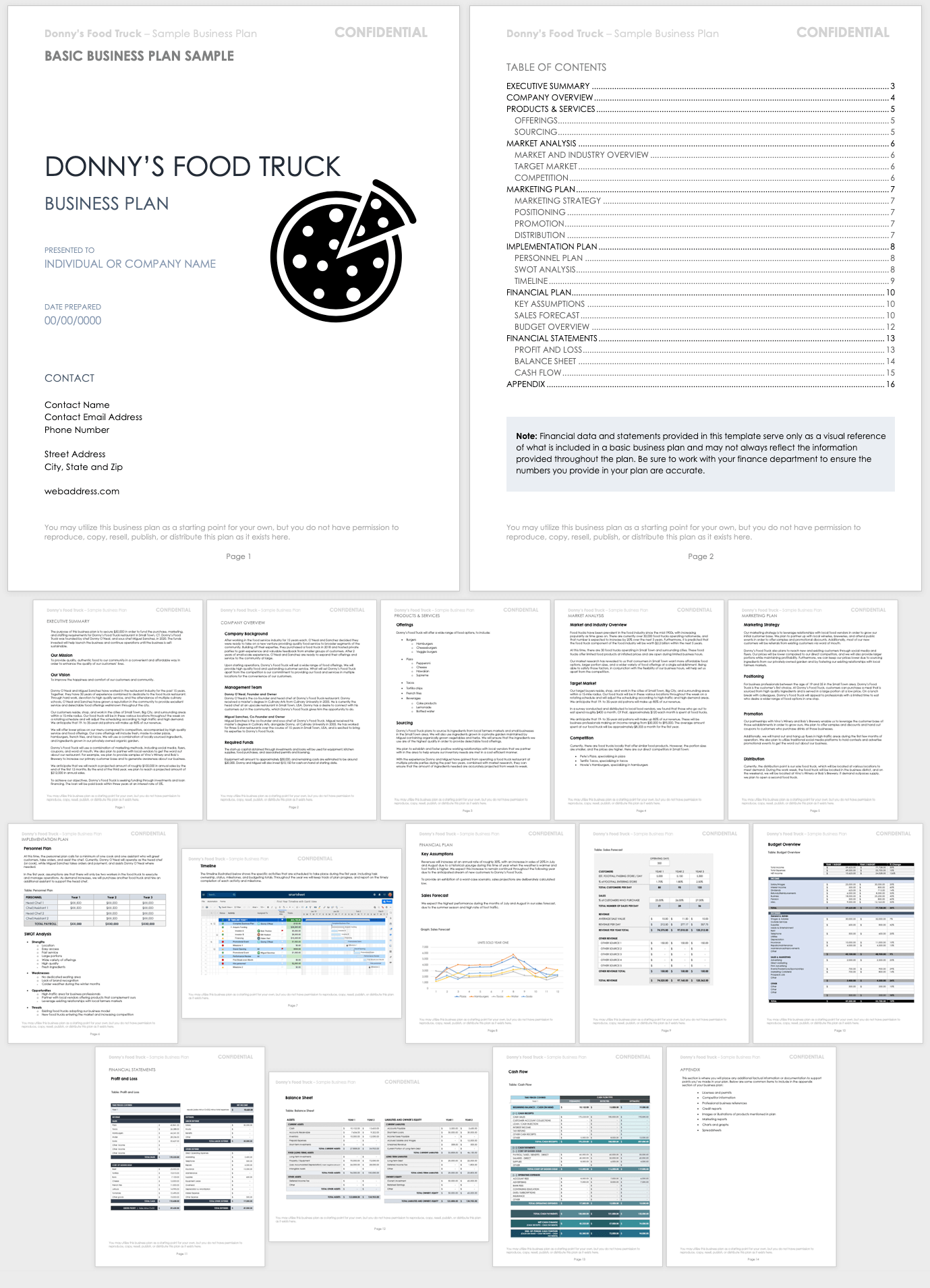

Business Plan Sample

This business plan example demonstrates a plan for a fictional food truck company. The sample includes all of the elements in a traditional business plan, which makes it a useful starting point for developing a plan specific to your business needs.

Download Basic Business Plan Sample - PDF

Sample Business Plan Outline Template

Use this sample outline as a starting point for your business plan. Shorten or expand the outline depending on your organization’s needs, and use it to develop a table of contents for your finalized plan.

Download Sample Business Plan Outline Template - PDF

Sample Business Financial Plan Template

Use this sample template to develop the financial portion of your business plan. The template provides space to include a financial overview, key assumptions, financial indicators, and business ratios. Complete the break-even analysis and add your financial statements to help prove the viability of your organization’s business plan.

Download Business Financial Plan Template

PDF | Smartsheet

For more free, downloadable templates for all aspects of your business, check out “ Free Business Templates for Organizations of All Sizes .”

Improve Business Planning with Real-Time Work Management in Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

Download Free Business Plan Examples

Download a free business plan in pdf or word doc format to make writing a plan fast and easy, find your sample plan.

Discover the sample plan that best fits your business. Search our gallery of over 550 sample business plans and find the one that's right for you.

View the Gallery

What You'll Get:

A complete business plan Unlike other blank templates, our business plan examples are complete business plans with all of the text and financial forecasts already filled out. Edit the text to make the plan your own and save hundreds of hours.

A professional business plan template All 550 of our business plans are in the SBA-approved format that’s proven to raise money from lenders and investors.

Instructions and help at every step Get help with clear, simple instructions for each section of the business plan. No business experience necessary.

A Word doc you can edit We don’t just have PDF documents that make editing a challenge. Each plan is available in Word format so you can start editing your business plan example right away.

Key Sections Included in our Example Business Plans:

Executive Summary : A quick overview of your plan and entices investors to read more of your plan.

Company : Describes the ownership and history of your business.

Products and Services : Reviews what you sell and what you’re offering your customers.

Market Analysis : Describes your customers and the size of your target market.

Strategy and Implementation : Provides the details of how you plan on building the business.

Management Team : An overview of the people behind the business and why they’re the right team to make the business a success.

Financial Plan : A complete set of forecasts including a Profit and Loss Statement, Cash Flow Statement, and Balance Sheet.

Looking for a sample business plan PDF? You can download a few PDF examples below:

- Accounting and Bookkeeping Sample Business Plan PDF

- Agriculture Farm Sample Business Plan PDF

- Cleaning Service Sample Business Plan PDF

Your download should begin immediately

If your download doesn't begin after 5 seconds, please click here .

View our entire gallery of free downloads

Tweet about it

I just downloaded a free business plan from Bplans.com!#smb #startup

Recommended Articles

Recommended Download

You might also enjoy:

The Small Business Toolkit

Access a free list of must–have resources for new and growing businesses in any industry.

Tax Season Savings

Get 40% off LivePlan

The #1 rated business plan software

Transform Tax Season into Growth Season

Discover the world’s #1 plan building software

How one millennial quit a corporate job, became self-employed, and set himself up financially to start a small business

- In 2017, Paul Millerd left his high-paying consulting job to work for himself.

- He set himself up financially by saving a 12-month cash runway and negotiating a gradual transition.

- This article is part of " Unlocking Small Business Success ," a series providing micro businesses with a road map to growth.

In 2017, Paul Millerd walked away from a six-figure consulting salary.

The decision also meant paying back his full $24,000 sign-on bonus to his previous employer, he said.

"It wasn't this cliché of, 'I'm going to boldly quit my job and run into the sunset and bet on myself,'" the 39-year-old solopreneur and author of " The Pathless Path " told Business Insider. "It was more of an exasperated only-option-left mindset. I wasn't loving my job. I was working with a boss that I wasn't getting along with."

Since graduating from college, Millerd had worked for five companies, convinced every move was "the final stop" but finding himself right where he found himself in 2017: burned out and looking for a different consulting gig.

It was time to try something new, but he wasn't sure what. He shared the steps he took that set him up to leave corporate America and exchange a comfortable paycheck for the unknown.

1. He had a 12-month cash runway

Millerd had about $50,000 in savings after paying back his bonus. It was enough to sustain him for roughly a year, according to back-of-the-envelope math.

He wouldn't necessarily have felt comfortable quitting without the cash cushion. "As soon as I calculated I could live a minimal life on 50 grand a year, I was out of there," he said, adding that he didn't always have savings. Business school "wiped out" what little he'd saved early on in his career and left him with about $70,000 in student-loan debt.

"As soon as that savings account built up, I became a little bolder in terms of taking risks," he said. "It was like, this is some potential freedom to try different things."

2. He negotiated a gradual transition with his company

Millerd didn't give two weeks' notice or leave immediately.

"I negotiated to stay on and train some people," he said. "I really had no plan, so I needed at least a couple of months."

If anything, he stayed "a month or a month and a half too long," he added, but it gave him time to prepare for his next chapter and think about what freelancing would look like.

"I set up my LLC," he said. "I started networking . I reached out to some small consulting firms to see if they needed contractors. I reached out to friends in business school. I built a website. I did some writing."

The networking paid off: It was at a business-school reunion that he landed his first freelance gig after reconnecting with one of his former professors who was looking for consulting work.

3. He lowered his expenses and funded a cheaper life through freelance projects

After leaving his firm in May 2017, the "first phase" of working for himself, as Millerd described it, was: "Get paid; lower costs."

He became a more conscious spender, he said: "A lot of people start with, 'Here's what I make; here's what I budget and spend.' I flipped this equation in my head. For me, it was, 'Everything I spend, I need to earn 30% more than that because of taxes.' So if I'm going to go out for ramen and it costs $20 in New York, that's going to cost me $26. I need to earn the $26."

It helped that he temporarily moved to Boston for his first freelance gig in late 2017. He sublet his New York City apartment, moved in with roommates in Boston, and "really simplified my life," he said, adding that he cut his cost of living from about $6,500 a month to $3,500 a month.

An early money mindset he adopted was "buying time" by living on as little as possible, Millerd, who moved to Taiwan in 2019 and decreased his expenses even more, said. The less he spent, the longer his runway would last.

"If you're spending $1,000 a month, you can buy six months for $6,000," he said. "That was the mode I was in from years two to three."

Lowering costs takes some of the earning pressure off, but it helps to have income coming in even if you have a cash runway.

"I think the smoothest transitions are what I did: Go from full-time work to freelance work, which is essentially doing full-time work, but you're just doing it in a more flexible contract way," said Millerd, who encourages aspiring entrepreneurs to start asking their employers about flexible, part-time work. "Go to your company and say, 'I don't want to quit. Would you be open to a pitch of me turning this into a four-day-a-week job? Could I do three days a week? Here's what I want to do. Here's how much I charge for this.'"

If your manager doesn't want to lose you, they may be more open than you think to part-time work, he said.

4. He had a 'break the glass' plan

In a worst-case scenario, if he drained his savings and couldn't land any freelance gigs, Millerd always knew he could find a way to make money.

Since leaving corporate America in 2017, his revenue streams have included freelance consulting, coaching , online course sales, book sales, and affiliate marketing.

If he never figured out how to make money working for himself , "there was always the sense that I had the capability of breaking glass in case of emergency," he said, adding: "I'm creative enough to figure out how to make money. I can go work at a restaurant. I'll take any job if I need to. Especially now with a kid, I don't have an ego when it comes to taking care of my family."

- Main content

- Election 2024

- Entertainment

- Newsletters

- Photography

- Personal Finance

- AP Investigations

- AP Buyline Personal Finance

- Press Releases

- Israel-Hamas War

- Russia-Ukraine War

- Global elections

- Asia Pacific

- Latin America

- Middle East

- Election Results

- Delegate Tracker

- AP & Elections

- March Madness

- AP Top 25 Poll

- Movie reviews

- Book reviews

- Personal finance

- Financial Markets

- Business Highlights

- Financial wellness

- Artificial Intelligence

- Social Media

Tax changes small business owners should be aware of as the tax deadline looms

FILE - A cash register is seen on the front counter at the Alpha Shoe Repair Corp., Feb. 3, 2023, in New York. As Tax Day, April 15, approaches, there are plenty of things small business owners should keep in mind when filing taxes this year. (AP Photo/Mary Altaffer, File)

- Copy Link copied

As Tax Day approaches, there are plenty of things small business owners should keep in mind when filing taxes this year.

April 15 is still the annual tax deadline for many small businesses although, unlike individuals, small businesses can have varying deadlines depending on the type of company, the state the taxes are filed in, and other factors. Quarterly estimated tax payments are generally required throughout the year. And certain types of small businesses had to file by March 15.

Since business tax filing is complex, most experts recommend small business owners work with a professional tax adviser rather than trying to file on their own or even with tax-filing software.

“Taxes should not be scary, especially when you have a certified tax professional or someone who is your trusted adviser,” said Amber Kellogg, vice president of affiliate origination and management at business consultancy Occams Advisory. “I always say you don’t go to the dentist to get your oil changed, and you certainly shouldn’t do (taxes) yourself unless you’re an expert.”

But even if small business owners aren’t filing taxes themselves, it’s still important to stay informed about any tax changes during the year. Here are things small business owners should consider as the April 15 deadline looms.

Consider an extension

Because of some pending tax legislation in Congress this year, Mitch Gerstein, senior tax adviser at accounting firm Isdaner & Co., said it might be a good idea to file for an extension. When you file an extension you still pay estimated taxes, but final paperwork isn’t due until September.

This gives your tax provider adequate time to file a return. And it’s cheaper to file an extension than an amended return, which costs more in administrative fees.

One reason Gerstein recommends an extension this year: a bonus depreciation write-off used by many small businesses is set to decrease for 2023. The bonus depreciation allowance was designed to spur capital purchases and it let businesses write off 100% of certain new and used assets in 2022. But beginning in 2023, that will decrease to 80% for used assets, dropping another 20% each year thereafter. However, a tax bill pending in Congress could restore the write-off to 100%. It’s rare that there is such a significant tax bill pending in Congress when taxes are due, Gerstein said.

Optimize your retirement plan

The Secure Act 2.0 passed by Congress in late 2022 gives small businesses some tax advantages if they offer a retirement plan. There’s a tax credit for small businesses starting new employee plans. The credit is up to 100% of the startup costs for adopting and maintaining a new 401(k) plan, capped at $5,000. There’s also a tax credit based on employer contribution, up to $1,000 annually per employee, over the plan’s first five years.

Changes in research and development write-offs

Scott Orn, chief operating officer of Kruze Consulting, works with startups backed by venture capital. Orn said the number one concern his clients are calling about is “Section 174,” a part of the tax code that involves writing off research and development costs.

In the past, companies were able to deduct 100% of research and development expenses from their taxable income. That was helpful because often that deduction meant the company was operating at a loss and wouldn’t have to pay taxes.

But starting in 2022 due to new legislation, companies have had to “capitalize” the expense – or spread it out over several years. That means they must now write off the expenses over five years for U.S.-based R&D, or 15 years for foreign R&D expenses.

Large and small companies alike are affected by the change, but small businesses are hurt the most, Orn said.

“(Small businesses) are the ones who are swinging into profit where they thought they were like safely losing money and not ever going to pay taxes for a while,” Orn said. “And that’s why it’s such a big surprise for them. It’s hurting people, it’s like it’s a lot of money these companies don’t have.”

Avoid underpayment penalties

Yet another reason for small business owners to use a tax professional is the fact that underpaying will cost more this year. In the past, underpayment penalties hovered at around 3%, but this year they’re more than double at 8% . That’s because the penalties are based on the federal short term interest rate plus three points, said Danny Castro, Florida Market Tax Leader at BDO USA, part of BDO Global, a global accounting network.

“The cost of underpayment is as high as it’s been in a long time,” he said.

One credit to skip: the ERC

At one time, the pandemic-era Employee Retention Credit seemed like a boon for small businesses. Designed to help small businesses keep employees during pandemic-era shutdowns, the generous credit let businesses file amended tax returns to claim the credit.

But that led to a cottage industry of scammers trying to entice small businesses to help them file for the credit – for a fee – even if they didn’t qualify. The IRS has launched several initiatives to claw back some money improperly given to businesses. To date, the IRS said 500 taxpayers have given back $225 million via a voluntary disclosure program, which ended on March 22, that let small businesses who thought they received the credit in error give back the money and keep 20%. And 1,800 businesses have withdrawn unprocessed claims totaling $251 million.

Get organized, stay organized

The best thing small businesses can do to help their tax advisers file their taxes is stay organized. A shoe box full of receipts isn’t helpful when trying to file timely taxes. Owners should log receipts in an orderly database they can turn over to their adviser. And stay on top of quarterly estimated payments.

“(Small business owners) need to be able to keep accurate records throughout the year and not have to go back in April and go, gosh, what what was this receipt for,” said Occams Advisory’s Amber Kellogg, “Keeping those, accurate records is very, very important.”

This story has been corrected to show that BDO USA is part of BDO Global, not BBO Global.

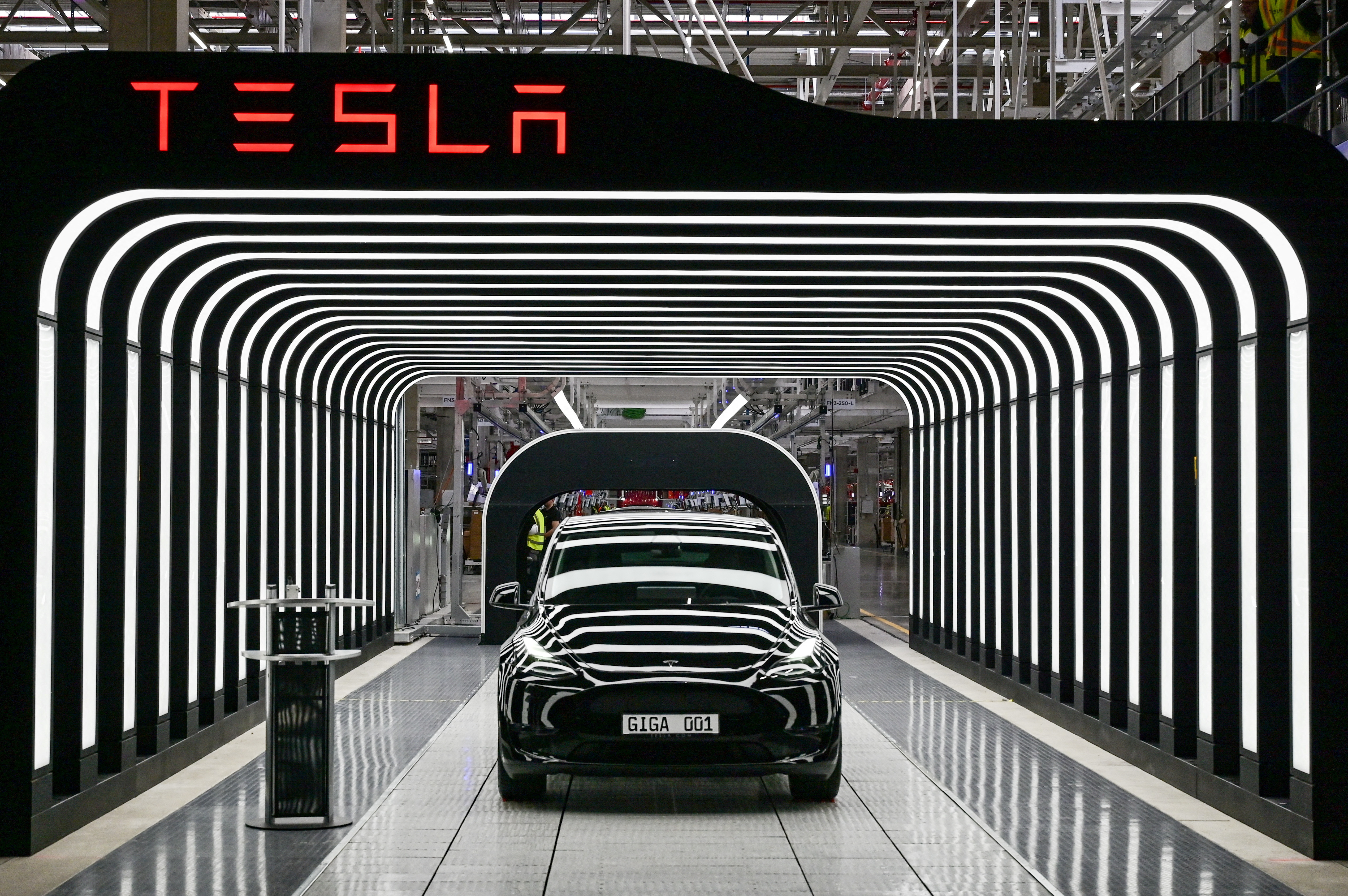

Exclusive: Tesla scraps low-cost car plans amid fierce Chinese EV competition

- Entry-level Tesla car won’t be built, three sources tell Reuters

- Tesla to focus on self-driving taxis instead, sources said

- Strategy shift comes as Tesla faces competition from China EV makers including BYD

‘HALT ALL FURTHER ACTIVITIES’

Running late.

Stay up to date with the latest news, trends and innovations that are driving the global automotive industry with the Reuters Auto File newsletter. Sign up here.

Reporting by Hyunjoo Jin in San Francisco, Norihiko Shirouzu in Austin and Ben Klayman in Detroit. Editing by Marla Dickerson and Brian Thevenot.

Our Standards: The Thomson Reuters Trust Principles. , opens new tab

Thomson Reuters

Is the Detroit Bureau Chief and North American Transportation Editor, responsible for a team of about 10 reporters covering everything from autos to aerospace to airlines to outer space.

China commerce minister kickstarts Europe trip with Chinese EV firms meeting

China's commerce minister kicked off a trip to Europe by meeting top Chinese automakers BYD and CATL , as he prepares to discuss an ongoing probe by the bloc into whether China's EV industry has benefited from unfair subsidies.

IMAGES

VIDEO

COMMENTS

Lean Business Plan Template PDF. This scannable business plan template allows you to easily identify the most important elements of your plan. Use this template to outline key details pertaining to your business and industry, product or service offerings, target customer segments (and channels to reach them), and to identify sources of revenue.

Business Plan Template for Small Businesses Business planning can feel complicated. It doesn't have to be. Start putting pen to paper today with your free business plan template download. ... Download as PDF Finish your business plan faster. Get an exclusive 7 day free trial to the world's #1 business planning software. Try LivePlan Free - 7 ...

Whether you want to launch a side gig, a solo operation or a small business, you need a simple business plan template to guide you. Forbes Advisor offers you a comprehensive and easy-to-follow ...

What You'll Get: A complete business plan Unlike other blank templates, our business plan examples are complete business plans with all of the text and financial forecasts already filled out. Edit the text to make the plan your own and save hundreds of hours. A professional business plan template All 550 of our business plans are in the SBA-approved format that's proven to raise money from ...

a business plan. Part III Structure Of The Business Plan will serve the purpose of helping you construct an effective business plan. It will explain why it is important to include certain sections within a business plan, and will also describe how to write them in a manner that is easily comprehensible and gets the message across to the reader.

business plan. It is therefore important to make your summary interesting and convincing. TIP: The executive summary is a summary, so this section should be the last piece of the business plan that you write. To write your executive summary, imagine being challenged to verbally summarize your entire business plan in two minutes.

include in your business plan and how to make it look pretty for investors, loan officers, or anyone else who might want to see it in the future—but the important work of your business plan is much more about the process than the result. At its core, writing a business plan is about thinking through and answering really hard questions

A well-crafted plan will continue to serve you throughout the life of your business. Expect to update your document regularly to ensure the information is current and aligns with the overall goals and growth of your organization. Instructions: Use this workbook to solidify and document the core components of your business plan.

A business plan is a written narrative that describes what a new business intends to accomplish and how it wants to achieve it. For most new ventures, the business plan is a dual-purpose document used both inside and outside the firm. Inside the firm, the business plan helps the company develop a 'road map' to follow to execute its strategies

696 templates. Create a blank Business Plan. Beige Aesthetic Modern Business Plan A4 Document. Document by Rise & Roar Design. Navy and Gray Modern Business Plan Cover Document. Document by Banuaa. Startup Business Plan. Document by Maea Studio. Blue White Simple Business Plan Cover Page.

Experience and advice from hundreds of small business owners /operators in fourteen countries by Jonathan T. Scott The Entrepreneur's Guide to Building a Successful Business Everything you need to build your successful business: • Finding a profitable business idea • Choosing a location • Writing a business plan • Business model examples

2.1 The Objectives of a Business Plan. There are two primary purposes for preparing a business plan. The first is external, to secure funding that is very important for the growth and development of the enterprise. The second is internal, which is to support the strategic and corporate development of the business.

This Small Business Guide is intended to provide quick references about Federal tax considerations when opening and running a small business. Publication 5557 (9-2021) Catalog Number 57953U Department of the Treasury Internal Revenue Service www.irs.gov.

A structured guide with worksheets to assist you in the development of your business plan, financial projections, and operating budget. Adapted from materials written by Donald J. Reilly. Southeastern MA Regional Small Business Development Center. 200 Pocasset Street. Fall River, Massachusetts 02721.

1. Regular reviews and updates. Markets shift, consumer behavior changes, and your business will grow. Your plan must evolve with these factors, which makes regular reviews and updates a must-do ...

Small Business MARKETING PLAN YOUR PLACE IN THE MARKETPLACE Tennessee Small Business Development Center Network Lead Center Middle Tennessee State University, PO Box 98, Murfreesboro, TN 37132 Toll Free: 877-898-3900 Phone: 615-849-9999 Fax: 615-893-7089 Small Business Development Centers

A business plan is a document that lays out a company's strategy and, in some cases, how a business owner plans to use loan funds, investments and capital. It demonstrates that a business is ...

You can start using UPDF's software and AI features for an initial cost of $83.99. This includes a one-time payment of $47.99 for the software and a yearly fee of $36 for AI features. This plan lets you look at 100 files, ask questions 1000 times, and upload documents with up to 1000 pages. Try UPDF today.

How one millennial quit a corporate job, became self-employed, and set himself up financially to start a small business. Kathleen Elkins. Apr 3, 2024, 7:04 AM PDT. Paul Millerd, author of "The ...

Revised 2024 Draft Business Plan. Documents summarize the proposed changes to the Draft 2022 Business Plan based on the comments received: Staff Recommended Edits table of proposed substantive text edits. Errata table of minor technical corrections for punctuation, spelling and updated current data.

In the preface of a new book on the subject, Wang Xianqing of Peking University likens the term to "reform and opening up", the formula that encapsulated China's embrace of market forces ...

Optimize your retirement plan. The Secure Act 2.0 passed by Congress in late 2022 gives small businesses some tax advantages if they offer a retirement plan. There's a tax credit for small businesses starting new employee plans. The credit is up to 100% of the startup costs for adopting and maintaining a new 401 (k) plan, capped at $5,000.

Hiring plans among U.S. small businesses in March were the weakest since May 2020 when pandemic shutdowns threw the economy into recession, dropping below a key threshold some economists see as a ...

New solution, designed for small businesses, will build upon Voya's prior success in the market as its NQDC plan growth more than doubled in 2023 WINDSOR, Conn.--(BUSINESS WIRE)-- Voya Financial, Inc. (NYSE: VOYA), announced today the launch of "Business-ready" — the latest addition to the firm's comprehensive lineup of nonqualified ...

The now-defunct entry-level vehicle, sometimes described as the Model 2, was expected to start at about $25,000. Tesla did not respond to requests for comment. The stark reversal comes as Tesla ...